Also in this letter:

■ CCI turns up the heat on small sellers as etailers hold back info

■ Uber hikes fares and offers flexible payments to drivers in many cities

■ Andreessen Horowitz launches $600 million gaming fund

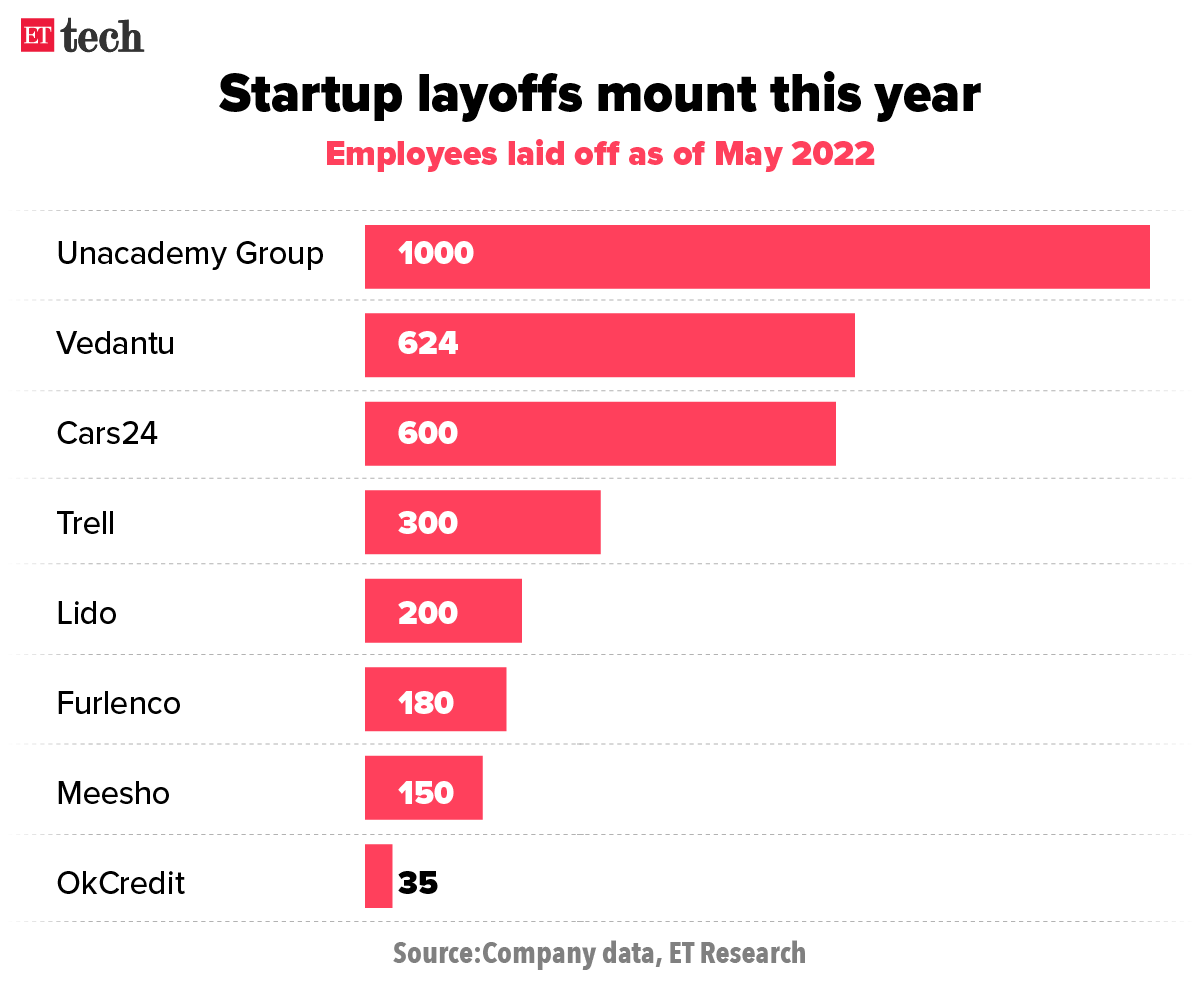

Cars24 sacks 600 employees as startup layoffs continue

Used car market marketplace Cars24 has laid off over 600 employees, or about 6% of its 9,000-strong workforce, according to people aware of the matter.

The layoffs have taken place across departments and roles, these people added.

Raised funds six months ago: Cars24 closed a $400 million financing round led by Alpha Wave Global in December. This included a $100 million debt component. The company’s valuation jumped three times to $3.3 billion after the funding round.

The company, which is backed by SoftBank and Alpha Wave Global, joins a growing list of startups that have fired employees to conserve cash amid a slowdown in funding.

Layoffs pile up: On Wednesday, edtech unicorn Vedantu said it had fired 424 full-time and contractual employees, or about 7% of its workforce. Earlier in the month, the company laid off 200 contractual and full-time staff amid falling demand for online education.

- In February, Lido Learning laid off over 150 employees, just five months after closing a $10 million funding round from Ronnie Screwvala’s Unilazer Ventures. OkCredit also announced 35 layoffs that month.

- In March, social commerce startup Trell said it would lay off hundreds of employees amid a probe into financial irregularities at the firm.

- The same month, furniture rental startup Furlenco laid off 180-200 employees.

- Meesho followed in April, laying off 150 employees from its grocery business, Meesho Superstore.

- In March and April, Unacademy fired 1,000 employees, including on-roll and contractual staff amid a slowdown in online education.

We reported on April 28 that startups had begun to cut costs and run a tighter ship after a record year of fundraising and aggressive expansion.

CCI turns up the heat on small sellers as etailers hold back info

The Competition Commission of India (CCI), which is investigating several large ecommerce platforms for allegedly violating India’s competition laws, is turning up the heat on small and medium businesses that deal with them.

What’s going on? Lawyers privy to the development said several online vendors have received information requests from CCI in the past few months. Its queries are said to be around input costs and details of their business arrangements with the digital platforms.

Why? CCI is probing these digital platforms for allegedly abusing their dominance in the market by giving preferential treatment to select vendors. It has asked them for business transaction data such as sales figures, input costs, and other expense statements.

But some of the large platforms have refused to share such information with CCI as they consider it confidential. So, the regulator is trying to obtain it from their associates, people with direct knowledge of the matter told us.

“Most of the large digital platforms are either giving vague replies to CCI’s questions or they are moving judicial forums against the investigations,” one of these people said.

In April, CCI had raided the premises of several top sellers on Amazon – including Cloudtail and Appario Retail – and Flipkart.

Concerns: But small and medium businesses that sell on Amazon said they were concerned by the CCI’s actions.

“There are only five or six big ecommerce vendors. The rest are micro and small enterprises,” said Vinod Kumar, president of India SME Forum. “Last month, when CCI raided certain vendors, we got a lot of anxious queries from our members about the impact the raids would have on their businesses.”

Tweet of the day

Uber hikes fares, offers flexible payments in a conciliatory note to drivers

Uber has hiked fares by 10-15% in several cities to increase its drivers’ earnings amid soaring fuel rates. It has also offered them flexibility on payments and visibility of destinations.

“With the recent hikes, we have managed to cushion the full impact of the fuel price increases,” said Nitish Bhushan, head of central operations, Uber India, and South Asia. He added that measures were focused on bringing back Uber’s “promise of reliability” amid stressful times.

Bhushan qualified the measures as “iterative,” meaning they are subject to revision and enhancement based on feedback from drivers and users.

Besides a higher income per ride, drivers can now choose trips based on the destination. This is incumbent on the driver crossing a certain trip acceptance threshold. “The upfront destination feature is already live across 20 cities and will be expanded to all others,” the company said in a post.

The conciliatory note follows an increase in customer grievances, particularly cancellations. Uber said its decision to show destinations to drivers as part of an effort “to remove frustration for riders and drivers alike,” and “incentivise right platform behaviour.”

Andreessen Horowitz launches $600 million gaming fund

Venture capital giant Andreessen Horowitz has launched a new $600 million gaming fund, according to a report by Techcrunch.

Tell me more: Called Games Fund One, the new fund will look to make bets in the fast-growing gaming world. It is being led by general partners Andrew Chen, Jon Lai, and James Gwertzman.

Quote: “With [Games Fund One], we will continue to add more functions and develop deeper networks that are tailored to the games ecosystem so we can help our portfolio companies with everything from building digital communities to managing their virtual economies, to IP licensing best practices, to helping build their development teams,” read the blog post announcing the fund.

Several big-name executives from gaming companies such as King, Discord, Roblox, and Twitch are backing the new fund. Andreessen Horowitz already holds investments in popular gaming platforms such as Zynga and Meta’s Oculus.

ETtech Done Deals

■ Warehouse robotics and automation company GreyOrange said it has raised $110 million from Peter Thiel’s Mithril Capital and other existing and new investors, along with separate debt financing from BlackRock.

■ GeoIQ, a location intelligence startup, has secured $2.25 million in funding from Lenskart, an omnichannel eyewear retailer. Existing investors 9Unicorns and Ecosystem Ventures also participated in the round.

■ Cloud certification and skilling platform QwikSkills has raised Rs 3.85 crore in a funding round from Indian Angel Network (IAN) and others. The round was led by angel investors Manish Sinha and Naveen Gupta of IAN.

JPMorgan downgrades India’s IT sector as pandemic boom fades

Soaring inflation, supply chain concerns, and the impact of the Ukraine crisis will put an end to India’s IT services industry’s development boom during the pandemic, according to JPMorgan analysts, who downgraded the sector to “underweight” on Thursday.

Losing sheen: The $194-billion sector, which helped businesses adapt amid the pandemic, is facing a demand slowdown this year as employees return to offices and the Russia-Ukraine war weighs on spending from clients in Europe.

“We see peak revenue growth behind us and EBIT margins trending down from inflation, mean reversion,” JPM said.

Bleak times: The brokerage expects the slowdown to worsen in 2023, partly due to a potential decline in orders from the United States, a key market, where economic growth has started to weaken.

It lowered Tata Consultancy Services Ltd to an “underweight” rating from “neutral” but stayed “overweight” on rival Infosys.

Taking stock: Shares of TCS, Infosys, Wipro, HCL Tech, and Tech Mahindra fell around 5% on the news.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai, Ruchir Vyas and Arun Padmanabhan in New Delhi. Graphics and illustrations by Rahul Awasthi.