Also in this letter:

■ Forex betting apps lure unwitting investors as crypto craze wanes

■ Rules allow cloud kitchens to service multiple brands: FSSAI

■ MeitY seeks views on draft data anonymisation rules

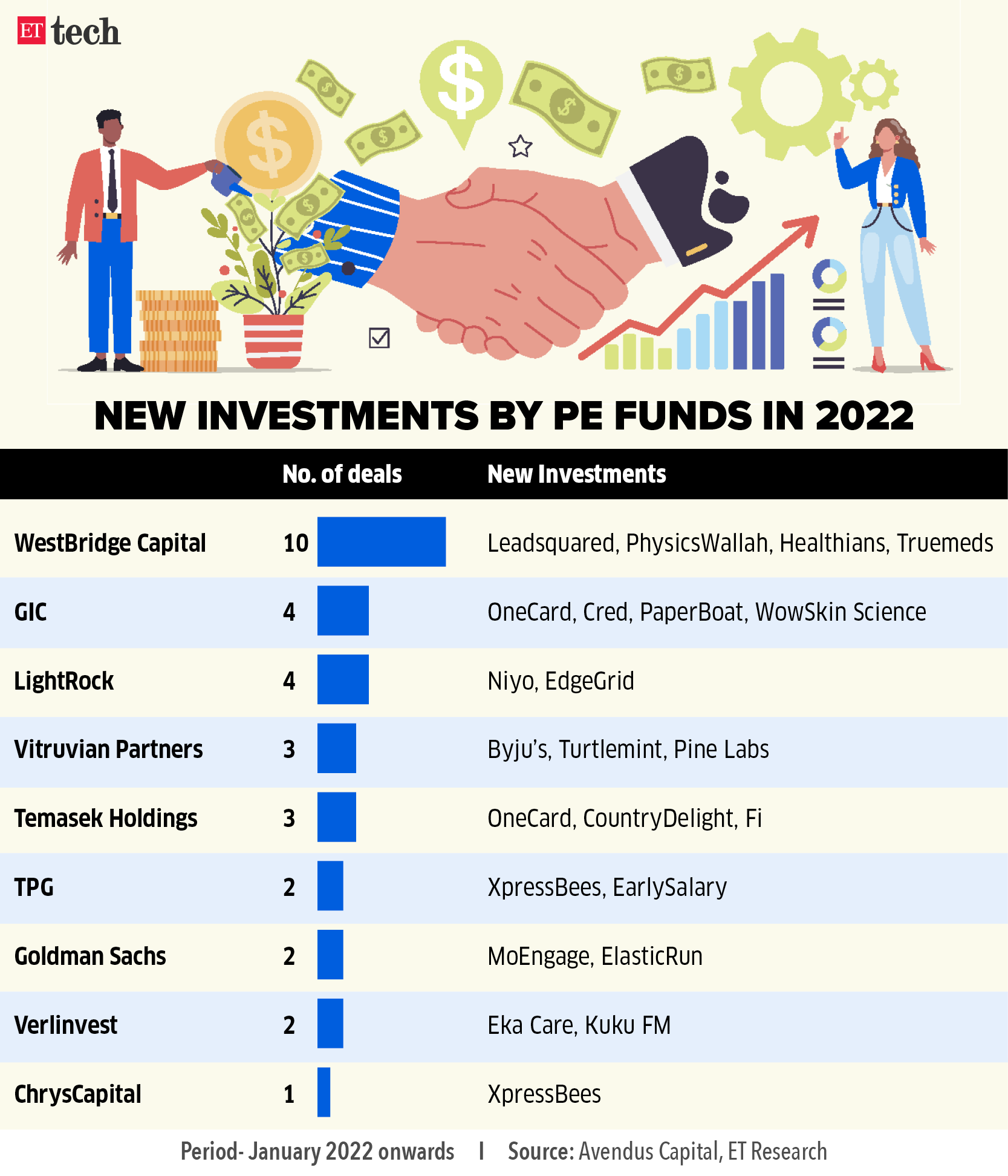

PEs start to join late-stage rounds as Tiger, SoftBank go slow

Advent International, which raised a $4-billion fund dedicated to backing tech firms last December, isn’t really known for making technology bets in India. But that may change soon.

The global private equity firm is warming up to Indian startups in sectors such as fintech.

It is in talks to lead a $100 million (nearly Rs 800 crore) investment in Kreditbee, which could value the startup at around $600 million, sources told us.

Emerging trend: If the transaction goes through, Advent will join the likes of TPG – which announced last week that it was backing instant loan disbursal startup EarlySalary through its Rise Fund – in raising its exposure in the Indian tech ecosystem.

Advent, TPG and Singapore’s sovereign funds Temasek and GIC have started to sign large cheques (typically $100 million and above) amid an overall slowdown in late-stage funding.

Others like Canadian pension funds CPPIB and CDPQ have also stayed on to make new investments here.

Shifting sands: Until last year, these late-stage rounds were led by the likes of Tiger Global, SoftBank, Naspers and Alpha Wave (Falcon Edge). Now, these funds are nursing bruises to their public tech portfolios in the US, and newer funds have sensed an opportunity.

A venture investor said PE firms typically look at businesses through the lens of profitability and unit economics, which is why investing is lending firms like Kreditbee and EarlySalary makes sense for them.

“But the significant point here is that, for the past few months there has been no big rush to close rounds in a few weeks… PEs take much longer to execute transactions, unlike a Tiger… which is giving them a window to assess tech companies. Last year, the market was very different.”

Forex betting apps lure unwitting investors as crypto craze wanes

The crypto market has been in a funk in 2022, so investors seeking the next get-rich-quick scheme are depositing money with forex trading apps to bet on intra-day and short-term price movements of the dollar, euro, yen and popular foreign currency pairs.

Courting trouble: But these trades could put them on the wrong side of the law, regulatory professionals say.

More than half a dozen apps, offered by brokerages registered in distant jurisdictions like St. Vincent and the Grenadines – a Caribbean tax haven – and the British Virgin Islands are peddling their services with trading literature, webinars, demo accounts, and videos of men and women talking about how the trading tools helped them beat the lockdown blues.

Yes, but: Indian laws allow only authorised dealer banks and firms with a forex trading licence to deal in foreign currencies.

Residents are permitted to trade currency futures contracts like USD-INR and Euro-INR on local stock exchanges, but an individual trader cannot trade directly in foreign currencies or even transfer funds abroad under RBI’s liberalised remittance scheme to trade in currencies in offshore financial markets.

But brokers that offer these apps spin a different story.

“There is no law in India which prohibits Indian traders from trading on our platform. We have a large number of customers from India. Also, the company is a member of the Financial Commission,” a customer support executive of the app OlympTrade said in the course of an online chat.

The Financial Commission, however, is not a regulatory body – as a quick internet search shows – but a dispute-resolution organisation for forex trades.

Rules allow cloud kitchens to service multiple brands: FSSAI

A cloud kitchen’s registered entity can supply its products to “innumerable brands as long as it complies with the norms,” the Food Safety and Standards Authority of India (FSSAI) has said.

Ecommerce platforms are obliged to display the FSSAI license and registration number of the concerned entity on their platforms, a spokesperson for FSSAI said in an emailed statement.

Driving the news: The food regulator’s comments came in response to our queries about a recent discussion on Twitter. Prashant Baid, a writer on Substack, revealed that a person was allegedly running hundreds of fake brands from a single cloud kitchen and spamming food aggregators with restaurant listings.

Baid revealed on Sunday that an operator was running 200 brands each out of two cloud kitchens in Bengaluru. In his post, he pointed out that the brand names operated by the cloud kitchen sounded similar or identical to other popular restaurants.

But three restaurant operators told us that there was nothing illegal about this.

MeitY seeks views on draft data anonymisation rules

The government has released draft guidelines on anonymisation of data for public consultation.

The draft, by the Ministry of Electronics and Information Technology, shows that the primary goal of the Working Group is to frame guidelines for anonymising data when personal information is processed and shared, especially in various e-governance applications.

The deadline for submission of comments is September 21.

Concerns: Officials involved in preparing the draft said that the guidelines were voluntary, but some experts have raised concerns with such anonymisation, arguing that there is a fear of being re-identified.

They also said that in the absence of a data protection legislation containing provisions which would specifically address the issue, re-identification through de-anonymisation could lead to a violation of the right to privacy of individuals.

Twitter testing long-awaited edit button

Twitter said on Thursday that it was testing an edit button for tweets.

It said it would test the feature – which users have been demanding for years – with select accounts and Twitter Blue users over the next few weeks but didn’t say when it would be rolled out to all users.

“The test will be localised to a single country at first and expand as we learn and observe how people use ‘Edit Tweet’. We’ll also be paying close attention to how the feature impacts the way people read, write, and engage with Tweets,” the company said.

Twitter Blue, the company’s premium offering, gives subscribers early access to new features. The company said the edit feature being tested right now will allow users to edit a tweet “a few times” within 30 minutes of posting it.

In April, Twitter’s communications team said the company had been working on an edit button since 2021.

TWEET OF THE DAY

Dabur’s D2C brands to cross Rs 100 crore in sales this fiscal: CEO

Packaged consumer goods maker Dabur’s direct-to-consumer (D2C) brands will cross Rs 100 crore in sales in the current financial year, chief executive Mohit Malhotra said.

These products, sold only on Dabur’s own webstore called DaburShop and marketplace platforms like Amazon and Flipkart, include diapers, talcs, moisturisers and soaps, hair care and face wash under the Vatika brand, and cold pressed oils and superfoods under its Real brand.

“We are rolling out a series of new digital-first products this year. Our strategy is to use ecommerce as the launch platform for many new-age formats, build up scale here and then roll them out in other channels,” Malhotra said.

While new products account for 4-5% of the company’s sales, the contribution of new products to the overall ecommerce space is close to 10%.

Other Top Stories By Our Reporters

Amazon India report card ‘decidedly mixed’: Despite investing over $6.5 billion in India over the past nine years, Amazon’s business report card here is “decidedly mixed”, Bernstein said in a report. The company has made headway with customers in metros and tier 1 cities, Bernsetein said in its report, but faces “immense competitive pressure” in new categories such as groceries from domestic players like Reliance (JioMart), and in new markets from startups like Meesho.

DXC Technology to continue WFH: Even as the Indian IT sector is gradually asking employees to return to offices, DXC Technology will continue with the work-from-home policy for its 43,000 employees in India, said Nachiket Sukhtankar, managing director of the Indian arm of the US company.

Zomato deputy CFO, Unacademy CMO resign: Nitin Savara, Zomato’s deputy chief financial officer (CFO), has quit, the company said in a disclosure to stock exchanges on Wednesday. Meanwhile, Karan Shroff, chief marketing officer (CMO) of Unacademy, who was elevated to partner last September, has left the company.

Global Picks We Are Reading

■ A new approach to car batteries is about to transform EVs (Wired)

■ Zoom wants to get back in the office. But not to work. (WSJ)

■ Venezuela’s gamers see esports as a way to escape the country’s crisis (Rest of World)