Also in this letter:

- Paytm’s poor show may affect private valuations, fundraising

- Early Paytm investors still in the green

- Many crypto exchanges decide to halt TV, print, radio ads

Paytm’s business model less understood than others, says Sharma

Paytm founder Vijay Shekhar Sharma

After Paytm’s parent firm One97 Communications had a disappointing debut on India’s stock markets on Thursday, Vijay Shekhar Sharma, its founder and chief executive, told us it should only be seen as a first-day reaction and not a reflection of the company’s long-term performance.

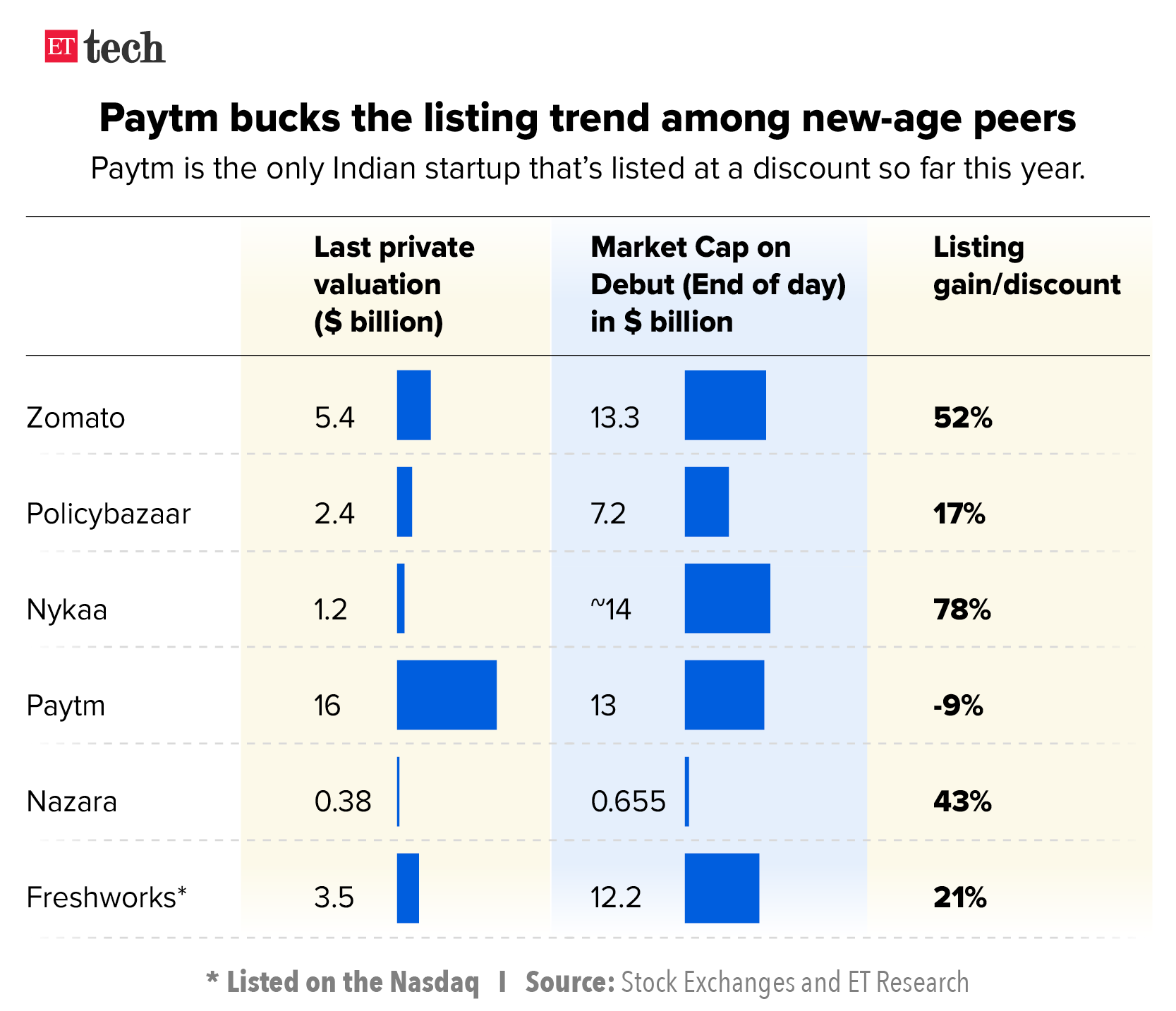

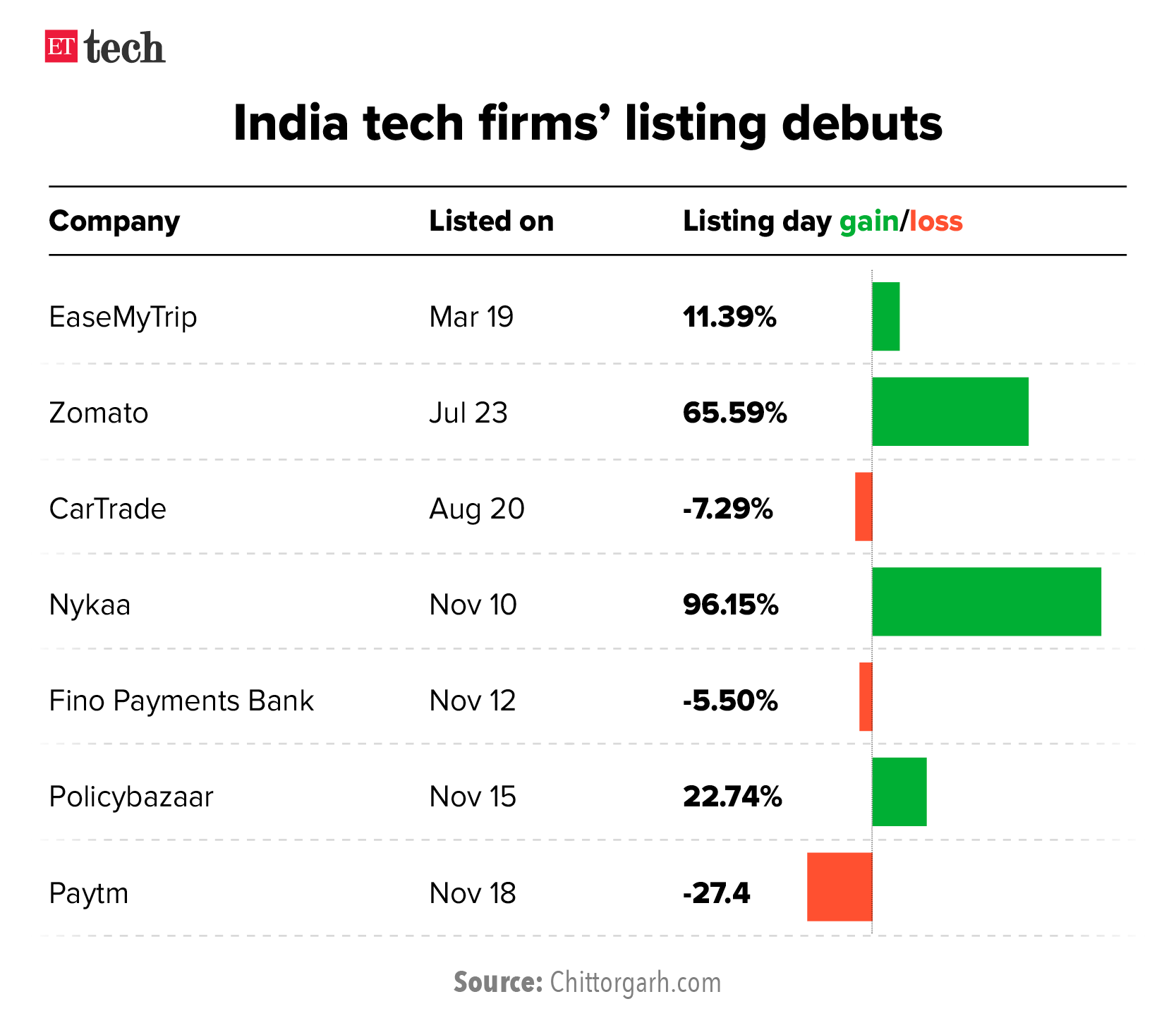

Paytm’s IPO, the largest-ever in India, followed successful listings by tech startups such as Zomato, Nykaa and Policybazaar.

Yes, but: Sharma said the business models of fintech platforms such as Paytm were not as well understood as those of other startups that have gone public. “These are easy to understand models… If I sell a wallet or a phone, or I can pick up food from a restaurant … then you know the business model… compared to how do you (payments) acquire customers? How do you make money and what’s cross-selling like? These are questions asked by public market investors,” Sharma told us after the company’s first day of trading.

He said stock markets are “opinion-polls” in the short term and “weighing machines” in the long term. “Stock market cannot impact the purpose of the company,” he said.

Sharma, who was in high spirits despite the disappointing first day of trading, said it was “incredibly tough” being the first in the industry to build a large-scale firm and take it public. He cited the example of Flipkart founders Sachin Bansal and Binny Bansal, who he said set the bar for private funding in the Indian startup sector when they racked up $1 billion in 2014 on the back of the super successful Alibaba IPO. The massive fundraise had led to intense dealmaking for a year, when India saw its first tech and startup boom.

Another concern: Another continuing concern for Paytm is that China’s Ant Group and Alibaba together hold close to 30% in the company, which could prove a hurdle in getting regulatory clearances, according to a report from global brokerage firm Macquarie on Thursday.

But Sharma said this was never a problem for the company and that it wasn’t seeking any new licences anyway.

Paytm’s poor show may affect private valuations and fundraising, experts say

Paytm founder and CEO Vijay Shekhar Sharma and Group CFO Madhur Deora

Paytm’s disappointing stock market debut on Thursday could affect upcoming technology IPOs and financing rounds at startups, investors and analysts told us. It may even soften the private markets and tech valuations overall in what has been a record year for dealmaking in the digital economy, they said.

Reality check: Anurag Singh, managing partner at hedge fund Ansid Capital, said “For a startup listing, investors would like to see some clear dominance in target markets with reasonable net margins or unit economics. Basically, the startup market will have to stop “creating unicorns” by bidding itself up… For some startups, the valuation at listing is totally divorced from reality.”

Prophets of profits: Analysts said that Paytm’s $20 billion valuation became hard to justify in the public markets as it lacks a clear path to profitability. “This pricing with no regard to profitability is not something that the markets have an appetite for. It hasn’t worked well even in the US, where new-age listings are struggling to keep their listing valuations,” Singh said.

Bad sign: An investor with a soon-to-IPO startup in his portfolio said, “If the largest fintech company in India goes public and hits the lower circuit on the first day, it is a negative signal… It will impact private valuations even if [the effect] is not immediate. Other [unicorns] have to become sustainable when they go public, or at least near-sustainable. Unlimited cash guzzling cannot happen,” he said.

Tweet of the day

Early Paytm investors still in the green despite poor market debut

Paytm’s market cap after its first day of trading stood at $13.6 billion, lower than the $16 billion valuation it commanded in its last private fundraising in November 2019. Despite this, its early backers, including SoftBank, Ant Group, Alibaba and Elevation Capital, are still in the green.

These investors, who continue to hold a sizable stake in the company, are betting that it will grow in the long term. Here’s a look at Paytm’s biggest shareholders what their stakes were worth after its first day on the bourses.

Paytm’s shares plummet on day one as investors question valuation, lack of profit

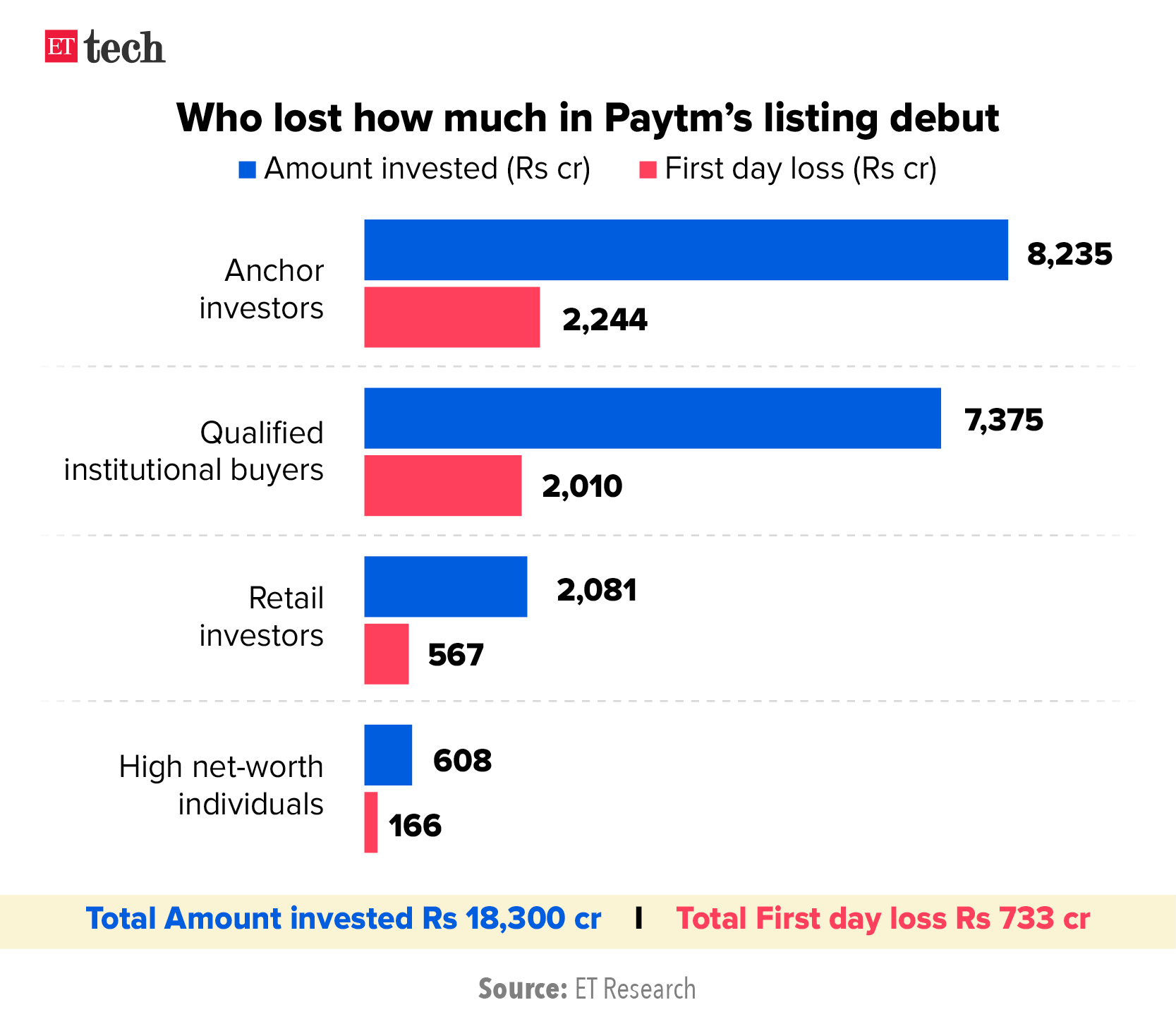

Shares of Paytm’s parent firm One97 Communications tumbled more than 25% on its first day of trading on Thursday, as investors questioned its lack of profits and lofty valuations in the country’s largest IPO ever.

Flop show: We reported Paytm’s stock was trading on the grey market at a premium of just Rs 20-25 on Wednesday, which indicated that its listing would be less than stellar. But a 27.4% fall in the share price at the end of the first trading day surprised even the company’s biggest critics.

- Shares changed hands at Rs 1,614 in the afternoon trade, down from the offer price of Rs 2,150, valuing the firm at about $14.2 billion. That’s less than the $16 billion Paytm was valued at two years ago, in November 2019, when it raised $1 billion from T Rowe Price, Ant Financial, SoftBank Vision Fund and Discovery Capital.

Things got worse from there, and Paytm’s shares eventually hit the lower circuit limit of Rs 1,564 on the BSE. This meant Paytm’s stock could only be bought at that price or higher.

Some saw it coming: Before the listing, Macquarie Capital Securities initiated coverage on the company with an “underperform” rating and a price target of Rs 1,200, 40% lower than the Rs 2,150 IPO price.

Paytm’s flop debut comes after a string of successful listings by Indian tech startups. Shares of Zomato had hit the upper circuit on its listing day before ending the trading session 66% higher, while Nykaa’s stock nearly doubled from its issue price on its market debut.

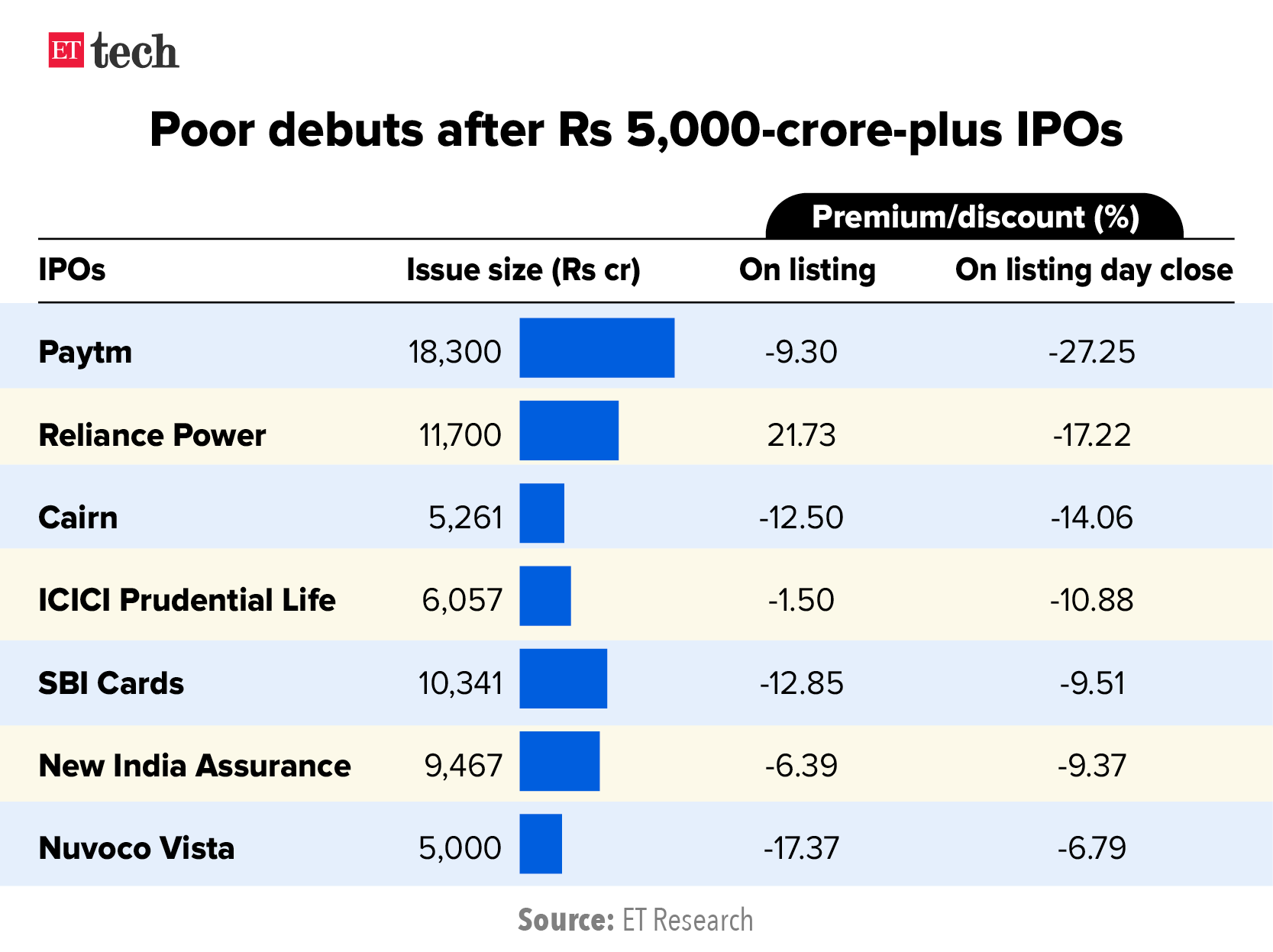

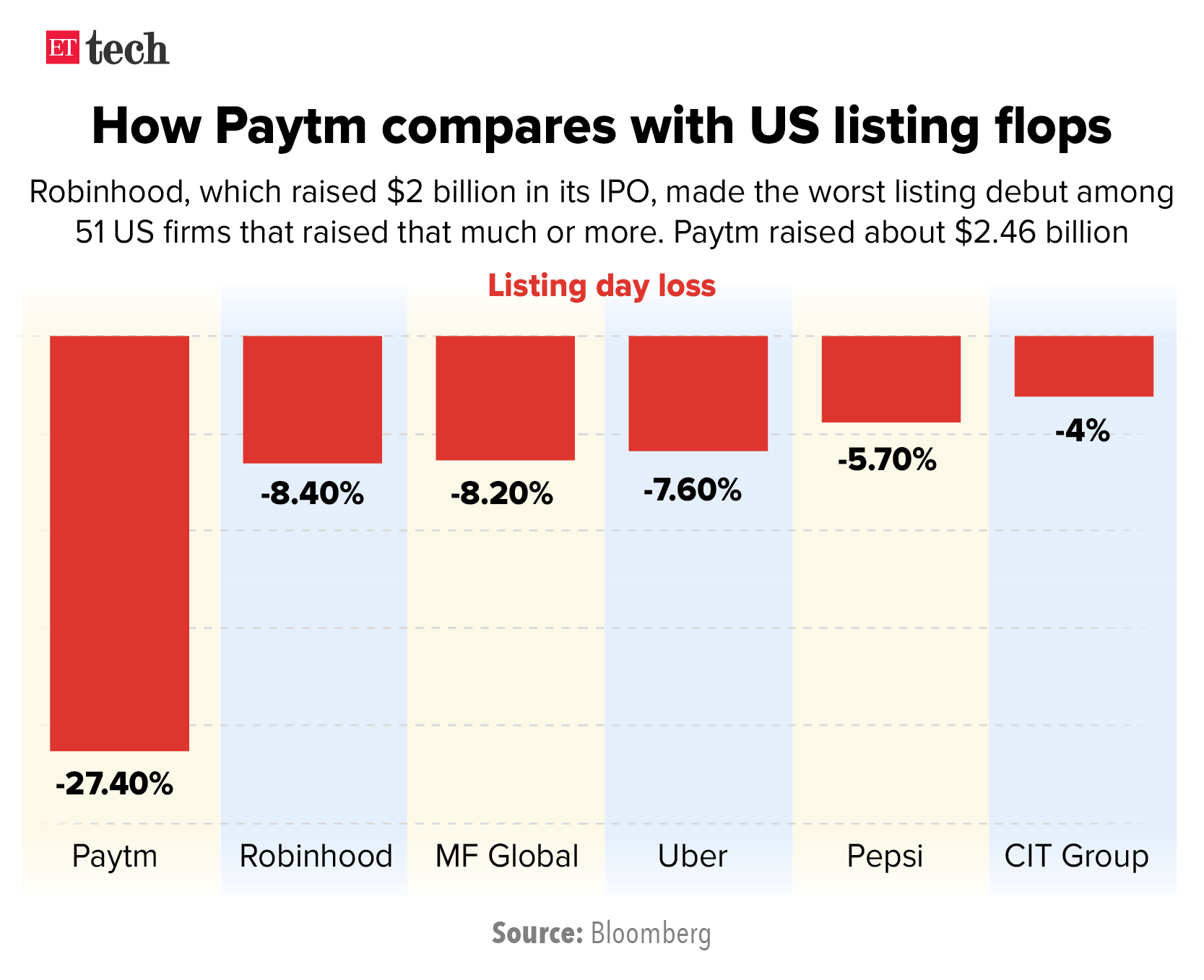

Paytm’s nightmare listing eclipses worst US flop debuts of similar size

Paytm’s nightmare listing debut was easily the worst of the seven Indian tech startups that have gone public this year. It even eclipsed the worst trading debuts ever by US firms that raised at least $2 billion in their IPOs. Paytm had raised about $2.42 billion.

Three of the seven Indian tech startups that have gone public so far this year—CarTrade, Fino Payments Bank and now Paytm—ended their first sessions down from the listing price. While CarTrade’s stock plunged 7.29% on the first day, Fino’s fell 5.5%.

At the other end of the scale, Nykaa ended its first day with its stock up an astonishing 96.15%, while Zomato’s stock was up more than 65% after its listing debut.

Biggest US flops: Paytm’s 27.4% fall on day one also eclipsed the worst trading debuts by US firms that raised $2 billion or more in their IPOs, according to data from Bloomberg.

The worst of these was the debut of trading app Robinhood in July. The company raised $2 billion in its IPO but its shares fell 8.4% from the opening $38 to just above $34 at the end of the first day, giving it a market capitalisation of around $29 billion, short of the anticipated $35 billion. This meant Robinhood’s listing debut was the worst among 51 US firms that raised a similar amount or more in their IPOs, according to Bloomberg data.

Before RobinHood, the worst trading debut by a US company was that of another brokerage, MF Global Holdings Ltd, which went public in 2007. It ended its first day down 8.2%.

Many crypto exchanges decide to halt TV, print, radio ads

Several crypto exchanges in India have decided to refrain from launching fresh advertisements on print, television and radio.

Context: This comes days after crypto exchange WazirX decided to abstain from putting out print and TV ads, amid discussions on regulations for the cryptocurrency sector.

The decision was taken this week at a meeting held by the Blockchain and Crypto Asset Committee, an arm of the industry body Internet and Mobile Association of India, two sources told us.

Quote: “These crypto platforms prefer to wait till there is some understanding on what’s acceptable. The ads for which payments have already been made would of course go on, but there would be no new deals. However, not all platforms have agreed to this…some think their ads are subtle enough and can continue,” said a senior officia at one of the exchanges.

Last month, the Advertising Standards Council of India chairman Subhash Kamath told us that celebrities must do their due diligence before endorsing cryptocurrency companies as they could be held accountable for misleading claims.

We earlier reported that financial and legal experts had sounded an alarm over some of the advertisements by crypto companies that are towing a fine line between “puffery” and “misrepresentation”.

Google prepared for more regulatory scrutiny in India, says country head

Google India head Sanjay Gupta

Google is prepared for more scrutiny from regulators as the Internet becomes deeper in India and around the world, its country head Sanjay Gupta told us in an exclusive interview.

At its flagship Google for India event on Thursday, the company announced a slew of new initiatives and product changes, including local language and voice support in search, digital payments and vaccine slot booking, and Rs 110 crore in financing for micro-enterprises.

Edited excerpts from the interview:

Even though India is the largest market for Google in terms of users, revenue is still low. What will be the main drivers of revenue going forward for Google?

Over the next five years, advertising revenues will start growing more significantly, especially led by digital and tech and startups, because they would like to build new brands and new businesses. They would like to be very targeted. I see a growth of advertising revenues on digital in the future.

Our business model has been largely led by advertising. The one big paradigm shift that we see is our cloud services, because that’s a B2B business, and we start earning revenues as people start embracing technology with us. The cloud business is really opening up the next set of opportunities.

What is your view of the Indian startups space and what is happening right now with IPOs and unicorns and money coming in?

The reality is that we (India) are likely to become a $4 trillion economy. A trillion dollars will be digital. I’m sure 50% of that will come from startups. Fundamentally, the growth of the Indian economy will be driven deeply by startups in a very significant way. So our commitment to startups is very, very high. With the Google for startups accelerator that is in the sixth year, we have touched more than 80 companies in India. Those companies have been able to get close to $2 billion investments.

To read the full interview, click here.

Also Read: Google announces new India-specific product features

Other Top Stories By Our Reporters

Facebook is stonewalling questions, says Delhi Assembly committee on riots: Delhi Assembly’s committee that is investigating the role of social media’s role in Delhi riots in February last year said Facebook’s generic answers or an outright refusal to answer its questions was frustrating the proceedings.

EaseMyTrip acquires Spree Hospitality: Online travel platform EaseMyTrip announced on Thursday that it has acquired hospitality management company Spree Hospitality. This is EaseMyTrip’s second acquisition. The company said Spree Hospitality will add a new revenue vertical for the company and enable it to scale up its hotel and holidays portfolio.

Apple investing significantly to grow its operations in India, VP says: Apple Inc., one among the world’s most valuable companies with a market cap of over $2.5 trillion, said it already supports around one millions jobs in India, both directly and indirectly, and is investing significantly to develop its operations further in the country and engage with more suppliers.

Global Picks We Are Reading