Also in this letter:

- Focus is on fundamentals, not valuation: Nykaa CEO

- Big Tech firms play it safe on India taxes

- Global exchanges await clarity India’s crypto rules

Oyo may reduce IPO size amid tough market conditions

Oyo founder Ritesh Agarwal

Oyo Hotels & Homes plans to substantially cut the size of its IPO, several sources told us.

Why? The planned reduction is due to adverse conditions in the secondary market and a crash in stock prices of new-age companies, the sources said.

Details: The issue size is expected to be much lower than $1 billion, they said. In its draft IPO papers filed with the markets regulator in October 2021, Oyo had said it planned to raise $1.2 billion. It was aiming for a valuation in the range of $9-12 billion but may now settle for around $7 billion, the sources said. Oyo was last valued at $9.6 billion in September 2021.

It may refile the draft red herring prospectus (DRHP) with the Securities and Exchanges Board of India (Sebi) if required, the sources said.

But a company spokesperson said that no such decision (on refiling the DRHP) can be made since “we are currently in the process of receiving final observations and necessary corporate approvals”.

Tough market: Changes in Oyo’s IPO plans come amid a correction in the valuations of global and local tech companies in both public and private markets.

After Paytm’s IPO debacle, smaller rival Mobikwik had deferred its IPO after securing Sebi’s nod in October 2021.

In the current market, “it’s tough for companies like Oyo to raise funds at the valuations decided earlier,” said a banker, who did not wish to be named. “They are willing to reduce the issue size, but other decisions like changes to the DRHP and launch date will be decided once Sebi gives its observation,” he said.

Focus is on fundamentals, not valuation, says Nykaa CEO Falguni Nayar

Nykaa founder Falguni Nayar

FSN E-Commerce Ventures, the parent entity of omnichannel beauty retailer Nykaa, has reported a 59% drop in net profit to Rs 29 crore for the quarter ended Dec. 31 from the same period last year. The company’s revenue from operations came in at Rs 1,098.36 crore, up 36% from Rs 808 crore in Q3 of FY21.

ETtech caught up with Falguni Nayar, founder and CEO of Nykaa, and Anchit Nayar, CEO for beauty ecommerce, for an exclusive interview after the company announced its earnings on Wednesday.

Here are some edited excerpts:

Your profit numbers have taken a hit. Can you elaborate on the reasons for this?

FN: We have ramped up our marketing and advertising spends and a bulk of our expenses are now towards that. Last year was a bit of an exception because after the lockdown, there was revenge buying and the numbers show that. Our revenue from operations grew 24% quarter-on-quarter (qoq) and 36% year-on-year (yoy) to Rs 1,098.4 crore, led by growth in transacting customers and advertisement revenue. So for us it has been a good quarter.

Tech stocks started crashing in the US around December and by the beginning this year we saw the effects of it in India. What are your thoughts, considering Nykaa too has been hit?

In the US, everyone is expecting the interest rates to go up and that is affecting stock prices in general and high-growth stocks in particular. On what is going to be the long-term strategy of the US and when will (interest rates) will change… I am not the best judge of any of those things. What I can explain is Nykaa’s performance and our strategy. All we can do is deliver on the fundamentals and if the valuation goes up or down with the broader market, there is nothing that we can do about it.

Click here for the full interview.

TWEET OF THE DAY

Big Tech firms play it safe, await clarity before adjusting India taxes

Large US multinationals including the Big Tech firms—Google, Facebook, Twitter, Amazon, and Apple—have decided not to create deferred tax assets or capitalise them in their accounting statements for next year until they have clarity on where India stands its equalisation levy, tax advisors told us.

Govt awaits clarity, too: The Indian government said in November 2021 that it would adjust the 2% equalisation levy collected from US multinationals against future tax liabilities once clarity emerges around ‘pillar one’ under the Organisation for Economic Cooperation and Development’s BEPS framework – an international collaboration to combat tax avoidance.

- Jargon check: The OECD’s framework contains two “pillars”. Pillar 1 seeks to shift tax on large digital service providers into the countries in which their sales take place. Pillar 2 seeks to establish a minimum global tax rate.

“India has said that the 2% equalisation levy it has collected from US multinationals will be adjusted against future tax liabilities of these companies. This would mean that India’s tax revenues from OECD’s pillar 1, whenever it’s introduced and implemented, will be reduced to the tune of the total equalisation levy collected,” said Ajay Rotti, partner with tax advisory firm Dhruva Advisors.

Levy’s days are numbered: “Going forward, India will not just have to withdraw these unilateral measures relating to digital services taxes, such as the equalisation levy, it may also require adjustment with respect to the money collected against the future pool that it will collect under pillar 1,” said Paras Savla, partner at KPB & Associates.

So, for instance, after the OECD deal is implemented, India’s share of a multinational’s global revenue comes to Rs 150 crore.

If India has already collected Rs 50 crore, then the country will only get Rs 100 crore from the kitty. The multinationals will be able to take credit for the remaining amount—Rs 50 crore—in the US and reduce their tax liability.

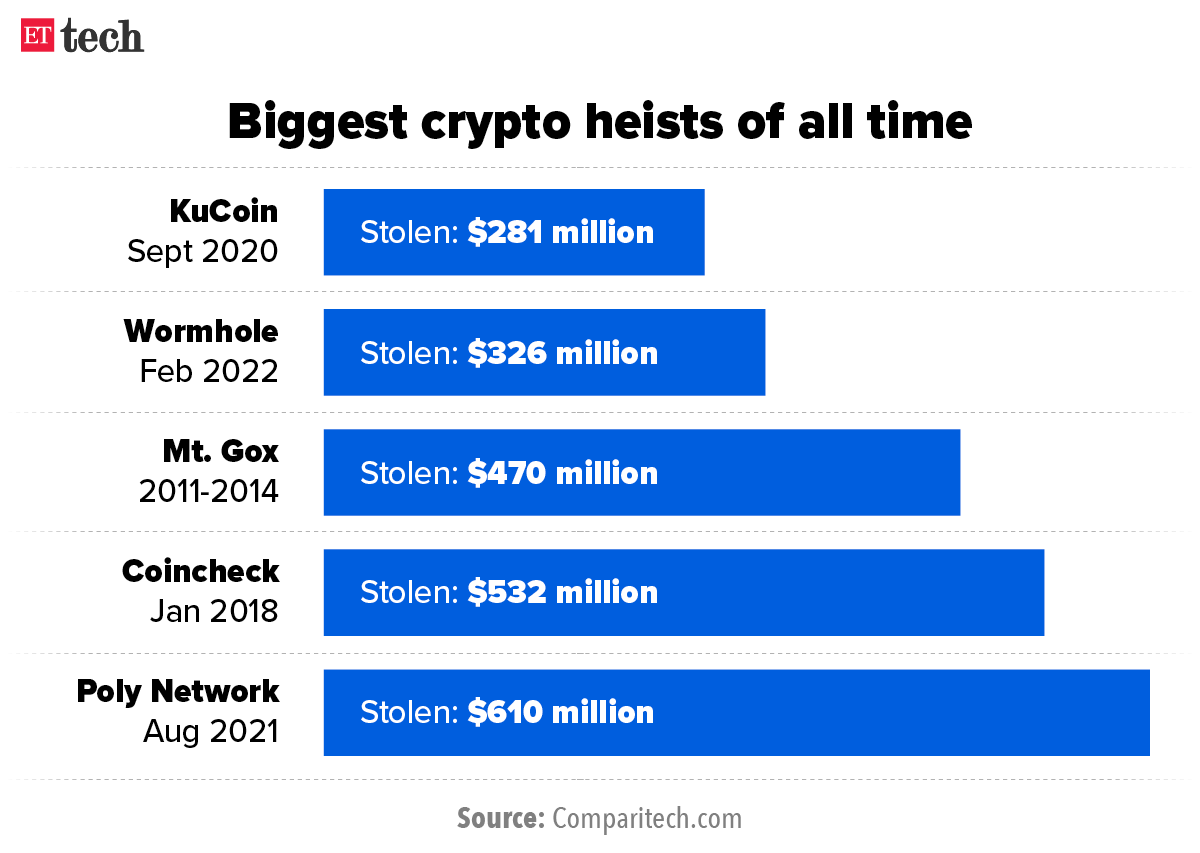

Infographic Insight

Global exchanges await clarity on India’s crypto rules

Global crypto exchanges are awaiting more clarity on India’s crypto regulations before deciding whether to enter or invest in the country.

Industry executives said that the global exchanges have seen the government’s flip-flops on crypto regulations in the past three years and that signals from the government have been confusing at best.

While the government has said that it is looking at regulating rather than banning crypto and has announced taxation provisions in the budget, senior government officials have said that all options are still on the table.

Moreover, the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, has not been listed for the ongoing budget session of Parliament.

As a result, global exchanges have preferred to remain on the sidelines.

Quote: “If the crypto legislation comes through in India, KuCoin will increase investment in the Indian market to consolidate its brand position and to better serve local traders. As for setting up an operational centre in India, it will be considered as per the request of the crypto bill,” said a spokesperson for KuCoin, one of the world’s largest exchanges.

India’s proposed data law worrying, Meta tells SEC

Facebook parent Meta Platforms said that it is concerned about India’s upcoming privacy legislation, which seeks local storage and processing of data, the company’s filing with the Securities and Exchange Commission (SEC) revealed.

Quote: “Some countries, such as India, are considering or passed legislation implementing data protection requirements or requiring local storage and processing of data or similar requirements that could increase the cost and complexity of delivering our services,” the company said.

India’s stand: The Joint Committee of the Parliament studying the Personal Data Protection Bill, 2019, submitted its report in December. The report and the draft legislation submitted by the committee recommended that sensitive personal data shall continue to be stored in India under Section 33 of the bill and its transfer will be allowed outside India only under certain conditions under Section 34.

Lawsuits galore: Meta also said that it has been managing investigations and lawsuits in Europe, India, and other jurisdictions. It specifically mentioned the lawsuit pending before the Supreme Court of India and government inquiries and lawsuits regarding the 2021 update to WhatsApp’s terms of service and privacy policy.

WhatsApp has also challenged the Indian government’s Intermediary Rules which mandate traceability of messages and would require the Meta owned instant messaging app to break its end-to-end encryption.

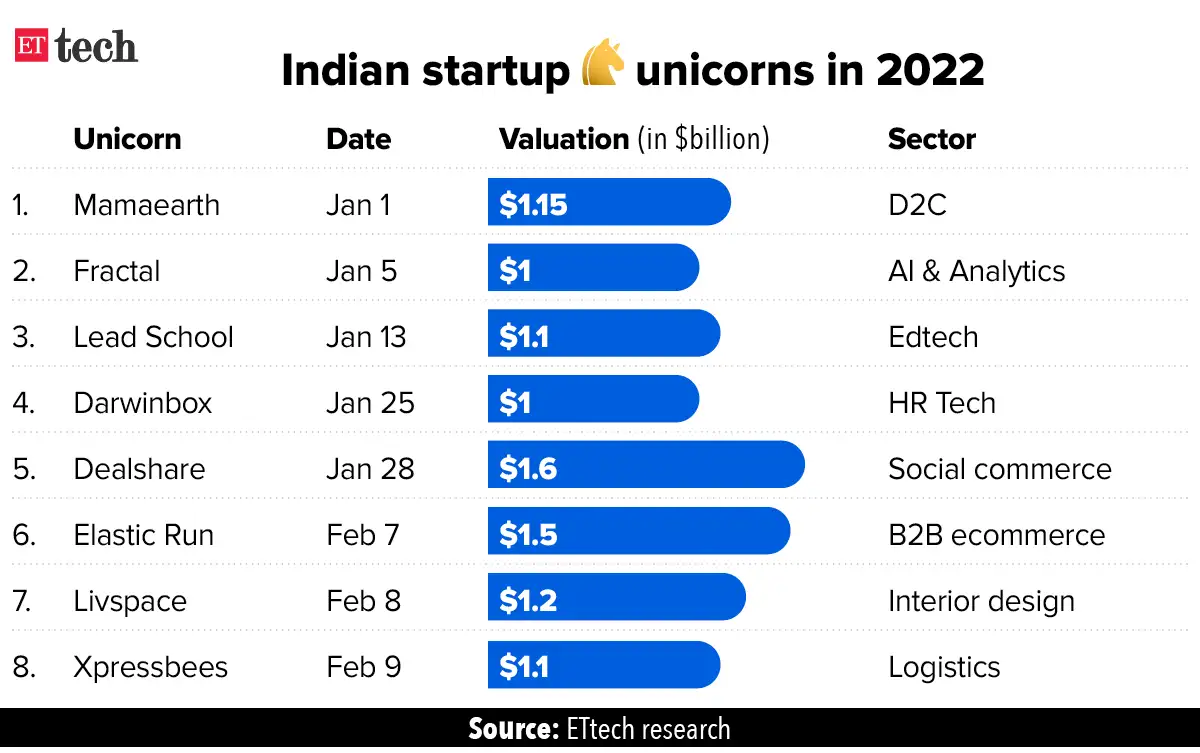

Logistics firm Xpressbees raises $300 million, turns unicorn

Xpressbees, a new-age logistics services provider, has raised $300 million in a new funding round led by private equity funds Blackstone Growth, TPG Growth and ChrysCapital. The latest financing values the Pune-based company at $1.1 billion, making it the latest member of India’s startup unicorn club.

The company aims to become a full-fledged logistics service provider by adding more muscle to its business-to-business (B2B), warehousing and cross-border verticals.

Footprint: Xpressbees is currently present in 3,000 cities, serving over 20,000 pin codes, and delivers over 1.5 million packages a day. It has over 100 hubs across India, more than 10 lakh square feet warehouse capacity, and operates across 52 airports in the country.

“A large part of the new financing round is secondary where some of our existing investors have partially cashed out,” Amitava Saha, CEO, Xpressbees told ET.

Other Top Stories By Our Reporters

Sequoia India MD Amit Jain steps down to pursue entrepreneurship: Jain, who joined Sequoia Capital India from Uber Technologies Inc. in 2019, has been part of the venture firm’s growth-stage investment practice and was based out of Singapore. (read more)

Amazon India launches startup accelerator 2.0: The participating startups will get an opportunity to win a total equity-free grant of $100,000 from Amazon as well as free AWS credits worth $10,000. The entries for the startup accelerator are open till March 14. (read more)

Binny Bansal leads $25 million round in xto10x: Flipkart cofounder Binny Bansal has led a fresh $25 million investment round in his own startup, xto10x Technologies, a scaling platform for growth-stage companies. (read more)

Global Picks We Are Reading

- Microsoft considers pursuing a deal for Mandiant (Bloomberg)

- Peloton’s future is uncertain after a swift fall from pandemic stardom (NYT)

- Sequoia’s invisible hand: How Roelof Botha became one of the most powerful people in venture capital (protocol)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.