This and more in today’s ETtech Top 5.

Also in this letter:

■ PhonePe goes live with UPI Lite

■ APAC to become world’s top fintech market by 2030: report

■ EV makers say safety certification delay impacting sales

Finance Minister Nirmala Sitharaman on Tuesday said the GST Council is deliberating on a taxation policy for online gaming and exuded confidence that the sector would attract investments once it is finalised. She was responding to a question from Korean gaming company Krafton on India’s plans to attract foreign investment in gaming companies.

Quote, unquote: “Once the policy certainty arrives, taxation becomes more … clear, it will attract investors,” Sitharaman said while addressing the Indian diaspora in Seoul.

More details: The vexatious issue of levying Goods and Services Tax (GST) on online games has been hanging fire for nearly two years now, with many states pitching for a lower tax rate on online games that require skill. They are of the opinion that games of skill should not be treated on par with games of chance. A final decision on taxation on online gaming is expected to be taken by the GST Council at its next meeting, either this month or in June.

Online gaming rules: Last month, the Ministry of Electronics and IT notified norms for the online gaming sector, which categorically prohibits games involving betting and wagering.

MIB writes to states to curb outdoor betting ads: The ministry of information and broadcasting (MIB) has written a letter to chief secretaries of all the states and union territories asking them to curb advertisements by online betting and gambling platforms on outdoor media.

The letter follows similar advisories issued by the MIB against advertisements run by online betting and gambling platforms on TV, print and digital media, including on social media intermediaries such as Google, Facebook, and Twitter.

Also read: ETtech Exclusive: Ads of betting, gambling sites still in play on social media

Freshworks Q1 results: SaaS major posts first adjusted operating profit

Girish Mathrubootham, founder & CEO, Freshworks

Nasdaq-listed software firm Freshworks on Tuesday reported its first adjusted operating profit of $3.9 million as a public company. Freshworks’ shares rose over 6% post the earnings announcement and closed at $14.05 apiece.

Details: The software as a service (SaaS) company has raised its full-year 2023 financial forecast midpoint to an adjusted operating profit of $5 million. It was moved to a range of $2 million to $8 million, against a previously forecast adjusted operating loss of $6 million to $14 million.

Loss narrows: The company said its net loss shrank to $42.7 million in the first quarter ended March 2023, from $49.1 million a year earlier. Total revenue in Q1 2023 rose 20% to $137.7 million.

Quote, unquote: “More companies are taking advantage of the opportunity to buy software that is designed to scale to meet their IT and customer needs,” said Girish Mathrubootham, CEO and founder, Freshworks.

Layoffs: To rein in costs, Freshworks executed more job cuts last month. It had laid off 90 employees globally in December 2022, of which 60 were part of its India team.

PhonePe goes live with UPI Lite

Payments major PhonePe announced on Wednesday that it has gone live with the UPI Lite feature on its app, allowing users to initiate low-value payments of up to Rs 200 without entering a personal identification number (PIN).

What is UPI Lite? UPI Lite was launched in September 2022 by Reserve Bank of India governor Shaktikanta Das to make low-value UPI payments faster and simpler. These transactions are processed directly, by debiting the on-device wallet balance without involving banks in real-time, making transactions seamless and faster than regular UPI transactions. It also increases the probability of success for a transaction.

Quote, unquote: “Small-ticket transactions make up a significant volume of overall UPI payments, and UPI Lite will make them quicker and convenient, without putting a strain on the existing UPI infrastructure,” Rahul Chari, cofounder and chief technology officer, PhonePe, said in the company’s statement.

Other platforms offering UPI Lite: ET had in February reported that two leading third-party platforms — Paytm and PhonePe — are in advanced stages of UPI Lite integration. PhonePe’s rival Paytm Payments Bank went live with the UPI Lite feature on its platform in February.

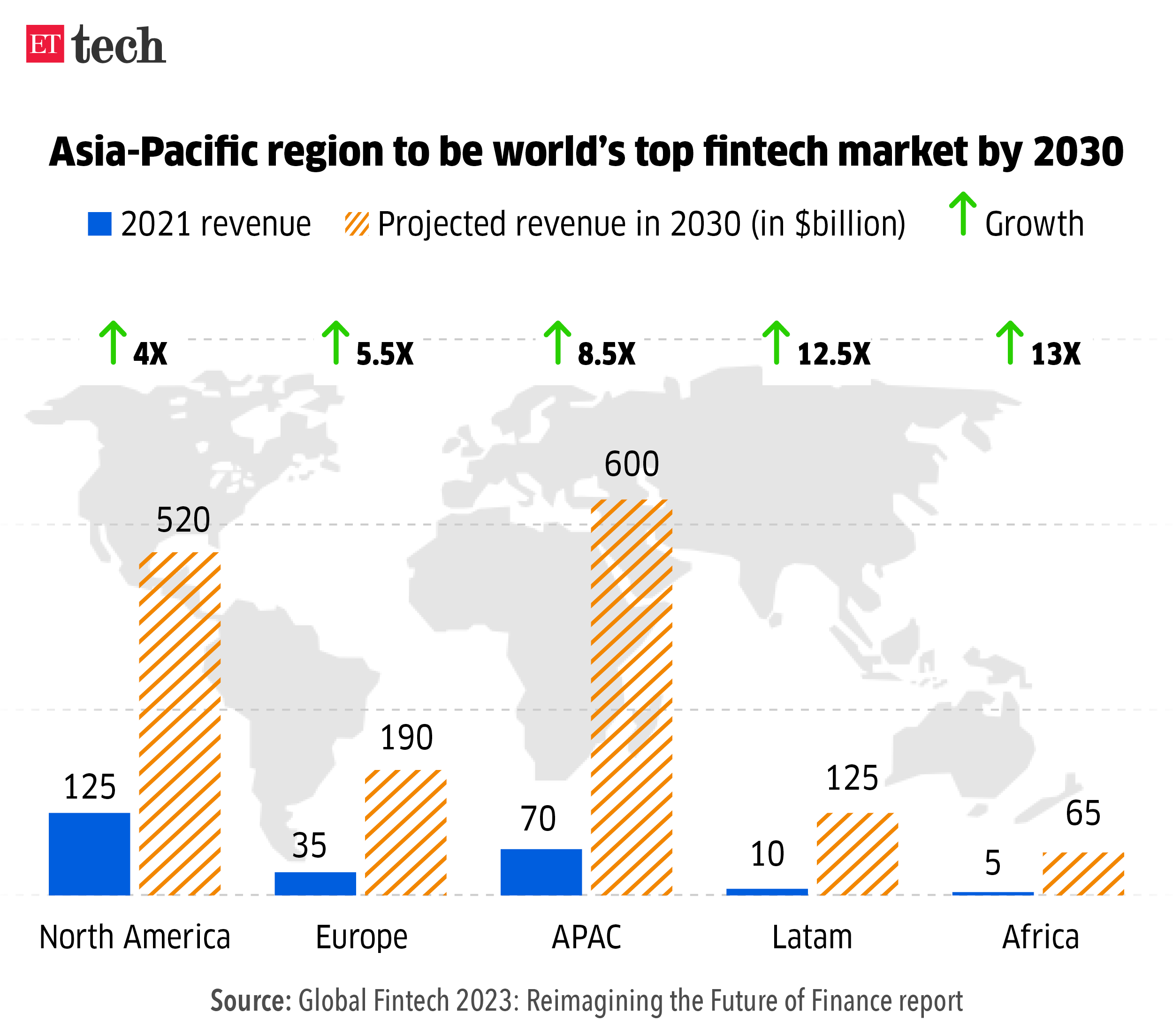

APAC to become world’s top fintech market by 2030: report

The Asia-Pacific region — led by India, China, and Indonesia — will pip the US to become the world’s top fintech market by 2030, according to a report from global consulting agency BCG and venture capital firm QED Investors.

Key numbers: Titled ‘Global Fintech 2023: Reimagining the Future of Finance’, the report projects that the global fintech industry will grow six-fold by 2030, from $245 billion to $1.5 trillion.

Further, the sector, which currently has a 2% slice in the $12.5 trillion global financial services pie, is estimated to see that revenue share grow to 7% by the end of this decade.

India in focus: India is undergoing “major fintech activity” with the emergence of local champions such as Paytm and Razorpay, the report notes, adding that India’s fintech revenue growth will be spurred by “expanding GDP (at a CAGR of 7% per year), the rise of the educated middle class, younger demographics coming of age, and increasing fintech penetration, with lending, neo banking and wealth tech set to see significant activity”.

Tweet of the day

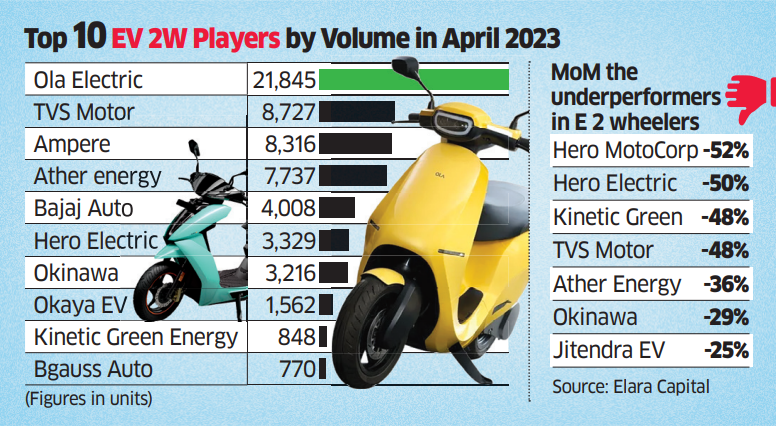

EV makers say safety certification delay impacting sales

Sales of electric two and three-wheelers fell sequentially last month. Manufacturers blamed the drop primarily on lower production due to a delay in getting their products certified for new safety regulations.

Major drop: Electric three-wheeler sales fell 16% from March to below 38,000 units last month, according to data sourced from the government’s Vahan portal, which tracks vehicle registrations. Retail sales of high-speed electric two-wheelers dropped to under 66,500 units in April, a 23% fall from March.

But compared to a year earlier, retail sales of both categories increased – by 27% for electric two-wheelers and 76% for three-wheelers.

What caused the sequential fall? Manufacturers said getting certification for compliance was taking time, affecting their production schedules and, in turn, the sales numbers.

Moreover, subsidies totalling over Rs 1,200 crore are on hold for around a dozen companies, as per a lobby group representing the industry.

Quote unquote: “There is a backlog with the testing agencies, and we are yet to get the certification. This means our production has come to a halt,” said Benling India executive director Amit Kumar.

“We are in the process of R&D validation and product integration,” said Sulajja Firodia Motwani, chief executive of Kinetic Green, which specialises in electric three-wheelers.

Catch up quick: The government has amended Rule 156 of the Automotive Industry Standards to introduce new safety regulations for electric two- and three-wheelers to address the problem of vehicles catching fire.

Today’s ETtech Top 5 newsletter was curated by Erick Massey in New Delhi and Megha Mishra in Mumbai. Graphics and illustrations by Rahul Awasthi.