Credit: Giphy

Also in this letter:

■ Turtlemint knocks on unicorn club door

■ Amazon reports rare quarterly loss; Apple going strong

■ Hero Electric clocks zero deliveries in April

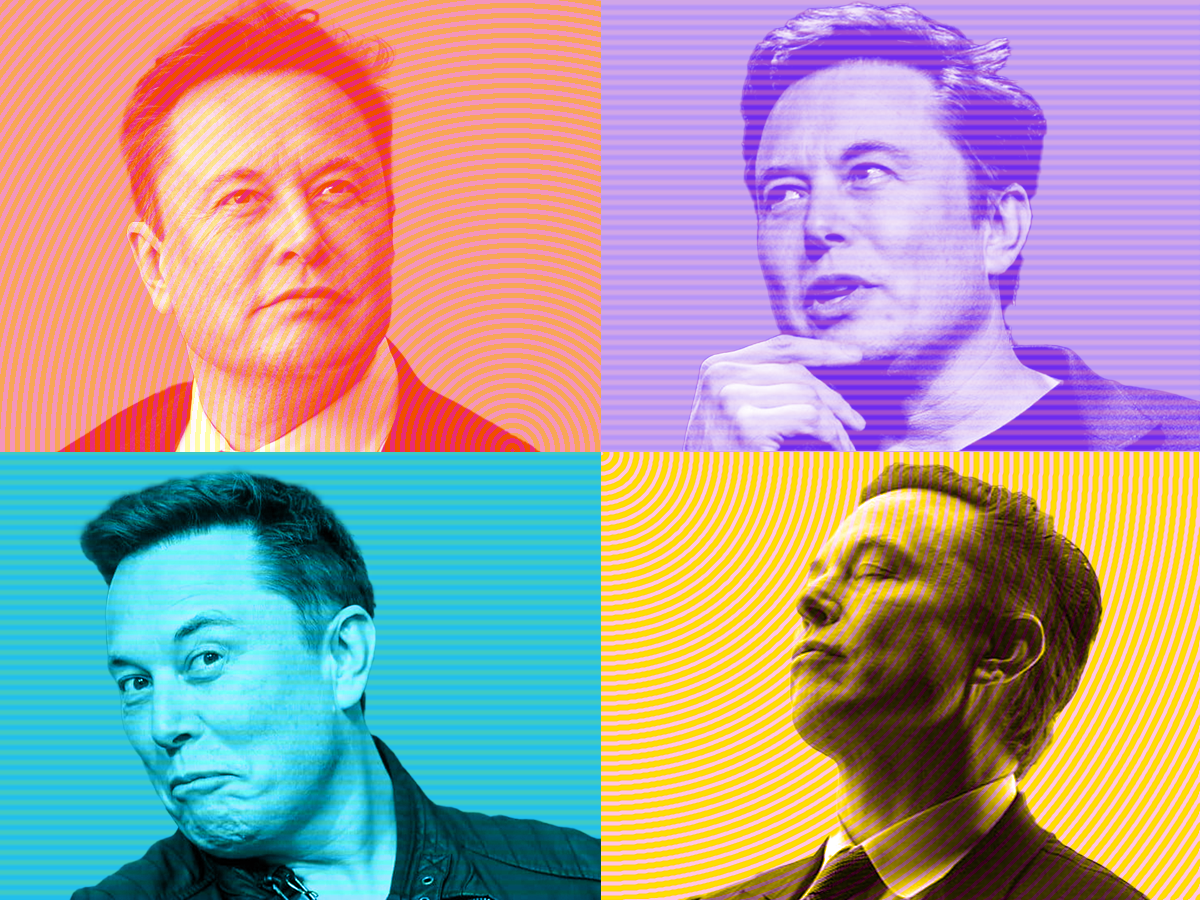

Musk sells Tesla shares worth $4 billion to fund Twitter deal

Tesla boss Elon Musk has sold $4 billion worth of shares in the electric vehicle maker, according to a US securities filing. The sale is likely aimed at helping finance his purchase of Twitter.

One and done: Musk said in a tweet that there are “no further TSLA sales planned after today”. He sold 4.4 million shares on Tuesday and Wednesday, according to the filings, equating to 2.6% of his stake in the company.

On Monday, Musk clinched a deal to buy Twitter for $44 billion in cash. As part of the deal, Musk said he would provide a $21 billion equity commitment.

What about the rest? It is not clear how Musk will cover the remaining $17 billion. He also has a 43.61% stake in unlisted rocket company SpaceX that is reportedly valued at $100 billion.

Musk has been looking for partners to reduce his equity contribution to the deal, a person familiar with the matter told Reuters, adding that it is far from certain that such a partner will emerge.

The billionaire told banks that agreed to help fund his acquisition of Twitter that he could crack down on executive and board pay at the company to slash costs, and would develop new ways to monetise tweets, sources told Reuters.

His submission of bank commitments on April 21 was key to Twitter’s board accepting his “best and final” offer.

Twitter, Tesla shares suffer: Some traders have fretted this week that Musk may not have enough cash to fund his $21 billion contribution and could walk away from the deal, weighing on Twitter shares.

Tesla shares have also fallen – nearly 20% – since Musk disclosed his 9.2% stake in Twitter on April 4 as investors have expressed concern that he may have to sell Tesla shares to fund his equity contribution.

Twitter admits error in user counts: When Twitter announced its Q1 results on Thursday, in addition to reporting substantial negative growth, it admitted to making an error that caused user counts to be higher than the actual numbers for the past three years.

The company said it accidentally overinflated monetisable daily active user (mDAU) counts and blamed the error on a 2019 change in how it managed user accounts.

Turtlemint could be India’s next startup unicorn

Insurtech startup Turtlemint said it has raised $120 million in a round led by Amansa Capital, Jungle Ventures and Nexus Venture Partners. It closed the round at a $900-950 million valuation, said a person in the know.

The fundraise also saw participation from new backers Vitruvian Partners and Marshall Wace, apart from existing investors. Turtlemint plans to use the funds to expand in new geographies, scale its leadership team and strengthen its product line.

Founded in 2015 by Dhirendra Mahyavanshi and Anand Prabhudesai, Mumbai-based Turtlemint is a platform that helps financial advisors understand and distribute insurance to their customers.

The company has raised $190 million to date, including the latest round.

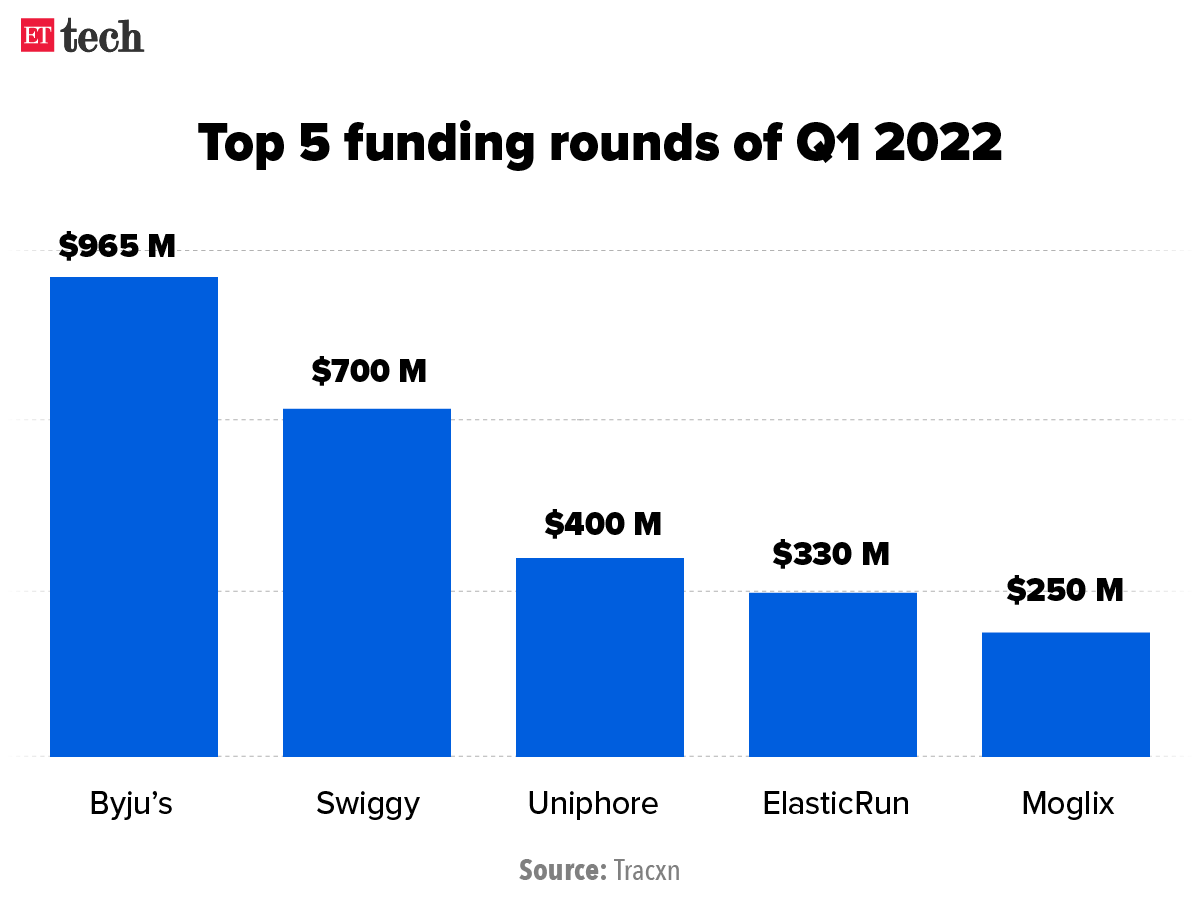

Early-stage deals boom: According to a Tracxn report, India’s startup ecosystem saw early-stage deals (Series A and B rounds) more than double to $2 billion in the first quarter of FY22 from $0.89 billion in the same period last year.

- Total funding in the first quarter of FY22 was up nearly 80% year-on-year (YoY) to $9.2 billion from $5.1 billion in the same quarter last year.

- But total funding was down 12.3% sequentially, indicating a broader correction in the funding market.

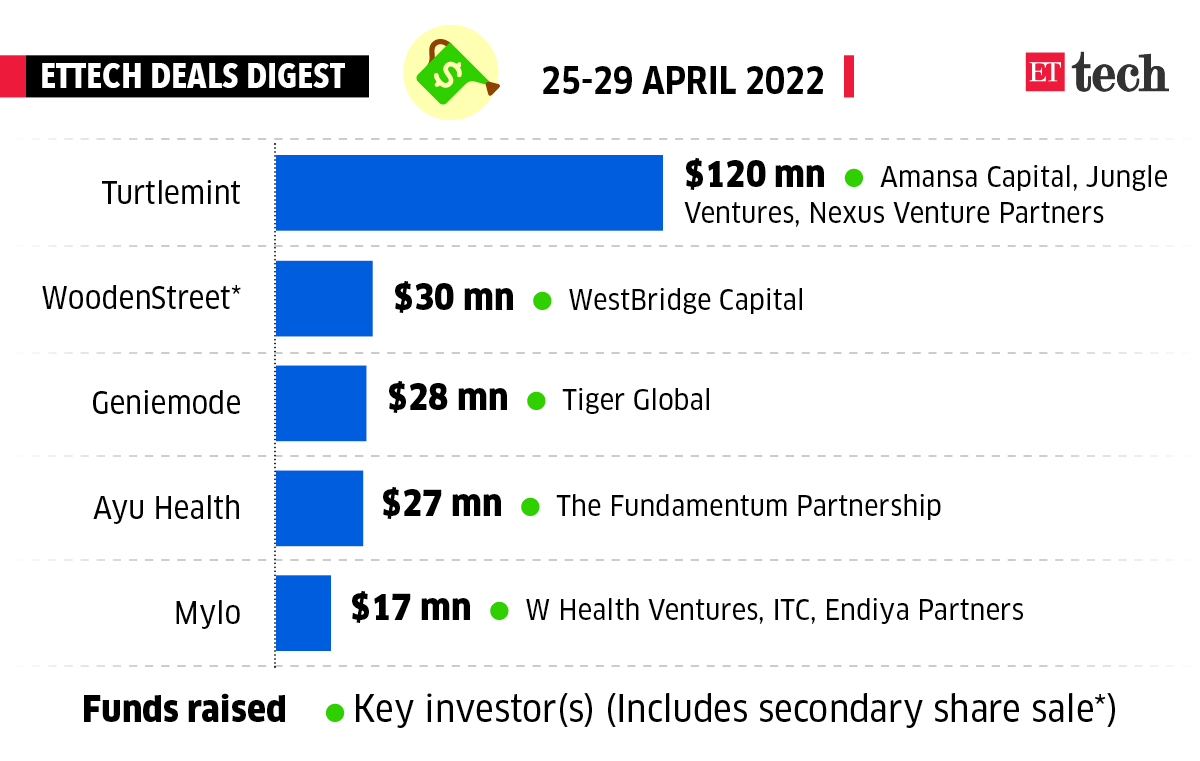

ETtech Deals Digest

Insurtech startup Turtlemin, furniture and home decor platform WoodenStreet, and GenieMode, a business-to-business cross-border tech platform for lifestyle goods, were among the startups that raised funds this week. Here’s a look at the top funding deals of the week.

Tweet of the day

Amazon reports rare quarterly loss as online shopping slows

Amazon’s money-making juggernaut has stopped due to a slowdown in pandemic-boosted internet shopping and a massive write-down of its investment in an electric-vehicle startup.

Report card: Amazon reported a loss of $3.84 billion, or $7.56 a share, for the first three months of the year. A year ago, it reported a profit of $8.1 billion, or $15.79 a share, for the first quarter.

- Wall Street analysts expected a profit of $8.35 a share in the latest quarter, according to FactSet.

- Revenue rose 7% to $116.44 billion, compared with $108.52 billion in the first quarter of 2021.

- Amazon’s ecommerce business also reported an operating loss of $1.57 billion in North America and $1.28 billion internationally.

- Sales at Amazon’s cloud-computing business grew 37% in the quarter.

- Sales in its advertising business rose 25%.

Pain point: The ocean of red ink in Amazon’s report came mostly from the company’s accounting for a $7.6 billion loss in value of its stock investment in Rivian Automotive. Rivian went public in late 2021 and its stock traded at close to $180 at one point. It closed Thursday at $32.18.

Outlook: Amazon said it forecasts sales for the current quarter of between $116 billion and $121 billion, below the $125.33 billion that analysts are forecasting.

Apple Q2 results: Even as revenue growth slowed as it navigated a continuing chip supply constraint, Apple announced better-than-expected profitability because of strong consumer demand for its gadgets and services.

By the numbers: The iPhone maker reported quarterly earnings of $25 billion, up 5.8% from the year-ago period as revenues rose 9% to $97.3 billion. It scored revenue increases in most of its categories, including iPhone and services.

Hero Electric clocks zero deliveries in April amid chip shortage; CEO apologises

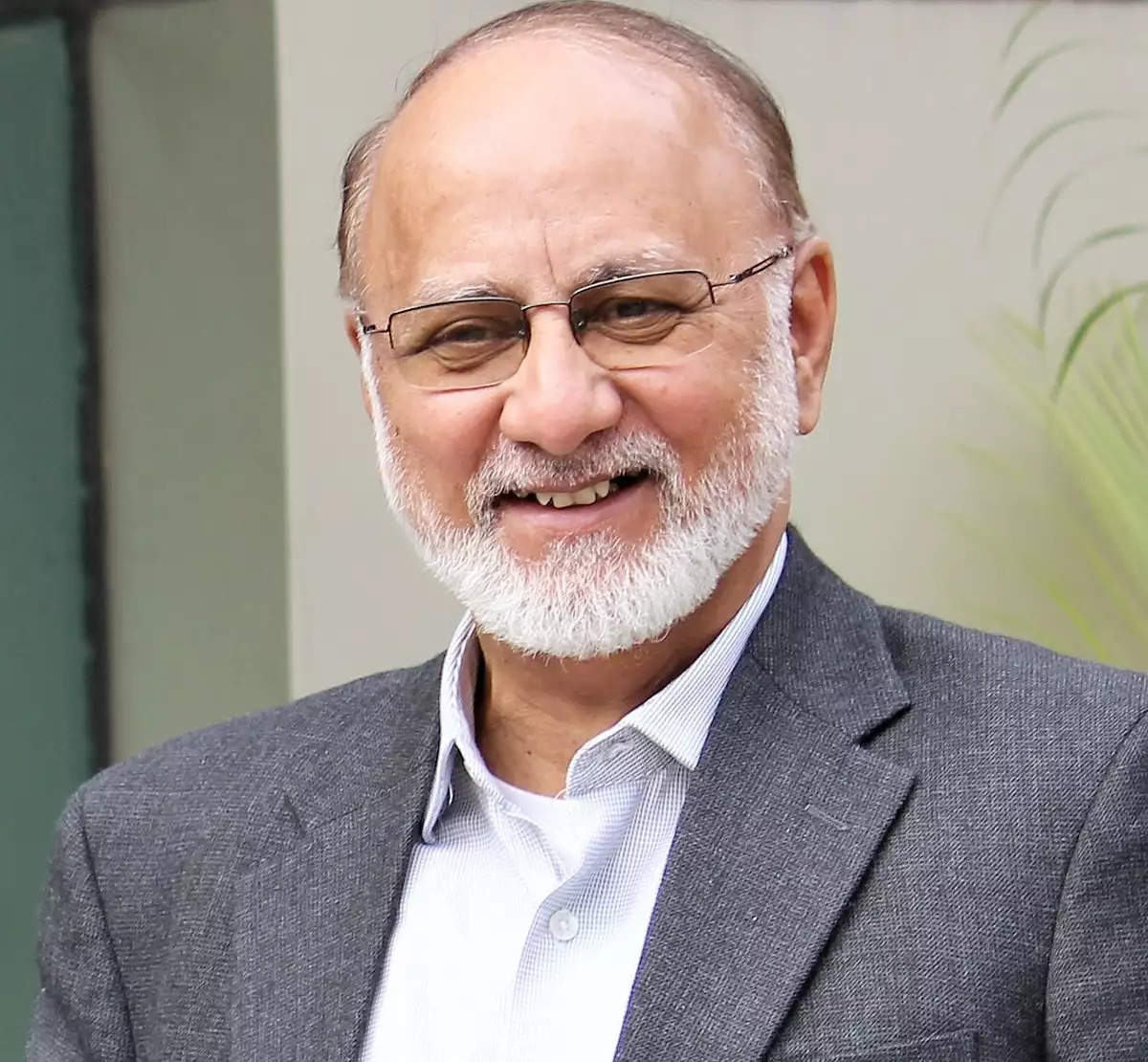

CEO of Hero Electric, Sohinder Gill

Hero Electric, which had zero vehicle dispatches in April 2022, is the latest casualty of the global semiconductor shortage.

“This has further increased the waiting list for customers to 60-plus days and some of the dealerships have no stock to display,” the company said in a statement.

Apology: Hero Electric CEO Sohinder Gill apologised to customers for the delay and cited the Russia-Ukraine war as the reason for the chip shortage.

“It’s like putting an emergency brake on a fast-moving train,” said Gill. “Our sales were almost doubling month on month and we somehow managed with sourcing from different geographies but the war collapsed a major supply chain, resulting in this disruption.”

Tough times: The company’s announcement comes at a time when electric vehicle manufacturers are facing more scrutiny following the recent fires of more than two dozen vehicles.

After transport minister Nitin Gadkari threatened companies with penalties if they were found to be careless, some manufacturers, including Ola Electric, Pure EV, and Okinawa, announced that they will recall nearly 7,000 two-wheelers.

Zomato hits all-time low, wipes out half of investor wealth in first four months of 2022

Shares of Zomato hit a new all-time low on Friday as the selloff in the counter continued. The food delivery platform has wiped out almost half of investors’ wealth in 2022 so far. The scrip has shed about 12% in April alone.

Zomato’s stock price dwindled to a low of Rs 71.6 on April 28 from the highs of around Rs 141 on January 3, the first trading session of the year.

But why? A probe announced by Competition Commission of India (CCI) has wreaked havoc on the stock. Before that, the sharp selloff in new-age stocks globally put huge pressure on shares of Zomato, Paytm, Nykaa and others.

On April 4, the watchdog had ordered a detailed probe against food delivery platforms such as Swiggy and Zomato for alleged unfair business practices with respect to their dealings with restaurant partners.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.