Also in this letter:

■ Crypto industry comes together for ad guidelines

■ Curefoods bags $62 million for acquisition spree

■ I&B Ministry’s Twitter account hacked, restored

Vijay Shekhar Sharma blames bad timing for Paytm’s flop listing

Paytm founder and CEO Vijay Shekhar Sharma

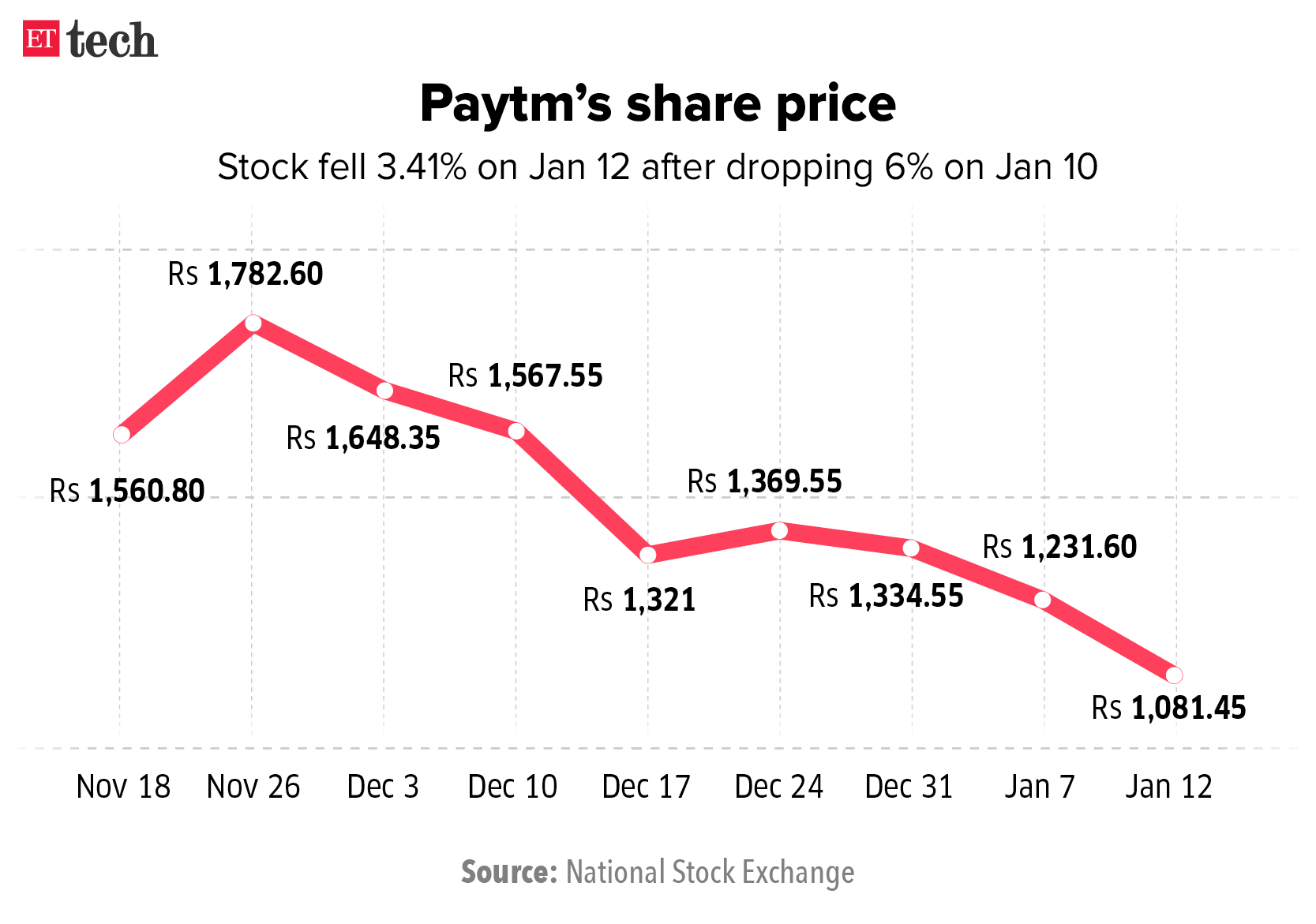

Paytm founder Vijay Shekhar Sharma blamed bad timing for the company’s poor IPO and listing on Wednesday, even as its stock continued to fall.

Paytm’s market cap was $9.49 billion as of close on Wednesday, down from a peak private market valuation of $16 billion.

What he said: Sharma said Paytm went public at a time when the market was spooked by various factors, which affected the pricing. He was in conversation with Sequoia Capital’s managing director Rajan Anandan at IAMAI’s India Digital Summit 2022 – one of his first public appearances since Paytm’s disastrous market debut in November.

“The success of Paytm will depend on what we do with monetisation, led by financial services. Payment is a revenue line item which is growing massively. This quarter we are talking about $100 million revenue from payments which is like a sizable revenue… People underestimate the size of payments revenue,” he said.

He also said Paytm ought to be benchmarked against only one company – Bajaj Finance. “Bajaj Finance has been there for 30-32 years. Paytm processes more loans than Bajaj today, in less than three years… For our credit business, we should be benchmarked against only one guy and that is Bajaj (Finance). We should be looked at for the scale we deliver in terms of total loans, value of loans and quality of loans,” he said.

Sharma said the contribution margin for payments continued to be in the double digits for Paytm, and that quarterly revenue from payments had hit $140 million, if merchant services were included. Payment revenue is expected to grow at least 50% to 60% year-on-year, he added.

Yes, but: On Monday, brokerage firm Macquarie slashed the target price of Paytm’s parent, One97 Communications, from Rs 1,200 to Rs 900. This was 58% lower compared to the issue price of Rs 2,150. Macquarie said Paytm’s payments business accounts for 70% of overall gross revenues and hence any regulations capping charges for digital payments could affect the company.

Also read: ETtech Analysis: Behind Paytm’s dismal IPO and its constant valuation catchup

Shares fell 6% on Monday: Shares of One 97 Communications, which owns Paytm, fell by more than 6% on Monday to Rs 1,151 before closing at Rs 1,157.90. The shares came under pressure following news that HDFC Mutual Fund, one of four mutual funds that were anchor investors in its IPO, had significantly reduced its holding in December.

Crypto industry comes together for ad guidelines

This month, Indian cryptocurrency exchanges and other stakeholders met to draw up a preliminary list of dos and don’ts on marketing the digital assets, two sources told us.

Not just ads: The proposed guidelines would apply not just to all forms of ads, but also communications and sales literature, television programmes, interviews, public talks, presentations, seminars, workshops, or any other forum crypto companies use to market their products. They include:

- Not comparing crypto ads with other regulated assets in ads.

- Not making claims like ‘understanding crypto products is so easy you don’t need to think twice about investing,’ or featuring cryptos as a solution to money problems.

- Not making exaggerated or unwarranted claims.

- Adding a prominent disclaimer to ads, which could read, “Crypto products are currently unregulated and subject to market risk. Please seek independent financial advice before investing.”

- Not using the word ‘currency’ in ads, as consumers associate the term with legal tender.

Why now? Caught between a market selloff and uncertain destiny, India’s crypto industry is trying to counter the stigma that has divided policymakers and put off the Reserve Bank of India. It will now discuss these rules with the Advertising Standards Council of India (ASCI).

An ad blitz by crypto exchanges in 2020 and a good part of 2021 came to a near standstill after they decided not to advertise on TV until crypto regulations were in place.

Govt consults tax experts: Meanwhile, the government has asked senior tax advisors whether the income earned from trading or investing in cryptocurrencies could be treated as business income as against capital gains from this year onwards, two people involved in the discussions told us. This would mean that the income tax on returns for investors or traders could be as high as 35% to 42%.

“If the definition of income is changed in the tax framework then it could give leeway to the tax department to charge income tax on any gains accrued from investing and trading in cryptocurrencies. Some clarity as far as taxation is concerned is required around cryptocurrencies even if we don’t have a framework in place defining the asset class,” said Dinesh Kanabar, CEO, Dhruva Advisors, a tax advisory firm.

Kim K, Floyd Mayweather sued over crypto promotion: Reality TV star Kim Kardashian and boxing legend Floyd Mayweather Jr. are facing a lawsuit that claims they misled investors in their promotion of a crypto token. The lawsuit, filed on January 7 in Los Angeles, claims the celebrities touted tokens sold by EthereumMax, or EMAX, to boost its price and make themselves a profit “at the expense of their followers and investors”.

Tweet of the day

Curefoods gets $62 million funding to double down on multi-brand play

Curefoods has raised $62 million from Iron Pillar, Chiratae Ventures, Sixteenth Street Capital, Accel Partners and Flipkart cofounder Binny Bansal amid a significant rise in demand for cloud kitchens and online-only restaurants.

It plans to deploy 30-50% of the fresh funds to continue its buying spree across the country, a strategy deployed by others in the sector.

Quote: “If you look at how the brands or cuisines are consumed, there are no national brands in any category. Hence, we decided to go after midsize regional players and city leaders, scale them, and see whether they can go national or not,” Nagori told ET. “Food is very fragmented and we will try and scale most brands up to a regional level. For the national level, we will only pick a few brands. Right now, we are taking three brands national.”

Tell me more: Curefoods is operated by Ankit Nagori, a former senior executive at Flipkart who branched out from Curefit—a company he co-founded with Myntra founder Mukesh Bansal. The firm wants to create a multi-brand, Thrasio-like play by acquiring, incubating and licensing other food brands. It already has 20 brands in its fold, of which 15 are fully acquired.

The strategy of acquiring brands is similar to what’s happening in the e-commerce sector, where Thrasio clones have emerged in India. Thrasio, a US firm, pioneered the model of buying and scaling small brands that sell on Amazon. Rebel Foods, which operates a network of cloud kitchens and digital brands, has committed $150 million (about Rs 1,138 crore) for strategic brand investments and acquisitions.

Other Done Deals

■ Refyne, a platform which helps employees draw their salaries on demand, said it has raised $82 million in new funding led by New York-based investment firm Tiger Global. The financing saw participation from existing investors, including QED Investors, partners of DST Global, Jigsaw VC, XYZ Capital, and RTP Global. Digital Horizon has come on board as a new investor, the company said.

■ The Michael & Susan Dell Foundation has led a $10 million equity infusion in Kaleidofin, a fintech platform that provides financial solutions to under-served customers engaged in the informal economy. Existing institutional investors in the fintech firm — OikoCredit, Flourish Ventures, Omidyar Network, Blume Ventures and Bharat Fund – also participated.

I&B Ministry’s Twitter account hacked, restored

The Twitter handle of India’s Information and Broadcasting (I&B) Ministry was compromised briefly on Wednesday and its name was changed to that of entrepreneur Elon Musk. The account was soon restored, but not before the hackers posted about – you guess it – crypto.

Tell me more: After the I&B ministry’s account was hacked, several tweets containing links to “amazing news”, with a Bitcoin-related image, were shared.

“The account @Mib_india has been restored. This is for the information of all the followers,” the ministry later tweeted.

Last month, Prime Minister Narendra Modi’s Twitter handle was briefly hacked, and a tweet claiming that India has “officially adopted bitcoin as legal tender” was posted from it. The Prime Minister’s Office later said the account was immediately secured after the matter was escalated to Twitter.

Also Read: Twitter says its systems not behind PM Modi’s account breach

In September 2020, the Twitter account associated with PM Modi’s personal website and mobile app was hacked by an unknown group.

US judge rejects Facebook request to dismiss FTC antitrust lawsuit

A US judge has declined to dismiss the Federal Trade Commission’s antitrust lawsuit against Facebook, saying the FTC had a plausible case that should be allowed to proceed.

Facebook, now Meta Platforms, had asked Judge James Boasberg in Washington, DC federal court to dismiss the lawsuit, in which the government asked the court to demand that Facebook sell Instagram and WhatsApp.

Landmark case: The FTC’s high-profile legal fight with Facebook represents one of the biggest challenges the government has brought against a tech company in decades, and is being closely watched as Washington aims to tackle Big Tech’s extensive market power.

Quote: “Ultimately, whether the FTC will be able to prove its case and prevail at summary judgment and trial is anyone’s guess. The Court declines to engage in such speculation and simply concludes that at this motion-to-dismiss stage, where the FTC’s allegations are treated as true, the agency has stated a plausible claim for relief,” wrote Boasberg.

Meta appoints DoorDash CEO Tony Xu to its board: Meanwhile, Meta Platforms has named DoorDash chief executive Tony Xu to its board. Xu’s appointment is effective immediately, according to the company, bringing the number of Meta directors to 10.

Xu has served as CEO and a member of the board of directors of DoorDash since May 2013. He was appointed DoorDash’s board chair in November 2020.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai.