Singapore’s ecommerce firm Shopee abruptly decided to shutter its India operations earlier this week, reported first by us.

It was quite sudden for us as reporters, as well. We were in the middle of an editorial meeting on Monday morning, when my colleague Samidha and I jumped up hearing from our sources about a company town-hall announcing the news to its staff.

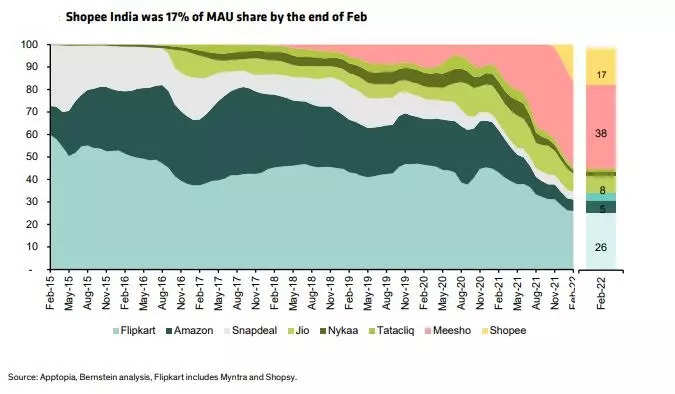

Background: Just a few months ago, we were hearing about Shopee giving fierce competition to Meesho, Flipkart’s Shopsy, in what’s being labelled as the new-age version of low-end e-commerce. We’d seen that story play out with Snapdeal and ShopClues back in 2014-2015.

While the company told us it’s taken the decision due to ‘global market uncertainties’, there’s more to the development. We will try to dive into what led the company’s departure from India.

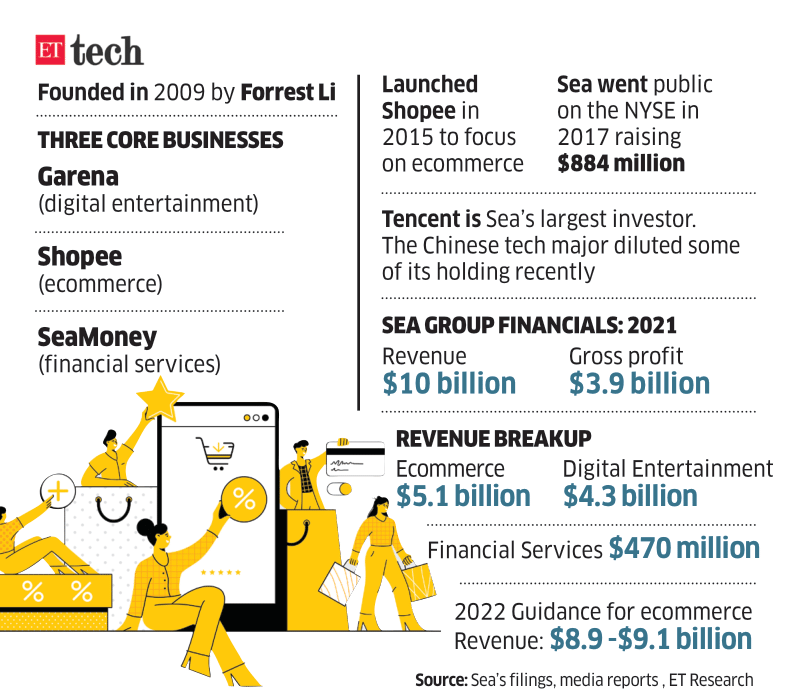

The sudden exit of Shopee, which is housed under Singapore’s Sea, is due to two main reasons:-

Geopolitical tensions: Shopee entered India in November 2021, and started growing at a fairly good pace. While it’s tough to compete in the low-end of online retail, the geopolitical factors played an important in Shopee pulling the plug here.

Sources in the know told us there were informal presentations made to the Indian government from Shopee following Sea’s Free Fire ban in February. The ban on Free Fire game was part of the government’s fresh clampdown on Chinese apps. While Shopee is based in Singapore, its Chinese connections have always been under scrutiny, especially recently in India.

Bernstein Research put out a note analysing the reasons for Shopee’s exit and its impact on Sea’s stock price on NYSE. The report said Shopee had scaled up to rank among the top three apps in India in terms of MAUs (monthly active users), with over 40 million MAUs in February.

“The room for Shopee to scale up in India – as the only pure-play 3P player was high, and hence the exit appears to be driven by other factors, in our view.”

What’s the other factor?

The Bernstein note echoed what sources told us about the other factor too. “ The challenge was perhaps the shareholding pattern with Tencent as a controlling shareholder, but that changed post the AGM in mid-February. In addition – there was a high court case on Shopee India for similar reasons. Therefore, it is likely that Shopee’s decision was linked to an unwillingness to invest in management bandwidth in India – as it may have mattered less in the next few years.”

What about business?

Shopee entered the Indian ecommerce industry by grabbing attention for selling low-priced items at steep discounts. According to a senior industry executive, it was selling products worth Rs 200-300 for Rs 70 or 80 in the beginning. This resulted in a monthly burn of at least around $20 million per month. It is well proven that you need gobs of capital to gain an initial foothold in the Indian e-commerce market where biggies like Flipkart, Amazon India and upstarts Meesho are also competing aggressively.

“The company was feeling the heat of the competition even as they were gaining traction. How long can they spend to win market share was becoming a question,” one of the sources who didn’t or want to be named said.

The Bernstein report said India exit will reduce Shopee’s cash-burn in the short-term but raise a question mark on its long-term prospects.

It said India wasn’t too relevant from a valuation view in the medium-term and would have led to a higher cash burn after a couple of years. “ However, from a narrative point of view, an India exit, especially when Shopee was gaining traction, impacts sentiment (which is tough to value on quantitative metrics). While the street was uncomfortable with the India launch, we believed India offered an excellent long-term scale-up opportunity for Shopee; it should have persisted with the launch, in our view,” Bernstein added in its report.

Two things to look out for going forward. Will Shopee’s India exit lead to some gains for local rivals and if the company will take a similar decision in other global markets after shutting shop in India and France.

TOP STORIES BY OUR REPORTERS

From the ecommerce corner

Logistics companies hike ecommerce freight rates as fuel prices shoot up

The rise in commercial fuel charges has now led to top logistics companies increasing their freight charges for ecommerce shipments. This may impact the end pricing for online consumers as sellers contemplate if they want to pass on the rising freight charges to the consumer.

First the news: Delhivery, one of the largest logistics companies in India that deliver for leading ecommerce firms like Amazon India, Flipkart and others, has decided to increase freight charges by 30% for Delhivery Air and Surface. Logistics aggregator Shiprocket, which works with Delhivery, told its clients about the hike in the charges from April 1! ETtech has reviewed the note.

Quite a hike!: “This is on account of the steep rise being witnessed in commercial fuel charges over the recent weeks and other systemic factors in the logistics markets,” the note read.

Do you have to pay more for your shopping? Online sellers, ultimately, have to pay delivery fee for their orders to be shipped. It’s one of the many charges they shell out to marketplaces. Flipkart and Amazon are the biggest clients of companies like Delhivery and an increase in freight charges will impact the per order income of online vendors. Typically, independent online sellers pass on at least a part of the price hike to consumers when marketplaces or delivery firms change their various fee components.

Demand for delivery workers continues to rise: The demand for delivery executives continues to rise even as in-store purchases pick up pace amid dropping Covid-19 infections in India.

Driving the news: Companies such as Zomato, BigBasket, Ecom Express, Shadowfax and Swiggy are beefing up their delivery fleets as demand for online delivery and quick-commerce services continues to grow.

More than 400,000 jobs will be up for grab for last-mile delivery and supply-chain personnel in the next 90 days, almost 50% up from a year ago, according to various estimates.

Lawmakers concerned about Zomato’s 10-min delivery plan: Lawmakers in Tamil Nadu and Karnataka have expressed concerns about Zomato’s plan to roll out 10-minute food delivery.

Driving the news: On Friday, Chennai’s traffic administrators summoned Zomato executives, seeking clarifications about the infrastructure needed to operate quick delivery services safely, people aware of the discussions told us.

The sources said Zomato clarified that 10-minute delivery was a ‘pilot project’ for select cities, and that it would not be implemented in Chennai for now. In turn, traffic regulators sought an assurance that Zomato would inform them before implementing any quick delivery services in the city, they added.

In The Crypto World

Crypto exchanges expect big drop in volumes as new tax regime for VDAs kicks in

Despite, large scale efforts, encompassing representations made to the Finance Ministry, social media campaigns (#reducecryptotax) – by crypto firms, crypto influencers and evangelists, the tax regime proposed for Virtual Digital Assets (VDAs) as part of the Finance Bill 2022, got implemented on April 1.

What happens starting April 1: Retail investors will have to cough up a flat 30% tax on gains made on VDAs. Unlike other asset classes, retail investors will not have the ability to set off losses, claim expenses or the cost of acquisition, or even a reduced slab for long-term capital gains.

More coming from July 1: 1% tax deducted at source (TDS) will come into effect.

Once fully in force, what would it mean? A crypto industry member on the condition of anonymity said the norms could evaporate volumes from the exchanges to the tune of 20-50% at least.

Crypto transactions involving Indian, foreign exchanges may attract GST: Transactions involving Indian crypto exchanges and those outside India, especially those procuring crypto assets that are traded in India, could come under the taxman’s lens.

The tax department is scrutinising how exchanges that allow trading in India manage their cryptocurrency float, and whether there is any element or any transaction where Goods and Services Tax (GST) could apply, sources aware of the development told us.

Details: Several exchanges operate in India but only a handful — mainly the large ones — have actual cryptocurrencies on their books to be bought or sold by Indian traders and investors. Some large exchanges also have holding entities outside India that hold a large chunk of the crypto assets.

These are then “transferred” to the Indian entity before any Indian can buy them.

CCI finds Google’s Play Store payments policy ‘unfair, discriminatory’

The Additional Director General of the Competition Commission of India (CCI) has found Google’s contentious payments policy for Play Store developers to be ‘unfair and discriminatory’, several sources told us.

The law: Section 4 of the Indian Competition Act states that no enterprise may abuse its dominant position, impose unfair practices for the sale of goods and services, or indulge in practices that limit market access for others.

What’s next? Further hearings on the findings of the probe will begin shortly, the sources said. Google will then have a chance to present its argument, following which a verdict will be given. One of the sources said CII “is quite convinced that the policy will definitely harm developers if implemented”.

Google’s response: A representative for Google said the company was reviewing the report, adding, “This report is not the CCI’s final decision and does not prejudge the outcome of the CCI’s inquiry.” The company will “continue to engage with the CCI and demonstrate that our practices benefit Indian consumers and developers, without in any way restricting competition,” the person added.

Delhi High Court adjourns WhatsApp, Meta appeal in CCI case to July 21

PDP Bill awaited: A division bench of Justices Poonam Bamba and Rajesh Shakdher adjourned the matter after WhatsApp’s counsel, senior advocate Harish Salve, said the Personal Data Protection Bill was yet to be passed by Parliament.

WhatsApp had given an undertaking to the central government that it would not enforce the privacy policy till the bill was cleared, Salve said.

From the IT Space

TCS, Infy, Wipro join race for small IT deals

Backstory: Deals in the $20 million range – traditionally the forte of mid-sized IT providers like Mindtree, Mphasis, LTI, and Hexaware – are now the backbone of the industry, and companies will have to dedicate more resources to manage this segment going forward, they said.

The $20-million client bucket: For instance, TCS is expected to restructure its operational model to focus specifically on the $20-million client bucket while the likes of Infosys and Tech Mahindra have recently launched metaverse and 5G co-innovation practices for clients.

India software products sales to hit $30 billion by 2025: The National Association of Software and Services Companies (Nasscom) today launched a report that indicates India’s software product industry is expected to post $30 billion in yearly revenue by 2025.

Behind the burgeoning industry: With the consumers’ ever-evolving needs, enterprises are keeping up with continuous innovation, leading to a shifting global marketplace and 10% annual growth in the IT services sector, generating high returns for shareholders and investors in the last decade. The estimates are also placed on the lookout that local players expand globally and several new companies get into the products space, a report by industry body Nasscom and market research company UnearthInsight said.

As EVs catch fire, makers look for ways to cool batteries

Electric vehicle (EV) makers and their battery suppliers are exploring various technical solutions to eliminate overheating risks amid incidents of electric two-wheelers catching fire.

On Saturday, an electric scooter caught fire in Vellore, Tamil Nadu, killing a man and his daughter. Earlier, videos of an S1 Pro of Ola Electric catching fire in Pune went viral on social media on Saturday afternoon.

While Ola Electric is investigating the issue and is yet to find the root cause of the problem, other EV companies plan to work closely with component and battery manufacturers to get to the bottom of the issue.

What’s the solution? Battery makers said their design and chemistry need to be looked into. “An ideal situation would be to keep the battery cold always and at a low temperature,” said Anand Kabra, managing director of Battrixx, a battery pack supplier for electric two-wheelers. “However, India being a low-cost market in the two/three-wheeler segment, companies are not ready to invest in active cooling solutions,” he added.

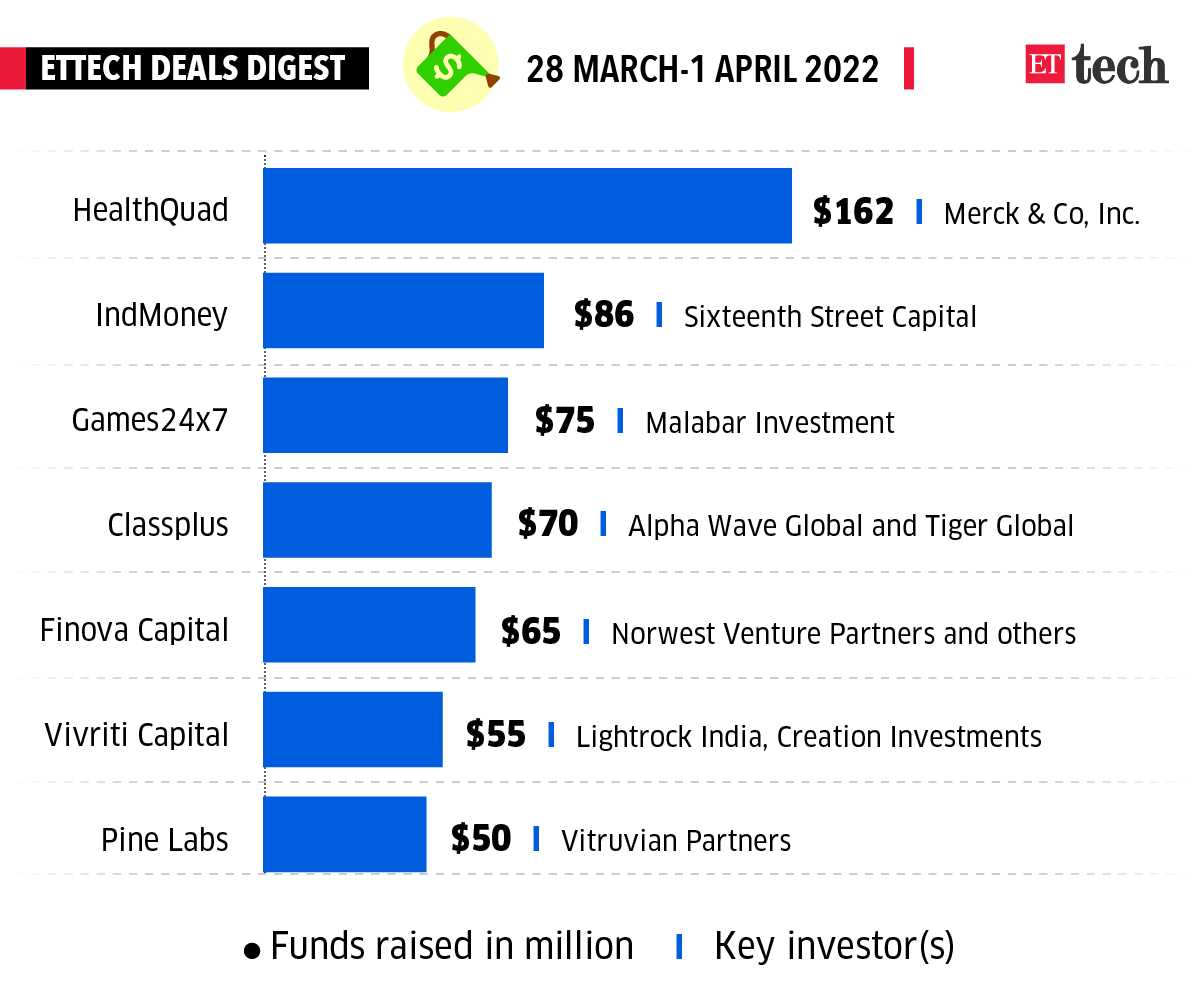

ETtech Done deals:

Vitruvian Partners invests $50 million in Pine Labs: Pine Labs has closed another $50 million in funding from London’s private equity major Vitruvian Partners at a valuation of just over $5 billion, according to regulatory documents filed in Singapore and people briefed on the matter.

Chalo acquires shared mobility startup Vogo: Chalo, a mobile app that helps users track buses across cities and book tickets online, said it has acquired two-wheeler shared mobility startup Vogo in what is a significant consolidation move. A person aware of the matter said the deal was a share-swap between the companies and did not involve any cash payout.

Adani ropes in Google Cloud for IT transformation deal: The Adani Group has struck a multi-year partnership with Google Cloud to migrate the Ahmedabad-based firm’s business-critical applications and collaborate in its data centre business.

TCS turns talent factory for Tata Group

Tata Consultancy Services (TCS) is turning into a talent factory of sorts for the Tata Group, with former executives of the country’s largest software firm now holding top leadership roles in several Tata businesses.

The group’s dependence on talent from TCS has significantly increased in the past few years as it sharpens focus on digital across subsidiaries to reinvent their businesses, experts said.

It has launched four new businesses since the onset of the pandemic and chief executives of two of them came from TCS.

- Pratik Pal, CEO of Tata Digital – which is stitching together the group’s ambitious ecommerce foray with its soon-to-be-launched super-app – is a 28-year veteran at TCS where he led the retail, CPG, and travel and transportation verticals.

- Venguswamy Ramaswamy, the brain behind TCS iON platform and creator of SME and B2B digital solutions at TCS, now leads the group’s B2B digital platform Tata Nexarc.

- Leaders such as A S Lakshminarayanan, CEO and MD of Tata Communications, and N Sivasamban, CEO of Tata Communication Transformation Services (TCTS), are also former TCS executives.