Also in this letter:

- Info Edge, SoftBank among big winners in Policybazaar listing

- Crypto here to stay, challenge is to regulate it, industry tells govt

- Indian mythological figures come out to play

Forcing firms to declare profits early will destroy value, says Policybazaar founder

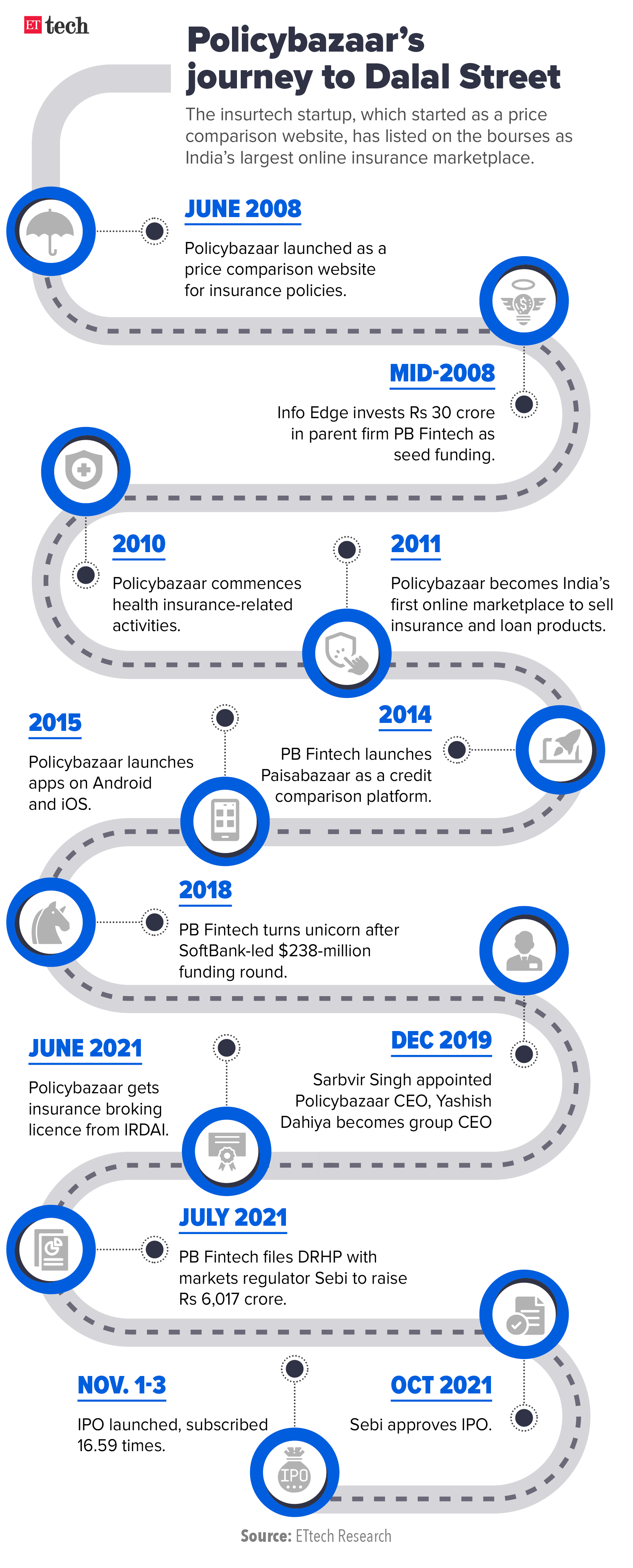

PB Fintech, which runs Policybazaar and Paisabazaar, made its debut on the bourses Monday, becoming the third high-profile consumer Internet startup after Zomato and Nykaa to list in India.

23% jump: The online insurance marketplace closed the day’s trade with a market cap of Rs 54,070 crore, as the stock ended at Rs 1,202.90 on the BSE, nearly 23% higher than the issue price.

Yashish Dahiya, cofounder and chairman of PB Fintech, said he was “quite kicked” with the listing gain, which seemed moderate compared with the 50% and 80% pops that Zomato and Nykaa saw on their first day of trade.

Yes, but: Dahiya, who cofounded PB Fintech along with Alok Bansal in 2008, told us in an interview that a short-term focus on profit could be destructive for long-term value creation for shareholders and companies like Policybazaar. He said the company was not taking any “pressure on profitability” after the IPO.

New-age companies like PB Fintech can’t be valued based on what they are today, he told ET. “You are valuing them for what they can become in a five to 10 years’ time. Let’s not be stupid and force these companies to try and declare profits early. That will be value-destroying for shareholders in the long term… without a shadow of doubt.”

Dahiya’s comments are a response to scepticism from some investors that the new-age startups are not profitable and that growth alone isn’t enough.

Numbers: The company’s revenue from operations increased more than 35% to Rs 237 crore in the June quarter of fiscal 2022 compared with a year earlier. Its loss for the quarter widened 85% year-on-year to more than Rs 110 crore.

“We will not be stupid. We have built Policybazaar and Paisabazaar with $150 million. We are not frugal, but we don’t waste it (either). I think our behaviour will not change in future either and it will be similar,” he said.

Next steps: PB Fintech, going forward, will stay focused in two large areas: insurance and credit. “Paisabazaar already gets double the traffic of Policybazaar. So, there is a lot of data access from there towards financial products. We may or may not do something on the investment side, but we keep looking and that doesn’t mean we will do it,” Dahiya said.

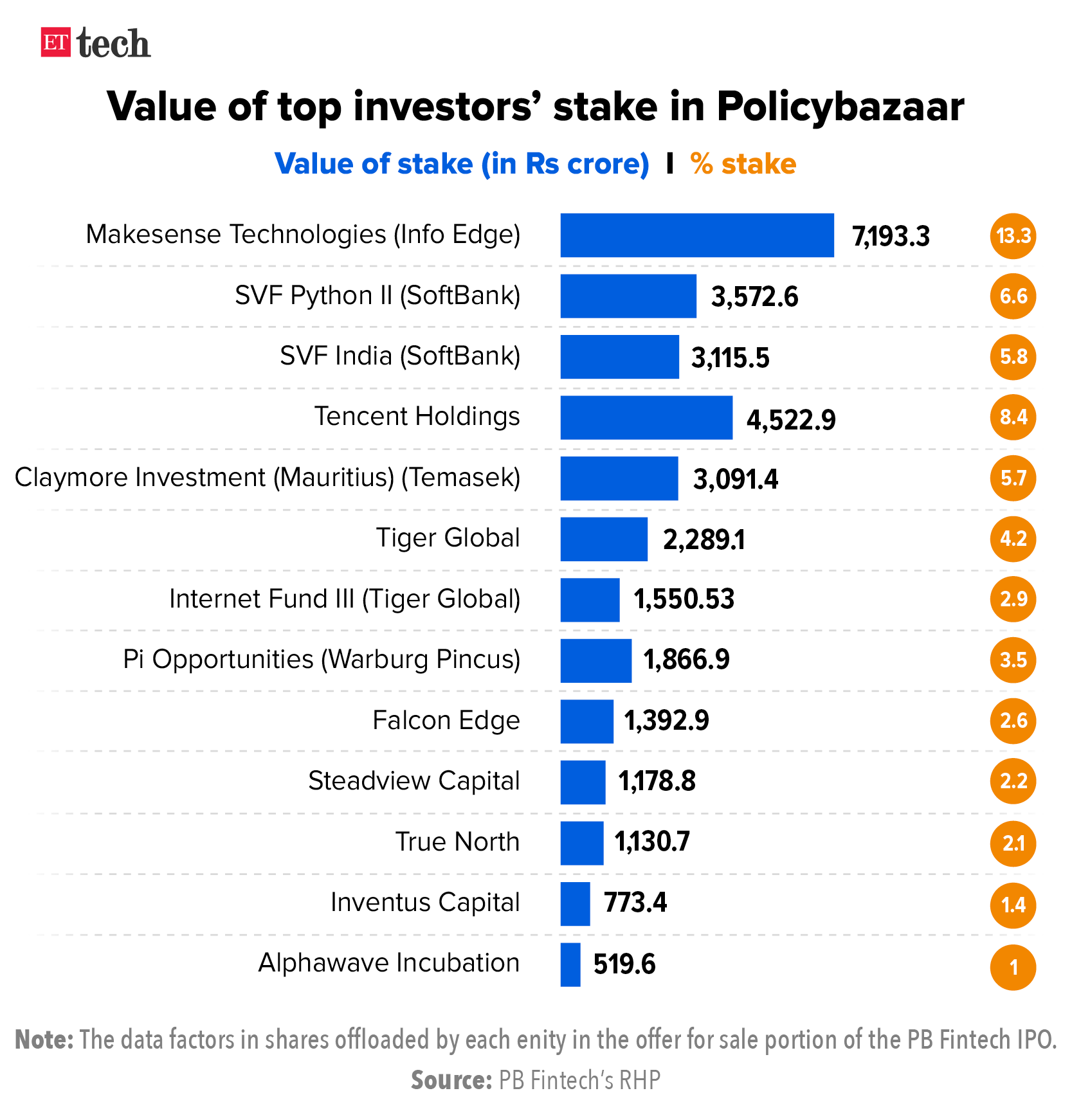

Info Edge, SoftBank among biggest winners in Policybazaar listing

Policybazaar parent PB Fintech’s market capitalisation surpassed Rs 54,070 crore on the first day of listing on Monday, causing the fortunes of more than a dozen institutional investors — including SoftBank, Tencent, Tiger Global, Temasek, Warburg Pincus and Falcon Edge — to soar.

Big winners: Info Edge saw the value of its 13.3% stake jump to Rs 7,193.3 crore, while SoftBank, which holds 12.4% in PB Fintech through Vision Fund Python II and Vision Fund India, saw the value of its stake rise to Rs 6,688.1 crore. Other big gainers were Temasek, Tiger Global and Tencent.

Here’s how much each investor’s stake in PolicyBazaar was worth as of Monday’s close.

Earlier on Monday, shares of PB Fintech listed at a 17.35% premium over the issue price and hit an intraday high of Rs 1,249 on the Bombay Stock Exchange before ending the day at Rs 1,202.90 — 22.74% higher than the issue price.

In comparison, the market cap of Zomato Ltd. and Nykaa parent FSN E-Commerce Ventures had topped the Rs 1 lakh-crore mark within the first few hours of trading on their stock market debuts.

“We are lucky we got to solve a problem where we could educate people about the need for life insurance,” PB Fintech’s cofounder Yashish Dahiya said during the listing event at the National Stock Exchange on Monday. “We have a long way to go”.

Also read: Who are Yashish Dahiya and Alok Bansal, founders of Policybazaar?

NSE CEO Vikram Limaye welcomed the company at the national bourses. “The listing of PB Fintech propels the story of new-age tech companies,” he said. “Indian markets have accepted the models of these companies which cannot be evaluated in conventional ways.”

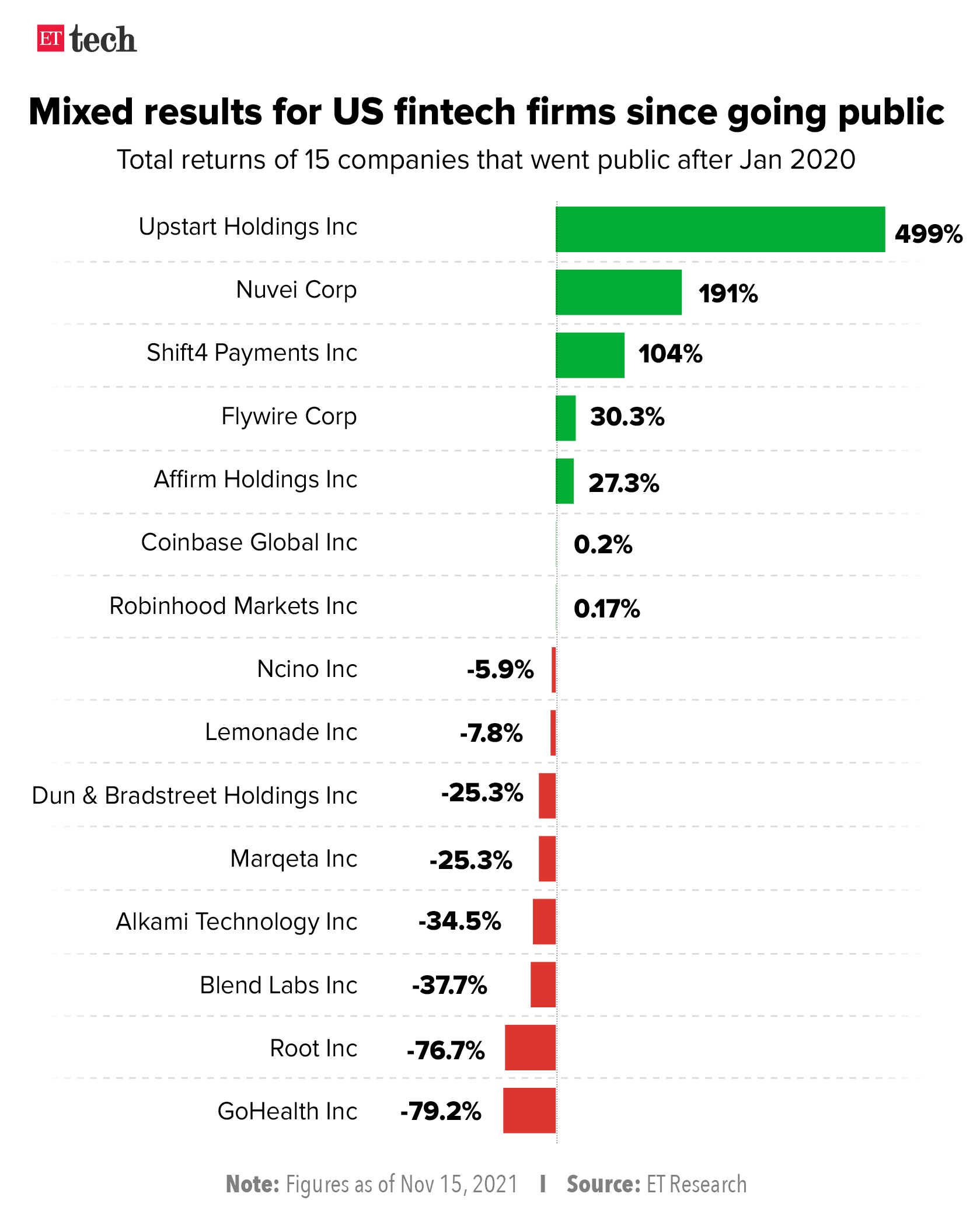

Yes, but: While this represents another stellar listing for an Indian tech startup, PB Fintech, Paytm and other fintech firms in India will have one eye on their counterparts in the US. That’s because some of these US fintech companies, which were embraced by private investors, have seen lukewarm trading in the public market.

Of 15 US fintech companies that conducted initial public offerings (IPO) since January 2020, eight were trading below their listing price as of November 15, two were trading flat and only five were trading above their listing price, according to data compiled by ET. This reflects a possible disconnect between enthusiastic private equity and venture capital investors and more measured portfolio managers and traders. As a result, excitement at other US fintech firms planning listings has cooled. Whether PB Fintech, Paytm, Mobikwik mirror or buck this trend remains to be seen.

Tweet of the day

Crypto here to stay, challenge is to regulate it, industry tells govt

Industry experts and associations told the parliamentary committee on finance on Monday that cryptocurrency is here to stay and the challenge is to find ways of regulating it.

First step: This was the first meeting to be convened by the Parliamentary Standing Committee on Finance on crypto, which has generated a lot of interest and concern. The panel, headed by Jayant Sinha, who is also a former minister of state for finance, also sought inputs from academics from IIM Ahmedabad. Sinha told us that the intent of the meeting was to get a better understanding of the market.

Quote: “No view has been taken by the committee… This meeting was essentially to gather information from the industry and understand the landscape of cryptofinance,” he said.

Sinha said the committee heard the exchanges on various aspects, including the user base and investments. Industry players claimed they had 15 million registered users with a total investment of Rs 600 crore, he said.

The Reserve Bank of India (RBI), which has been skeptical of such numbers, was against virtual currencies but said there were other aspects that needed to be taken into account, said a person with knowledge of the committee’s deliberations.

Panel members aired their concerns about the possible misuse of cryptocurrency and sought to know how these can be dealt with. They also pointed to advertisements that could entice people to invest in a volatile segment.

The panel’s meeting is significant as it comes days after Prime Minister Narendra Modi chaired a high-level meeting with officials from various ministries and RBI on cryptocurrencies.

Crypto bill soon? The government is likely to introduce a bill on cryptocurrencies during the winter session of Parliament, which begins on November 29, PTI reported.

Crypto ad blitz: Meanwhile, Indian cryptocurrency exchanges collectively spent more than Rs 50 crore during the recently concluded ICC T20 World Cup.

- Data show that cryptocurrency exchange CoinDCX advertised seven times per match on every channel during the tournament, spending a total of Rs 40 crore for ads on Star Sports.

- With about 50 ads per match across all channels, CoinDCX had a total inventory of close to 10 hours on TV, according to information from TAM Sports, a division of TAM Media Research. Data for the first 42 matches also showed that the cryptocurrency exchange had a 4% share of the overall ad volume during the tournament.

- CoinSwitch Kuber, which had a sponsorship deal with Disney+Hotstar, spent over Rs 10 crore, said people with knowledge of the matter.

Ad rules: The government is likely to approach the Advertising Standards Council of India to push for greater disclosures and stricter statutory warnings to accompany ads on virtual currencies or their trading platforms, we reported on Monday.

Indian mythological figures come out to play

Indian mythological characters such as Bheem, Surpanakha, Arjun and Sugriva may soon light up your gaming screens.

What’s happening? Demand for culturally significant icons is growing amid a gaming boom in the domestic market.

Three months ago, Studio Sirah, the makers of ‘Kurukshetra: Ascension’, a strategy video game featuring iconic characters from Indian mythology, raised $830,000 in seed funding from Lumikai Fund, InMobi cofounder Piyush Shah, Swedish gaming firm Stillfront Group chief operating officer Alexis Bonte and Nodwin Gaming founder Akshat Rathee, among others.

Around the same time, SuperGaming, the makers of Indus, a new battle royale shooter game steeped in Indo futurism, raised $5.5 million in a Series A round from Skycatcher, AET Fund, BAce Capital, Dream Incubator, 1Up Ventures, and Icertis cofounder Monish Darda.

Quote: “We are tapping into stories which people already have a connection to. In our case, the Mahabharat and Ramayan have an array of stories and characters which people have seen when growing up. You don’t have to do a lot of context-building and world immersion,” said Abhaas Shah, cofounder of Studio Sirah.

Indian gamers are maturing in the way they play different gaming genres, RedSeer Consulting said in a report last month. Apart from their propensity to pay, gamers are also embracing the trend of playing “India-first content” games. About 60% of gamers are willing to play games with an Indian-centric theme or characters from mythology or celebrities, the report stated.

We expect festive buying to continue into next year, says Nykaa CEO

Nykaa will focus on growth and profitability while investing significant sums in marketing and to acquire customers, founder and CEO Falguni Nayar told us earlier today.

Profit down: The remarks came after the newly listed company registered a 96% fall in profit to Rs 1.2 crore in the second quarter. Revenue, however, rose 47% to Rs 885 crore year on year and 8% sequentially, the company said in stock exchange filings late on Sunday.

The company’s marketing and advertising expenses shot up to Rs 121.4 crore in the quarter ended September 30, from Rs 31.5 crore in the corresponding period last year.

Earnings before interest, tax, depreciation and amortisation (Ebitda) in the September quarter stood at Rs 28.8 crore, a 48% decline from the same period last year.

Shares of FSN E-Commerce, the parent company of Nykaa, dropped about 8% to Rs 2,185.05 in early trade today. It closed the day 3.32% lower on the BSE at Rs 2,280.6 a share.

Founder responds: “We will continue to invest in the future and maintain a strong balance between growth and profitability,” Nayar said. “Last year, the marketing costs were unusually low and there was revenge buying seen in the market post the first wave of the pandemic,” she said. “We will push the pedal on acquiring more customers.” There has been phenomenal growth in the current festive season and the December quarter will reflect that, she added.

“This year, July, August and September were muted but we expect the festive buying to continue well into next year till February-March when the wedding season kicks in,” she said.

The Mumbai-based e-tailer said on Sunday that its gross merchandise value (GMV) for the June-September period rose 63% year on year and 10% sequentially. The company’s total GMV stood at Rs 1,622.9 crore for the quarter as against Rs 997.1 crore in the same period last year.

“Our half-yearly numbers show that we registered a profit of Rs 4.7 crore for the current financial year over a loss of Rs 25.1 crore in the same period last year, which to us is a key change,” Nayar said.

Nykaa hit the Indian stock exchanges on November 10 and its market capitalisation went past Rs 1 lakh crore after the stock started trading at a nearly 80% premium to its issue price of Rs 1,125.

Other Top Stories By Our Reporters

Krafton removes 25 lakh accounts in Battlegrounds Mobile India to avoid cheating: South Korean gaming firm Krafton said that it had removed 25 lakh accounts in the past month in a bid to do away with cheating on its popular game, Battlegrounds Mobile India (BGMI).

Chinese hackers may have targeted Zoho: Enterprise software maker Zoho was targeted by hackers, possibly of Chinese origin, who exploited a vulnerability in its self-serve password management tool ManageEngine from late September to early October, according to Palo Alto Networks.

Global Picks We Are Reading