Credit: Giphy

Also in this letter:

■ New US export rules target Russian tech

■ Zomato, Paytm, Nykaa to get a place in junior Nifty50

■ Koo raises $10 million in two tranches

Bounce’s shared mobility business shrank 83% during the pandemic

Shared mobility and EV company Bounce’s operating revenue fell 83% to Rs 14 crore for the financial year ended March 2021 as the pandemic dedicated shared mobility services. The information was sourced from the company’s filings with the Ministry of Corporate Affairs (MCA).

Yes, but: Bounce’s overall revenue shrank ‘only’ 52% to Rs 53 crore as the company earned income from interest from fixed deposits and other investments.

In January 2020, before the pandemic hit, the company was able to raise $105 million from Accel Partners and B Capital at a valuation of $520 million. This fundraise helped Bounce increase its income from interest.

Financials: Bounce’s losses shrunk 97% to Rs 29 crore as expenses fell from Rs 143 crore to Rs 29.9 crore. According to the financials, Bounce reduced expenses across advertising and promotion, legal, rent, power and fuel. As the mobility business took a hit, the company laid off 40-60% of its workforce in February 2021.

Pivot or perish: Before the pandemic, Bounce, like Vogo, was known for its shared two-wheeler service. Yulu also competes with the company but all of these businesses have moved in different directions.

While Bounce has moved on to EVs, Vogo was acquired by Mumbai-based Chalo. ET reported about the acquisition on November 13. Bounce and Yulu now provide vehicles for food and essential delivery workers.

Driving force: Bounce’s shared and personal mobility business will co-exist as it plans to use the same battery swapping technology across all its vehicles. The battery-as-a-service model has allowed the company to price its scooter, called Bounce Infinity, at Rs 45,099 (ex-showroom).

Explained: New US export rules designed to freeze Russian tech

The US has restricted exports to Russia of a broad set of US-made products and foreign-produced goods built with US technology. Here is how the rules are expected to affect both sides and the world at large, according to six experts on US trade law Reuters spoke to.

What are the new restrictions? US companies must now obtain licences to sell computers, sensors, lasers, navigation tools, and telecommunications, aerospace and marine equipment. The US will deny almost all requests.

- The new rules also force companies making tech products overseas with US tools to seek a US licence before shipping to Russia.

- A similar restriction was first applied in recent years to companies shipping to Chinese technology giant Huawei, to great effect.

How will Russia be affected? Emily Kilcrease, senior fellow at the Center for a New American Security, said the restrictions will freeze Russia’s technology where it is today.

But William Reinsch, a trade expert at the Center for Strategic and International Studies, said he expected a slow escalation of impact. “Eventually they will be hurting, but maybe not for months,” he said. “It’s not an immediate body blow.”

What tech isn’t covered? The measures include carve-outs for consumer items such as household electronics, humanitarian goods, and technology necessary for flight safety. Cell phones are permitted as long as they are not sent to Russian government employees or certain affiliates.

Also not restricted are consumer encryption technologies, which one attorney described as a sign that the United States and its allies do not want to disrupt protesters and media.

Ukraine calls on hackers for help: The government of Ukraine is asking for volunteers from the country’s hacker underground to help protect critical infrastructure and conduct cyber spying missions against Russian troops, Reuters reported, citing two people involved in the project.

“Ukrainian cybercommunity! It’s time to get involved in the cyber defence of our country,” the post read. It asked hackers and cybersecurity experts to list their specialities in a Google docs.

Meta’s monitoring centre in Ukraine: Meta has set up a special operations centre to monitor the conflict in Ukraine. It has also launched a feature that lets users in the country lock their social media profiles for security.

This comes a day after Twitter posted tips on how users can secure their accounts against hacking, make sure their tweets are private, and deactivate their accounts.

Zomato, Paytm and Nykaa to get a seat in junior Nifty50

In the upcoming semi-annual index reviews, three recently listed new-age companies — Zomato, One97 Communications (Paytm) and FSN E-commerce Ventures (Nykaa) — will become a part of Nifty Next50 index, leading to inflows of $33 million, $11 million and $9 million, respectively.

The revised list will be effective from March 31.

Market analysts noted that new eligibility criteria helped Nykaa and Paytm earn a place in Nifty Next50.

“Constituents should have a minimum listing history of one calendar month as on the cut-off date vs earlier requirement of three months,” said Abhilash Pagaria at Edelweiss Securities. “This has paved the way for stocks such as Nykaa, Paytm and Policybazaar.”

The news comes even as shares of the three companies have been hitting new lows or approaching their all-time lows every few days. Zomato’s shares are down a whopping 44.11% since the start of the year, Paytm’s are down 41.04%, and Nykaa’s are down 37.72%.

Tweet of the day

Koo raises $10 million in two tranches

Indian microblogging platform Koo has raised around $10 million (Rs 79 crore) in two tranches from a clutch of investors including Caspier Venture Partner, Ashneer Grover and Ravi Modi Family Trust, regulatory filings showed.

Deal details: As part of the first tranche, which was executed in January, the company said it has allotted 3,389 Series B2 compulsory convertible preference shares (CCPS) to seven investors for Rs 28 crore, documents accessed by ET show.

Other Investors that participated in the round include FBC Venture Partners, Yulubike’s Hemant Gupta, and Adventz Finance Private Limited.

A month later, the company raised Rs 51 crore from 28 investors by allocating 6,142 Series B2 CCPS shares.

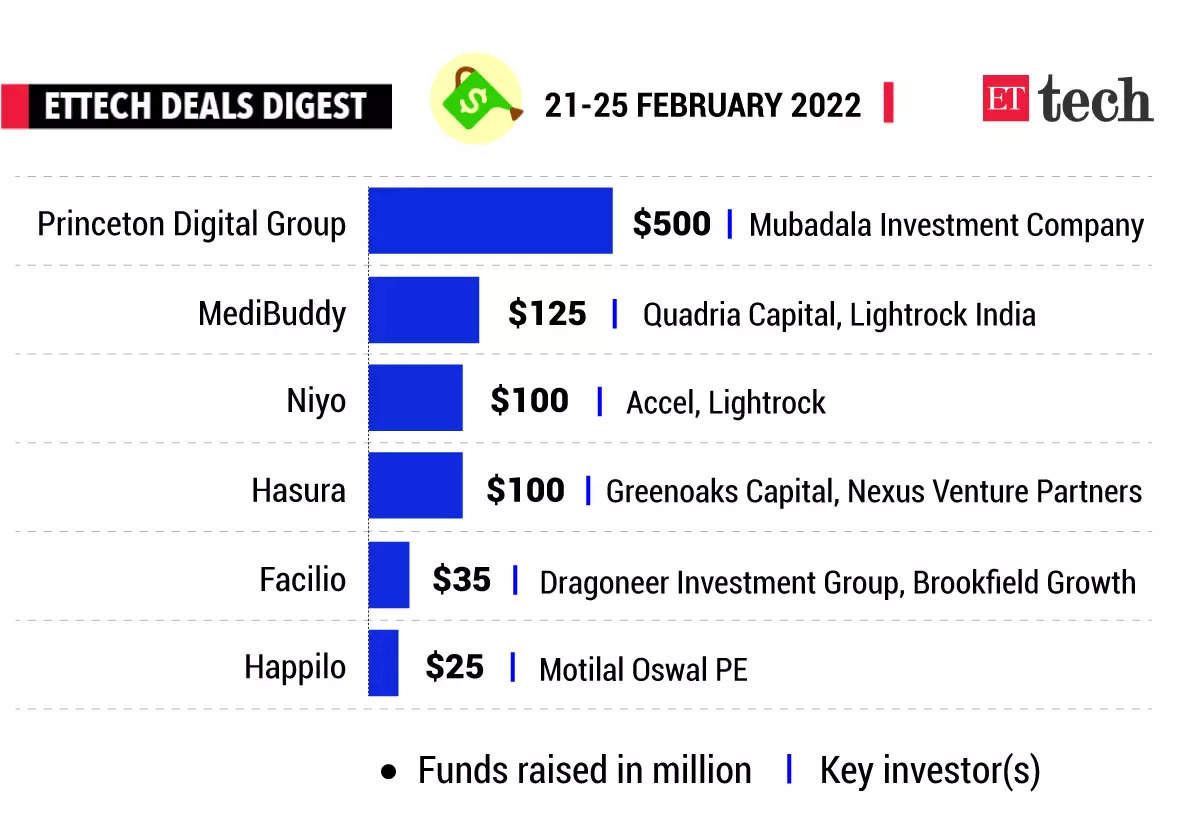

ETtech Deals Digest

Data centre company Princeton Digital Group (PDG), Health-tech startup MediBuddy, Neobanking platform Niyo were among the startups that raised funds this week. Here’s a look at the top funding deals of the week.

SEC probes Elon Musk, brother Kimbal over Tesla share sales

Tesla CEO Elon Musk

The US Securities and Exchange Commission (SEC) is investigating whether recent stock sales by Tesla Inc chief executive Elon Musk and his brother Kimbal Musk “violated insider trading rules”, the Wall Street Journal reported, citing people familiar with the matter.

Tell me more: According to the report, the investigation began last year after Kimbal sold shares of the electric carmaker valued at $108 million, a day before Musk polled Twitter users asking whether he should offload 10% of his stake in Tesla.

Kimbal Musk did not know about the Twitter poll ahead of it, Elon Musk told the Financial Times in an email, adding that his lawyers were “aware” of the poll.

Locking horns: The potential probe would escalate Musk’s battle with regulators as they scrutinize his social media posts and Tesla’s treatment of workers, including accusations of discrimination.

Last week, Musk accused the SEC of harassing him and Tesla with an “endless” and “unrelenting” investigation to punish him for being an outspoken critic of the government.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.