Also in this letter:

■ Country Delight raises funds and other done deals

■ Manish Maheshwari holding Invact hostage, says investor

■ Amazon faces record challenges at shareholder meeting

Era of being rewarded for hypergrowth at any costs is quickly coming to an end: Sequoia

Sequoia Capital has issued another worldwide downturn missive cautioning its portfolio founders not to expect a speedy recovery from current market conditions.

Sequoia is not new to calling out periods of downturn through these memos. The most memorable one is its 2008 “RIP Good Times” email which has become legendary among startup circles.

The VC fund had also warned its portfolio companies at the outset of the pandemic in March 2020 that the epidemic might usher in a prolonged global economic slowdown and profoundly disrupt the business landscape.

Companies should consider decreasing costs, modifying sales expectations, and conserving cash, it said in an editorial titled “Coronavirus: The Black Swan of 2020.”

Sequoia published a follow-up memo a year later, in March 2021, recommending startups to plan for better economic growth in the second half of 2021.

The latest message: The venture capital firm claimed in a 51-page presentation that loose monetary policies around the world had led to negative interest rates in the previous two years. This made financing easier for growing companies and drive up valuations. With interest rates rising, “money is no longer free,” it said, which can have significant ramifications for values and fundraising.

- Many of the fund’s portfolio founders will face “challenges and opportunities” as a result of the downturn, according to the fund.

Quote: “We foresaw some of this when we first published our Black Swan memo at the start of the Covid in early 2020. What we got wrong was the monetary and fiscal policy response that followed and the distortion field that created,” Sequoia wrote in a confidential advisory note to the founders of companies in which it invested in.

Sequoia said the valuation swings currently seen were a reflection of uncertainty about demand, changing labour market conditions, supply chain uncertainties and war. These are factors that ultimately affect business, it said.

Tech slowdown and expensive capital: While 2021 was a seminal year for fundraising for Indian startups, the first half of 2022 has seen late-stage rounds getting delayed on account of higher diligence from investors, as well as disagreements on valuations and investment terms.

“When capital was free, the best-performing companies were capital consumptive. As capital has gotten expensive, these have become the worst-performing companies,” Sequoia said in its advisory.

Sequoia’s advisory follows a similar one by Y Combinator. We reported on May 19, that Silicon Valley’s famed startup accelerator asked founders of its portfolio firms to plan for the worst amid a perceptible slowdown in funding.

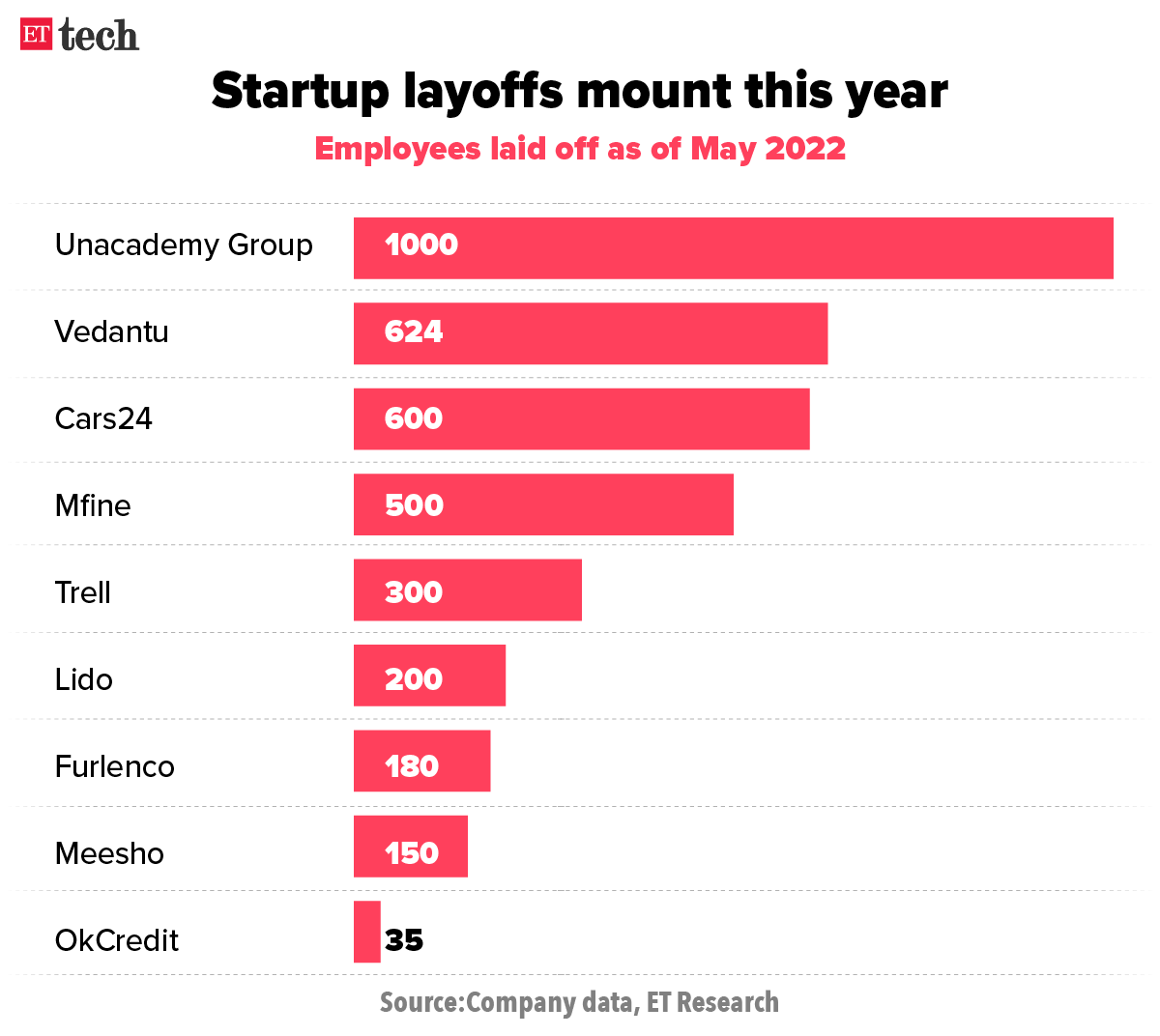

Layoffs set in: We first reported on April 28 that more than 1,800 contractual and full-time employees have been fired from Unacademy, Meesho, Trell, Lido Learning and Furlenco.

Since then more startups like Cars24 and Vedantu have fired staff and many others have frozen hiring, as we at ETtech have been reporting.

Tweet of the day

Country Delight raises fresh funds as valuation touches $615 million

Country Delight cofounders (from left) Nitin Kaushal and Chakradhar Gade

Direct-to-consumer (D2C) fresh foods brand Country Delight has raised $108 million in a funding round led by Venturi Partners and Temasek, valuing the company at $615 million post-money. The company will use the funding for geographical expansion, enter new product categories and deepening its existing product portfolio.

Other Done Deals

■ Flowcarbon, a blockchain-enabled carbon credit trading platform cofounded by WeWork’s Adam Neumann, announced it has raised $70 million in venture capital funding led by a16z crypto and the sale of its carbon-backed tokens.

■ Web3 startup Stan has raised $2.5 million in seed funding led by General Catalyst and participation from Better Capital, Coinbase Ventures, OpenSea, Kaleyra, among others. This investment marks General Catalyst’s first – of many investments in the Web3 and crypto sector in India at a time when the region has attracted large and small crypto native and traditional capital locally and from around the world.

■ Software-as-a-Service (SaaS) major Zoho has invested Rs 20 crore in Genrobotics, a startup that has rolled out a robotic scavenger capable of cleaning confined spaces such as sewers in its attempt to eradicate manual scavenging in the country.

■ Almo, a direct to consumer (D2C) brand selling men’s innerwear, has raised $2 million towards the pre-Series A funding round led by Inflection Point Ventures. The company will use the funds to bolster its branding and marketing efforts along with setting up its R&D lab, it said in a statement. Investors such as LetsVenture, AngelList India, and other angels also participated in the round.

Invact Metaversity angel investor says CEO Manish Maheshwari holding company hostage

Gergely Orosz, an angel investor in troubled edtech startup Invact Metaversity, has publicly chastised its cofounder and CEO Manish Maheshwari, days after the former Twitter India chief stated on the microblogging site that the platform is at a crossroads and may shut down.

ETtech reported about the email sent by Maheshwari’s cofounder Tanay Pratap on May 23 detailing the rift between the two.

Responding to Maheshwari’s tweet, Orosz said “I am an investor in @invactHQ. Contrary to what this thread says, the company is not failing. However, its CEO is.”

“The company has a product, has a CTO, and is executing. It also has a CEO holding the company hostage. As an investor, I see @invactHQ succeeding: but without you,” he added.

Tell me more: Maheshwari wrote in a series of tweets on Monday that the company is “standing at crossroads” and exploring several options, including cutting its cash burn, pivoting to another idea, letting one of the founders run the startup, or even returning unspent capital back to its investors.

Maheshwari and Pratap have been at odds over the company’s vision of late, which Maheshwari acknowledged in his tweets.

Amazon faces record challenges at the shareholder meeting

Ecommerce giant Amazon faced 14 shareholder resolutions questioning its policies at its annual shareholder meeting, a new high for the retail and cloud computing behemoth, as socially conscious investors investigate its treatment of employees.

What are these resolutions? Over the last few years, investors and activists have become increasingly vocal about numerous issues at Amazon. Approximately ten proposals call for reporting and adjustments on social concerns such as employee working conditions, workers’ rights, the gender pay gap, and government contracts that may violate human rights. Other plans, such as Amazon’s usage of plastic, have sparked environmental worries. Some have also highlighted the way directors are appointed to the board.

Company’s response: Amazon has recommended its shareholders to vote against all 14 resolutions, claiming in its proxy statement that it has often already taken steps to address the proposals’ underlying concerns. While the resolutions are not legally enforceable, firms frequently take action if they receive 30 percent to 40% of the vote.

Meta, Kalaari Capital partner to scale India’s early-stage startups

Meta announced today that it has partnered with leading VC fund Kalaari Capital to help youngsters by providing them with ‘timely’ business skilling support.

Purpose: The programme is geared towards providing businesses with ‘timely’ business and digital skills and ‘customised’ training to improve key profitability levers such as new customer acquisition, reach, and brand engagement.

- “In the last three years, some of India’s fastest-growing startups have been a part of this programme,” said Ajit Mohan, vice president (VP) and managing director (MD) at Meta in India.

Quote: Vani Kola, founder and managing director of Kalaari Capital said, “ As startups scale, they need to leverage several tools and platforms like Meta to support their growth. We are delighted to partner with Meta’s VC Brand Incubator, as we look to collectively enable this digital ecosystem and turbocharge the growth of our early-stage companies.”

Previous upskilling initiatives by Meta: This is not the first time Meta is investing in ‘upskilling’ Indian potential. Meta founder and chief executive officer (CEO) Mark Zuckerberg announced in late 2021 that the company will expand its partnership with the Central Board of Secondary Education (CBSE) to provide a curriculum on digital safety, online well-being and augmented reality (AR) for over 10 million students and 1 million teachers in India.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Aishwarya Dabhade in Mumbai. Graphics and illustrations by Rahul Awasthi.