Credit: Giphy

Also in this letter:

■ Tata Neu will also have other firms’ brands in future, says N Chandrasekaran

■ Flipkart puts another $116 million in Myntra

■ Kotak pauses crypto trade with CoinSwitch Kuber

Programming note: ETtech Top 5 and ETtech Morning Dispatch will be on a break tomorrow on account of Good Friday. Happy Easter to you and your family!

After turning down board seat, Elon Musk offers to buy Twitter for $41 billion

Days after turning down a seat on Twitter’s board, Elon Musk, its largest shareholder, has launched a hostile takeover of the social media company, according to a filing with the Securities and Exchange Commission (SEC).

‘Best and final offer’: Musk offered $54.20 a share in cash, or $41.39 billion in total. That represents a 54% premium over Twitter’s closing price on January 28, 2022, the last trading day before Musk began investing in the company, and a 38% premium over the closing price on April 1, the last trading day before his 9.2% stake in the company was made public.

Musk said in the filing that this was his “best and final offer”, and that he would have to reconsider his position as a shareholder if it was rejected. “Twitter has extraordinary potential. I will unlock it,” he wrote.

Twitter shares were 11% higher in premarket trading, as per NYT.

In his words: “I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy,” Musk wrote in the filing.

“However, since making my investment I now realise the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.”

Twitter responds: Twitter said that it had received Elon Musk’s “unsolicited, non-binding proposal” to buy the company and take it private.

It said that the board would review Musk’s filing and “determine the course of action that it believes is in the best interest of the company and all Twitter stockholders”.

Musk’s board games: On April 11, a week after Musk disclosed a 9.2% stake in the firm, Twitter’s chief executive Parag Agrawal said the billionaire had decided not to join the social media company’s board, and now we know why. As a board member, Musk would have been unable to launch a takeover of Twitter as his stake would have been capped at just under 15%, as per Reuters.

“Elon’s appointment to the board was to become officially effective [April 9], but Elon shared that same morning he will no longer be joining the board. I believe this is for the best,” Parag added in a note to employees, which he later posted on Twitter.

Minutes after Agrawal’s tweet, Musk had tweeted a chuckling emoji, leaving users confused. He later deleted the tweet.

Also Read: Elon Musk, Twitter’s new technoking

Tata Neu will also have other companies’ brands in future, says N Chandrasekaran

The Tata Group’s new ‘super app’ Tata Neu, which aims to bring all the company’s brands onto a single platform, will open itself up to brands from other companies in the future, group chairman N Chandrasekaran said at a press conference to mark the launch of an improved version of the app on Thursday evening.

The app was marred by glitches and a poor experience on its debut on April 7.

Yes, but: Tata Neu’s evolution will be customer-driven, and determined by consumers and not contracts, Chandrasekaran added.

He said, “Today, there is no solution developed with the Indian consumer in mind,” adding, “We have brought all our consumer brands in a single platform. It has brought in a lot of synergy for the group and massively expanded the value proposition for the Indian consumer.”

Speaking on the Neu Pass, the platform’s rewards programme, N Chandrasekaran said, “We are working on a number of categories and innovations, including an AI-driven personal assistant.”

One-stop shop: Tata-owned brands including BigBasket, 1mg, Croma, AirAsia, IHCL, Qmin, Starbucks, Tata Cliq, Tata Play, and Westside are available on the super app initially. Vistara, Air India, Titan, Tanishq, and Tata Motors will be added soon.

According to Tata Digital CEO Pratik Pal, the app now has 2.2 million downloads.

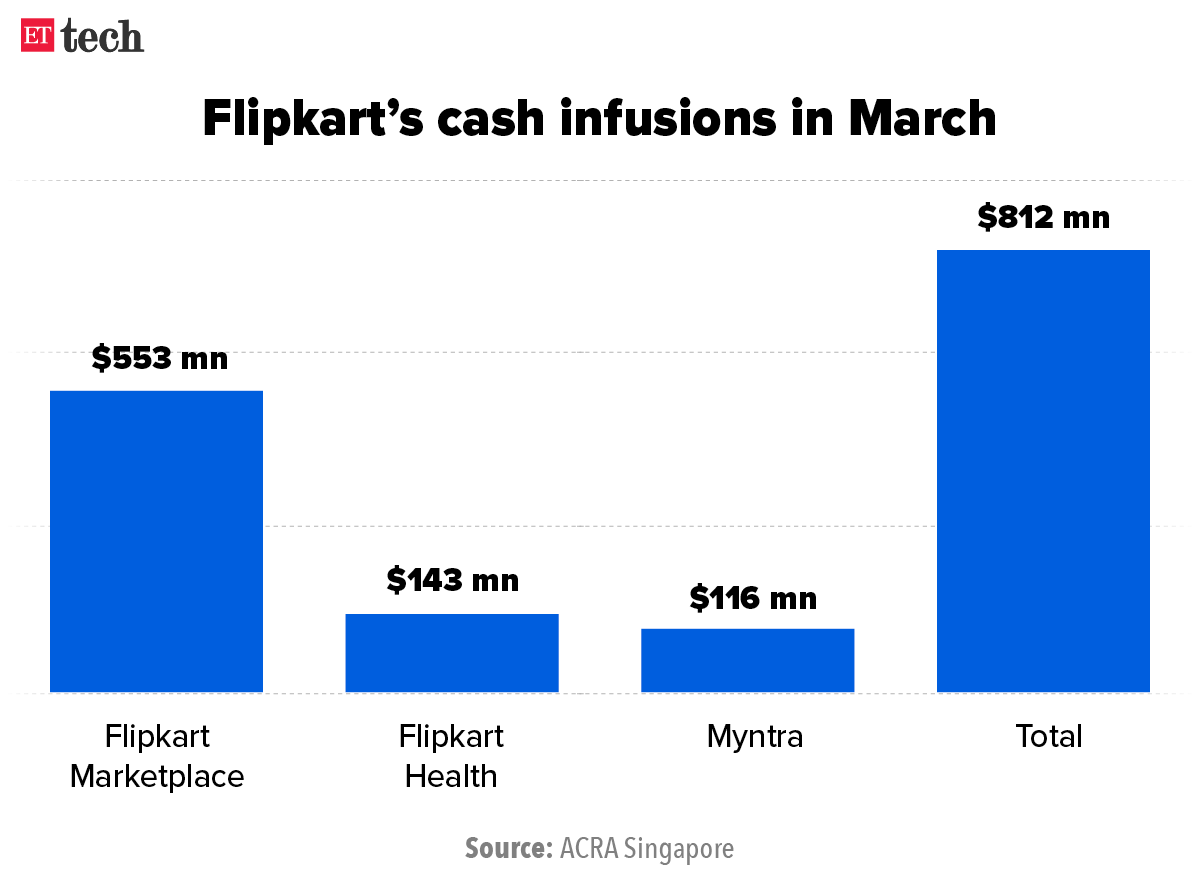

Flipkart puts another $116 million in Myntra, March investments hit $800 million

After investing close to $700 million in Flipkart’s marketplace and new healthcare vertical, the Indian ecommerce company’s Singapore entity has invested $116 million in fashion retailer Myntra, according to regulatory filings in Singapore.

The investment was made on March 25, before the financial year ended.

Spend, spend, spend: This takes Flipkart’s investment in its various businesses in March to more than $800 million. We reported on March 31 that it invested $553 million in Flipkart Marketplaces and $143 million in its new healthcare business.

Flipkart also launched a separate app for the healthcare business, called Flipkart Health+, on April 6.

Challenges ahead: The new investment comes as Myntra is facing new challenges, with Reliance’s Ajio emerging as a significant second player in the market.

- Beauty retailer Nykaa is also venturing into fashion, which Myntra has dominated for over a decade.

- Reliance Industries and Tata Group are also looking at building their own beauty and personal care platforms.

- Tata Group has launched multiple fashion platforms – Tata Cliq and Westside – on its new ‘super app’ Tata Neu, which it launched on April 7.

Myntra’s new CEO Nandita Sinha told ET on February 24 that the company would focus on building live commerce and the beauty category in the near future. The live commerce feature is Myntra’s new initiative to target Gen Z shoppers.

Tweet of the day

Kotak pauses crypto trade with CoinSwitch Kuber

Kotak Mahindra Bank, among the very few Indian financial institutions that had warmed to the cryptocurrency world, is having second thoughts.

What’s happening? The private sector bank has stopped – at least temporarily – handling payments for trades with CoinSwitch Kuber, a large crypto intermediary, two sources told us. What triggered the call is unclear, but the sources said Kotak has decided to pause till the dust settles on crypto regulations.

Another blow to Indian crypto: Kotak’s move represents another blow to the unregulated industry. It follows digital wallet MobiKwik snapping its links with crypto-related payments since the beginning of April.

Earlier this week, CoinSwitch Kuber temporarily suspended all rupee deposit services on its app, amid growing uncertainty around these digital assets in India.

Oppressive tax: Payment avenues for crypto transactions are being choked at a point when the industry is faced with an oppressive tax regime that treats crypto dealers worse than gamblers.

A crypto trader, unlike a gambler, cannot set off losses against profits to lower the tax outgo. Besides the 30% tax the trader pays on gains from crypto trades, there is a 1% tax deducted at source on the sale proceeds, irrespective of whether money is made on the trade.

Sequoia’s Shailendra Singh leaves Zilingo board amid accounting probe

Sequoia Capital India’s Shailendra Singh has stepped down from the board of Zilingo following questions about the Singapore startup’s accounting practices, Bloomberg reported, citing sources.

Turbulent times: Singh resigned as a director about a week ago, after the departures of Xu Wei Yang of Temasek Holdings and Albert Shyy of Burda Principal Investments.

Sequoia plans to appoint a replacement and still holds the board seat.

CEO’s ouster: Zilingo has suspended chief executive officer Ankiti Bose and begun an investigation into its financial practices. The company had been trying to raise $150 million to $200 million with help from Goldman Sachs when investors began to question its finances as part of the due diligence process, people familiar with the matter said.

Bose has disputed allegations of wrongdoing and contends her suspension was due in part to her complaints about harassment. She has hired an attorney to represent her, Abraham Vergis of Providence Law Asia, and has called the investigation a “witch hunt”.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.