Credit: Giphy

Also in this letter:

■ Chinese loan apps: ED freezes over Rs 46 crore in payment gateway accounts

■ Google-backed DotPe raises $54.4 million in funding led by Temasek

■ Big Tech layoffs won’t hit India’s telecom projects, say staffing firms

Video, audio & book apps on Play Store may attract only 6% commission

Small Indian app developers and startups that offer video, audio, or book content may have to pay only a 6% commission for in-app purchases on the Google Play Store, a top company executive told us.

This follows recent changes, such as allowing alternatives to its billing systems, that Google has announced in select markets. The Play Store commission is due to come into effect from October 31 in India.

Yes, but: Other apps, barring those offering gaming content, will pay close to 11% commission if they choose to adopt alternative billing systems, our source said. The 6% and 11% commissions will apply to non-gaming apps that earn less than $1 million in revenues in a year.

Big climbdown: To be sure, this marks a significant climbdown by Google from the 30% commission that it said it would charge when announcing its Play Store commission policy two years ago.

The announcement led to a concerted pushback from the local startup ecosystem and triggered a probe by the Competition Commission of India (CCI), which is now in its final stages, according to people in the know.

Google was also criticised for not allowing developers alternatives to its in-house billing system.

Also Read | HC dismisses appeals of WhatsApp, Facebook against CCI probe

Recent changes: Earlier this month, Google said it was rolling out the next phase of its user choice billing pilot and that India would be among the markets where this would be available. The new regime will allow all non-gaming developers to offer users an alternative billing system alongside Google’s.

And on September 8, Google said it was conducting a pilot to allow the distribution of Indian-made daily fantasy sports (DFS) and rummy apps on the Play Store in India. Currently, such apps – which include Dream11, Mobile Premier League, and many others – are not available on the Play Store because they fall within the ambit of gambling.

The pilot is scheduled to run from September 28, 2022, to September 28, 2023.

Chinese app loans: ED freezes over Rs 46 crore in payment gateway accounts

The Enforcement Directorate on Friday said it has frozen Rs 46.67 crore kept in payment gateways Easebuzz, Razorpay, Cashfree and Paytm after it carried out raids this week against Chinese-controlled loan apps and investment tokens.

Sixteen offices of banks and payment gateways in Delhi, Gurugram, Mumbai, Pune, Chennai, Hyderabad, Jaipur, Jodhpur and Bengaluru were also searched in connection with an investigation into an app-based token called HPZ, the agency said in a statement.

Also Read | India cracks down on China-backed fintech lenders in the country

The funds have been frozen under India’s anti-money laundering law.

Details: The searches were launched on September 14 at multiple premises of the companies in Delhi, Mumbai, Ghaziabad, Lucknow and Gaya.

The money-laundering case stems from an October 2021 first information report filed by the cybercrime unit of Kohima Police in Nagaland, it said.

“During the search, various incriminating documents have been recovered and seized,” the ED said.

“Huge balances were found to be maintained in the virtual accounts of the involved entities with payment aggregators…Rs 33.36 crore was found with Easebuzz Private Limited, Pune, Rs 8.21 crore with Razorpay Software Private Limited, Bangalore, Rs 1.28 crore with Cashfree Payments India Private Limited, Bangalore and Rs 1.11 crore with Paytm Payments Services Limited, New Delhi,” the agency added.

Also Read | Funds seized by ED don’t belong to us, says Paytm parent firm

Previous searches: On Wednesday, ANI reported the ED was conducting searches at several premises of fintech companies Paytm and PayU in connection with the Chinese loan apps case.

Sources told the news agency the searches were taking place in Mumbai, Delhi, Gurugram, Lucknow and Kolkata. On September 3, the agency conducted similar searches at the premises of online payments gateways including Razorpay Pvt Ltd, Cashfree Payments, and Paytm Payment Services Ltd.

Also Read | Offices of Paytm, Razorpay and Cashfree raided in Chinese loan app case

A MESSAGE FROM SOFTBANK GROUP

Lessons from India’s top startup champions on scaling, even in tough markets

Powered by over 70,000 tech startups, India’s digital economy is potentially the biggest draw for common good in the decade ahead and expected to catalyse new India’s techade. And yet, as Indian founders come of age, they must switch to self-preservation mode too in the face of increasing macro pressures and a shift in the operating environment.

While most Indian startup founders come from tenacious middle-class backgrounds and are strong-willed about a step-change in collective fortunes, the coping pressures in a volatile, fast-growth ecosystem can test the best of the generational entrepreneurs.

At the ‘Global Unicorn Series,’ SoftBank Group International India country head Manoj Kohli hosts some of the country’s leading startup champions, including founders of Nykaa, Zomato, Oyo, Cars24 and Globalbees, asking about their growth ambitions, survival instincts, and lessons learnt in their extraordinary entrepreneurial journeys.

Watch the full conversation with India’s digital startup heroes here.

Google-backed DotPe raises $54.4 million in funding led by Temasek

DotPe founders Shailaz Nag, Anurag Gupta and Gyanesh Sharma

Google-backed DotPe, founded by PayU India cofounder Shailaz Nag, is raising Rs 434.5 crore (about $54.4 million) in funding led by Singapore’s sovereign fund Temasek.

DotPe helps small and medium enterprises set up online payments and delivery systems. It also provides them with store management and marketing management tools.

The company’s board passed a special resolution in an extraordinary general meeting held earlier this week for the startup to raise the amount.

Break-up: According to regulatory documents we accessed, Temasek – through its investment arm V-Sciences Investments – is investing Rs 150 crore ($18.7 million). Naya Global, MUFG Bank, and PayU Fintech investments will be investing roughly Rs 82.5 crore ($10.3 million), Rs 75 crore ($9.3 million) and Rs 91.7 crore ($11.4 million), respectively.

Cred to invest $10 million in LiquiLoans: Meanwhile, Kunal Shah-led fintech startup Cred is investing $10 million to acquire a minority stake in peer-to-peer (P2P) non-banking finance company (NBFC) LiquiLoans, the two companies said on Friday. Cred will pick up a minority stake — roughly 5-6% — in the company, valuing it at roughly $200 million.

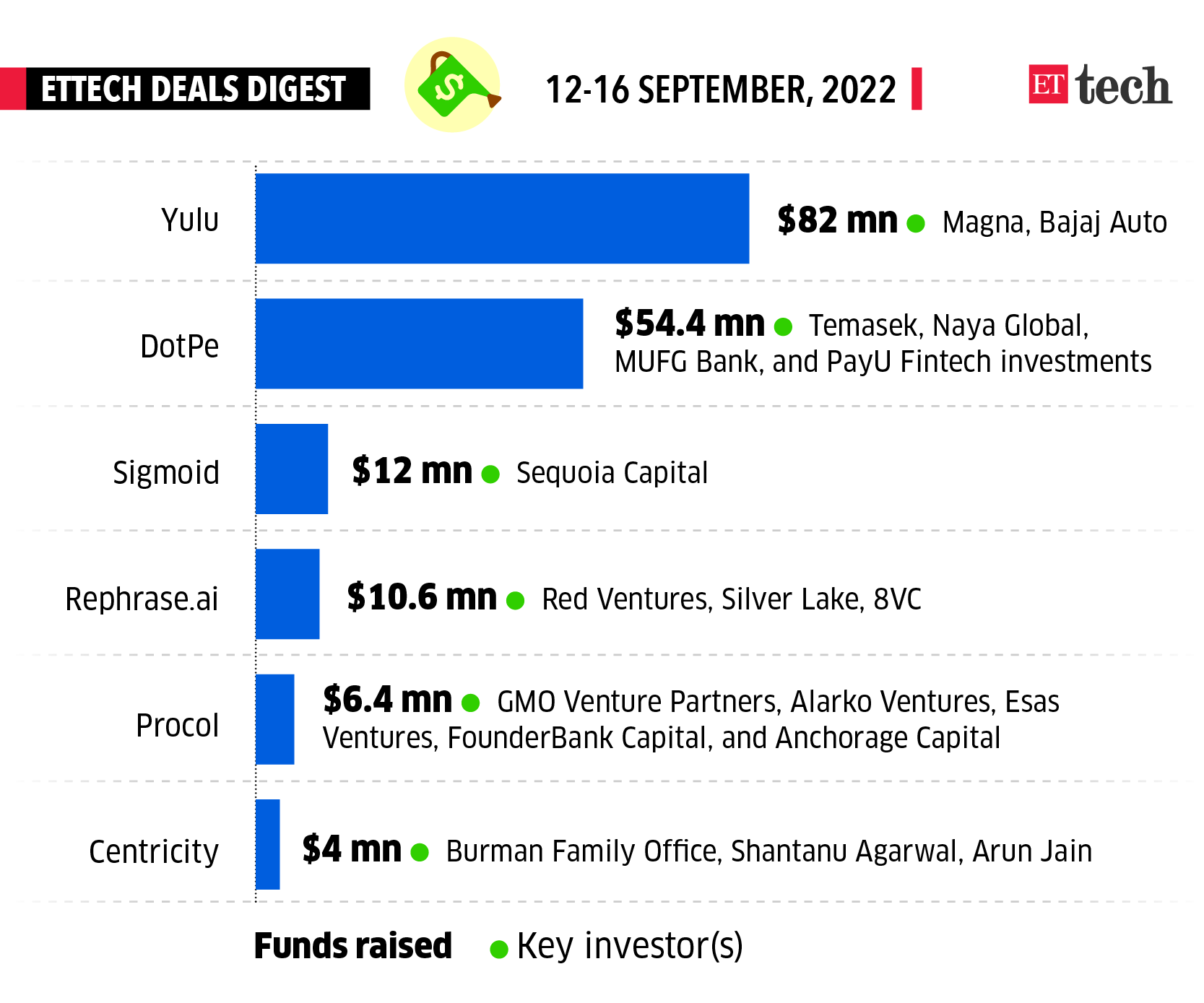

ETtech Deals Digest

The funding winter for Indian startups continued into the third week of September. Though there was an uptick in the total amount raised from last week, the figures were still far below what startups raised in 2021.

The number of funding rounds of $100 million and upwards has fallen from 29 in the first quarter of the calendar year to 18 in the second quarter and just three in the third quarter (as of August 24).

With large PE and VC funds still placing their bets cautiously amid the volatile macroeconomic environment, the dry spell might continue for some time. EV startup Yulu and Google-backed DotPe led the funding charts this week.

Here is a list of all the startups that raised funds this week.

Big Tech layoffs won’t hit India’s telecom projects: staffing firms

Layoffs at global tech giants such as Meta, Microsoft and Google won’t affect the projects these companies are executing for their Indian telecom clients, staffing firms told us.

These tech companies still have sufficient manpower to serve their main telecom clients, they said, adding that Indian telcos Reliance Jio, Bharti Airtel and Vodafone Idea (Vi) have been hiring engineers and software and application developers in droves over the past two years for their 5G services rollout, which should more than offset any potential impact from the layoffs.

“Regardless of team size, most tech companies will honour contracts and, hence, workflow/support to telcos won’t be affected,” Sachin Alug, chief executive of staffing firm NLB Services, told us.

Layoffs: Over the past few months, Microsoft has laid off around 2,000 employees, and Google has warned of layoffs if the company’s performance doesn’t improve. Meta and Apple have laid off 60 and 100 employees, respectively, so far.

Elon Musk accuses Twitter of fraud in tweaked court filing

Elon Musk has accused Twitter of committing fraud by concealing serious flaws in its data security, saying this should allow him to terminate his $44-billion deal for the company, Reuters reported, citing a court filing.

Changes to lawsuit: Musk amended his previously filed lawsuit by adopting allegations by a Twitter whistleblower, who told Congress on Tuesday of meddling on the influential social media platform by foreign agents.

The Tesla boss also alleged that Twitter hid from him that it was not complying with a 2011 agreement with the Federal Trade Commission regarding user data.

“Needless to say, the newest revelations make undeniably clear that the Musk Parties have the full right to walk away from the Merger Agreement — for numerous independently sufficient reasons,” read the amended countersuit.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Gaurab Dasgupta in New Delhi. Graphics and illustrations by Rahul Awasthi.