Also in this letter:

- Investors are feeling like a commodity, says A91 Partners

- SoftBank could invest up to $10B in Indian startups in 2022

- Data localisation ‘essential’ for India, says new JPC chairman

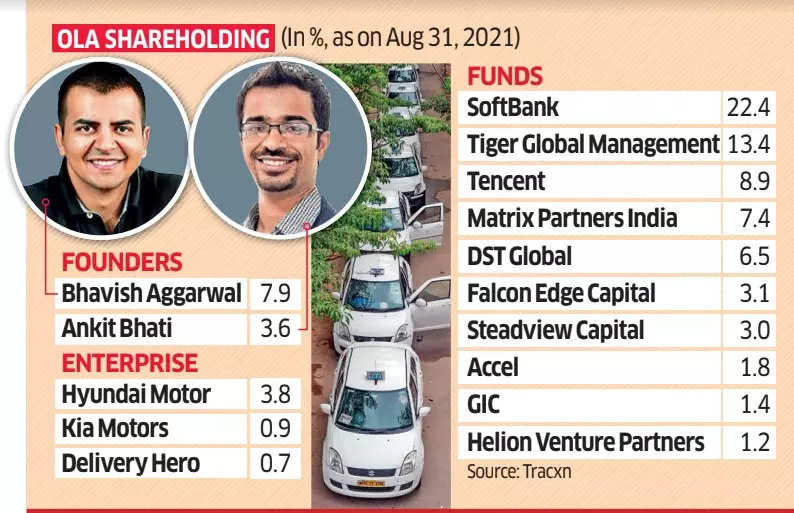

IIFL, Edelweiss may invest in Ola at $7 billion valuation

Ola is finalising a pre-IPO financing round that’s likely to be led by IIFL Wealth Management and Edelweiss Private Equity, sources told us.

The fundraise, which could range anywhere from $250-500 million, will double Ola’s valuation from its previous round in July to around $7 billion. It also signals increased investor interest in the mobility sector as the economy reopens following the devastating second wave of Covid.

Other existing investors such as private equity fund Warburg Pincus, Japan’s SoftBank and others are likely to participate in the fundraise, the sources added.

IPO plan: Ola plans to raise up to $1 billion through its public offering, which is expected to hit the public markets in the next few months. The Uber competitor will join a crush of Indian startups that are preparing to list on domestic bourses.

Food-delivery and restaurant discovery firm Zomato set the tone for a slew of startups to tap the capital markets, with the latest being beauty retailer Nykaa, which made a bumper debut with its listing on Wednesday.

The company may raise half the capital through a primary issuance in its IPO, while the rest of it will be via an offer for sale (OFS) by early backers, said another source.

Post-Covid recovery: ANI Technologies, Ola’s parent company, saw revenue for the fiscal year 2021 decline 65% year-on-year to Rs 689 crore, according to filings made with the registrar of companies.

Ola’s loss after taxes was Rs 1,326 crore in fiscal 2021, compared with Rs 1,714 crore in the previous year. Its consolidated operating revenue, which includes food delivery and financial services, for the same period stood at Rs 983 crore as against more than Rs 2,662 crore in FY20.

Operating loss narrowed to Rs 429 crore from Rs 1,485 crore the year before, the documents showed.

Uber hits a bump: In its latest quarterly earnings released earlier this month, Uber said it was ‘leaning in a little bit more on driver supply” in markets such as India and Australia as they recovered. Supply-side issues have crippled operations of both Ola and Uber even as cities — and offices — have started opening up.

Uber reported a net loss of $2.4 billion for the third quarter due to a drop in value of its investment holdings, particularly in Chinese ride hailing major Didi. The company said its stakes in Zomato, Aurora and Joby helped offset some of that loss. It had posted a net loss of $1.09 billion in the same quarter a year ago.

Investors feel like a commodity; we’ve faced many rejections recently: A91 Partners

The leadership team at A91 Partners: (from left) Prasun Agarwal, Abhay Pandey, VT Bhardwaj, Ruchi Khajanchi, Gautam Mago and Kaushik Anand.

A91 Partners, which closed its second India-dedicated fund at $550 million, has been among the more conservative investors at a time when India is seeing record deal making across private and public markets.

- Founded in 2018 by three former Sequoia Capital managing directors, Abhay Pandey, VT Bharadwaj and Gautam Mago, the Mumbai-headquartered firm had raised one of the largest maiden domestic funds by Indian general partners at $350 million two years ago.

Sticking to the basics: A91 wants to stick to backing companies that have sound business fundamentals and not be governed by mark ups (when one firm invests after another one at a higher valuation) to determine the success of its portfolio firms. It will look to find a balance between being relevant and disciplined while focussing on the fund’s overall performance amid the backdrop of a highly hopped up funding environment, the firm’s founding partners told us in an hour-long chat.

Having invested in 13 companies since its inception, including the likes of Digit Insurance, which is currently valued at $3.5 billion, Sugar Cosmetics, Exotel, A91 will take slightly larger sized bets from the new corpus.

Feet on the ground: The funding environment has changed dramatically in the past year, with more than $25 billion of risk capital being raised by Indian startups and as many as 36 new unicorns being birthed in 2021 alone. But Pandey said A91 was clear they did not want to further increase their fund size, at least not for now.

“When we launched the first fund in 2018-19, we had a certain set of opportunities in India that we needed to address as per our team’s bandwidth and $350 million was good then..” he said. But the market opportunity has expanded which is why we can now invest $ 25–$30 million across 15-17 companies with a larger sized fund, that’s the math we did, he added.

A91 invests across consumer, healthcare, financial services and technology companies and backs companies which have net revenues of about $7-10 million. The fund says it is focused on businesses that have somewhat proven themselves, which may not be an ever standing view but for now it will look to invest in such companies.

Pressure to be more aggressive? Most India-focussed investors have opted for enhanced fund sizes as the market becomes intensely competitive with the likes of Tiger Global, Falcon Edge and even traditional VCs such as Sequoia Capital closing record numbers of deals this year.

Stellaris Venture Partners raised $225 million for its second India-dedicated fund, almost three times the size of its $90 million maiden fund, launched four years ago. Nikhil Vora’s Sixth Sense Ventures racked up Rs 2,500-crore for its third fund, five times bigger than his previous fund.

On the cut-throat deal making and skyrocketing valuations, Pandey said,“ We are genuinely struggling with valuations in an environment where investors have been humbled and made to feel like a commodity due to the surplus liquidity. The level of competition is very high, which has meant that there have been many rejections and disappointments in recent months. So what you do is, you pick your spots, and work hard on them.”

Tweet of the day

SoftBank may invest $10 billion in Indian startups in 2022

SoftBank Group Corp. could invest $5 billion to $10 billion in India next year if it finds valuations attractive, Rajeev Misra, chief executive officer of SoftBank Investment Advisers, told Bloomberg.

Quote: “If we find the right companies, we could invest $5 billion to $10 billion in 2022,” Misra said on Thursday at the Bloomberg India Economic Forum, adding, “If we find the right opportunities at the right valuation.”

“The key is to find interesting companies where we like the founder and the valuation,” Misra had told us in an interview earlier this year.

These comments come days after SoftBank Group Corp posted a $3.5 billion loss for the July-September quarter, hit by falling valuations in the tech portfolio of its Vision Fund unit.

Among the most well-known and high-profile global technology investors, SoftBank has recently placed bets on food delivery platform Swiggy, social commerce venture Meesho and banking technology startup Zeta.

ETtech Done Deals

■ Wakefit, a home and sleep solutions company has raised $28 million (Rs 200 crore) in a Series C funding round from investors led by US-based SIG, a global trading and investment firm headquartered in Pennsylvania. The funding round, in which existing investors Sequoia Capital India and Verlinvest also participated, values the company at over Rs 2,800 crore, senior company officials told us.

■ Cradlewise, a Silicon Valley-based startup that makes smart cribs for babies, has raised $7 million in a seed funding round led by early-stage venture capital firm Footwork. VC firm CRV participated in the fundraising, as did SOSV and Better Capital, and angels like Stitch Fix founder Katrina Lake, Italic CEO Jeremy Cai and Molekule CTO Dilip Goswami.

■ CapGrid, a B2B commerce startup specialising in sourcing and procurement of direct-material supplies, has raised Rs 4.1 crore seed funding from Anicut Angel Fund, Axilor Ventures and Firstcheque. The B2B startup plans to leverage the new funds to boost product innovation, scale operations, and expand its team.

■ Exotel, a cloud telephony firm, has acquired chatbot developer Cogno AI in a cash-and-stock deal, as part of its plans to build a complete customer engagement platform. The financial terms of the deal weren’t disclosed. Cogno AI is Exotel’s second M&A deal since absorbing Ameyo in June. The company had raised $35 million in a Series C funding round in September.

■ Capital A, a venture fund for seed to early-stage start-ups, on Thursday said it has invested in Bengaluru-based B2B logistics-tech startup RoaDo, its maiden investment from its proprietary corpus of $25 million (about Rs 186.2 crore). It did not disclose the amount invested.

Data localisation ‘essential’ for India, says JPC chairman Chaudhary

Data localisation is essential for the country and important for Indian companies to compete well in the market, said PP Chaudhary, the new chairman of the Joint Parliamentary Committee studying the Personal Data Protection Bill.

‘Enough safeguards’: On the controversial Section 35 of the Bill, which grants the government wide-ranging exemptions on accessing citizen’s data, Chaudhary said “enough safeguards” have been built into the legislation and that the right balance between the country’s need for security and integrity and sovereignty must be provided.

Quote: “Even the data which is stored outside should be mirrored, I feel. This is important since suppose there is an enemy state, and we don’t have access to our data. Even our judiciary doesn’t have jurisdiction there. So some strict provisions have to be there,” he said.

The committee has been deliberating the much-awaited bill for close to two years now. It was further delayed last year because of Covid, and later because new members had to be appointed after existing ones took charge as union ministers.

Non-personal data: We reported on Thursday that the Kris Gopalakrishnan-led committee, tasked with defining the regulatory structure for use of non-personal data (NPD), had submitted a draft bill along with its final report to the government. It has recommended the establishment of a national NPD authority. It has also laid out provisions under which companies that control large amounts of data will be classified as “data businesses”, and what constitutes “high-value data”.

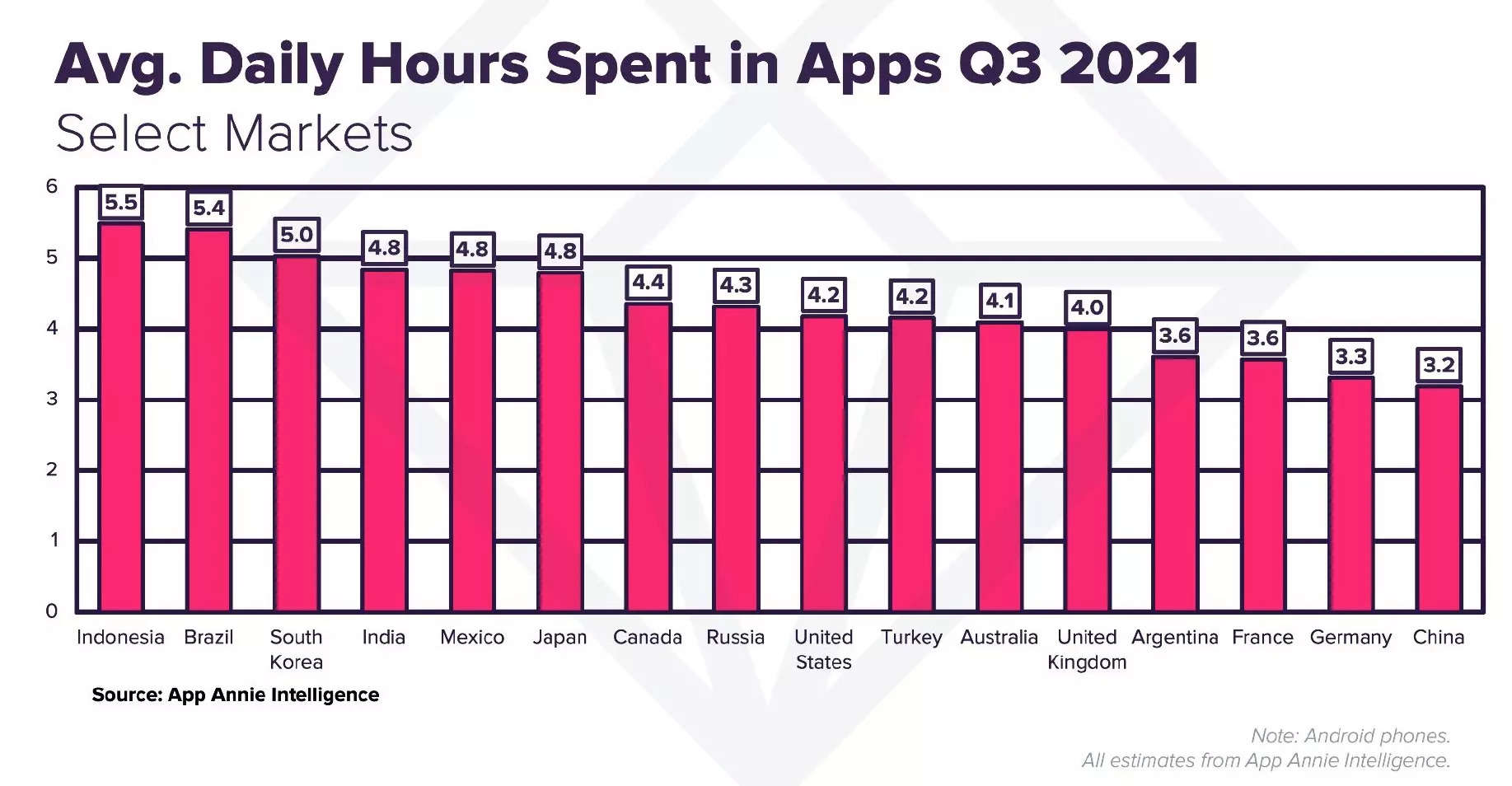

Indian consumers are spending almost five hours a day on mobile apps, report finds

The average smartphone user in India spent an average of 4.8 hours a day using various mobile apps in Q3 of 2021 (July-September), making Indians “among the most mobile-first consumers in the world”, according to a new report by App Annie.

The time Indians spend on mobile apps had been rising steadily before the pandemic hit, but began to skyrocket early last year when Covid and lockdowns became our collective reality. This meant that Indian consumers spent more than four hours a day on mobile apps for the first time in 2020, or a collective 651 billion hours for the year. That was a 40% jump from 2019, when Indians spent “just” 3.3 hours a day on apps.

In fact, the time spent every day using apps increased from under three hours in Q1 2019 to 4.6 hours in Q1 2021, a stunning 80% jump in two years.

Gaming

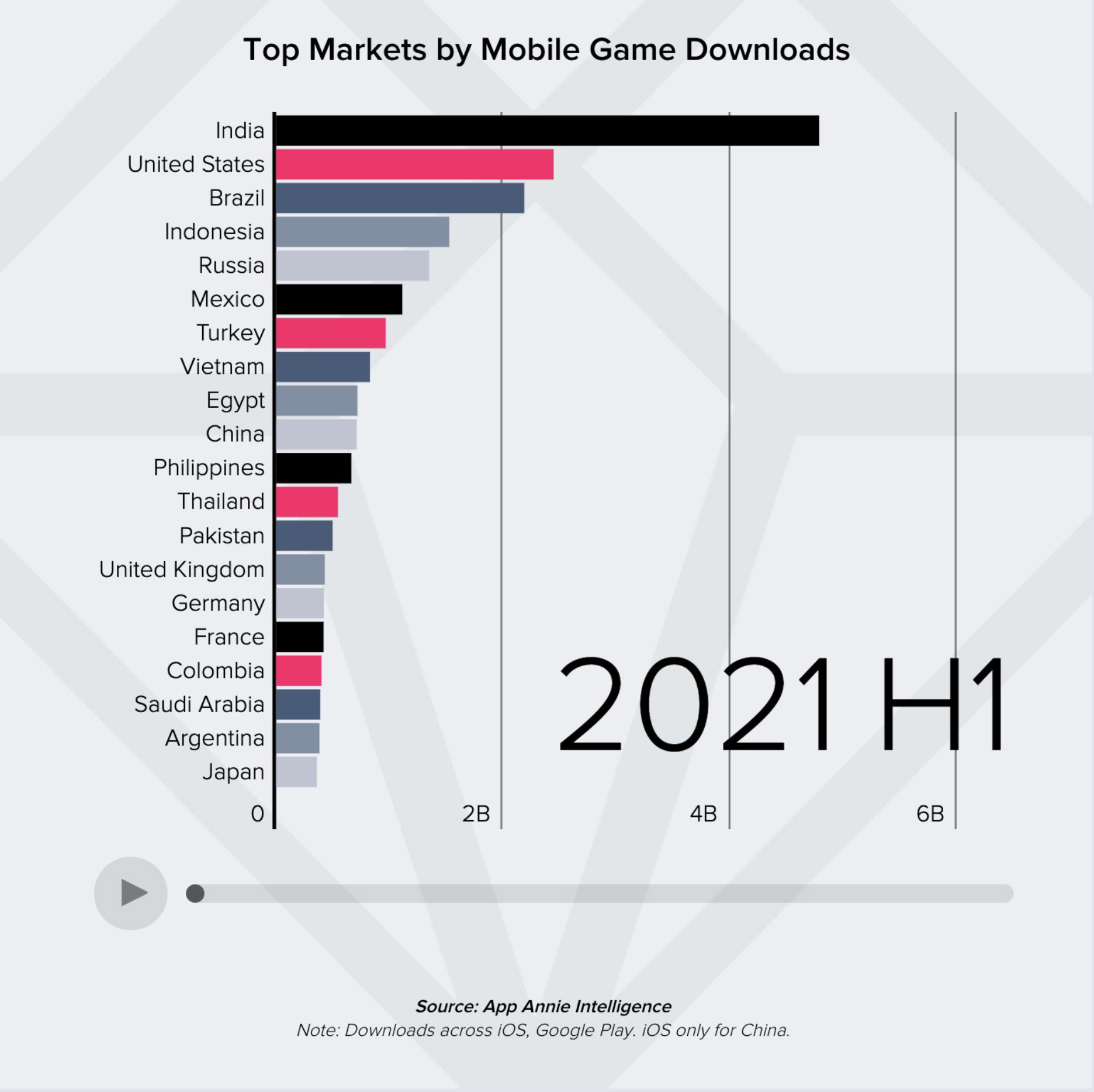

India is the world’s top market for mobile gaming in terms of downloads across Android and iPhones. In the first half of 2021, Indian players installed 4.8 billion games, or one in every five installed globally, the report said.

The top game in this period, by downloads and active users, was Ludo King, a free-to-play title developed by Indian studio Gametion Technologies.

The report noted, however, that Ludo King, which was made in India, is something of an anomaly. Indian-made games barely figure in the country’s games charts, and just 7.6% of the top 1,000 games are made by Indian companies. “The situation is very different in other regions. In China, the homegrown ratio is 60%,” the report said.

Payments

India is also setting the pace on mobile payments, the report said, largely thanks to UPI. The volume of UPI transactions doubled in a year to nearly 8 billion in Q2 2021. Earlier this month we reported that UPI transactions crossed $100 billion in value in a month for the first time in October.

This growth, the report said, has created a significant opportunity among developers to create apps for merchants. “According to our numbers, one of the market-leading products Khata Book had 14 million average smartphone monthly active users in India in Q2 2021,” it stated.

Others that have benefited from UPI are ‘buy now pay later’ and credit apps such as StashFin, Dhani, Kissht and Slice Super Card, which give consumers access to near-instant credit.

Click here to read other highlights from the report.

Other Top Stories By Our Reporters

Freshworks launches unified product suite for startups: Software services firm Freshworks has launched Freshstack, a unified customer relationship management (CRM) offering for support, sales and marketing teams at startups. The offering is a combination of the company’s Freshmarketer, Freshsales and Freshdesk products, but it’s the first time this has been packaged together for targeting startups.

EaseMyTrip announces 50% dividend, its second since listing: Online travel platform EaseMyTrip on Thursday declared an interim dividend of Re 1 (50%) per equity share of the face value of Rs 2 each for the fiscal 2021-22. The company said that the total payout of the interim dividend is Rs 10.86 crore.

Global Picks We Are Reading