In fact, their aggressive bets on new-age Indian startups like Nykaa and Zomato have paid off handsomely after both companies listed on domestic stock exchanges earlier this year.

A report that surveyed 100 family offices and ultra HNIs (UHNIs) – those whose net worth exceeds Rs 500 crore – showed that over 40% had doubled their allocation to private markets in the past five years.

Cash-rich individuals have, instead of being limited partners (LPs) or sponsors in venture and private equity funds, preferred to cut larger cheques and directly participate in a startup’s capitalisation table, the report – which technology platform for startups trica has published in partnership with law firm AZB Partners and consulting firm EY – showed.

About 10% of the total funding mopped up by Indian startups so far this year came from domestic capital, constituting Indian funds, family offices and UHNIs and angel investors, said Nimesh Kampani, cofounder and chief executive of trica, which is part of startup investment platform LetsVenture

Domestic startups this year pulled in a record $31.9 billion as of December 10, according to Venture Intelligence data.

-

“ETtech is a sharply-focused lens that brings alive India’s tech businesses & dynamic world of startups”

Kunal Bahl, Co-Founder & CEO, Snapdeal

-

“I read ETtech for in-depth stories on technology companies”

Ritesh Agarwal, Founder & CEO, Oyo

-

“I read ETtech to understand trends & the larger India technology space, everyday”

Deepinder Goyal, Co-founder & CEO, Zomato

ETtech

ETtech“If you look back five years in time, family offices were happy being LPs in funds. Now they have a professional setup of family offices. Their knowledge and expertise have risen,” Kampani said. “I think the next decade will belong to the private markets in terms of wealth creation. We have already seen it happen with events like IPOs, the number of new unicorns… The domestic investor participation will only increase.”

Private market investments remain an alternative investment of choice, with allocations to startups and VC funds comprising 18% of the overall pie, compared to a 15% allocation to other assets such as real estate, infrastructure, and art, the report said.

As much as 20% of the capital was deployed to fixed income, while 36% went to listed equities, it showed.

First-gen UHNIs

The changing face of the startup ecosystem – with a spate of IPOs and acquisitions – has created a new category of first-generation UHNIs that are exploring the family office route to manage their wealth.

ETtech

ETtechSensing the opportunity, more family offices have mushroomed, which the report estimates at over 140 this past year.

Adar Poonawalla, chief executive of vaccine maker Serum Institute of India, said his family office has increased its allocation to the private market and is actively pursuing more deals.

“In the private market, the valuations of these startups have not been priced in, whereas some of the listed companies in the stock market are already overvalued…therefore, private, direct investment acts as a good alternative to back companies that are not fully valued at the moment,” Poonawalla said.

Falguni Nayar, founder and chief executive of omnichannel beauty retailer Nykaa, which made a stellar stock market debut last month,

told ET on the day of its listing that the capital she had raised from HNIs and family offices came with fewer conditions.

“I was looking for pure equity investment and that came more from high net-worth family offices, and we got enough of those. I didn’t want to raise money for the first few years as I didn’t want to show a spreadsheet and get my assumptions questioned…High net-worth capital is good capital, they understand the risk profile, they support you on your decisions as they have done it themselves…,” she had said.

Family offices and HNIs like the HS Banga family, Sunil Kant Munjal of the Hero group, Narotam Sekhsaria of Ambuja Cements, among others, have been big gainers following the Nykaa IPO.

Participation has also got a leg up due to the exposure to Western markets, especially of the younger generation of Indian business families, a string of IPOs of domestic tech companies, and better understanding of the digital and tech sectors.

About 25% of the Om Kothari Group’s portfolio is invested into startups, said Siddharth Kothari, chief investment strategist of the family fund who had launched the startup investment practice.

The family office backs startups across stages and has bet on 30 companies, including Eat Just, Arata, ClearDekho, GoodMylk and Klub.

The fund counts Innov8, ApnaComplex and Beardo among its successful exits.

“I have invested aggressively this year. We feel like we understand this game a lot better than we did five years ago when we started with smaller cheques,” Kothari said. “It is an amazing time because we are getting exit offers and up rounds on portfolio companies. But it is also a very tough time when it comes to striking new deals because there’s so much competition and there’s more money chasing fewer deals.”

Year of personal wealth

Along with frenetic fundraising by Indian startups, 2021 has been an unprecedented year in terms of wealth creation for professionals through employee stock ownership plans, or Esops.

ET

reported last month that nearly 40 Indian

startups had bought back Rs 3,200 crore worth shares since July 2020 from employees who had been given stock options.

ETtech

ETtechThe fact that consumer tech startups such as Nykaa and Zomato have tapped the public market has also boosted confidence among family offices and UHNIs.

Food delivery app Zomato’s

big-bang public market debut spawned about 18 dollar-millionaires.

According to the report, 75% of investors surveyed saw direct startup investments as the highest conviction opportunities in the next 3-5 years. Family offices were attracted to a non-linear route for participating in startup investments.

“…people are now ready to take higher risk because the understanding of the sector has improved a lot. At the end of the day, you cannot value them with the traditional investment metrics that we use for public markets. That is why 82% said we are ready to take this kind of risk,” Kampani of trica said.

Sanjay Mehta, founder and partner at micro-VC fund

100X.VC, has invested through his family office since 2011. In the last decade, their family portfolio has birthed four unicorns, including a 280x exit in budget hospitality chain Oyo in 2016.

This year, besides

100X.VC and Mehta Ventures, the family office sponsored another early-stage fund, 2AM VC. As a family, they have allocated 9% of the overall allocation to investments in startups. Their current portfolio exit value is at 7.4x on capital invested, he said.

“There is no sign of slowing down. Investing in a startup by family offices or family-owned businesses is a well understood opportunity. These startups can be directly or indirectly strategic to their business or pure play investments in alternative asset classes,” Mehta said.

“Earlier, it used to be up to 2-3% of the overall portfolio, but today we are seeing families crossing 5% and looking to touch 10% by 2025. We believe the startup investments are compounding in India,” he added.

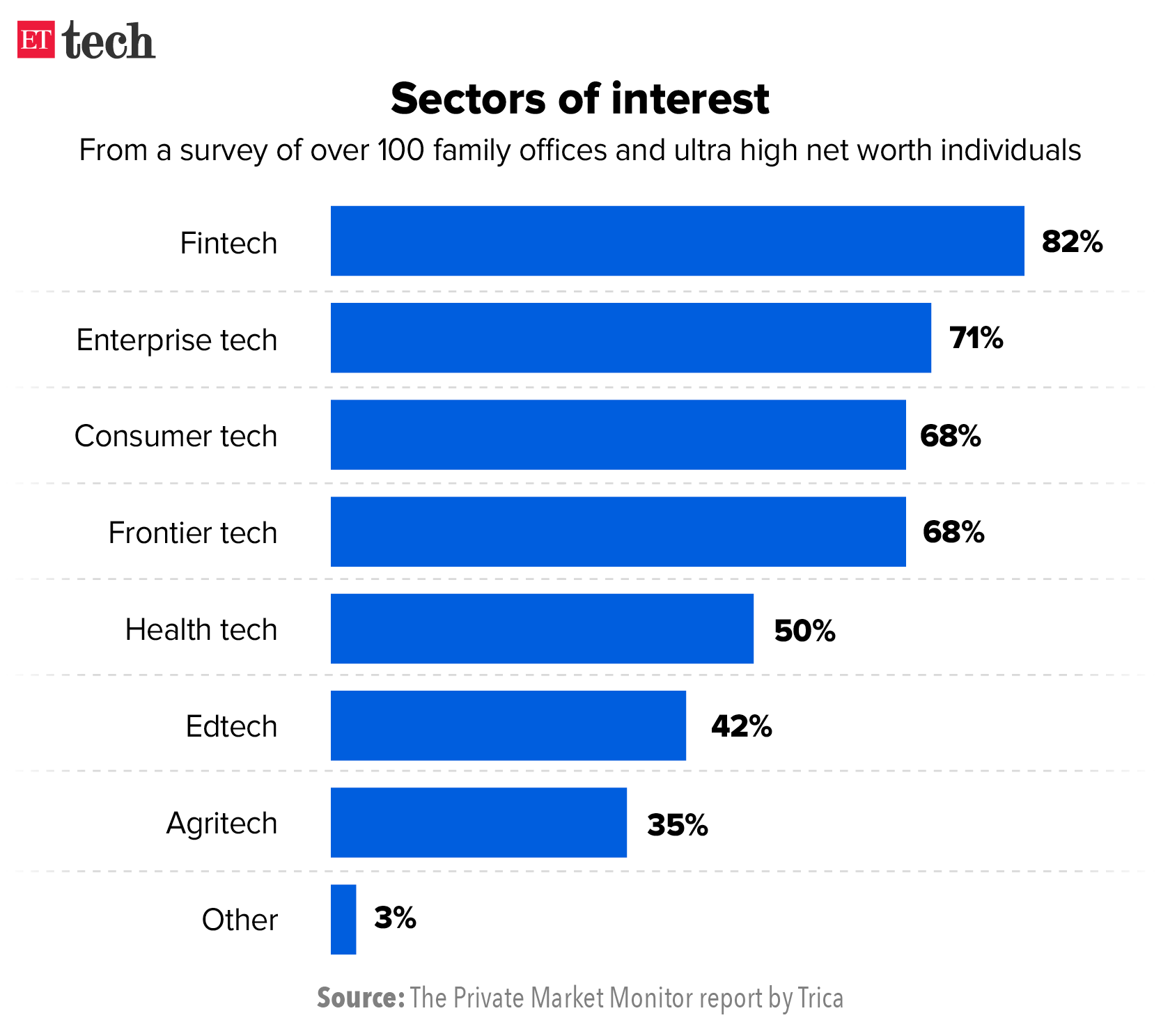

Family offices and UHNIs were bullish about fintech and enterprise technology, followed by consumer technology, the report said.