Credit: Giphy

Also in this letter:

■ SoftBank chief executive on Paytm’s IPO

■ Byju’s raises $1.2 billion via term loan

■ Twitter users vote ‘yes’ on Musk’s stake sale idea

Paytm’s record-breaking IPO subscribed 18% on first day

Paytm’s initial public offering (IPO) was subscribed 18% on the first day of bidding today with the company receiving bids for 88.21 lakh of the 4.83 crore equity shares on offer.

■ Retail investors snapped up 78% of the shares allotted to them

■ Non-institutional investors bid for 2% of shares in their quota

■ Qualified institutional buyers bid for 16.78 lakh of the 2.63 crore shares meant for them

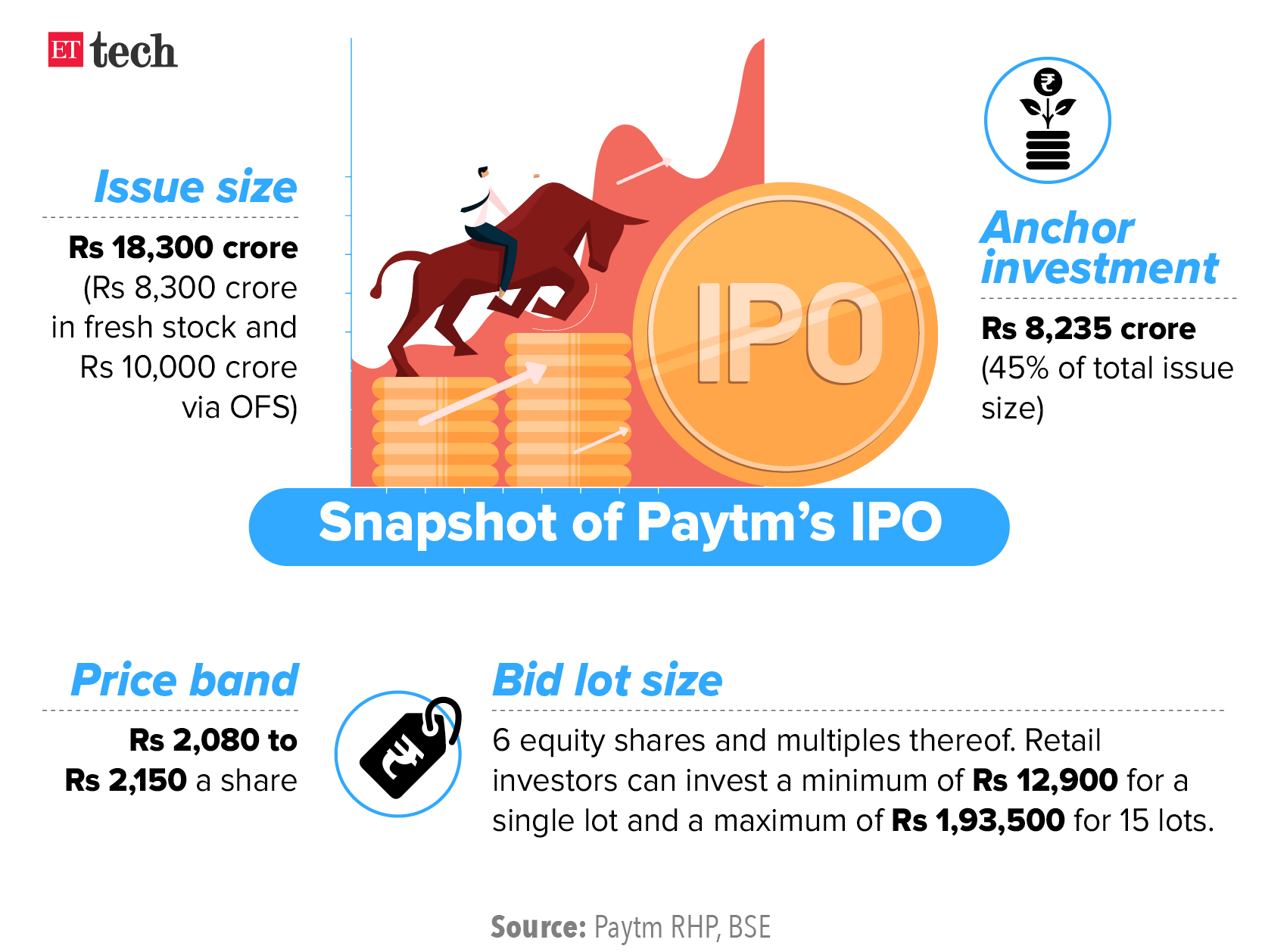

IPO in 5 points: Paytm’s Rs 18,300 crore IPO comprises a fresh issue of Rs 8,300 crore and an offer for sale (OFS) by existing shareholders worth Rs 10,000 crore.

Last week, Paytm raised Rs 8,235 crore from anchor investors, or about 45% of the Rs 18,300 crore it is seeking to raise in total from the IPO. Top sovereign wealth funds and financial investors such as Singapore’s GIC, Canada’s CPPIB, BlackRock, Alkeon Capital, Abu Dhabi Investment Authority are among those that picked up stakes in Paytm.

Large investors including Jack Ma’s Ant Group and Masayoshi Son’s SoftBank Corp are among Paytm’s investors who are selling their shares in the IPO.

Paytm said it plans to use the money it raises to grow and strengthen its ecosystem. It will spend (Rs 4,300 crore on acquiring and retaining more customers and merchants, and giving them greater access to technology and financial services. It also plans to use Rs 2,000 crore for new business initiatives, acquisitions and strategic partnerships, and for other general corporate purposes.

The company is expected to list on the exchanges in mid-November.

Paytm’s numbers: Paytm is a leader in India’s digital ecosystem for consumers and merchants. Its total merchant base grew from 11.2 million as of March 31, 2019, to 21.1 million as of March 31, 2021.

Its gross merchandise value (GMV) has increased from Rs 2,292 billion in FY19 to Rs 4,033 billion in FY21. It offers consumers and merchants digital products and services. As of June 30, 2021, it offered payment services, commerce and cloud services, and financial services to 33.7 crore consumers and more than 2.2 crore merchants, as per its DRHP.

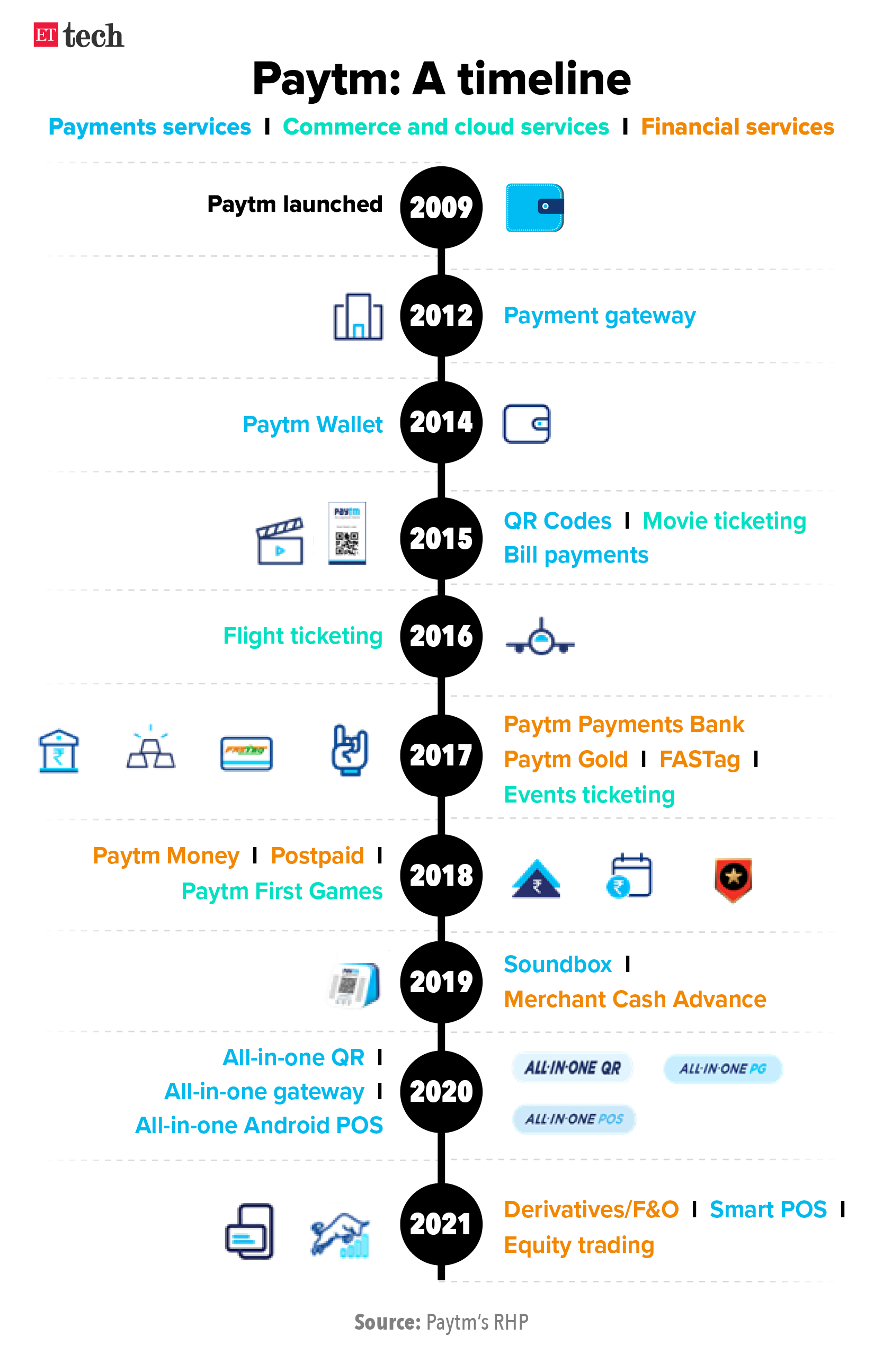

Rapid rise: Paytm has come a long way since its early days when it was best known for its e-wallet, and now offers a range of services:

- Payment services: Paytm earns through transaction charges, also known as merchant fees. It also earns via consumer, convenience and subscription fees.

- Financial services: It charges customers a fee for various services, and businesses for marketing and distribution of credit cards, commission on insurance policies, and lending.

- Commerce services: It charges customers a convenience fee and earns a transaction fee from merchants on tickets for entertainment, travel and other such services.

- Cloud services: Paytm charges a subscription fee for cloud services.

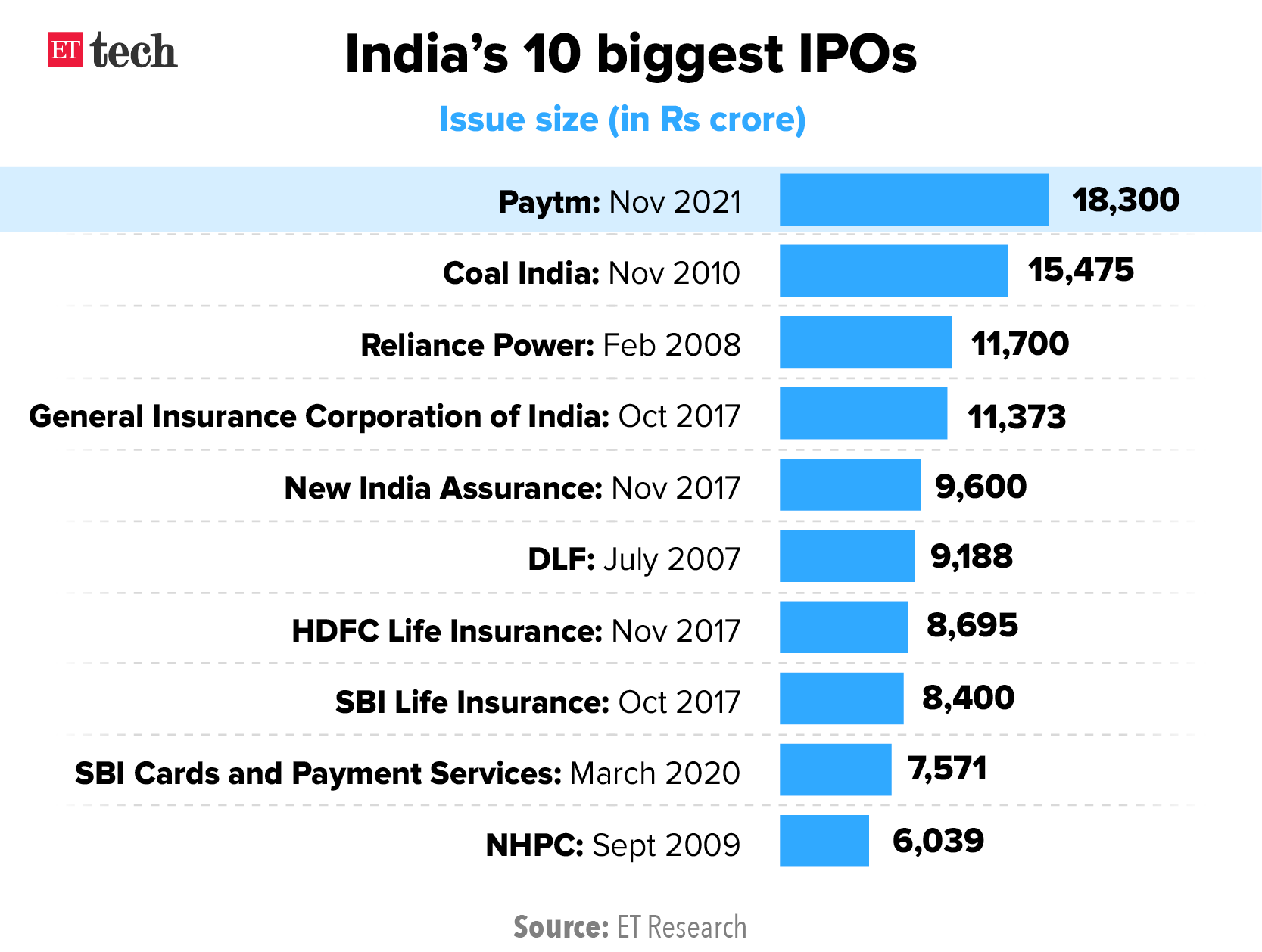

India’s biggest IPO: Paytm’s IPO is expected to be the largest in Indian corporate history, eclipsing the Rs 15,475 crore IPO by Coal India in November 2010. Four of the country’s 10 biggest IPOs are now by private firms.

Paytm’s valuation should be higher than when we invested in it: SoftBank CEO

SoftBank CEO Masayoshi Son

Masayoshi Son, founder and CEO of SoftBank, said Paytm’s IPO should be a “great event” for the Japanese investment major.

Quote: “I believe Paytm should grow significantly… and valuation-wise. Of course, it depends on market conditions and investors’ appetite. Either way, I believe the valuation (of Paytm during the IPO) should be bigger than the cost that we spent when we made an investment (in the company). So for us, the IPO should be a great event,” Son told reporters after announcing SoftBank’s earnings on Monday. He was asked if Paytm’s IPO valuation of around $20 billion was less than expected, and what he thought about the company’s potential to grow the valuation after the IPO.

SoftBank had first invested in Paytm parent One97 Communications in 2017, after which the payments firm was valued at around $7-8 billion. SoftBank had put around $1.4 billion in Paytm in what was a mix of primary and secondary share sale four years ago.

“I believe they (Paytm) can grow their value going forward (after the IPO)… not only Paytm but there are other businesses that we have high expectations of,” Son said, adding that the number of IPOs from its portfolio has been increasing.

SoftBank, which owns 18.5% of Noida-based Paytm, will sell shares worth Rs 1,689 crore as part of the Rs 10,000 crore offer for sale (OFS) in Paytm’s IPO.

SoftBank’s financials: SoftBank meanwhile reported a quarterly loss as the Japanese conglomerate was affected by a $10 billion hit at its Vision Fund unit amid falling valuations and a Chinese regulatory crackdown on tech firms.

The group reported a net loss of 397 billion yen ($3.5 billion) compared to a profit of 628 billion yen ($5.53 billion) a year earlier. Vision Fund’s investment loss totalled 1.167 trillion yen.

Why? While Son describes SoftBank as a goose laying “golden eggs”, referring to its stakes in startups that go to market, IPOs have dropped off and shares in many top assets fell during the quarter. It has been trimming stakes in companies such as Uber and DoorDash following the expiry of lock-up periods.

Byju’s raises $1.2 billion via term loan

Byju’s founder Byju Raveendran

Byju’s, India’s highest-valued startup, has raised $1.2 billion via a term loan from overseas markets, three sources with knowledge of the development said.

The edtech firm valued at $18 billion had earlier planned to raise $700 million, but the round was upsized with recommitments due later today. The company has taken advantage of the interest rate arbitrage available in global markets, with record-low rates.

It has raised capital at a rate of Libor + 550 basis points, much lower than what’s available in domestic markets. Libor, or London interbank offered rate, is the benchmark at which overseas interest rates are set.

What will it be used for? Byju’s plans to use the term loan proceeds to fund general corporate purposes, offshore only, including to support business growth in North America and fund potential inorganic growth opportunities.

Acquisition machine: The company has spent more than $2 billion on acquisitions over the past few months, triggering consolidation in an industry that has gained due to the pandemic.

Earlier this year, Byju’s expanded in overseas markets through its ‘Future School’ offering in the US, UK, Brazil, Indonesia and Mexico. “The company is looking at entering the North American market and will be announcing another strategic investment soon,” said a person with knowledge of the development.

Tweet of the day

Twitter users say ‘yes’ to Elon Musk’s Tesla stake sale proposal

Tesla CEO Elon Musk

Tesla chief executive Elon Musk should sell about 10% of his stake in the company, according to 57.9% of people who voted on his Twitter poll, in which he asked if he should offload the stake.

- “I was prepared to accept either outcome,” Musk said, after the voting ended.

Quick catch-up: US Senate Democrats have unveiled a proposal to tax billionaires’ stocks and other tradable assets to help finance President Joe Biden’s social spending agenda and fill a loophole that has allowed them to defer capital gains taxes indefinitely. Musk has criticised the proposal saying, “Eventually, they run out of other people’s money and then they come for you.”

Musk tweeted on Saturday that he would offload 10% of his stock if users approved the proposal. The poll got more than 3.5 million votes.

“Much is made lately of unrealised gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock,” Musk said on Saturday, adding that he does not take cash salary or bonus “from anywhere”, and only has stock.

The numbers: As of June 30, Musk’s holding in Tesla was about 170.5 million shares and selling 10% would amount to close to $21 billion based on Friday’s closing, according to calculations by Reuters.

Including stock options, Musk owns a 23% stake in Tesla, the world’s most valuable car company, whose market cap recently crossed $1 trillion.

A week ago, Musk had said on Twitter that he would sell $6 billion in Tesla stock and donate it to the United Nations’ World Food Program (WFP), provided the organisation was more transparent on how it spends money.

Crypto rally lifts Ether to new record, Bitcoin to near three-week high

Bitcoin rose to near its all-time high on Monday and Ether set a new record as cryptocurrencies rode higher on a wave of momentum, flows, favourable news and inflation fears.

Big gains: Bitcoin rose as much as 5.5% on Monday to $66,339, nearing its previous record of about $67,000. Ether advanced as much as 3% to a new high of $4,768.

Ether is up 57% since the start of October and Bitcoin about 50% as investors have cheered last month’s launch of a US futures-based Bitcoin exchange-traded funds (ETFs) and sought exposure to an asset class sometimes regarded as an inflation hedge.

Read our explainer on crypto ETFs here.

Expert speak: Falling real yields, as traders brace for inflation, adds to the attractiveness of assets such as gold and cryptocurrencies, which do not pay a coupon, said Kyle Rodda, analyst at broker IG Markets, adding that the mood in the sector has also been good.

- “Financial institutions want to be a part of it, regulators don’t want to clamp down on it too much,” he said. “We’re almost past the inflection point, where it’s part of the system and it’s going to be very, very hard to extricate it.”

In a separate development, Vikaram Pandit, chairman of The Orogen Group and former CEO of Citigroup, said that all major financial institutions will soon be thinking about trading cryptocurrencies.

Quote: “My big hope is that central banks around the world understand the benefit of central bank digital currency, and move on to accept, adopt them,” Pandit said.

Growing acceptance: Wall Street giants are warming up to the idea of digital currencies after dismissing them for years.

JPMorgan and Bank of America are among US banks hiring for crypto as demand for the virtual currencies balloons. Goldman Sachs has started trading crypto futures and last week, the Commonwealth Bank of Australia said it will offer customers the ability to buy, sell and hold crypto assets.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.