Also in today’s edition

- TCS, Infy, Wipro join race for small IT deals

- Flipkart infuses nearly $700M into its marketplace and healthcare unit

- SoftBank is slowing down its investment pace amid market crash

Crypto exchanges expect big drop in volumes as new tax regime for VDAs kicks in

Hi, Apoorva here in Mumbai. A new chapter will begin today (and no this is surely not an April Fools’ Day joke) for crypto exchanges and retail investors in India. Despite, large scale efforts, encompassing representations made to the Finance Ministry, social media campaigns (#reducecryptotax) – by crypto firms, crypto influencers and evangelists, the tax regime proposed for Virtual Digital Assets (VDAs) as part of the Finance Bill 2022, will get implemented as is as of today.

What happens starting April 1: Retail investors will have to cough up a flat 30% tax on gains made on VDAs. Unlike other asset classes, retail investors will not have the ability to set off losses, claim expenses or the cost of acquisition, or even a reduced slab for long-term capital gains.

More coming from July 1: 1% tax deducted at source (TDS) will come into effect.

Once fully in force, what would it mean? A crypto industry member on the condition of anonymity said the norms could evaporate volumes from the exchanges to the tune of 20-50% at least.

Quote: “ Trading volumes are expected to dip significantly after the new tax provisions come into effect. The full impact (will be) felt in the next year, when even common people who have bought cryptos will feel (it),” said Meyya Nagappan, leader of international tax at Nishith Desai Associates.

According to industry estimates, the top 5-6 Indian crypto platforms clocked about $70-100 billion in trading volumes for the calendar year 2021 with WazirX alone racking about $43 billion. However, such growth is likely to taper off this fiscal if tax provisions are not altered, industry executives said.

Logistics companies hike ecommerce freight rates as fuel prices shoot up

Hi, Pranav here in Bengaluru. Today, we are breaking a story on the impact of rising fuel prices for the ecommerce and logistics industry.

First the news: Delhivery, one of the largest logistics companies in India that deliver for leading ecommerce firms like Amazon India, Flipkart and others, has decided to increase freight charges by 30% for Delhivery Air and Surface. Logistics aggregator Shiprocket, which works with Delhivery, told its clients about the hike in the charges from April 1! ETtech has reviewed the note.

Quite a hike!: “This is on account of the steep rise being witnessed in commercial fuel charges over the recent weeks and other systemic factors in the logistics markets,” the note read.

Do you have to pay more for your shopping? Online sellers, ultimately, have to pay delivery fee for their orders to be shipped. It’s one of the many charges they shell out to marketplaces. Flipkart and Amazon are the biggest clients of companies like Delhivery and an increase in freight charges will impact the per order income of online vendors. Typically, independent online sellers pass on at least a part of the price hike to consumers when marketplaces or delivery firms change their various fee components.

Quote: “The costs have gone up so there is some correction that is needed,” Ecom Express cofounder T A Krishnan told ET. “ We are internally contemplating because even to set up our own infrastructure, the cost of steel has gone up, the rents have gone up, we are evaluating, but have not decided on this yet.”

So what’s next? As of now the major e-commerce platforms, Flipkart and Amazon India, have increased their seller commissions. Meesho, which operates on a zero-commission model, will be hurt the most if third party delivery companies raise prices as it completely relies on them to deliver goods. Flipkart and Amazon India have in-house delivery arms– Ekart and Amazon Transportation Services.

Flipkart infuses nearly $700 million in its marketplace and healthcare unit: Ecommerce major Flipkart has infused about $553 million into its marketplace business, according to recent regulatory filings made in Singapore. Additionally, it has pumped another $143 million into its healthcare unit Flipkart Health, these filings showed. With the new capital coming in, it takes the total cash infusion by Flipkart into the two entities —Flipkart Marketplace Private Limited and Flipkart Health Private Limited—to nearly $700 million.

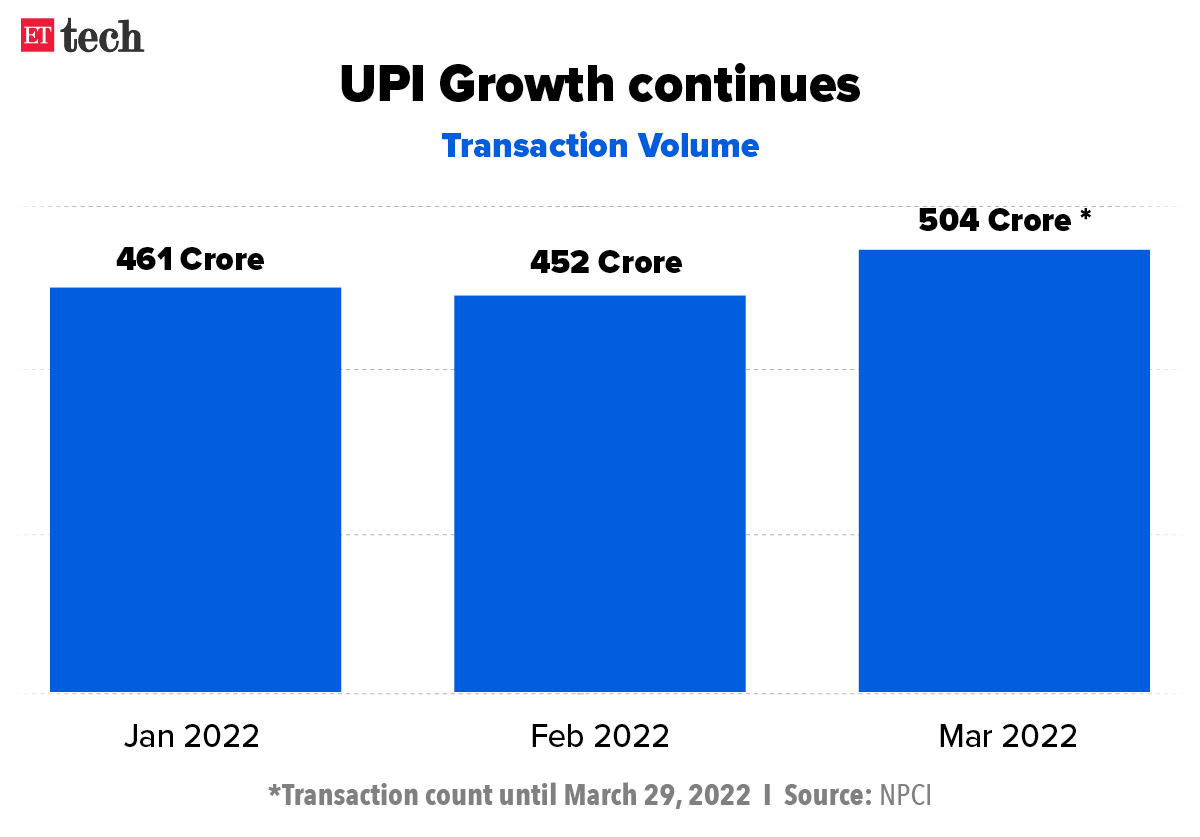

INFOGRAPHIC INSIGHT

TCS, Infy, Wipro join race for small IT deals

Large IT players including the likes of Tata Consultancy Services (TCS), Infosys and Wipro are giving stiff competition to mid-tier IT companies as they all fish for smaller deals in the $20-million range. Mega $100-million-plus deals are still available in the market, but their frequency and duration are reducing as clients seek to break down their digital needs across vendors to diversify dependencies, analysts and industry leaders said.

Backstory: Deals in the $20 million range – traditionally the forte of mid-sized IT providers like Mindtree, Mphasis, LTI, and Hexaware – are now the backbone of the industry, and companies will have to dedicate more resources to manage this segment going forward, they said.

The $20-million client bucket: For instance, TCS is expected to restructure its operational model to focus specifically on the $20-million client bucket while the likes of Infosys and Tech Mahindra have recently launched metaverse and 5G co-innovation practices for clients.

ETtech Done Deals

■ Chennai-based digital supply chain startup Wiz Freight has raised Rs 275 crore in a funding round led by Tiger Global with participation from Axilor, Foundamental, Arali Ventures, Stride Ventures and Alteria Capital.

■ OneCode, a platform which provides on-ground resellers to financial firms, has raised $13 million (or Rs 100 crore) as part of its latest round of funding led by General Catalyst, the company said. According to the company, it will use the capital to invest in hiring across functions and accelerate its product and technology development. With the investment, the company will be expanding its presence to 100 additional cities and will increase the size of its agent network.

India software products sales to hit $30 billion by 2025, says Nasscom

The National Association of Software and Services Companies (Nasscom) today launched a report that indicates India’s software product industry is expected to post $30 billion in yearly revenue by 2025.

Behind the burgeoning industry: With the consumers’ ever-evolving needs, enterprises are keeping up with continuous innovation, leading to a shifting global marketplace and 10% annual growth in the IT services sector, generating high returns for shareholders and investors in the last decade. The estimates are also placed on the lookout that local players expand globally and several new companies get into the products space, a report by industry body Nasscom and market research company UnearthInsight said.

The quote: ” We are very bullish about their international expansion as global markets are opening up for Indian product companies,” said Ramkumar Narayanan, chairperson of Nasscom Product Council.

TWEET OF THE DAY

Other Top Stories By Our Reporters

SoftBank CEO Masayoshi Son

Hit hard by crash, Masayoshi Son says SoftBank to slow tech bets: Masayoshi Son, founder of SoftBank, recently told the top leadership of the group to go slow with technology investments due to the crash in its holdings, according to a report in Financial Times (FT)

This is of significance as SoftBank’s Vision Fund is one of the largest and most influential tech investors in the world.

Microsoft launches Startups Founders Hub platform in India: Microsoft said on Thursday that it has launched Microsoft for Startups Founders Hub in India, to empower early-stage startup founders in India with over $300,000 worth of benefits and credits. It will give startups free access to the technology, tools, and resources they need to build and run their business.

ServiceNow opens two data centres in India: Software-as-a-service (SaaS) company ServiceNow has announced the opening of data centres in Mumbai and Bangalore to cater to strong demand from its Indian customers and meet their local data residency preferences.

Global Picks We Are Reading

■ U.S. Senators Pressure FTC to Review Microsoft-Activision Merger (WSJ)

■ Facebook fails to label 80% of posts promoting bioweapons conspiracy theory (The Guardian)

■ Ronin Network: What a $600m hack says about the state of crypto (BBC)

Today’s ETtech Morning Dispatch was curated by ETtech team. Graphics and illustrations by Rahul Awasthi.