Linking Aadhaar with PAN from tomorrow (July 1, 2022) will attract a penalty of ₹1,000, according to a notification by the Central Board of Direct Taxes (CBDT) dated March 29, 2022. However, if PAN-Aadhaar is linked between April 1, 2022, and June 30, 2022, then the individual is liable to pay ₹500 as a penalty.

Steps to check PAN-Aadhaar linking status

Step 1: Visit the official website of the Income Tax Department: https://www.incometax.gov.in/iec/foportal

Step 2: Select ‘Link Aadhaar Status’ option from the menu appearing in the sidebar.

Link Aadhaar status

Step 3: Fill in your PAN and Aadhaar number details.

Step 4: Click ‘View Link Aadhaar Status’ and the status will be displayed on the screen.

Here is how to link PAN with Aadhaar

Step 1: Visit the official website of the Income Tax Department: https://www.incometax.gov.in/iec/foportal

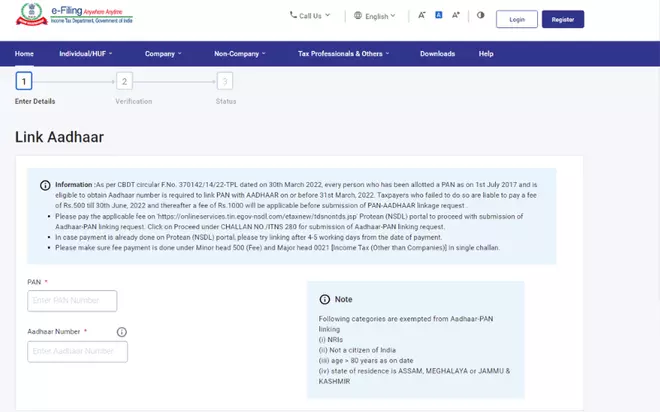

Step 2: Select the‘ Link Aadhaar’ option from the section menu appearing in the sidebar.

Step 3: Enter your PAN details, Aadhar card details.

Link Aadhaar tab

Step 4: Fill in the details required, including the mobile number and OTP sent to the registered mobile number and then select ‘Validate.’

On payment of the penalty, your PAN and Aadhaar will be linked. You can also check the status on the portal.

Published on

June 30, 2022