Also in this letter:

■ After a year-long delay, Byju’s FY22 results this week

■ GST-hit gaming firms, VCs in a huddle

■ Cred hires Sujay Das to head risk for NBFC Newtap

Wellness startup Mojocare to return money to its investors

Mojocare, the startup infamous for fudging sales numbers, is nearing a closure. Here’s how:

Refund initiated: The board of the troubled healthcare startup has now decided to return money to its investors following revelations that the company’s founders had shown inflated revenue and sales figures in internal presentations, sources aware of the matter said. It had $12 million, or close to Rs 100 crore, left in the firm before the founders admitted to having misled investors on business metrics.

Yes, but: While the matter has been finalised, there are certain outstanding vendor payments that need to be resolved before returning the capital fully. The investor group is trying to resolve the issue with vendors, sources said.

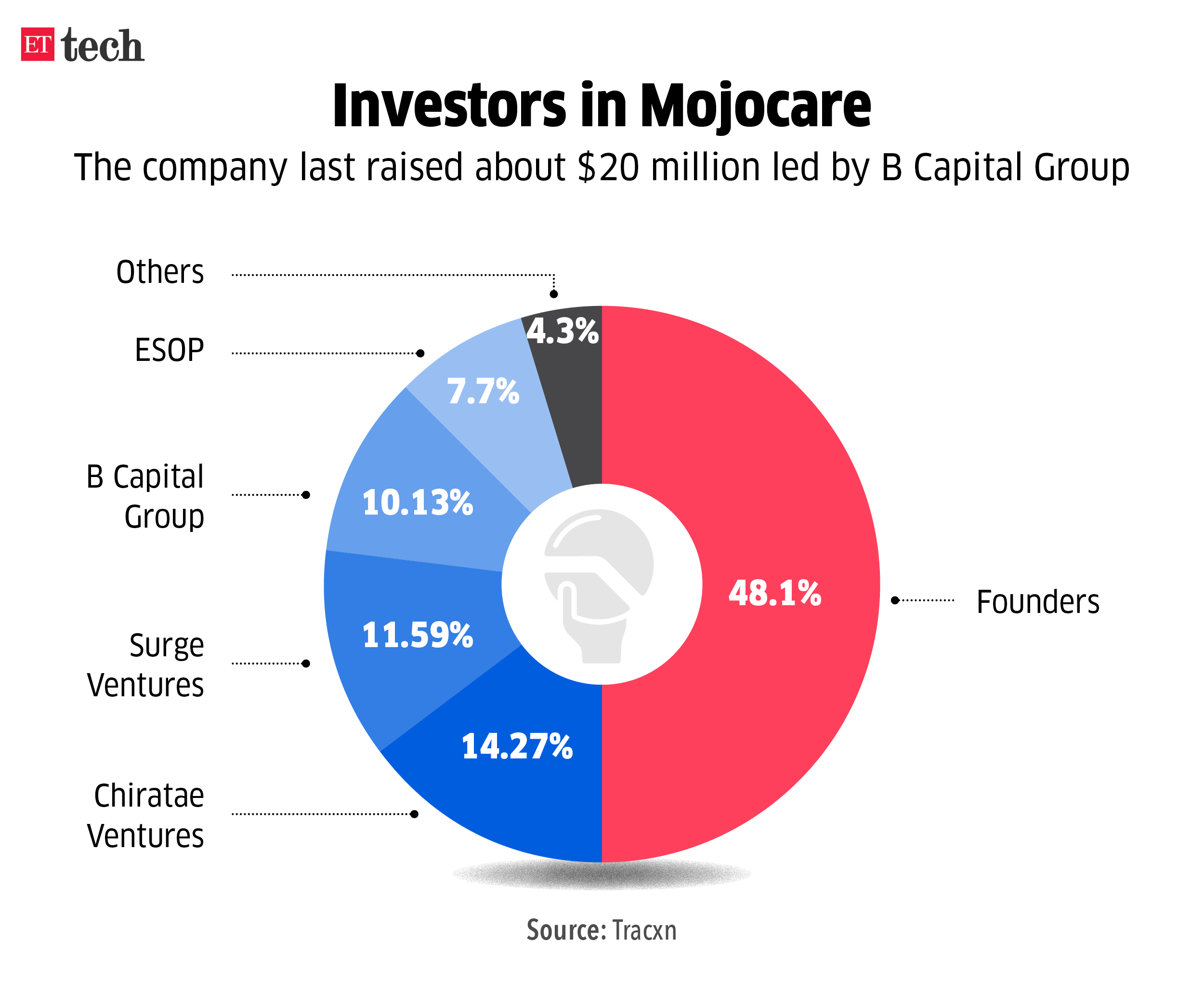

Key shareholders: Facebook cofounder Eduardo Saverin’s B Capital, Chiratae Ventures, Peak XV Partners (formerly Sequoia Capital India) are the large shareholders of the startup. The company last raised about $20 million led by B Capital in August last year. Surge is a seed-stage investment vehicle run by Peak XV.

Forensic findings: While Big 4 audit firm Deloitte had submitted its audit report, the final forensic report, according to people briefed on the content, found that the founders – Rajat Gupta and Ashwin Swaminathan – had misled investors and the board by inflating revenue.

Also read | Mojocare board to decide on shutting shop, returning money to investors

Mamaearth readies for renewed overseas push

Omnichannel personal care retailer Honasa Consumer Ltd, which is planning to go public, is planning a more focussed global push for its flagship brand, Mamaearth.

Details: Honasa has assigned certain markets – including Bangladesh, Malaysia, Vietnam and Thailand – as priority geographies into which it is planning a deeper push for Mamaearth by appointing channel partners.

Tell me more: The company is already present in a few overseas markets such as the UAE, Singapore, Nepal, Malaysia, Maldives and Mauritius, where it operates through modern trade and ecommerce marketplaces. In some cases, it even has its own dedicated brand website.

Changing times: The fresh push on overseas markets has come in the backdrop of a top-deck change at Honasa with senior vice president (SVP) for offline and international businesses Ashish Mishra moving on in September to join rival brand Clensta. The company announced the appointment of Nishchay Bahl, former chief business officer at The Good Glamm Group, as its new SVP for offline sales.

Going public: Honasa has received a nod from the Securities and Exchange Board of India (SEBI) for its initial public offering (IPO), and the company’s top management is currently doing roadshows, meeting investors to gauge the interest in its public offering. The company plans to issue fresh shares worth Rs 400 crore, in addition to an offer-for-sale (OFS) component for 46.82 million shares. The OFS will see some stakeholders, including founders Varun and Ghazal Alagh, sell their stakes partially.

After a year-long delay, Byju’s FY22 results this week

After more than a year’s delay, beleaguered edtech firm Byju’s is expected to file its financial results for the year ended March 2022 (FY22) this week. Byju’s new CFO, Ajay Goel, had promised shareholders on June 24 that the audited FY22 results would be shared by the end of September, and those for FY23 would be ready by December this year.

Quick catch-up: Following a meeting between Byju’s auditor BDO and the company management in September, the edtech had said it would present the audited fiscal 2022 results to its board, advisory council as well as investors Peak XV Partners and Prosus — whose representatives recently quit the edtech’s board — in the second week of October.

Comeback at Aakash: Aakash Institute, one of the key assets of Byju’s, is likely to see its promoter Aakash Chaudhry return to the helm. His comeback is part of a broader arrangement being finalised with Byju’s. He is in the final stages of talks to close a stock-swap deal with the edtech firm as part of the 2021 acquisition.

Read ETtech’s detailed coverage on Byju’s

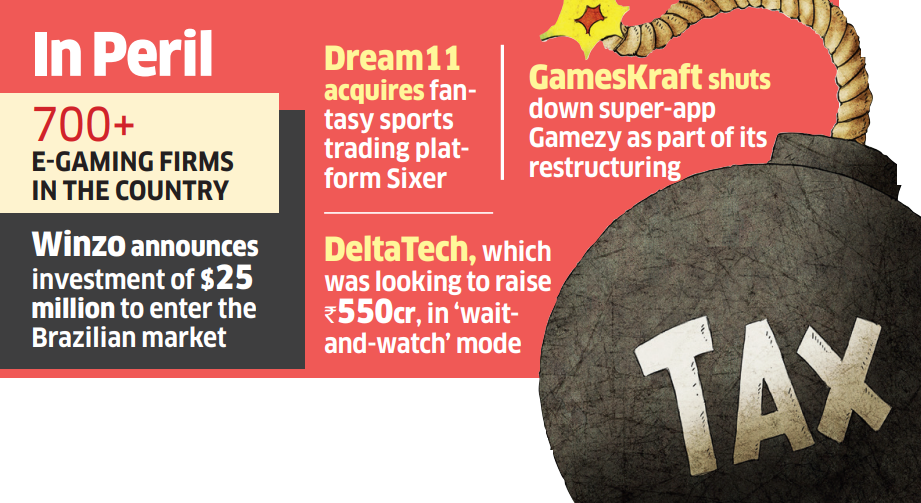

GST-hit gaming companies, VCs in a huddle to keep the lights on

As the government’s hiked goods and services tax (GST) on online gaming in India came into effect this month, venture capitalists and online gaming executives are scrambling to come up with strategies to pivot their business models and diversify outside the country.

Consolidation incoming: Experts predict that this will force a major consolidation in the real-money gaming (RMG) industry in the near future, wherein 80% of the smaller companies will either shut down or get acquired by bigger rivals such as MPL, Dream11 and Games24x7.

Conundrum: “Investors and founders are in a state of conundrum due to misalignment between various arms of the government on the issue,” said a top executive at a VC fund with active investments in gaming. “The government must come up with a self-regulatory body to differentiate among categories of gaming under the MeitY model so that the taxman can decide which activities they want to discourage,” said another executive.

Also read | DGGI raises Rs 55,000-crore tax demand from Dream11, other online gaming companies

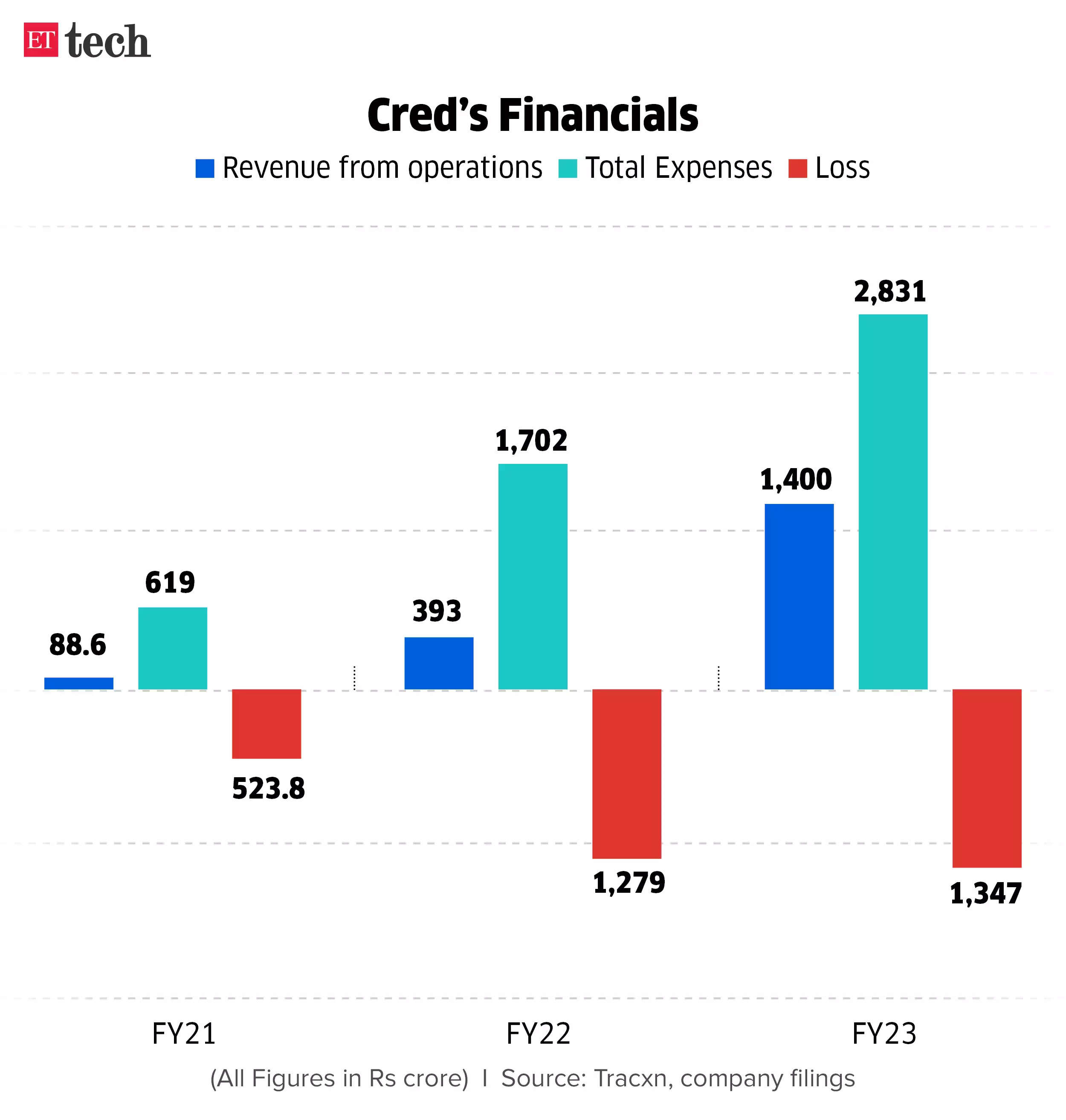

Cred hires Sujay Das to head risk for NBFC Newtap

Fintech startup Cred has hired banking veteran Sujay Das to lead its risk assessment vertical. Sources in the know said Das has been hired for Cred’s in-house non-banking finance company Newtap Finance.

Fresh hiring: With this appointment, Cred is attempting to strengthen its credit underwriting policies and scale up its overall lending play. Das, who spent more than 12 years at HSBC Bank and then headed the analytics team at Bajaj Finance, joined Bengaluru-based lending startup Freo (previously MoneyTap) in 2020.

Typically, the company does not have designations like CEO or business head, but Das would be the senior-most executive for the risk side of Kunal Shah’s credit business, the people added.

Also read | How Kunal Shah’s Cred is rejigging the fintech’s lending strategy to tap more users

Cred’s focus on credit: Cred is looking to scale up unsecured credit products like personal loans, consumer durable loans and check-out finance as the first set of products, one of the persons quoted earlier said. He added that eventually, fintechs will venture into secured lending, but given the current customer base for Cred, instant personal loans at competitive rates will be the starting point.

Also read | Cred’s FY23 revenue more than triples, losses grow marginally

Flipkart HR head quits: Walmart-owned Flipkart’s chief human resources officer Krishna Raghavan is leaving the company after a stint of over six years, sources told us, adding that an internal announcement has been made regarding his exit. Raghavan was the senior vice-president of engineering, fulfilment and services, before being elevated as the chief people officer, a post he held for nearly four years.

Also read | Flipkart merges tech and product ops of travel and epharmacy biz

ONDC scores big on India vs Pakistan world cup clash

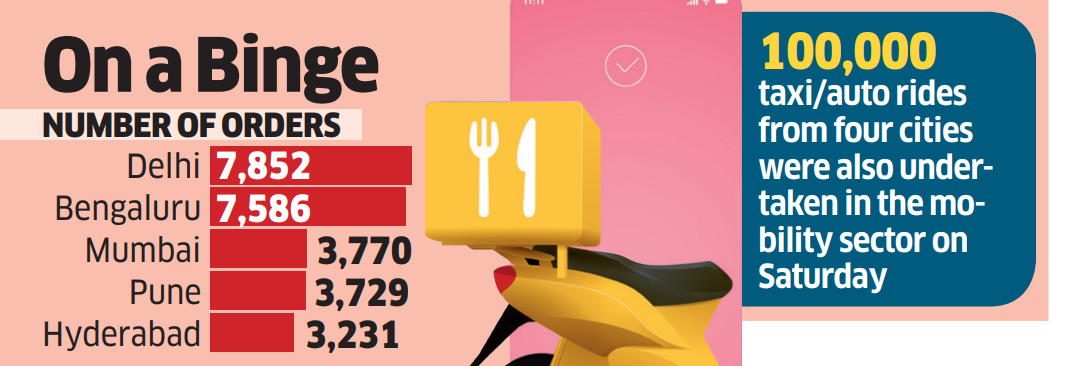

While cricket fans across the country were glued to their screens watching India beat the daylights out of its all-time rivals Pakistan in Ahmedabad, the government-backed Open Network for Digital Commerce (ONDC), notched a remarkable achievement, recording its highest volume of retail orders in a single day.

65,400 not out: The network saw 65,400 pure retail orders from across 600 cities, 47% of which came from the food and beverages sector. Orders on ONDC saw an unprecedented rise on October 14, according to multiple buyer apps ET spoke with. In addition, another 100,000 taxi/auto rides from four cities were also undertaken in the mobility sector.

Who ordered what? New Delhi led the surge with 7,852 orders, closely followed by Bengaluru with 7,586, Mumbai with 3,770, Pune with 3,729, and Hyderabad with 3,231 orders. Over 70 cities contributed more than 100 orders each to the upswing in activity on the network.

Also read | ONDC logs meteoric rise; challenges are climbing fast too

Other Top Stories By Our Reporters

Uber, Ola services in Chennai hit by two-day drivers’ strike: Drivers on ride-hailing platforms like Ola and Uber called for a two-day strike on Monday and Tuesday in Chennai protesting against the high commission rates imposed by the aggregators. A sit-in protest is also planned for Wednesday.

Gaganyaan crew escape system’s first test flight on October 21: Isro | The Indian Space Research Organisation (Isro) on Monday announced that the Flight Test Vehicle Abort Mission-1 (TV-D1) unmanned test flight — the first development flight that tests the performance of the Gaganyaan crew escape system — is scheduled for October 21 between 7 am and 9 am from Satish Dhawan Space Centre, Sriharikota.

Coming soon: One smart ring to connect them all | As early as January, you could waltz through the metro turnstiles in your city by simply pressing your knuckled fist to the gate – no card or token needed – if you have the 7 Ring, a smart wearable that enables contactless payments. You can wake up with just the buzz of a ‘silent alarm’ that won’t disturb your partner sleeping next to you, if you are wearing another ring — called the Ring One — that is set to roll out a new ‘haptic actuator’ feature.

B2B SaaS startup Leucine raises $7 million in funding led by Ecolab: Leucine, a business-to-business startup servicing software for pharmaceutical companies in India and the United States, on Monday said it has raised $7 million in a Series A funding round led by Ecolab.

Global Picks We Are Reading

■ Deepfake porn is out of control (Wired)

■ China’s favorite resale app is a youth subculture hot spot (Rest of World)

■ Memory-chip stocks can ride the AI gravy train, too (WSJ)