Also in this letter:

■ Deepinder Goyal, core Zomato team invest in Park+

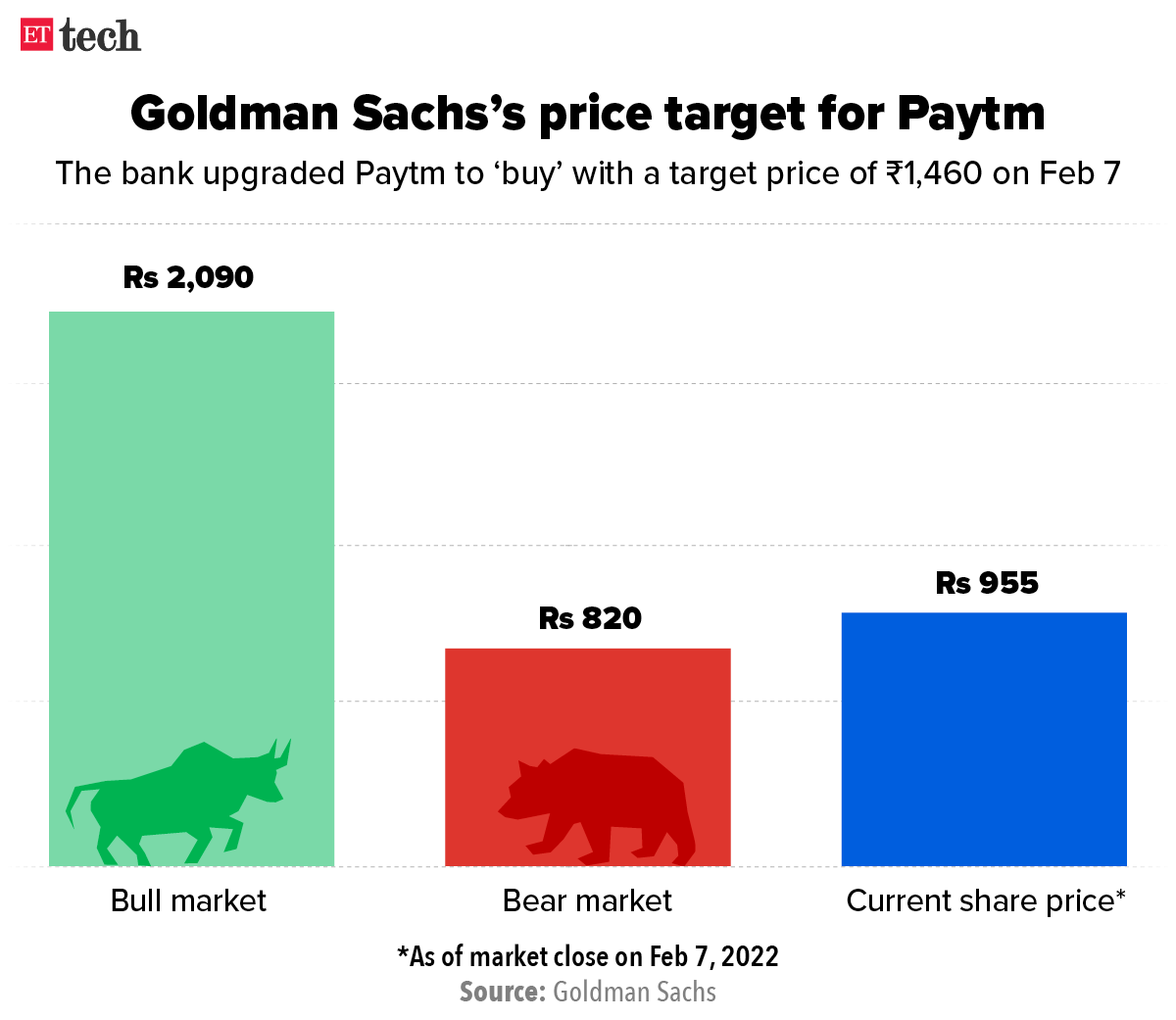

■ Paytm may rally up to 119% in bull scenario: Goldman Sachs

■ Why the Meta meltdown burnishes appeal of TCS, Infosys

NCLAT to hear Amazon’s plea against CCI order next Monday

Amazon will ask the National Company Law Appellate Tribunal (NCLAT) next Monday to stay the Competition Commission of India’s (CCI) order suspending its approval for Amazon’s 2019 deal with Future Coupons.

Catch up quick: On December 17, 2021 the CCI revoked its approval for Amazon’s deal to acquire a 49% stake in Future Coupons, a subsidiary of Future Retail. It had also fined the US firm Rs 202 crore.

Amazon approached the NCLAT on January 9, challenging the CCI’s order. On Monday, Justice M Venugopal said the tribunal would hear the matter on February 14.

The anti-trust watchdog’s order had said that Amazon tried to “suppress and misrepresent” the facts of the deal. It had, however, granted time to Amazon to seek fresh approval for the deal.

Future and Amazon have been locked in a bitter legal battle since October 2020 when the US ecommerce giant dragged the Indian retailer to arbitration in Singapore, saying it had violated their contract by agreeing to sell its assets to Reliance Retail for Rs 24,713 crore.

Amazon offers to help: On January 20, we reported that Amazon had offered financial assistance to Future Retail – with a rider. The US firm warned Mumbai-based FRL not to sell any of its retail stores without Amazon’s consent.

In response, the independent directors of FRL sought a Rs 3,500 crore from Amazon as a long-term loan since the US company had objected to the sale of its small format stores. The proceeds of this sale, they said, would have been used to pay its lenders and prevent its debt being classified as non-performing assets.

Amazon in SC tomorrow: Meanwhile, the Supreme Court is set to hear tomorrow (February 8) Amazon’s appeal against a Delhi High Court order that stayed the arbitration proceedings in Singapore.

Last week, the court said it would hear the matter on February 8 after senior counsel Gopal Subramanium, appearing for Amazon, sought an urgent hearing.

The tribunal had rescheduled its hearing in the arbitration case for May after the Delhi High Court stayed its proceedings on January 5, citing the CCI’s order suspending its clearance for the Amazon-Future Coupons deal.

The arbitration proceedings were earlier scheduled for between January 5 and 8.

Deepinder Goyal and core Zomato team invest in car app Park+

Deepinder Goyal

Zomato founder and chief executive Deepinder Goyal has invested in Park+, an app for car owners. Gurugram-based Park+ said Goyal’s core team members at Zomato have also invested in the startup.

Goyal’s personal bet on Park+ comes at a time when the Zomato founder has been divesting his stakes in companies in which Zomato is coming in as an investor, possibly to avoid conflicts of interest.

Last week, we reported, citing regulatory filings, that Goyal had transferred his holding in Blinkit’s parent firm to existing investor Tiger Global.

Goyal’s personal investment in logistics aggregator Shiprocket, in which Zomato has invested in December, attracted controversy after Mohandas Pai, former Infosys director and chairman at Aarin Capital Partners, tweeted concerns of a conflict of interest.

Goyal responded to Pai saying he had exited his $100,000 personal investment in Shiprocket in December, when Zomato invested in the company.

Other done deals

■ Invact Metaversity, a startup at the intersection of education and the metaverse, said it has raised funds from more than 70 global corporate leaders and founders of unicorns. The funding round values the edtech startup, founded by former Twitter India head Manish Maheshwari, at $33 million.

■ Gold Setu Private Limited, a mobile-first micro SaaS platform for jewellery retailers, on Monday said it has raised $1.2 million in a seed funding round led by Village Global, Better Capital, Titan Capital, iSeed and Anjali Bansal for Avaana Seed. The Bengaluru-based company said it will use the funds to fuel go-to-market initiatives, launch new products on its platform and expand into new markets.

Tweet of the day

Paytm stock may rally up to 119% in bull scenario: Goldman Sachs

Goldman Sachs has upgraded Paytm’s parent company One97 Communications to ‘buy’ from ‘neutral’ after its December quarter result, citing strong growth outlook and attractive risk-reward.

Taking stock: The brokerage has a target price of Rs 1,460 on the stock, revised from Rs 1,600 earlier. Goldman Sachs said Paytm’s share price is down 30% so far this year and the risk-reward is now inclined more towards the upside.

The brokerage’s bull case scenario case suggests an upside of 119% and the bear case assumption implies a 14% downside in the stock.

Yes, but why? According to Goldman Sachs, the current share price is factoring in multiple bearish factors such as merchant discount rate (MDR) caps, a decline in market share and a slower ramp-up of financial services business which is unlikely.

“We believe Paytm’s strong topline growth of 89% YoY in 3QFY22 (December quarter) will help allay investor concerns around declining payments take rate in recent years. In addition, Paytm continues to gain market share across both UPI (unified payments interface) and non-UPI, and its lending business is seeing robust traction,” said Goldman Sachs, raising topline estimates for Paytm by 7-10%.

Financials: The company reported a loss of Rs 780 crore for the December quarter, compared with a loss of Rs 474 crore a quarter earlier. Revenue rose 34% from the previous quarter to Rs 1,460 crore.

Why the Meta meltdown burnishes appeal of TCS, Infosys

Tata Consultancy Services vanished – statistically, that is. Investors lost the equivalent of India’s technology powerhouse as more than $220 billion evaporated in a matter of hours in the biggest single-stock slump in US corporate history. Meta Platforms Inc., the parent of Facebook, had a meltdown.

Last week’s 26%-plus decline in Meta’s share price seemed to faithfully track the declining trend in tech-heavy Nasdaq in an eerie throwback to the start of the millennium. It is not surprising to see the 11-plus percentage point decline in the Nasdaq in 2022–a year likely standing out for steep rate increases.

Index movement: Respective stock weightings show that the Nasdaq is tilted in favour of consumer technology. Apple Inc. accounts for about 12 percentage points weighting, and the stock has held its own, losing barely 4% this year and contributing about half a percentage point to the index’s overall shrinkage.

Tesla Inc. has lost 22.5% so far. With a weight of 4.4% on the Nasdaq, the electric vehicle maker has contributed about 0.9 percentage point to the decline of the index. Amazon.com Inc., with a 6.9% weighting, has shed 17% so far, making up more than 1.15 percentage points of the benchmark’s slide. Microsoft Corp., with a weighting of about 10%, has lost about 8.5% so far, contributing about 0.85 percentage point to the decline.

And after last week’s meltdown, Meta has lost 29% for the year. With a weighting of about 5%, the stock has contributed about 1.45 percentage points to the decline in the index.

Overall, these five stocks – Apple, Microsoft, Amazon, Meta Platforms and Tesla – have contributed about 42% to Nasdaq’s decline.

A reminder of the dotcom bust? A swift reversal in the fortunes of tech stocks in the US has raised a big question on the fate of Indian outsourcing behemoths and their stock valuations.

UK fintech giant Revolut invests Rs 340 crore in India ops

Revolut India CEO Paroma Chatterjee

British fintech giant Revolut has pumped Rs 340 crore (roughly $45.5 million) into Revolut India as a part of its first tranche of investments in its Indian arm, a top executive told us.

The investments are for Revolut’s first cross-border remittance product in India, which it plans to launch in the second half of 2022. The company is still in talks with the Reserve Bank of India (RBI) to procure the necessary licences for its products.

$33 billion firm: In July 2021, the company raised $800 million led by private equity giants SoftBank and Tiger Global at a valuation of $33 billion, making it one of the most valuable fintechs in the world after US-based Stripe and Sweden’s Klarna. It was looking to leverage the funds to ramp up its play in the US, India and Latin America.

Bullish on India: Back in India, Revolut is bullish on domestic remittances and will look to offer Unified Payments Interface (UPI) payments to Indian consumers along with its flagship international cards. Over the next few years, the company is gearing up to also launch trading and investments, and to debut credit-based products for consumers and small and medium enterprises (SMEs). The company has also been scouting local acquisitions to turbocharge its growth in India.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.