New Delhi. Lost an enormous number of friends and family in the nation of Corona infection pestilence. Indeed, even numerous youngsters became vagrants. There were many such reports that every one of the individuals from the family dies because of covid and the youngsters became vagrants.

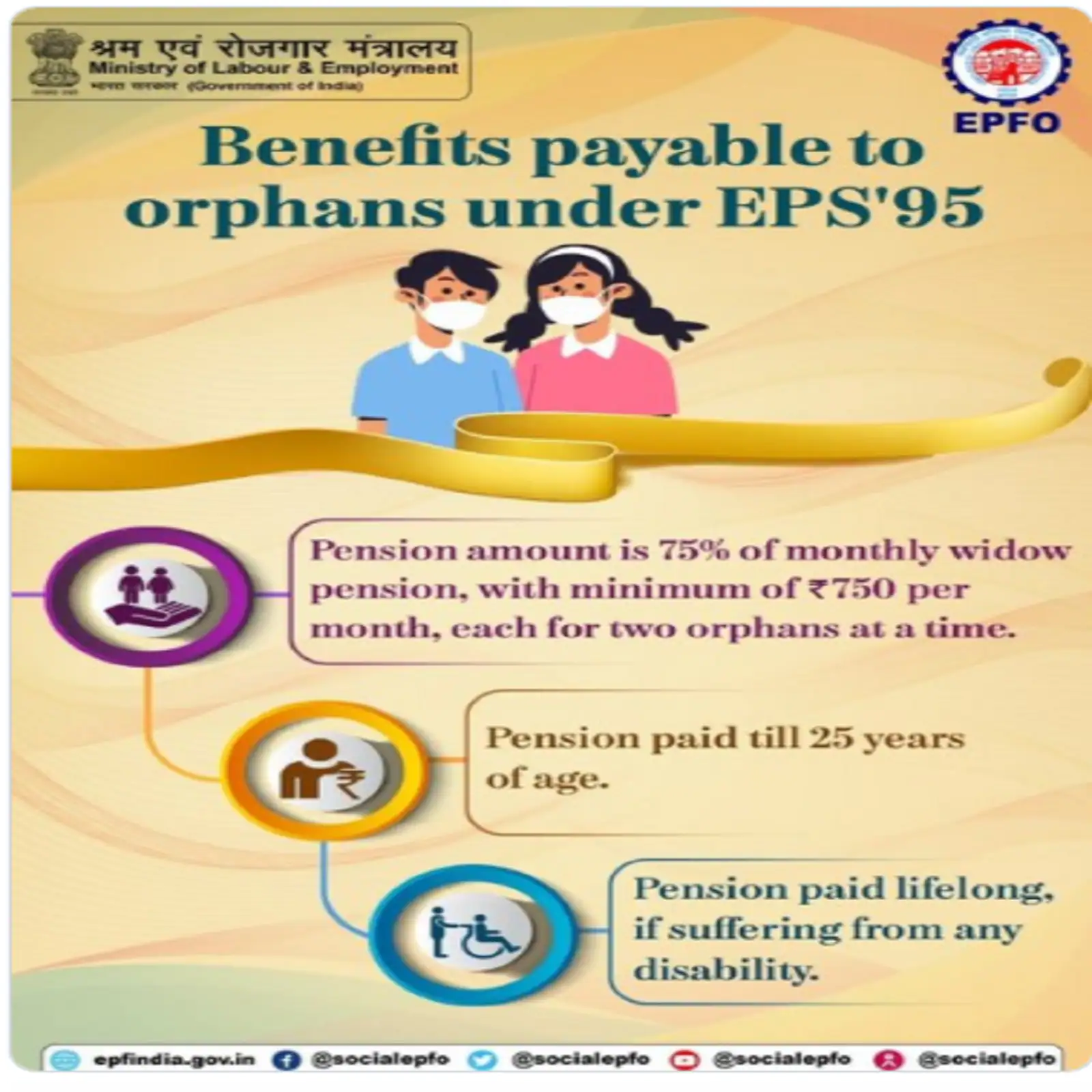

Monetary help can be accessible for such stranded kids under the Employee Pension Scheme (EPS). Be that as it may, this advantage will be accessible to those vagrant youngsters, whose guardians were either salaried or have been EPS individuals. The Employees Provident Fund Organization (EPFO) has tweeted with regards to the advantages (EPS Benefits) to the vagrant kids under the EPS scheme.

What are the advantages of stranded children under EPS?

The amount of benefits will be 75% of the month to month widow annuity. This sum will be essentially Rs 750 every month.

At a time, each of the two vagrant youngsters will get a benefits measure of Rs 750 every month.

Under the EPS plot, vagrant kids will be given benefits till the age of 25.If the kids are experiencing any incapacity, they will be given annuity forever.

Will there be any installment for EPS?

For EPS, the organization doesn't deduct any cash from the worker's pay.

Some piece of the organization's commitment is saved in EPS.

Under the new rule, those with fundamental compensation up to Rs 15,000 will get this office.

As indicated by the new rule, 8.33 percent of the compensation is saved in EPS.

On having a basic salary of Rs 15,000, the organization deposits Rs 1,250 in EPS.

Life certificate to be submitted for benefits

Beneficiaries are needed to submit life endorsement or computerized life declaration for benefits installment under the Employees’ Pension Scheme-1995 (EPS-95). Consistently beneficiaries are needed to submit life endorsement or life authentication. Because of this there is no snag in getting benefits. Presently the office of submitting life declaration through video call has likewise been begun.