Also in this letter:

■ Antler India’s ONDC-based platform for founders

■ Disney+ Hotstar reports biggest quarterly subscriber drop

■ Metaverse’s $900-billion potential

Ola revenue doubles in FY22, but losses widen 36% to Rs 1,522 crore

Ola CEO Bhavish Aggarwal

Ride-hailing company Ola said consolidated revenue for the year ended March 2022 more than doubled from pandemic days, but its losses also rose 36%. Meanwhile, Ola Electric posted an operating revenue of Rs 373.42 crore in FY22, against Rs 86 lakh in the year-ago period.

Ola’s key numbers:

■ ANI Technologies, Ola’s parent entity, reported a consolidated revenue of Rs 1,970.4 crore in FY22 from Rs 983.2 crore a year ago.

■ Net loss widened over 36% to Rs 1,522.3 crore for FY22, against Rs 1,116.6 crore the previous year.

■ Total expenses shot up to Rs 3,362.1 crore, up from the Rs 2,007.1 crore a year ago.

Ola Electric highlights:

■ Expenses rose after it started selling scooters in December 2021, resulting in a wider net loss of Rs 784.15 crore in FY22, against Rs 199.23 crore in FY21.

■ More than 90% of Ola Electric’s revenue in FY22 came from sale of scooters.

■ During FY22, Ola Electric sold 14,403 electric scooters.

Valuation markdowns: On August 2, ET reported that Ola saw its valuation cut to $3.5 billion by US-based investment major Vanguard Group — down over 50% from a peak of $7.3 billion.

Increasing competition: In the last year, Ola’s competition has grown with Bengaluru-based Rapido expanding its three-wheeler category, and ONDC-run auto hailing firm Namma Yatri also entering the mix.

Also read | ETtech In-depth: How BluSmart plans to fight the Uber, Ola onslaught in buzzy EV cab business

Zerodha allocates Rs 1,000 crore more to back startups via Rainmatter

Zerodha chief executive Nithin Kamath

India’s largest stock broker, Zerodha has allocated an additional Rs 1,000 crore towards its startup accelerator Rainmatter, even as it follows what it calls a ‘perennial investment’ structure for the fund, with no exit mandates.

The rationale: “We believe that founders can similarly benefit from investors who bring in long-term patient capital—investors who are willing to stick around and help in any way possible, where the goal is to build a good, sustainable, long-term business, and not just to generate rapid returns. We can remain invested forever, as the investments we make are from our own capital,” Zerodha chief executive Nithin Kamath said in a blog post.

What does Rainmatter do? Rainmatter was launched in 2016 to back innovative startups in the financial technology space, helping individuals invest and trade better. According to Kamath, the profits from the investments made by Rainmatter Capital go back to supporting more entrepreneurs and the Rainmatter Foundation, the company’s non-profit arm.

Under the fund structure, Zerodha invests up to Rs 50 crore in an upcoming venture and does not take a board seat or participate actively in the business.

Portfolio: Rainmatter has invested in a host of startups ranging from fintechs — Cred, Jupiter, Smallcase, and Digio among others — to edtechs such as LearnApp and QShala. It has also invested in climate-tech startups such as Blue Sky and SundayGrids as well as spacetech startups such as Agnikul.

RBI MPC: Key takeaways for Indian fintech ecosystem

RBI Governor Shaktikanta Das

The Reserve Bank of India announced its monetary policy today. Along with its key policy updates on macroeconomic conditions and inflation, Governor Shaktikanta Das announced certain policy updates for the fintech sector.

UPI all the way: The regulator cannot seem to get enough of UPI and is still pushing for new features on the instant payment rail. The aim is to get more and more consumers to use UPI for their regular requirements.

From updates on UPI Lite to conversational bots on UPI apps, the regulator issued multiple statements today.

Quick top-up: The RBI said that it will issue instructions to NPCI on developing conversational bots on UPI. NPCI is already working on building an AI voice bot and could take it live by October.

What this means: While P2P and merchant payments have moved to digital in a major way, transit payments and those in rural areas continue to be dominated by cash. The RBI’s move to expand the use case of UPI Lite and NCMC (National Common Mobility Cards) signifies its thrust to push digital payments into rural areas, which typically have lower internet connectivity.

Quote, unquote: “Today’s announcement by the RBI to integrate conversational payment technology into UPI…will certainly harness innovative capabilities and help create a convenient and easy-to-use payment system…, bringing a vast number of users to the digital platform,” said Pranay Jhaveri, India and South East Asia, Euronet.

Disney+ Hotstar lost 12.5 million subscribers in biggest drop

Disney’s streaming service in India, Disney+ Hotstar, reported its biggest quarterly subscriber drop, with a loss of over 12 million paid subscribers in the April-June quarter.

Driving the news: The sharp fall in Disney+ Hotstar’s subscriber count was primarily driven by the loss of streaming rights to the Indian Premier League and the non-renewal of its HBO contract.

Disney+ Hotstar’s subscriber base plummeted to 40.4 million during the quarter, marking a 24% reduction from the previous quarter’s 52.9 million. The service had reached a peak of 61.3 million subscribers in the last quarter of 2022.

Quote, unquote: “Disney+ Hotstar subscribers declined this quarter as we adjusted our product from one centered around the IPL to one more balanced with other sports and entertainment offerings,” said Walt Disney interim CFO Kevin Lansberry.

Antler India launches ONDC-focused platform for founders

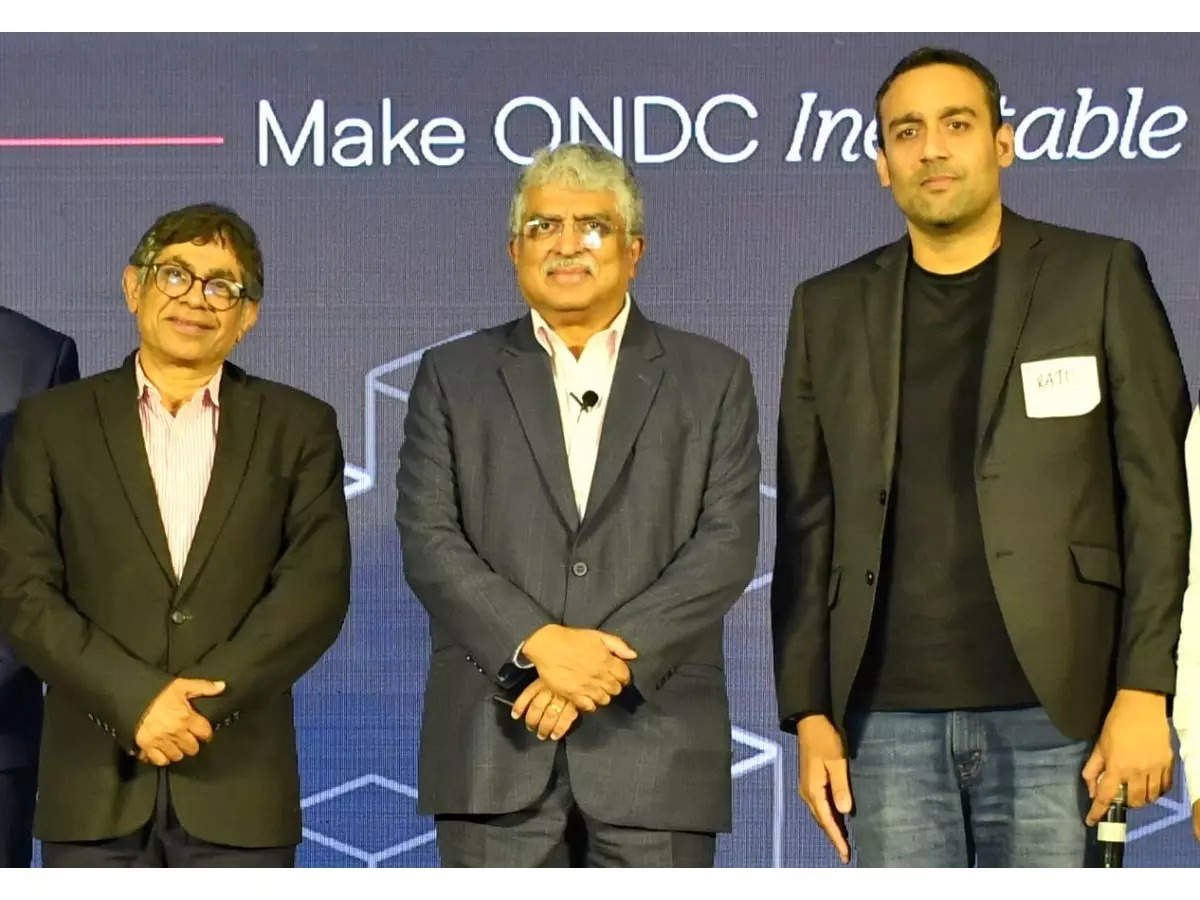

From left to right: ONDC chief executive Thampy Koshy, Infosys chairman Nandan Nilekani, Antler India partner Rajiv Srivatsa

Early-stage venture capital firm Antler India unveiled a platform to support and fund founders working with the government-backed Open Network for Digital Commerce (ONDC). The platform is also being backed by the Foundation for Interoperability in Digital Economy (FIDE) and Infosys chairman Nandan Nilekani.

Tell me more: The platform is offering pre-seed capital of $300,000 to “ready-teams with an idea” that are building on the ONDC protocol, with an additional investment of up to $200,000 from “key partners”, such as founders in the Antler network. Also, the platform is touted to be the country’s first for ONDC.

Increasing MSME potential: Nitin Sharma, partner at Antler India, believes there is potential for MSME sellers to grow in the next decade. “Only 6% of MSMEs are active sellers on digital platforms. With ONDC, we believe this has the potential to grow to 30-40% over the next decade… we are excited to see founders build at population scale in themes like complex commerce, vernacular commerce, and flow-based lending, to name a few.”

Today’s ETtech Top 5 newsletter was curated by Gaurab Dasgupta in New Delhi.