Source: Giphy

Also in this letter:

■ China asks Didi to delist from the US on security fears

■ Beijing steps up pressure on tech with draft online ad rules

■ Israel slashes list of countries that can buy cyber tech

Paytm wild ride continues as stock sinks again ahead of earnings

India’s digital payments giant Paytm is set for another bout of scrutiny tomorrow when it reports earnings in the wake of its record-breaking initial public offering and tumultuous stock market debut.

Ahead of the results, Paytm’s shares dropped as much as 7.7% in early Mumbai trading on Friday. While the stock had jumped about 32% over the last three days, it is still well below its IPO issue price of Rs 2,150 as investors continue to raise questions on its longer-term prospects.

Taking stock: Paytm’s shares closed 0.86% lower at Rs 1,781.15 on Friday. On Thursday, its stock price on BSE closed at Rs 1,796.55, higher by Rs 43.40 or 2.48% from its previous close.

Concerns over profitability: “Revenues for Paytm have remained more or less flat despite a rise in customer base for the last couple of years,” Ruchit Jain, head of research at listed discount broker 5paisa.com told Bloomberg. “While it has reduced losses, none of the business segments, like payments, consumer loans or insurance distribution, are showing signs of profitability.”

Doubling down: Despite the challenges, Paytm’s backers include the likes of Warren Buffett’s Berkshire Hathaway Inc. and Masayoshi Son’s SoftBank Group Corp. BlackRock Inc. and Canada Pension Plan Investment Board were among so-called anchor investors in the IPO that bought more shares on Tuesday and Wednesday, according to people familiar with the matter.

- “The road to profitability for Paytm is a long way away,” Chakri Lokapriya, chief investment officer at TCG Advisory Services told Bloomberg. “Nearly 75% of its business is digital payments, which is now a highly-competitive segment, where retaining customers is a challenge.”

Nykaa’s market cap briefly surpasses that of Zomato: FSN E-Commerce, which runs Nykaa saw its market capitalisation briefly go past that of online food-delivery platform Zomato and Paytm on Friday on BSE.

For a brief period during the day’s trade, the market cap of the cosmetics-to-fashion ecommerce player hit Rs 1.19 lakh crore, while Zomato and Paytm had a market cap of Rs 1.18 lakh crore and 1.12 lakh crore, respectively.

At end of the day’s trade, the market cap of FSN E-Commerce dipped to Rs 1.15 lakh crore, while Zomato managed to regain some lost ground and closed at a market cap of Rs 1.16 lakh crore.

At close, the shares of FSN E-Commerce Ventures was up 1.15% at Rs 2,434.80 on Friday on BSE. Zomato shares ended the day 7.23% lower on BSE at Rs 148.20 after opening at Rs 157.55 apiece.

China asks Didi to delist from the US on security fears

Chinese regulators have pressed top executives of ride-hailing giant Didi Global Inc. to devise a plan to delist from the New York Stock Exchange due to concerns about data security, people familiar with the matter told Reuters.

Security concerns: China’s powerful Cyberspace Administration of China (CAC) has asked the management to take the company off the US bourse due to worries about leakage of sensitive data.

Beijing also wants the ride-hailing giant to promise it would solve the delisting issue within a certain period of time.

Conditions apply: The cyberspace regulator said the prerequisite for the relaunch of Didi’s ride-hailing and other apps in China is that the company has to agree to delist from New York.

Proposals under consideration include a straight-up privatisation or a second listing in Hong Kong followed by a delisting from the United States, said the person.

Tell me more: In July, the CAC ordered app stores to remove 25 mobile apps operated by Didi – just days after the company listed in New York. It also told Didi to stop registering new users, citing national security and the public interest.

Soon after, the CAC launched an investigation into Didi over its collection and use of personal data. It said data had been collected illegally.

Didi responded at the time by saying it had stopped registering new users and would make changes to comply with rules on national security and personal data usage and would protect users’ rights.

Didi’s China ops remain in the dark: Earlier this month reports suggested that Didi is preparing to relaunch its apps in the country by the end of the year in anticipation that Beijing’s cybersecurity investigation into the company would be wrapped up by then, citing sources directly involved in the relaunch.

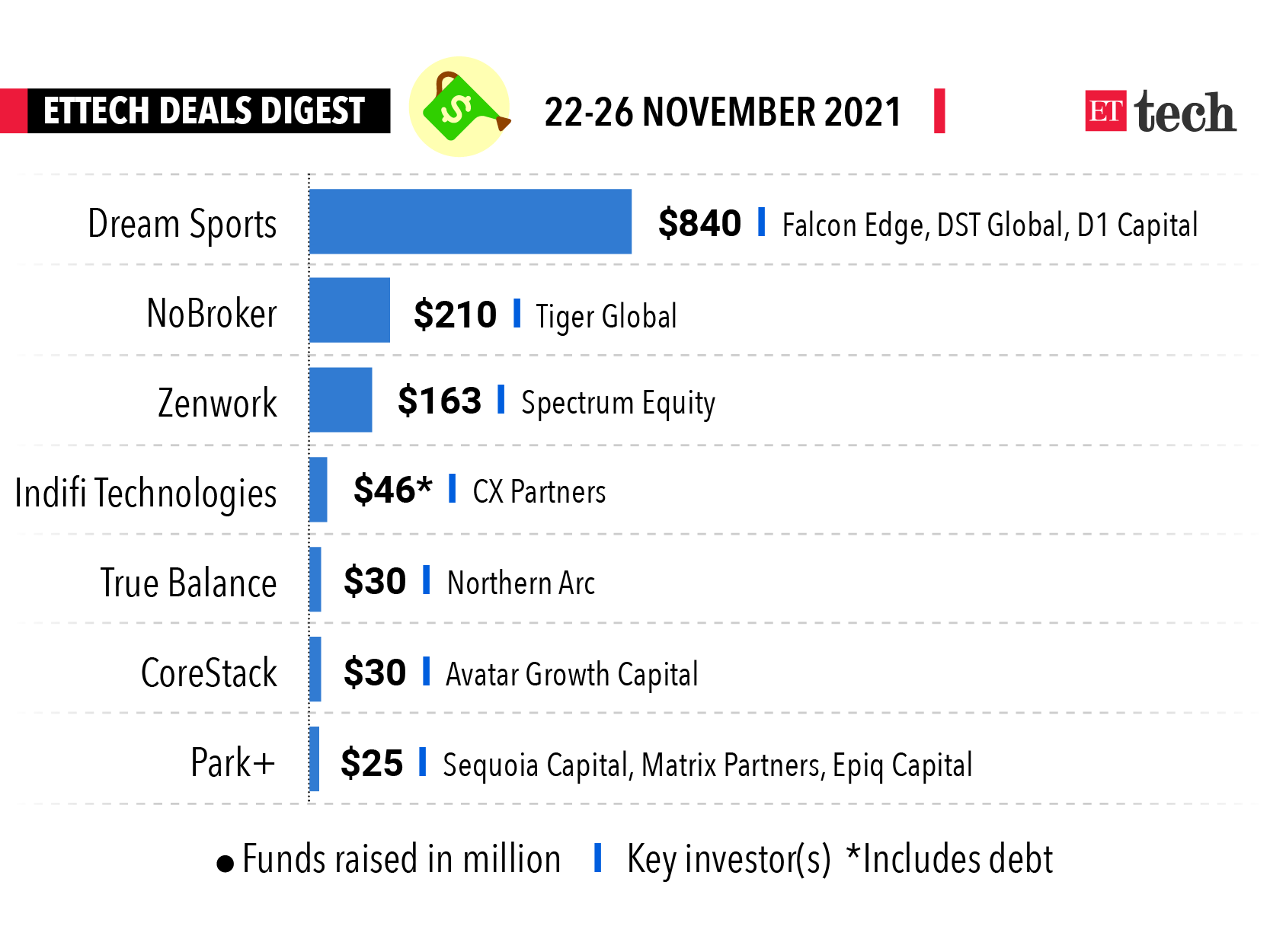

ETtech Deals Digest

India minted another unicorn this week as real estate platform NoBroker entered the club. The real estate platform is India’s first property tech—or proptech—unicorn. Here’s a quick look at the top funding deals of the week.

Beijing steps up pressure on tech with draft online ad rules

China’s market regulator proposed new rules today that would increase online advertising oversight, including stipulating that adverts should not affect normal internet use or mislead users.

Authorities in China have tightened regulation across a range of industries this year, with an emphasis on technology.

Ad sales to take a hit: Search giant Baidu Inc and game publisher Tencent Holdings warned during recent quarterly results that the short-term outlook for advertising sales looked weak, impacted by the pandemic and China’s regulatory crackdown.

Quote: Internet advertising must “meet the requirements for the establishment of socialist spiritual civilization and the promotion of excellent traditional culture of the Chinese nation”, the State Administration for Market Regulation said.

What are the new rules? The proposed rules call on platform operators to establish a system for registering and reviewing advertisers and adverts, and “monitor and inspect the content of advertisements displayed and published by using its information services.”

The proposed rules also call for bans on advertisements aimed at minors promoting medical treatments, cosmetics and online games “that are not conducive to the physical and mental health of minors.”

Tweet of the day

Israel slashes list of countries that can buy cyber tech

Israel slashed its list of countries eligible to buy its cyber technologies following concern over possible abuses abroad of a hacking tool sold by Israeli firm NSO Group, according to a report in Israel’s Calcalist financial newspaper.

On the black list: The report said Mexico, Morocco, Saudi Arabia, Mexico and the United Arab Emirates were among countries that would now be barred from importing Israeli cyber tech. The list of countries licensed to buy it had been cut to just 37 states, down from 102.

Government’s response: Israel’s defence ministry said in a statement it takes “appropriate steps” when terms of usage set in export licenses it issues are violated, but stopped short of confirming any licenses had been revoked.

Catch up quick: Israel has been under pressure to rein in exports of spyware since July, when a group of international news organisations reported that NSO’s Pegasus tool had been used to hack into phones of journalists, government officials and rights activists in several countries.

Those reports prompted Israel to review the cyber export policy administered by the Defence Ministry.

Snooping allegations: Morocco and the UAE, which both normalised relations with Israel last year, as well as Saudi Arabia and Mexico were among countries where Pegasus has been linked to political surveillance, according to Amnesty International and the University of Toronto’s Citizen Lab which studies surveillance.

NSO has denied any wrongdoing, saying it sells its tools only to governments and law enforcement agencies and has safeguards in place to prevent misuse.

Earlier this month, US officials placed NSO on a trade blacklist for selling spyware to governments that misused it. The company said it was dismayed by the decision, since its technologies “support US national security interests and policies by preventing terrorism and crime”.

NSO has also faced lawsuits and criticism from big tech firms who accuse it of exposing their customers to hacking. Apple Inc was the latest to sue NSO this week.