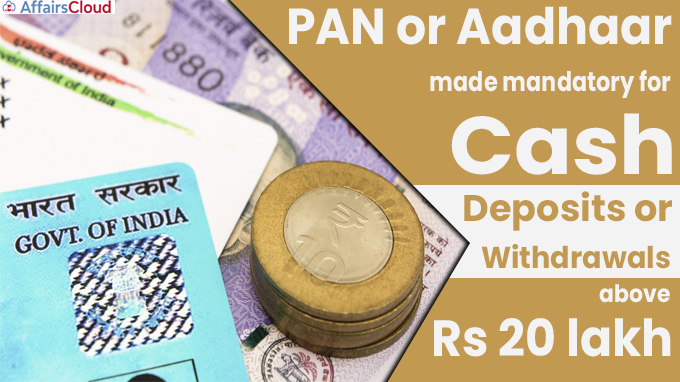

The government has made new standards in regards to trade exchanges out the bank or post office. As per the new guidelines, PAN and Aadhaar will be expected for saving money of Rs 20 lakh or more in a bank or post office in any one monetary year.

The Central Board of Direct Taxes (CBDT) has given new principles under the Income Tax (fifteenth Amendment) Rules, 2022. Nonetheless, the new principles will be carried out from 26 May. In any case, they have been advised.

Peruse the full notice of the new guidelines with respect to cash exchanges here

In which exchanges PAN-Aadhaar will be fundamental?

PAN Aadhaar will be compulsory for depositing Rs 20 lakh in real money in at least one accounts in a monetary year in a financial organization, corporative bank, or post office.

It will likewise be vital for cash withdrawal of 20 lakh rupees from any at least one accounts in a financial organization, co-employable bank, or post office in a monetary year.

PAN Aadhaar will be required for opening an ongoing account or money credit account in a financial organization, co-employable bank or post office.

PAN card compulsory in any event, for opening an ongoing account

Presently anybody needs to show their PAN card to open an ongoing account. Simultaneously, individuals whose bank account is now connected with PAN will likewise need to observe this guideline at the hour of exchange.

Watching out for cash exchanges

The government needs to bring an ever increasing number of individuals under the duty net through this progression. They do gigantic money exchanges, however they neither have a PAN card nor do they file ITR. While doing such exchanges, the Income Tax Department will actually want to follow such exchanges on the PAN number without any problem.