Also in this letter:

- Crypto bill to ban exchange-to-exchange transfers

- Pristyn Care turns unicorn with $100 million fundraise

- Byju’s bags math platform GeoGebra for $100 million

Meesho plans ‘price drop’ amid scrutiny on ecommerce discounts

Ecommerce platform Meesho told sellers and suppliers earlier this week that it would give a “price drop” of its own in a sale on Thursday.

Why it matters: Meesho’s decision comes at a time when larger, foreign-owned ecommerce platforms such as Amazon India and Walmart’s Flipkart are being scrutinised by regulators for offering steep discounts, among other things. Meesho, though founded in India, is backed by foreign investors such as SoftBank and Fidelity.

Under India’s laws, foreign-owned ecommerce marketplaces cannot directly or indirectly influence pricing on their platforms. Offline traders in India have long been complaining to the government about ecommerce discounts hurting their sales.

The details: Meesho told sellers that it will offer a minimum 2% “price drop” from its end during the sale. “Since Meesho is contributing to the price drop, we expect a similar price drop from your (sellers’) end too. Let’s together bring the best price for our customers,” it said in the note, which ET has reviewed.

The company, which turned a unicorn earlier this year with an over $1 billion valuation, added that it expects a 3.5x growth in sales in one day of the event.

A spokesperson for Meesho told us that the company was not discounting prices of products on the platform. “We are compliant with FDI norms in the country,” the spokesperson added.

After the government tightened the rules around online discounts in 2019, Flipkart and Amazon India stopped offering direct discounts to consumers. Most of their pricing incentives are now through brands and sellers.

Vidit Aatrey and Sanjeev Barnwal cofounded Meesho in 2015, which has now raised around $900 million this year and is valued at $4.9 billion.

D2C ecommerce play: Meesho, which has raised around $900 million this year, has also entered direct-to-consumer ecommerce, looking to challenge Flipkart and Amazon India. Flipkart in turn has entered the social commerce business through Shopsy. Singapore’s Shopee also entered India recently and is said to be gaining early traction.

Google’s Meesho bet: In October we reported that Google was in talks to invest $50-75 million in Meesho. The investment, part of a larger funding round, will value the company at $4.9 billion. The previous month, Meesho had raised $570 million from Fidelity and Eduardo Saverin’s B Capital. Google’s investment will take the round size to more than $600 million.

Crypto bill to ban exchange-to-exchange transfers, certain types of wallets

India’s proposed cryptocurrency bill is expected ban all exchange-to-exchange transfers in the country, restrict certain types of wallets that mask the owner’s identity, and put a halt to dealing in cryptocurrencies through Google Chrome extensions that allow users to dabble in more than 4,000 cryptos, four sources told us.

The legislation would also give the government the power to monitor crypto exchanges’ ledgers for foreign exchange transfers.

“The government will put in place a mechanism to monitor INR outflow. Exchanges will have to open up their books or ledgers to regulators when they tally the buy-side and sell-side every quarter,” said one of the sources.

The government will only allow Indian exchanges to operate, and investors will be asked to move their crypto assets to Indian wallets for better monitoring and regulatory oversight, the person added.

How it will work: Crypto exchanges will have the same restrictions as stock or commodity exchanges on the amount of money that can leave India and how trades can happen, another source told us.

There is also a proposal to have a uniform crypto wallet, something along the lines of a demat account, but that will be difficult to implement due to the complexity involved.

Closed loop: “But investors cannot be allowed to trade among themselves across exchanges,” said another official. This would make cryptocurrency transactions a closed loop deal, meaning that transactions would be restricted to a single exchange.

Some Indian exchanges already operate in a closed loop, preventing investors from transferring crypto assets off the platform.

“The government is formulating rules that will regulate exchanges in a closed loop system, disallowing the transfer of crypto currencies among exchanges and placing restrictions on non-custodial wallets like MetaMask,” said an official involved in the discussions. “However, stopping non-custodial wallets is impossible; it’s like restricting the internet.”

Tweet of the day

Pristyn Care turns unicorn with $100 million fundraise

Health tech startup Pristyn Care has picked up around $100 million in its Series E round, led by Sequoia Capital US, valuing it at $1.4 billion.

ET was the first to report about the company’s fundraising plans on October 13.

Latest unicorn: This makes it the latest entrant to the coveted unicorn club, comprising privately held companies valued at $1 billion or more. The three-year-old startup has seen its valuation double from April, when it raised funds from investors led by Tiger Global, at a valuation of around $550 million.

The Gurugram-based company has raised $85 million from Sequoia Capital, Tiger Global, Winter Capital and other existing investors, according to regulatory filings. It is in the process of filing documents for another $15 million – which it has already raised – taking the total funding to $100 million.

“The company is considering a term sheet which might take the total round size to $120 million,” a person with knowledge of the development said.

Byju’s bags math platform GeoGebra for $100 million

Edtech firm Byju’s said on Wednesday that it has acquired Austria-headquartered GeoGebra. While the company did not disclose the size of the deal, people briefed on the matter told us it was a $100 million cash-and-stock deal.

Under the terms of the deal, GeoGebra will continue to operate as an independent unit within the Byju’s group under the leadership of its founder Markus Hohenwarter. GeoGebra, with an expanding community of over 100 million learners across more than 195 countries, has a dynamic, interactive and collaborative mathematics learning tool, Byju’s said.

“This acquisition complements Byju’s overall product strategy and integrates GeoGebra’s capabilities to enable the creation of new product offerings and learning formats to its existing mathematics portfolio,” the company added.

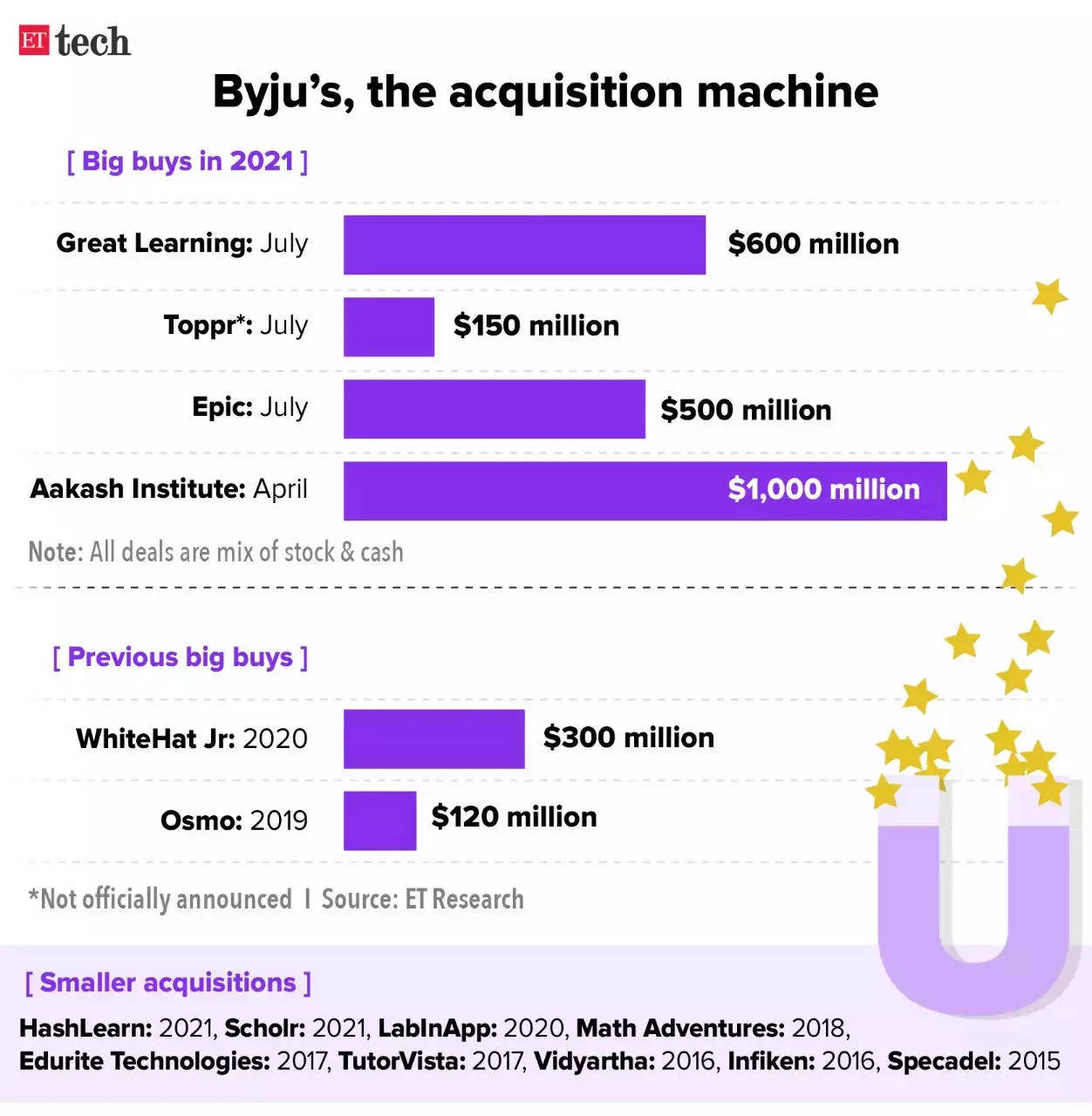

Buy-buy-buy: Byju’s has already spent more than $2 billion on acquisitions this year, including $1 billion on brick-and-mortar coaching network Aakash Institutes in April, a $500 million on kids’ learning platform Epic in July, and $600 million on Great Learning. In September, it acquired US-based coding platform Tynker for $200 million.

India’s highest-valued startup at $18 billion, the company raised $1.2 billion via a term loan from the overseas market last month.

Other done deals

■ Mobility startup Ola has raised $139 million as part of its Series J (G4) funding round, led by Edelweiss PE, valuing it at $7.3 billion, regulatory filings showed. ET was the first to report on November 12 about Ola looking to mop up $200-$250 million from investors led by Edelweiss and IIFL as part of its pre-IPO round, valuing it at $7-$7.5 billion. The company is preparing to file it.

■ Ola Electric has raised Rs 398.26 crore (about $52.7 million) in a financing round led by Temasek, regulatory filings sourced from Tofler showed. According to the filings, Ola Electric has allotted 371 Series C preference shares at an issue price of Rs 1.07 crore each to raise Rs 398.3 crore in the round.

■ Direct-to-consumer dental-tech startup Snazzy said it has raised a $2.2 million in a funding round from YCombinator, Form Capital, Goodwater Capital, and ANIM Fund. The funding round also saw participation from angel investors such as CRED founder Kunal Shah, Bobby Goodlatte (Stripe and coinbase angel investor), Verod Capital partner Eric Idiahi, and others.

■ Exponent Energy, a startup developing fast-charging battery and charger technology for electric vehicles, has raised $5 million in funding led by YourNest VC, along with participation from 3one4 Capital, AdvantEdge VC and automotive component maker Motherson Group.

■ Social commerce startup Stage3 announced that it has raised Rs 20 crore in a funding round co-led by Inflection Point Ventures and LC Nueva Investment Partners LLP along with Let’s Venture and Stanford Angels. Blume Ventures, Stage3’s existing investor has also participated in the round.

■ Logistics services provider Delhivery said it has acquired Transition Robotics Inc (TRI), a California-based company focused on developing Unmanned Aerial System (UAS) platforms. The deal size was not disclosed.

Google may take ‘JioPhone model’ to other markets

Google, which launched a low-cost smartphone for India in partnership with Reliance Jio earlier this year, may replicate the concept in global markets, a top executive told us.

The JioPhone Next, which runs on the Pragati OS — a custom-made version of Android — and is targeted at first-time internet users, offers Google a model that can be used to develop similar products for other emerging markets, according to Sanjay Gupta, country head, Google India.

Quote: “We are committed to working with Jio on it (JioPhone Next) and test it out in India. But, if there is an opportunity to take it beyond India, the answer is yes,” he said in an exclusive interview with ET.

India has been at the forefront of product development for the US technology giant, and several new products developed for the low-bandwidth and multilingual country have been scaled up globally. This includes the successful payment product Google Tez (now Google Pay), Offline Maps and Files Go.

More than one in three Indian firms use outdated cybersecurity tech: report

A report by Cisco has found that 37% of Indian companies use cybersecurity technology that’s considered outdated by security and privacy professionals working at these very organisations.

Respondents from India also considered their companies’ cybersecurity infrastructure to be unreliable and complex, with 33% and 40%, respectively, saying so in the survey.

Nearly 89% of respondents in India said their company was investing in a ‘zero trust’ strategy, with 44% saying their organisation was making steady progress in adopting it and 45% saying they were at an advanced state of implementing it.

And 88% of respondents said their company was investing in Secure Access Service Edge (SASE) architecture, with 44% making good progress with adoption and a similar number saying their implementation is at mature levels.

These two approaches are crucial to building a strong security posture for companies in the modern cloud-first and application-centric world.

Quote: “Cisco’s Security Outcomes Study indicates where the biggest gaps lie in India Inc.’s cybersecurity posture. In response, nearly 60% of companies are expanding their investments in cloud-based security technology plans. As they ramp up these efforts, they must focus on building a robust cloud-based, integrated, and highly automated architecture to ensure agility and intelligence in threat remediation and enable visibility and management of newly distributed users and applications,” said Vishak Raman, director, security business, Cisco India and SAARC.

Other Top Stories By Our Reporters

Govt blocked 9,849 social media URLs in 2020: The government ordered to block 9,849 social media accounts or URLs in the year 2020, up 171% since last year, minister of state of electronics and IT, Rajiv Chandrasekhar told the Parliament in response to a question on Wednesday.

Microsoft settles immigration related claims with US Justice Department: The US Department of Justice (DOJ) on Tuesday said that it has reached a settlement with Microsoft Corporation resolving allegations that the company discriminated against non-US citizens based on their citizenship status during the early stages of Microsoft’s hiring process.

HCL acquires banking firm in Germany: HCL and Deutsche Apotheker- und Ärztebank eG (apoBank), the largest cooperative primary bank in Germany, have signed with Atruvia AG an agreement to acquire IT consulting company Gesellschaft für Banksysteme GmbH (gbs).

Global Picks We Are Reading