Credit: Giphy

Also in this letter:

■ Navi Finserv set to raise Rs 600 crore from public bond sale

■ What India’s new VPN rules mean for your privacy

■ Funding for Asia-Pacific fintech firms hits three-year high in Q122

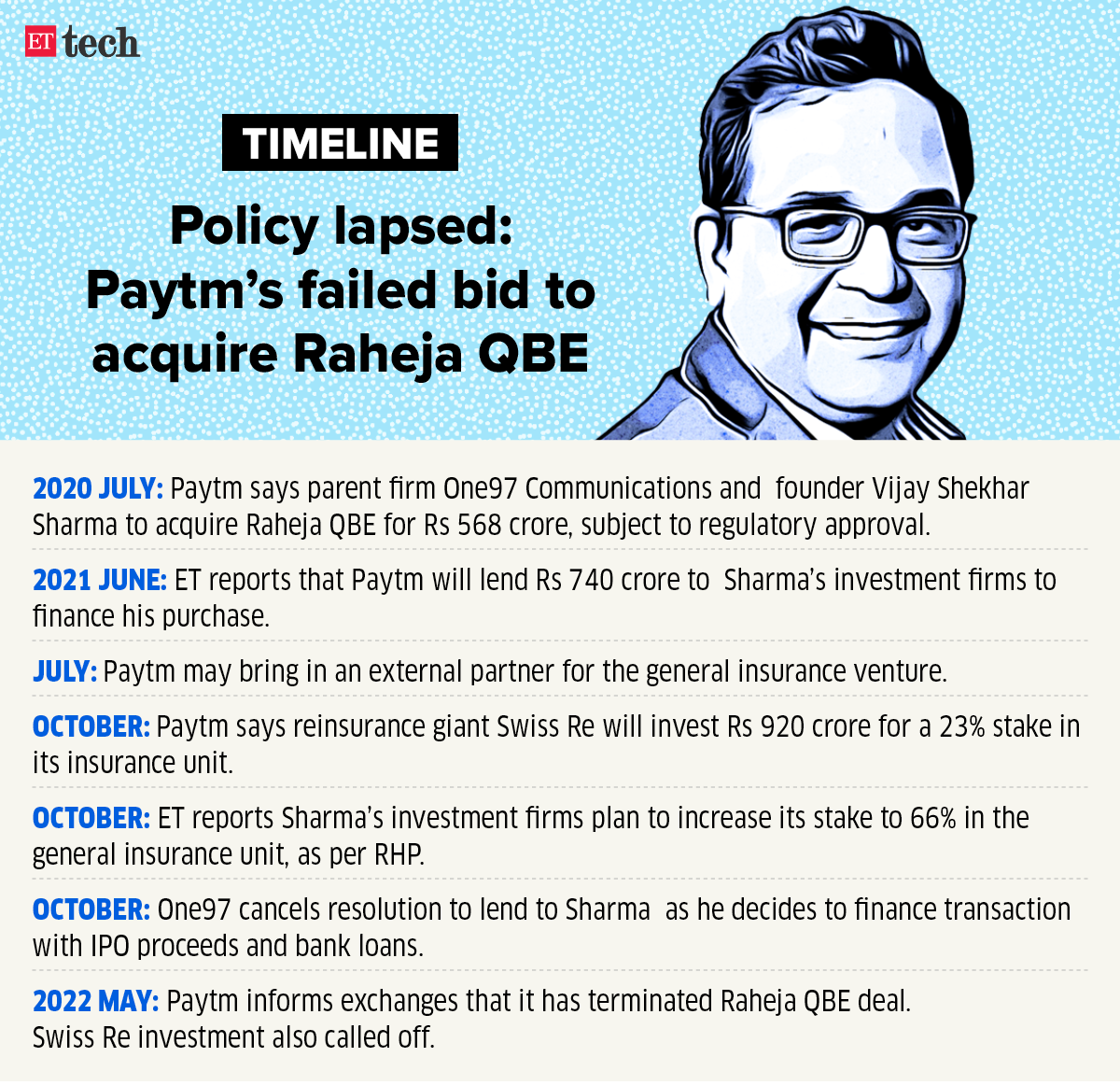

Paytm’s Rs 568-crore deal to acquire Raheja QBE is off

One97 Communications, the parent company of Paytm, has said its deal to acquire Raheja QBE General Insurance Company Ltd has been terminated.

The news comes nearly two years after the digital payments firm first announced its plan to fully acquire Raheja QBE.

Driving the news: In a stock exchange filing late on Sunday night, One97 Communications said “since the share sale and purchase transaction has not been consummated within the time period envisaged by the parties under the said agreement, the agreement has automatically terminated.”

Prism Johnson, which holds 51% in Raheja QBE, also said in a filing that the deal stands terminated.

Insurance biz on hold: Paytm had struck a deal to acquire Raheja QBE for Rs 568 crore and was expected to launch its insurance business this year.

Paytm founder Vijay Shekhar Sharma was expected to use the proceeds from his offer for sale in Paytm’s November 2021 IPO to fund his stake in Paytm Insuretech. In its red herring prospectus (RHP), Paytm had said Sharma would hold over 60% in the unit.

Swiss Re announced last October that it would invest around Rs 920 crore ($127 million) in Paytm Insuretech for a 23% stake. It is not immediately clear what will happen to Swiss Re’s investment now that the deal has been terminated.

Also Read | Paytm Mall announces pivot to ONDC as its primary focus; to explore export opportunities

Still bullish: Paytm said it remains bullish on its roadmap for general insurance and plans to seek approvals for a new general insurance licence for a new entity in which it will hold 74% upfront.

Navi Finserv set to raise Rs 600 crore from public bond sale

Navi Finserv, controlled by Flipkart cofounder Sachin Bansal, is set to raise Rs 600 crore via a public issuance of bonds, three people familiar with the matter told us. This could be the first such retail bond sale by a fintech company in India.

Why? Navi, which deals in personal and home loans, is looking to diversify its borrowing sources amid an evolving credit market and expand its credit portfolio via digital lending.

“The company has a digital retail interface, which can be strengthened via public issuance of bonds even if a retail issue is a bit more expensive than private placement,” said one of the people.

Details: The bonds, rated A, will offer as much as 9.75% with 27-month maturity. Another series will offer 9.50% with 18-month maturity.

The base size of the proposed issue is pegged at Rs 300 crore with an option to retain oversubscriptions up to another Rs 300 crore. The bond sale will open for subscription on May 23 and is expected to close by June 10. Bonds will be listed both on the BSE and the NSE.

IPO on the horizon: Navi Finserv is a subsidiary of Navi Technologies, which plans to raise about Rs 3,350 crore via an initial public offering in the next two to three months.

On Monday we reported that another startup, FirstCry, which was to file draft IPO papers this month, has decided to postpone the offering IPO amid turmoil in global markets.

Sources told us the company’s cautious approach followed the muted response to Delhivery’s IPO last week, amid broader headwinds in global markets.

Only 24% of Delhivery’s IPO was subscribed on the second day of its issue, signalling a lack of excitement from retail and high-net-worth investors, leaving company insiders on tenterhooks until the IPO was fully subscribed on the final day.

Tweet of the day

ETtech Explainer: What India’s new VPN rules mean for your privacy

On April 28, India’s cybersecurity agency, CERT-In, released new guidelines requiring companies that provide virtual private networks (VPNs) to keep a variety of data on their users for five years, including contact numbers, email addresses and IP addresses.

Companies are also required to report cybersecurity incidents to CERT-In within six hours of becoming aware of them.

Clarification: On May 12 we reported that CERT-In issued some clarifications to the rules, saying they would apply only to individual VPN customers and not to enterprise or corporate VPNs.

Set to go into effect at the end of June, the rules have triggered privacy concerns, and many top VPN providers have threatened to leave the country if forced to comply.

How will the new rules affect VPN companies and users? With the new rules, VPN companies will be forced to switch to storage servers, which will inflate their costs and eliminate their core function — user privacy. Failure to follow the rules will attract penalties for VPN providers. If they all refuse to comply, VPN services will effectively become illegal in India.

Users, apart from potentially having their privacy data exposed to the government (not to mention hackers), will also face a stringent know-your-customer (KYC) verification process when signing up for a VPN service, and will have to state their reasons for using it.

Click here to read the full explainer.

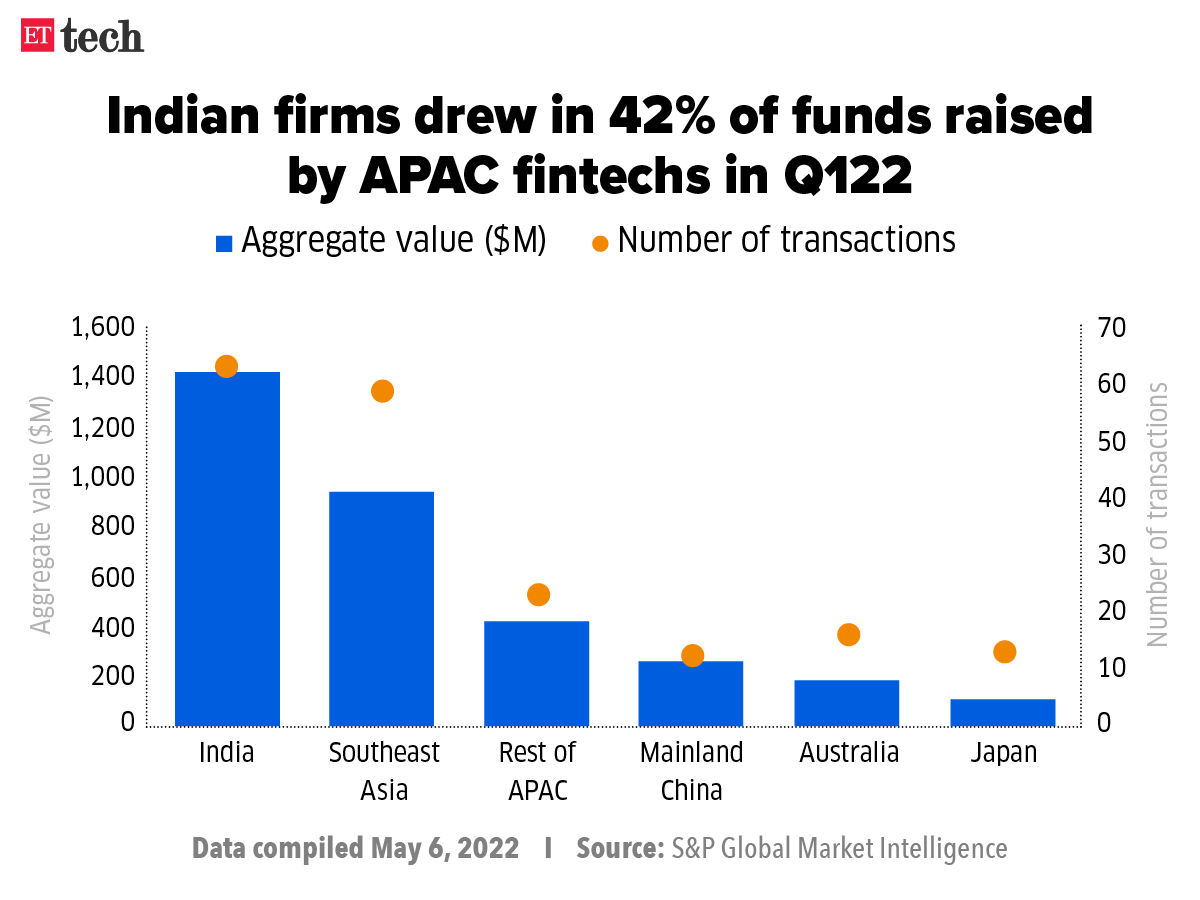

Funding for Asia-Pacific fintech firms hits three-year high in Q1 2022

Fintech companies based in the Asia-Pacific (APAC) region raised $3.3 billion in over 186 deals in Q1 2022 — the most in any March quarter in the past three years, according to a report by S&P Global Market Intelligence.

India led the way: Indian fintech companies once again brought in the most money, accounting for 42% of the total amount invested and 34% of the total number of deals. Most of the funding went to three firms — Pine Labs, Oxyzo and Credavenue, which raised over $100 million combined in Q1.

The report said digital lending, which was the hardest hit fintech category during Covid, topped all other categories to raise $1.28 billion in over 52 deals in the quarter.

Yes, but: It cautioned that while year-over-year numbers paint a rosy picture, a sequential comparison signals otherwise, and is perhaps more indicative of what lies ahead.

On a quarter-over-quarter basis, the first-quarter funding levels represent a 26% fall in the amount raised and 9.7% drop in the number of deals. “Fintech fundraising activity could see a further slowdown in subsequent periods in wake of an underwhelming public equity market and further rate hikes,” the report added.

Regulator says Tesla recalling 107,293 China-made Model 3, Model Y cars

Tesla Inc is recalling 107,293 Model 3 and Model Y vehicles built in China due to overheating, which might cause the centre touchscreen display to malfunction, among other issues, China’s market regulatory agency said.

According to a statement by the State Administration for Market Regulation, the overheating could also cause other faults in windshield settings and gear displays.

Covid woes: The EV maker has delayed a plan to restore production at its Shanghai plant to levels before the city’s Covid-19 lockdown by at least a week, according to an internal memo seen by Reuters.

Tesla originally aimed to increase output at its Shanghai plant to 2,600 cars a day from May 16, Reuters reported earlier this month, citing another memo.

But the latest memo said that it plans to stick to one shift for its Shanghai plant for the current week, with a daily output of around 1,200 units. It also said that it would now aim to increase output to 2,600 units per day from May 23.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai, Ruchir Vyas in Ludhiana, and Arun Padmanabhan in New Delhi. Graphics and illustrations by Rahul Awasthi.