Also in this letter:

■ ETtech Done Deals

■ Israel’s Tower seeks govt inputs for fab foray

■ Seller apps on ONDC bat for unique identifiers

Offshore gaming apps lure users with ‘No GST’ carrot

Offshore counterparts of India-based real money gaming (RMG) applications have upped their game and are now luring customers with advertisements that their bets won’t attract 28% Goods and Services tax (GST).

Driving the news: “Post the October 1 notification on the 28% GST applicable on RMG apps, there has been a sudden surge in the advertisements by the offshore betting applications on social media platforms claiming that their platforms don’t attract any GST and the sum thus saved would be credited in the accounts of the customers,” a senior government official told ET.

Govt at work: The official said the ads have been brought to the notice of both Directorate General of GST Intelligence (DGGI) and the Enforcement Directorate (ED) probing players, including the likes of Mahadev Book, Lotus365, FairPlay, Reddy Anna, Laser Book, Tiger Exchange, BetBook247 and Gold365, Parimatch and others.

Sources told ET that probe agencies have alerted the government on these apps being used for causing financial insecurity.

Also read | Decoding government’s tax math for online gaming players

Multiple challenges: Probing agencies face numerous challenges such as tracking the real owners of these apps since most of them are based in offshore tax havens; the connection with the underworld, particularly the Dawood gang; the use of illegal means of transactions like hawala and cryptocurrency; and the use of payment getaways using fake credentials.

Quick catch-up: Earlier this month, the GST Council signalled there would be no back-pedaling on the 28% levy on bets made in online gaming, casinos and horse racing from October 1, despite 13 states not having passed the enabling laws yet.

Binny Bansal may invest $25-30 million more in Nagori’s Curefoods

(L-R) Binny Bansal, cofounder, Flipkart and Curefoods founder Ankit Nagori

Flipkart cofounder Binny Bansal is likely to infuse $25-30 million into his former colleague Ankit Nagori’s startup Curefoods, which runs cloud kitchens and restaurants, people aware of the discussions said. This will take his total investment in the company to around $50 million.

Details: This comes after Curefoods closed a Rs 240 crore or about $29 million fundraising round with Bansal’s Three State Ventures comprising primary and secondary investments in April. In the present investment, it is unclear if other investors are also participating or if it would be via a secondary share sale. Bansal currently owns about 12% of the platform.

Camaraderie: Bansal’s latest plans for Curefoods signal closer relations between the two entrepreneurs as he has also finalised plans to pick up a 10% stake in the Bengaluru franchise of the volleyball team under the Prime Volleyball League (PVL), where Nagori is the largest shareholder. ET was the first to report on this in May this year.

Bansal’s investment play: Bansal, who made a complete exit from Flipkart in August by selling his remaining shares in the ecommerce firm he cofounded with Sachin Bansal in 2007, has accelerated his personal investments. People aware of Binny Bansal’s plans said the entrepreneur has been meeting a wide array of startup founders to discuss potential investments.

Yumlane acquisition: Earlier on Monday, Curefoods said it has closed the acquisition of foodtech company Yumlane and its proprietary pizza technology. Financial terms of the deal were not disclosed.

ETtech Done Deals

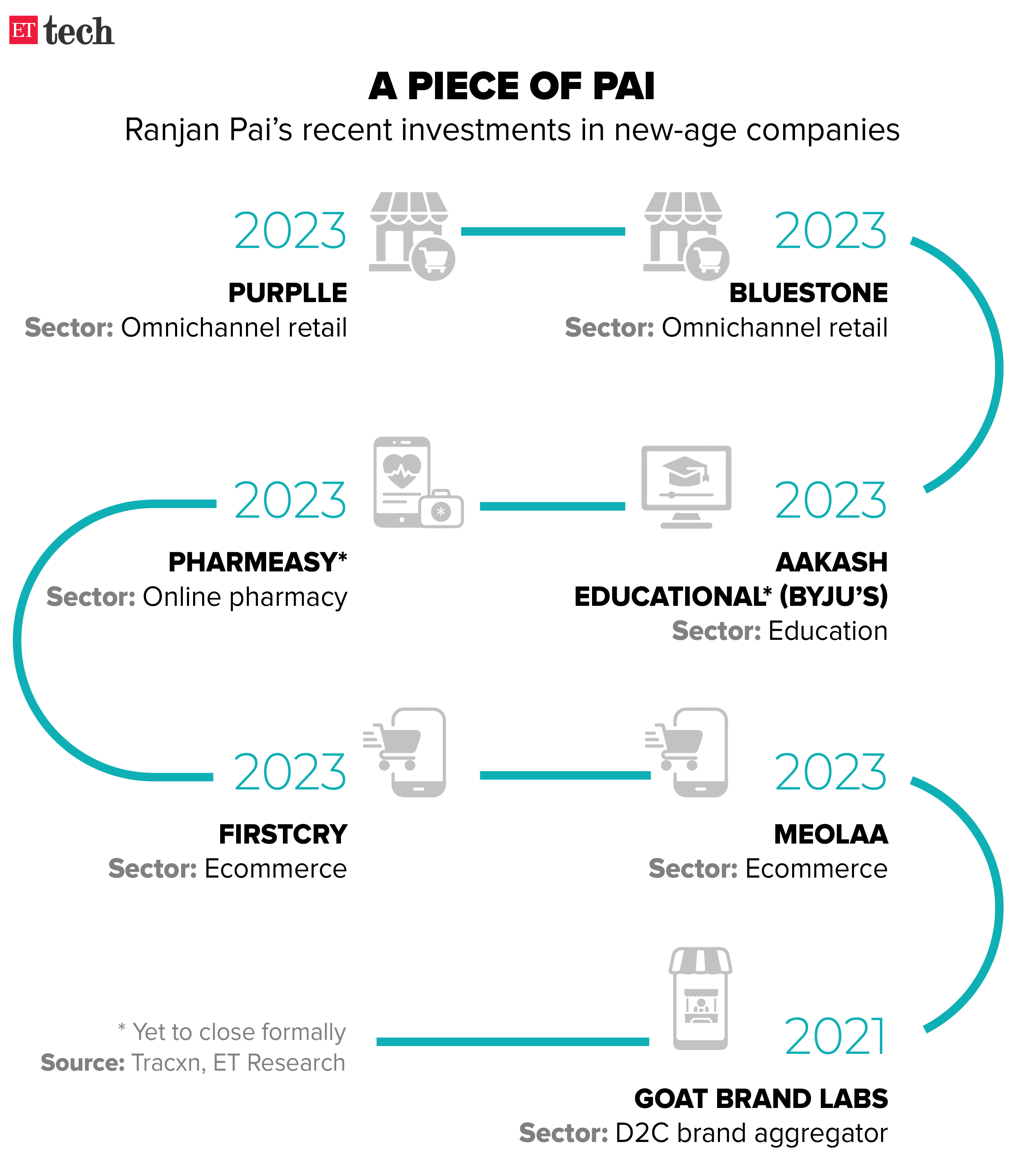

Manipal Education and Medical Group chairman Ranjan Pai

Manipal Group’s Ranjan Pai invests in omnichannel beauty retailer Purplle: The family office of Manipal Group chairman Ranjan Pai has invested in omnichannel beauty products retailer Purplle in a secondary transaction, purchasing shares from JSW Ventures, the venture capital arm of JSW Group.

Through the deal, JSW Ventures has partially exited the Mumbai-based startup. With this, the VC firm said it has earned a 2.7-times return on investments from its first fund.

Skyroot Aerospace raises $27.5 million: Spacetech company Skyroot Aerospace said it has raised $27.5 million in a pre-Series C funding round led by Temasek, a global investment company owned by the government of Singapore..

Lenskart acquires AI-powered video analytics startup Tango Eye: Hopping on to the artificial intelligence (AI) bandwagon, omnichannel eyewear retailer Lenskart announced it will acquire Tango Eye, an AI-based computer vision startup.

Vridhi Home Finance secures Rs 150 crore: Vridhi Home Finance, a housing finance lender, has raised Rs 150 crore in its maiden round of funding from venture capital firm Elevation Capital.

Gaming company Funstop Games secures $1.5 million funding: Funstop Games, a Gurugram-based casual gaming studio, said it has raised $1.5 million in funding from InfoEdge Ventures.

Israel’s Tower seeks govt inputs for fab foray by FY24-end

Israel’s Tower Semiconductor is keen to set up a semiconductor fabrication facility in India by the end of this financial year and is seeking guidance from the Indian government for the same, people directly aware of the matter said.

Next steps: Russell C Ellwanger, chief executive of the company, and other senior executives met with officials of the Ministry of Electronics and Information Technology (Meity) as well as from the India Semiconductor Mission, sources added. A senior official in the know said that “nothing concrete has been chalked out” so far, but the company is hopeful about setting up shop in India.

Try and try again: This is the Israeli firm’s second attempt to enter India’s semiconductor space after an earlier joint venture agreement with the International Semiconductor Consortium (ISMC) to set up a chip fabrication unit with a proposed investment of $3 billion failed to fructify.

Counted among the world’s leading manufacturers of analog semiconductor chips, Tower had earlier helped the government plan the 180 nanometre chip plant at the Semiconductor Lab in Mohali.

Also read | ETtech Explainer: What does it take to build a semiconductor ecosystem in a country?

ONDC seller apps seek unique ID for network’s vendors

Citing a loss in commission for companies spending time on onboarding vendors, multiple seller apps on the ONDC network are suggesting unique identifiers for vendors to avoid duplication of entries on the apps for buyers.

What’s the confusion? Vendors have to pay for multiple apps as onboarding fees and multiple entries are creating confusion for end consumers. Sellers pay for onboarding if there are custom integrations. For example, if a seller is using a specific order management system (OMS) and wants to integrate, then they will have to pay for it.

Suggestions: Some companies told ET that ONDC could use a unique identifier, which could be a mix of GSTN number, FSSAI registration number, PAN, GPS coordinates etc, to address the issue.

“If two seller apps onboard the same seller, two entries are reflected on the buyer apps. Whichever entry the customer clicks on, the order goes to them, and the other seller app that did not get the order loses on the commission despite onboarding the same seller,” said Dilip Vamanan, cofounder of SellerApp.

Also read | ONDC logs meteoric rise; challenges are climbing fast too

Astrotalk aims to launch IPO by 2025-26

Puneet Gupta, founder and CEO, Astrotalk

Astrotalk, an app which enables consultation with astrologers, is considering launching its initial public offering (IPO) in the Indian market in 2025-26, founder and chief executive Puneet Gupta told ET.

Growth trajectory: Astrotalk claims to have transactions totalling Rs 600 crore on its platform on an annual recurring basis, with 100% year-on-year revenue growth over the last three years.

Gupta said the company is now targeting Rs 2,000 crore in revenue in the next couple of years. “We will be doing the IPO prep once we hit these numbers. As of now, we are still evaluating options,” he added.

Other Top Stories By Our Reporters

Ola, Porter, Uber, Dunzo among worst platforms for gig workers: report | Mobility major Ola and on-demand logistics startup Porter are the worst platforms for gig workers, said research firm Fairwork India, after evaluating 12 companies. Both Ola and Porter scored zero when evaluated for minimum standards.

Nazara Technologies launches game publishing arm: Gaming and media firm Nazara Technologies has launched a game publishing arm, Nazara Publishing. The firm is looking to invest at least Rs 1 crore each in up to 20 games over the next 18 months.

Global Picks We Are Reading

■ Generative AI is playing a surprising role in Israel-Hamas disinformation (Wired)

■ AI policymaking must include business leaders (Financial Times)

■ Can AI replace your financial adviser? Not yet, but wait (WSJ)