Also in this letter:

■ Shares of Zomato, Paytm and Nykaa hit all-time lows

■ Blockchain network 5ire bags $100 million from GEM

■ Hiranandanis to invest Rs 3,500 crore in tech foray

Govt will continue to scrutinise Chinese apps after fifth round of bans

The Indian government, which announced a fifth round of China-based app bans on Monday, will continue to scrutinise such apps that access data of Indians “through illegal means”, a senior official told us.

What they said: “Chinese apps are constantly changing names or hosts to access sensitive data of Indians. The government will keep scanning them from time to time,” the official said, asking not to be named.

- There have been a series of bans since it is easy for the apps to spring up again with similar names.

- The apps have also been changing ownership and are being hosted out of countries such as Singapore or Hong Kong to evade the bans.

- “The data of Indians was, however, being ultimately routed to Chinese servers, which is why these apps have been banned,” the official said.

Catch up quick: On Monday, the government banned 54 Chinese apps, terming them a threat to national security. On the list were apps owned by large technology firms such as Alibaba, Tencent and NetEase. These included a host of games, including Garena Free Fire; Isoland 2: Ashes of Time Lite; Rise of Kingdoms: Lost Crusade; Conquer Online and Twilight Pioneers.

A number of Chinese apps banned in the latest round are “rebranded or rechristened avatars” of apps that have been banned in the country since 2020, officials said.

The apps were also removed from major app stores, including Google’s Play Store.

Free Fire in freefall: In September 2020, the government had banned the hugely popular PUBG Mobile, owned by Tencent. That fuelled the growth of Garena’s Free Fire in India, which has now been banned as well.

India is one of Free Fire’s largest markets, so when the latest round of bans was announced on Monday, shares of its parent company Sea Ltd plunged 18.4% in New York, wiping off more than $16 billion from the company’s market value.

App war: The first round of Chinese app bans came in June 2020 following border tensions between India and China. The government blocked 59 apps, including hugely popular ones such as TikTok, Shareit, UC Browser and WeChat. Since then, the government has banned around 224 Chinese apps in total.

Shares of Zomato, Paytm and Nykaa hit all-time lows

Shares of newly listed Indian tech firms such as Zomato, Nykaa and Paytm hit record lows on Tuesday as investors continued selling shares of loss-making internet companies even as the wider market recovered from frantic selling on Monday.

Zomato: Shares of Zomato crashed as much as 8% to hit an all-time-low of Rs 75.75 on the BSE. That’s below the IPO issue price of Rs 76. The stock had turned into a multibagger before the selling began but now it has wiped out all of its gains in the past three months.

The stock is down nearly 40% from its listing price and is more than 55% from its peak in November 2021. Zomato stock recovered some losses to close at 82.75.

The selling has persisted despite the company narrowing its losses drastically in the December quarter. Zomato also hinted it was very close to achieving breaking even, but none of this seems to have reassured investors.

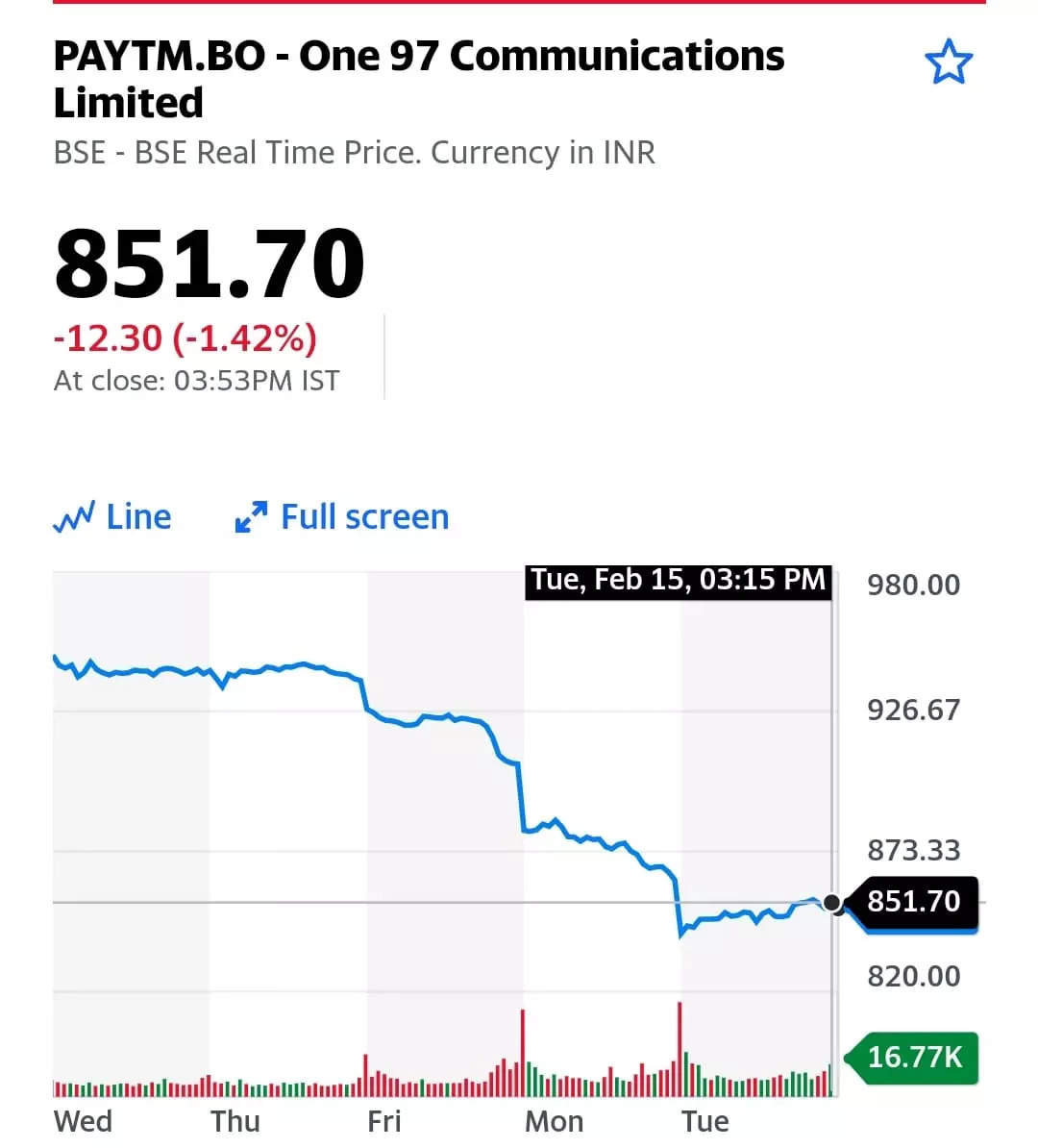

Paytm: Shares of Paytm’s parent firm One 97 Communications also hit an all-time low of Rs 840.05 on the BSE Tuesday. Its market cap slipped below Rs 55,000 crore.

The company’s shares have dropped about 60% since it listed on the stock exchanges on November 18, eroding about Rs 85,000 crore of investor wealth from the IPO valuation of Rs 1.39 lakh crore.

Last week, the company reported a loss of Rs 778.50 crore for the December quarter, up from Rs 481.70 crore a year ago. Revenue from operations rose 89% to Rs 1,456 crore.

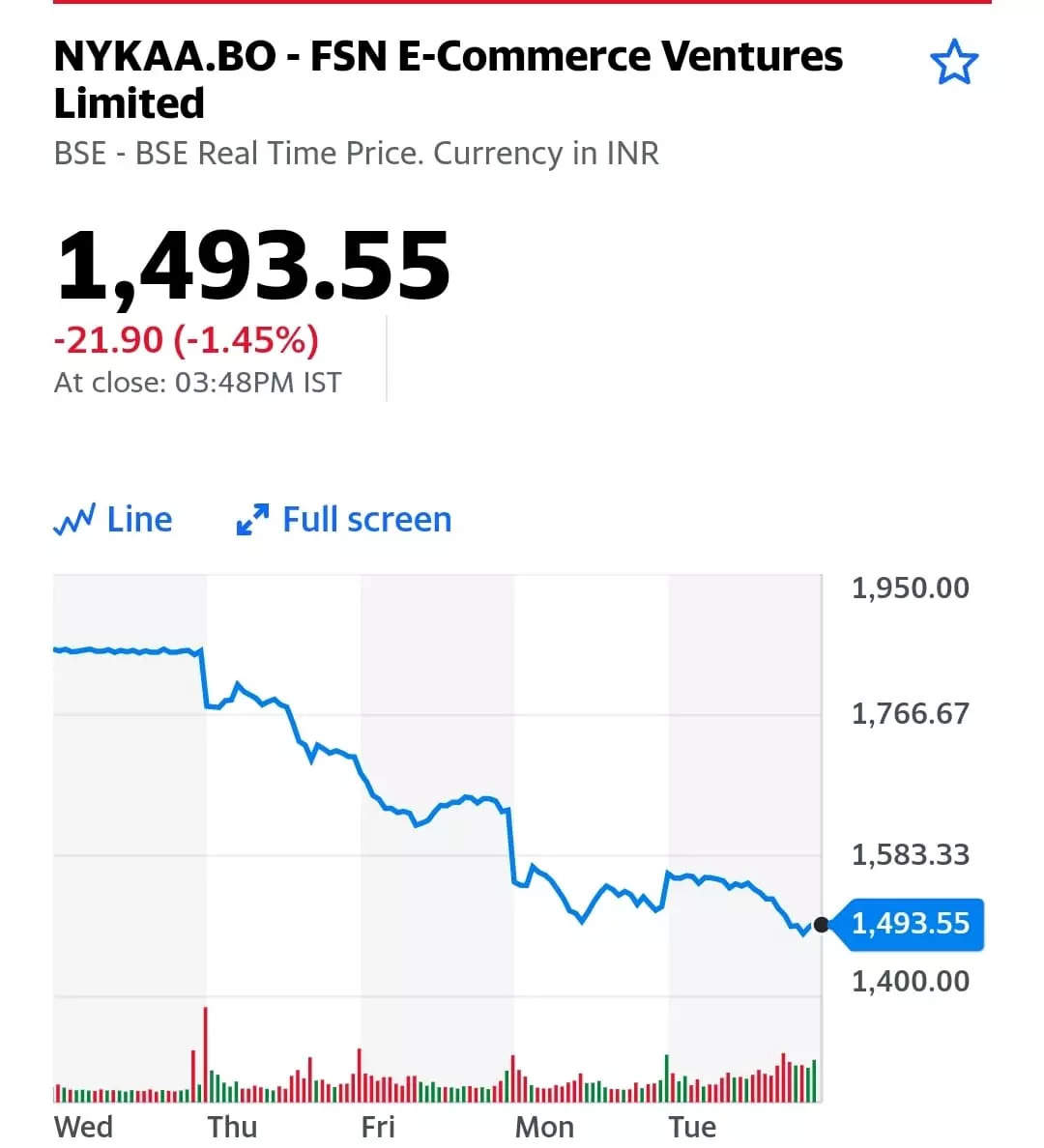

Nykaa: Shares of Nykaa’s parent firm FSN Ecommerce Ventures hit an all-time low of Rs 1,479 on the NSE. Still, it’s the only one of the three tech stocks that’s still trading above its IPO price.

Why is this happening? Shares of unprofitable new-age tech firms, which benefited from optimism in the IPO market in 2021 and were thus overpriced, are now seeing a reality check as the boom in global tech stocks has cooled. This, along with geopolitical tensions between Ukraine and Russia, foreign fund outflows and inflation pressure, has investors selling such stocks in their droves.

Blockchain network 5ire bags $100 million from GEM

5ire, a fifth-generation blockchain network, announced it has secured a $100 million capital commitment from GEM Global Yield LLC SCS (GGY), as it seeks to file for an IPO.

Strategic investment: By investing in 5ire, GEM will solidify its foothold in the emerging markets for a sustainable level 1 blockchains with a highly diversified portfolio of use cases and a growing cache of MoUs with government and private sector partners.

The platform plans to use the fresh funds to expand the ecosystem – which involves liaising with government stakeholders in India and upcoming international markets – invest in technology and resources, hiring, and to increase the adoption of 5ireChain.

Other done deals

■ Indonesian agri-tech startup Semaai has raised $1.25 million in its pre-seed round, led by Sequoia Surge, and Beenext. Angel investors Nipun Mehra, founder and CEO of e-commerce startup Ula; Harshet Lunani, founder and CEO of Qoala; and Prashant Pawar, technology investment banker at Houlihan Lokey, also participated in the round. Semaai will channel a large part of the funding to expand its engineering and product teams in India, though it primarily operates in Indonesia.

■ Join Ventures, a direct-to-consumer firm with brands as such as IGP, Interflora and Masqa, said it has raised $10 million (Rs 75 crore) in Series A round funding led by DSG Consumer Partners, Rajiv Dadlani Group, 9Unicorns and Venture Catalysts. The company will use the money to expand its captive dark stores network, tech advancements at the product level, and logistic improvements.

Tweet of the day

Hiranandani Group to invest Rs 3,500 crore in its tech platform Tez

Real estate firm Hiranandani Group has entered the technology-led consumer services business through a new venture and expects to invest up to Rs 3,500 crore over the next two to three years.

CEO speak: Tez Platforms will focus on solutions in the entertainment and gaming space, apart from social media, ecommerce, personal mobility, artificial intelligence and blockchain-linked solutions, group chief executive Darshan Hiranandani said.

Hiranandani, however, said the company does not need capital now or acquire companies at present.

- “I don’t think there is a need to raise capital for credibility. The focus may be on raising capital if we see a strategic fit,” he said.

In the past, oil and gas conglomerate Reliance Industries has forayed into consumer-facing digital solutions with Jio Platforms, while salt-to-steel conglomerate Tata Group has also announced its entry into a similar space with Tata Digital.

Details: Tez’s initial outlay to launch services this year will be about Rs 1,000 crore. Over the next 2-3 years, it expects to invest approximately Rs 3,500 crore.

The company will announce senior management appointments for Tez in a few weeks. For now, Chirag Daru, who previously worked with the Hiranandani Group, RIL and most recently with Navneet, is coordinating some of the digital projects at Tez.

IT industry expected to cross $200 billion in revenues in FY22, says Nasscom

The Indian IT services industry is expected to grow by $30 billion in FY2022, crossing $200 billion in revenues in the financial year, according to the Nasscom Strategic Review on Tuesday.

- The IT services industry has grown by over 2 times to $227 billion, and has a total workforce of 5 million.

Quote: “This has been a watershed year for the tech industry thanks to the persistent focus on customer centricity…The industry has added $100 billion in ten years; the first $100 billion took 30 years,” said Debjani Ghosh, president, Nasscom.

The split: Exports contributed $178 billion to total revenues, growing by over 17%, while the balance was domestic, led by growth in hardware and products. There were close to 300 acquisitions announced during the year. IT services exports now account for 51% of India’s total services exports.

Job creator: The industry added 4.5 lakh new hires during FY22, the highest ever in a single year, of which 44% were women. The IT industry is now the largest private sector employer of women – over 1.8 million.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.