Also in this letter:

■ Some influencers say Trell hasn’t paid them for months

■ Swiggy vies with Reliance and others for Metro AG’s India unit

■ Zomato lays out top priorities once Blinkit deal is done

Payments Council of India seeks govt’s help on RBI rule

The Payments Council of India (PCI) and several fintech firms have urged the government to step in to resolve the fallout from a recent directive by the Reserve Bank of India (RBI), which barred payment companies from loading credit lines onto wallets and prepaid payment instruments (PPIs).

Catch up quick: We reported last week that fintech firms, along with the Digital Lenders’ Association of India (DLAI), had reached out to the government and the banking regulator seeking a six-month extension to comply with the new mandate.

We also reported that RBI’s circular had come after commercial banks raised concerns over likely breach of rules, including anti-money laundering (AML) and KYC guidelines, by the fintech companies.

What PCI wants: The council – under the Internet and Mobile Association of India (IAMAI) – said wallets that comply fully with know your customer (KYC) norms should be treated on par with bank accounts, and that they should be allowed to disburse credit.

It said, “a drawdown by the customer from a non-revolving credit line (which has been given by a regulated lender) should be allowed to be disbursed into a full KYC PPI”.

This essentially means that it is seeking a reversal of the RBI order published last week.

A non-revolving credit line is a concept where the credit is ‘non-replenishable’ unless the customer is being underwritten again for a new credit line and has a clear repayment schedule with no minimum due.

Making fintech’s case: In the letter, PCI explained the various models of using PPIs for disbursing loans to customers. It also said disbursing loans on a wallet or PPI helps lenders to better control how the loan is used versus running the risk of misuse if it is given out in cash.

It also said the current model of disbursing loans through a PPI has led to greater financial inclusion and movement towards a cashless future.

Fallout: Industry sources have told us that credit card startups, such as Tiger Global-backed unicorn Slice and Uni Cards, were more likely to be impacted by the regulator’s move.

Tiger Global, Insight Partners, General Catalyst and others have invested more than $500 million in challenger credit card companies over the last 18 months.

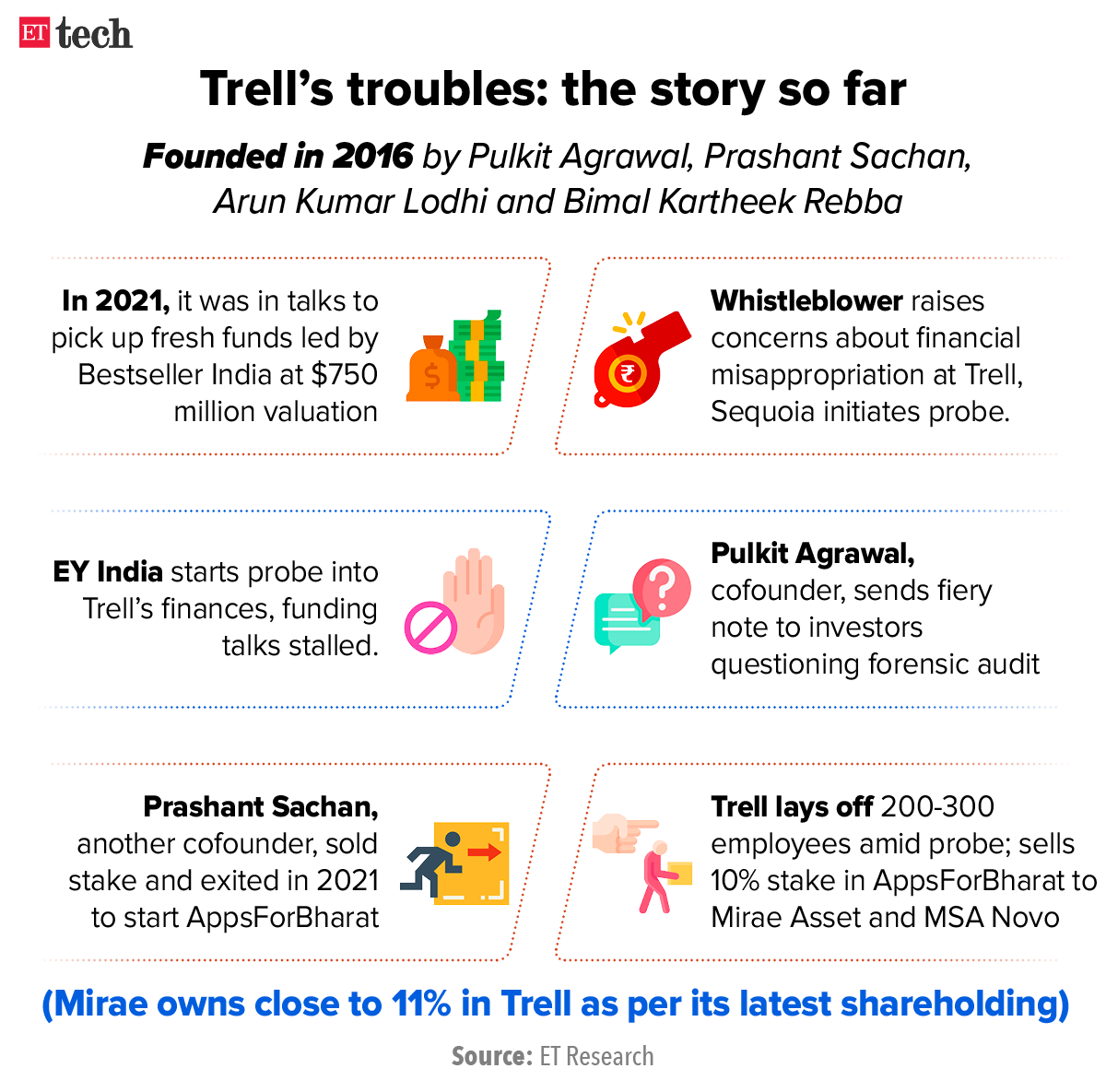

Some influencers say Trell hasn’t paid them for months; 100 more staff leave

Influencer-led video commerce platform Trell has not paid its dues to a section of content creators for the past six to seven months, three creators told us.

About 100 employees of Trell have also voluntarily left the company over the last two months, a source said.

Troubles galore:Trell is being investigated by a forensic team from EY India, which is looking into alleged related-party transactions, incorrect reporting of business numbers, and other financial irregularities at the firm.

How many are unpaid? We could not ascertain the exact figure but sources told us Trell hasn’t paid a “significant” number of creators. At one point the company was working with 1,000-1,500 creators, they said.

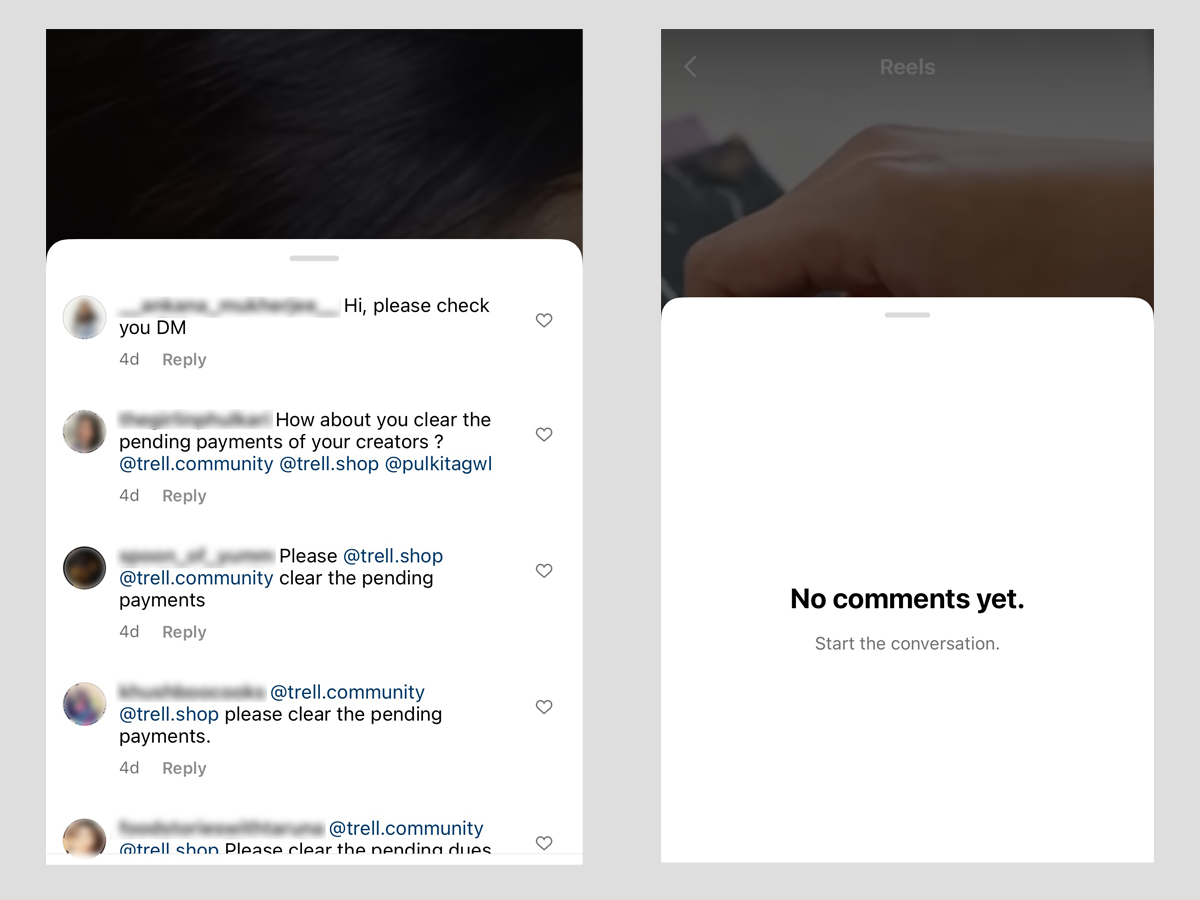

Deleting comments: The community page of Trell on Instagram had several comments from creators, such as “please clear the pending payments”, prodding the company to pay. Trell was actively deleting these comments, we found.

At least one creator also alleged that the company was only paying influencers with large followings on popular social media platforms like Instagram to avoid public shaming, while not paying creators with a relatively smaller number of followers.

Denial: Trell denied the allegations.

“Trell has paid all its creators as per our contractual agreements with them. A certain percentage of creators work via their agencies. Trell has cleared payments with agencies as well,” the company said in a statement.

“However, it has come to our notice that certain agencies have been delaying payments. While that is an agency-creator discrepancy, we have been actively working with them to ensure our creators are taken care of and payments are cleared at the earliest…”

Layoffs: In March, Trell laid off 300 employees amid growing uncertainty around the company and talks of a funding round coming to a halt.

TWEET OF THE DAY

Swiggy vies with Reliance, PremjiInvest for Metro AG’s India unit

Food delivery firm Swiggy is competing with Reliance Retail, Thailand’s largest conglomerate Charoen Pokphand (CP) Group and PremjiInvest – the investment fund managed by the family office of Indian tech billionaire Azim Premji – to buy the Indian cash-and-carry operations of German retailer Metro AG, several sources told us.

The Tata Group and private equity fund Bain Capital are evaluating the $1-1.5 billion buyout opportunity but are yet to firm up any plans, said the people mentioned above.

The submission of non-binding offers is scheduled for this week. Flipkart-Walmart, DMart and Amazon have for the moment opted out of the race. Detailed due diligence will start after the non-binding offers are received with firm offers expected in two months.

We reported on May 20 that Metro AG had decided to exit India by selling its local operations, and that at least 10 potential candidates including Reliance, CP Group, Flipkart, D-Mart had been approached.

On May 30, we reported that Swiggy was also evaluating the prospect.

Fleet integration, customer cross-selling are top priorities after Zomato-Blinkit deal

Zomato plans to start integrating Blinkit on multiple fronts after its board approved the proposed acquisition, top executives said in a conference call on Saturday.

Catch up quick: Zomato’s board okayed its acquisition of quick commerce startup Blinkit for 4,447 crore ($570 million) in an all-stock deal on Friday. The company said the markdown in Blinkit’s valuation was due to macroeconomic factors.

Priorities: During the analyst and shareholder call, Zomato executives indicated that once the transaction closes, the priorities would be customers and delivery fleet integration. Zomato may consider moving Blinkit to the Zomato app.

“We will experiment with different ways of integrating the two customer bases or rather making sure that we are able to leverage Zomato’s customer base for the growth of Blinkit business,” said Zomato CFO Akshant Goyal.

“Once the transaction is done, we’ll test these things and if it makes sense to actually have both the brands on the same app, then why not? So there are multiple ideas in our head and we’ll experiment and see what works eventually.”

Using Zomato’s food delivery customer base to cross-sell quick commerce is going to be a large part of “synergy realisation”, he said.

More than half of IT firm struggling to get workers back to office: report

Three in four employees working in information technology (IT) companies in India are not coming to office even once a week despite their organisations resuming work from office (WFO) according to a survey conducted by CIEL HR.

Many IT companies are also going easy on their return-to-office policy as they fear coercion may trigger more resignations. CIEL surveyed 40 IT companies in India, including those among the top 10, employing a total of about 900,000 employees.

Among the companies surveyed by CIEL, 30% are operating in WFH mode while the remaining have either resumed WFO or intend to get employees back into the office soon. But these employees are not yet open to the idea of switching from WFH mode.

TCS to spread out: To counter this, TCS plans to set up offices in small cities and non-metro regions including Guwahati, Nagpur and Goa.

This is aimed at encouraging collaboration among staff members as many are reluctant to go back to their base locations after working out of home, mostly in their native towns, following the Covid-19 pandemic, executives said.

Its peers such as Infosys, Wipro, HCL Technologies and Tech Mahindra have already announced major expansion plans into non-metro regions.

Other Top Stories By Our Reporters

Policy conundrum | The impact on Indian tech firms: The power corridors in New Delhi are once again buzzing with a bunch of policies and legislation that directly impact technology and internet companies. The IT ministry is seeking to amend the IT Rules, 2021 for significant social media intermediaries, in order to plug “infirmities and gaps” in the existing regulations. The proposed changes are, however, not the only way that the IT ministry is seeking more accountability from internet companies operating in India.

India’s first NFT platform for esports: Game streaming and e-sports platform Loco is set to launch a new platform that will allow fans to own and trade e-sports collectibles through non-fungible tokens (NFTs). The platform, Loco Legends, will partner with 50 of India’s most popular esports teams and allow fans to buy and trade in virtual collectibles, not unlike how sports fans buy merchandise and collectibles for their favourite sports teams in the real world.

Indian cos ready to dial 5G in a year:Indian enterprises are betting big on 5G, with 52% of firms surveyed by Omdia saying that they intended to start using it in the next 12 months, and 56% ranking it among their most important technologies for digital transformation.

Global Picks We Are Reading

■ Period-tracker apps aim for anonymity following Roe v Wade decision (WSJ)

■ One day, AI will Seem as human as anyone. What then? (Wired)

■ How to scrub yourself from the internet, the best that you can (The Washington Post)