Credit: Giphy

Also in this letter:

■ Trell to lay off hundreds of employees amid probe

■ ETSA 2021: A celebration of India’s startups

■ Meta narrows guidance, prohibit calls for death of a head of state

RBI punished Paytm Payments Bank for sharing data with China firm: report

The RBI barred Paytm Payments Bank from taking on new customers on March 11 as it had allowed data to flow to servers abroad in violation of India’s rules, and didn’t properly verify its customers, Bloomberg reported on Monday, citing a source.

RBI inspection: Annual inspections by the Reserve Bank of India found the company’s servers were sharing information with China-based entities that indirectly own a stake in Paytm Payments Bank, the source added.

Paytm Payments Bank is a joint venture between Paytm and its founder Vijay Shekhar Sharma. China’s Alibaba Group Holding. and its affiliate, Jack Ma’s Ant Group, own shares of Paytm, according to exchange filings.

VSS responds: “In various observations RBI has shared with Paytm Payments Bank, there is absolutely no reference to any data sharing or servers being outside or data sharing with any unauthorised personnel, national or international, or any country whatsoever.” He also said the banking regulator has not raised any concerns about ownership of the payments bank. Sharma owns 51% in the bank while the rest is held by One 97 Communications, parent firm of Paytm.

Catch up quick: On Friday, the RBI had barred Paytm Payments Bank from adding more customers, citing “material supervisory concerns”. The central bank directed it to appoint an audit firm for a comprehensive system audit of its IT system.

Paytm Payments Bank has over 300 million wallets and 60 million bank accounts, according to its website.

Paytm stock plunges 13%: Meanwhile, shares of Paytm’s parent firm One97 Communications plunged more than 13% to hit an all-time low of Rs 661.50 on March 14 – and that was before the news of the alleged China link emerged. The stock closed the day at Rs 680.40 on NSE, down 12.21%.

The fintech startup had launched a Rs 18,300-crore IPO in November but the stock has been falling ever since. It has now shed about 65% from the issue price of Rs 2,150 and its IPO valuation of Rs 1.5 lakh crore has been whittled down to a market cap of Rs 44,000 crore.

Compounding troubles: On Sunday, it emerged that Paytm founder Vijay Shekhar Sharma had been arrested in February for allegedly ramming his SUV into the vehicle of South Delhi deputy commissioner of police Benita Mary Jaiker. Paytm later issued a statement claiming the news reports were “exaggerated”.

“Media reports claiming the nature of the arrest are exaggerated, as even the complaint against the vehicle was for a minor offence under a bailable provision of law and requisite legal formalities were completed on the same day,” a spokesperson said.

Trell to lay off hundreds of employees amid probe

Influencer-led social commerce startup Trell, which is under investigation for alleged financial irregularities, is looking to lay off hundreds of employees amidst growing uncertainty about the implications of the probe, people with knowledge of the development said.

“The company has begun to fire people with immediate effect,” one of these people said. It was not immediately clear how many employees would be fired. News portal Entrackr first reported that the company was in the midst of mass layoffs.

A Trell spokesperson said, “… the board has decided to focus on a few core initiatives and strengthen our systems and processes before we plan to raise the next round of funding. “Unfortunately, this also means that we will have to do some right-sizing within the firm. This can entail some roles getting redundant while there will be new roles that will also be added.”

EY submits interim report: ET was the first to report about an ongoing investigation into the company’s books of accounts on March 12. A forensic team from EY India has now submitted an interim report, four sources with direct knowledge of the matter said.

Trell’s board of directors is likely to act on the EY report over the next few weeks, they added.

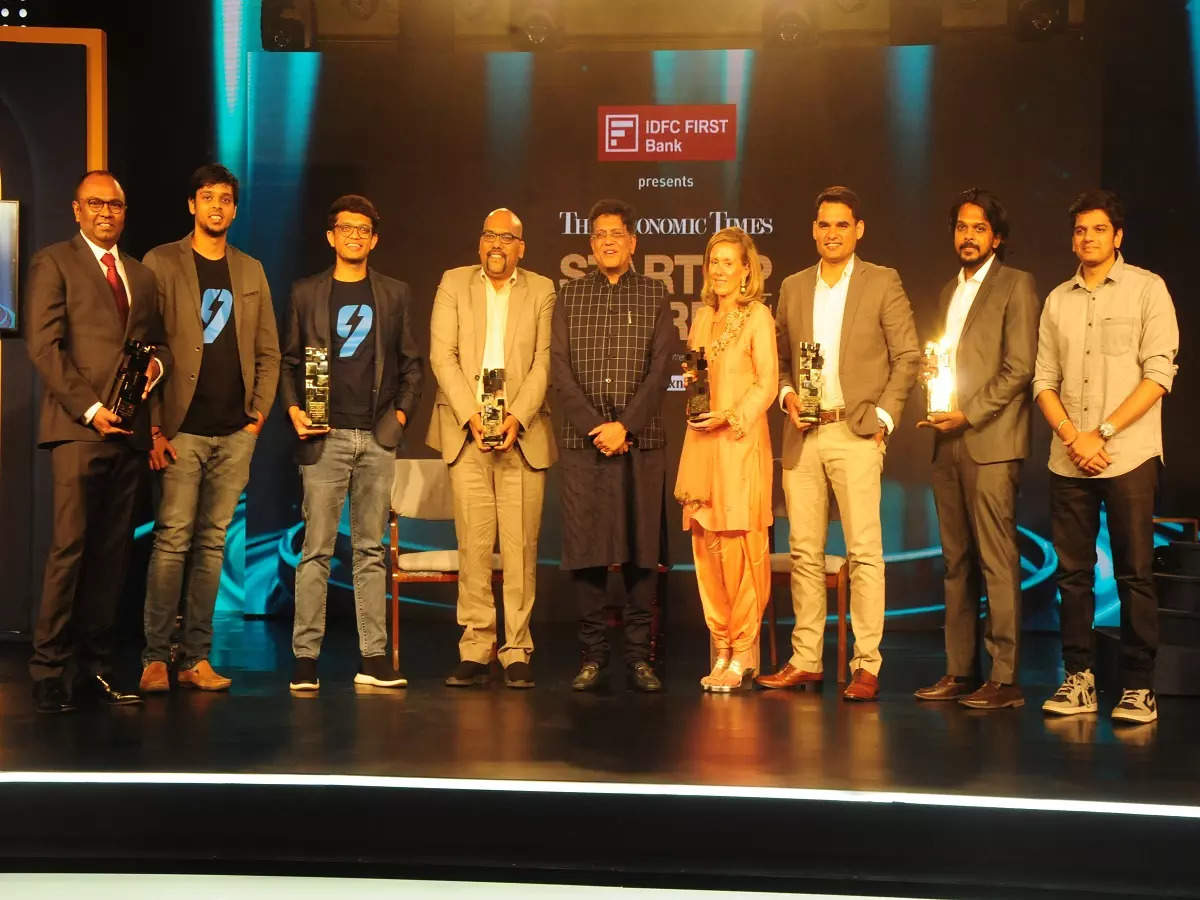

ETSA 2021: A celebration of India’s startups

Around 175 guests gathered in Bengaluru for the Economic Times Startup Awards, held in a physical setting after two years. The event turned out to be a high-energy coming together of a star-studded group from India’s startup world.

Meet the winners: At the grand ceremony on Saturday, online food-delivery and restaurant discovery platform Zomato won the prestigious Startup of the Year award.

Zomato’s Surobhi Das receiving the award on behalf of Deepinder Goyal from Karnataka chief minister Basavaraj Bommai and Ashwini Vaishnaw. Word of caution for startups: Speaking at the event, Ashwini Vaishnaw, minister of railways, communications, electronics and IT cautioned that as new-age companies grow in size, they will need to prepare for the challenges they will face as larger companies.

Chandrasekhar on data protection: India will soon roll out a data protection framework that will strike the right balance between protecting private data and preserving the enabling business environment, said Rajeev Chandrasekhar, minister of state for skill development and entrepreneurship, and electronics and IT.

(L-R) ETtech editor Samidha Sharma, Zerodha founder Nithin Kamath, Urban Company cofounder Abhiraj Bhal, Delhivery cofounder Sahil Barua, ZestMoney cofounder Lizzie Chapman and Accel partner Shekhar Kirani at the ET Startup Awards panel discussion.

Panel discussion: The most hotly discussed topic was technology startup IPOs, with founders and investors unanimously agreeing that going public continues to be on the cards for Indian startups and it’s just a matter of favourable timing.

(From left) Abhay Hanjura of Licious, Neeraj Kakkar of Hector Beverages, Vivek Gupta of Licious and Aman Gupta of Boat.

From left: Satyan Gajwani of Times Internet, Ananth Narayanan of Mensa Brands, Sameer Nigam of PhonePe, Virendra Gupta of Verse Innovation, Kunal Shah of Cred, and Vikram Vaidyanathan of Matrix Partners.

For the entrepreneurs and investors attending, it was a welcome return to networking and bonding, albeit with some changes.

Meta narrows guidance, prohibit calls for death of a head of state

Facebook owner Meta Platforms said that it is further narrowing its content moderation policy for Ukraine to prohibit calls for the death of a head of state, Reuters reported.

The move came after reports that Meta was temporarily allowing some posts on Facebook and Instagram calling for the death of Russian President Vladimir Putin or Belarusian President Alexander Lukashenko.

Quote: “We are now narrowing the focus to make it explicitly clear in the guidance that it is never to be interpreted as condoning violence against Russians in general,” Meta global affairs President Nick Clegg wrote in a post on the company’s internal platform.

Meta said on Friday that a temporary change in its content policy, only applicable for Ukraine, was needed to let users voice opposition to Russia’s attack. On the same day, Russia opened a criminal case against the social media firm.

Insta ban: Russia’s communications regulator has imposed restrictions on Meta’s Instagram, effective Monday. Meta had previously restricted access to Russian state media outlets RT and Sputnik on its platforms across the European Union.

Ukraine deploys facial recognition tech: Ukraine’s defence ministry has begun using Clearview AI’s facial recognition technology after the US startup offered to uncover Russian assailants, combat misinformation and identify the dead.

Bitcoin, Ether see brief spike after Elon Musk says he isn’t selling

Bitcoin, Ether and Dogecoin got a quick boost on Monday after Elon Musk tweeted that he owns the digital tokens and isn’t planning to sell.

Musk effect: Bitcoin, which has fallen as much as 2.9% before Musk’s tweet, briefly erased losses before retreating again. Ether was up as much as 2.3% before giving up some gains. Dogecoin’s 3.8% gain on Monday afternoon was the biggest among cryptocurrencies tracked by CoinGecko.

Also read: Twelve times Elon Musk moved markets in 2021

Inflation concerns: In another tweet, Tesla Inc chief executive officer Elon Musk said the US electric carmaker and his rocket company SpaceX are facing significant inflationary pressure in raw materials and logistics.

He also asked about the inflation rate outlook and said his companies “are not alone”, retweeting an article saying the Ukraine-Russia conflict has sent commodity prices to their highest levels since 2008.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.