Also in this letter:

- Razorpay valued at $7.5 billion after raising $375 million

- Oh-micron! IT services firms cautious on return to office

- How the data protection bill will affect the average Indian

Meesho bets big on live commerce with new streaming platform

Social commerce platform Meesho is building a live streaming platform, sources told us, as it looks to harness a lucrative new trend in ecommerce called live commerce. The service will be offered to sellers on the platform for a charge, one of the sources said.

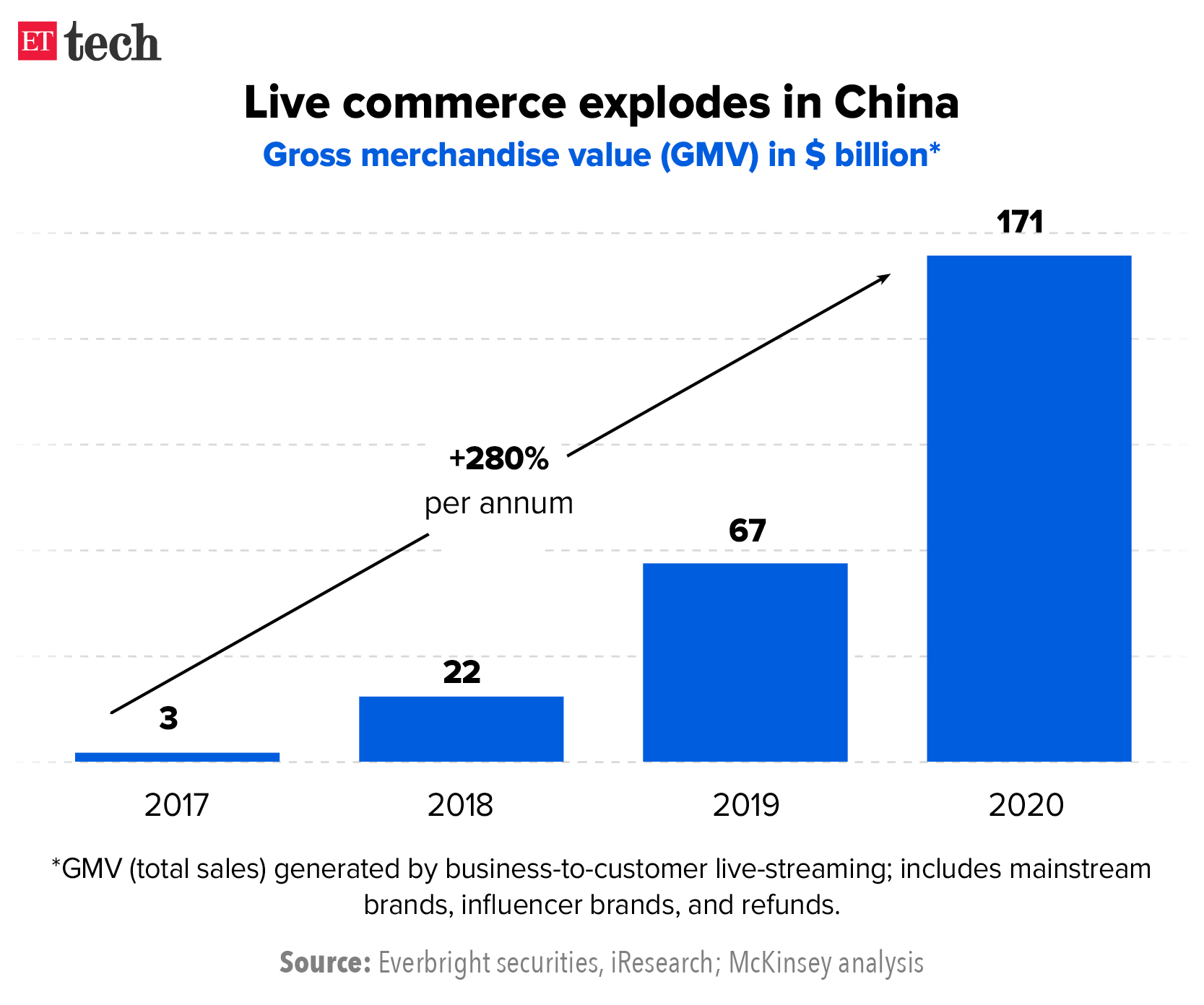

What is live commerce? Pioneered by the Chinese company Taobao, live commerce entails linking up an online livestream broadcast with an ecommerce store to allow viewers to watch and shop at the same time. The model proved a reliable digital tool for boosting customer engagement and sales in China and quickly became a fixture in sales campaigns for Singles’ Day—the country’s version of Black Friday. In 2020, the first 30 minutes of Alibaba’s Singles’ Day presales campaign on Taobao Live generated $7.5 billion in total transaction value, according to a McKinsey report.

This is the model that Meesho—and others—are looking to replicate in India.

“Live streaming will be a big part [of the business],” one of the sources said. “If you onboard enough influencers on your app, they do the selling for you.” Since Meesho runs on a zero-commission model, ads by sellers are currently its only source of revenue.

What is social commerce? Unlike regular ecommerce, social commerce involves a middleman called a reseller. Resellers buy goods in bulk and sell them through social media platforms such as WhatsApp and Instagram by sharing curated catalogues among their local communities.

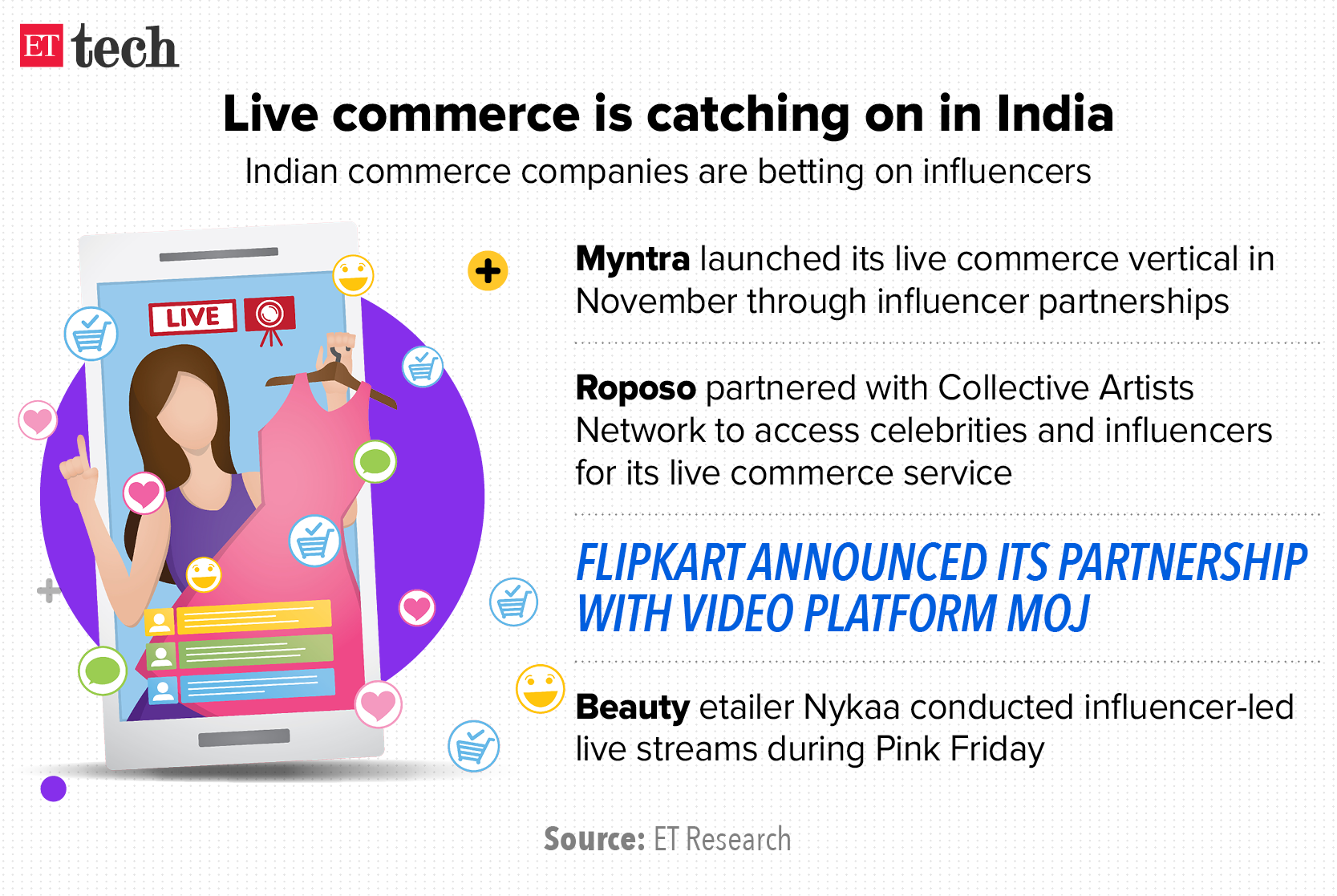

Long way to go: Other Indian firms that are tipping their toes into live commerce include biggies such as Flipkart and Myntra, and influencer-led platforms such as Glance’s Roposo. But they have a long way to go to replicate the success of their Chinese counterparts. The value of China’s live commerce market is expected to hit $423 billion by 2022, up from $171 billion in 2020.

In India, companies are betting that adding live commerce to their box of tools will take online shopping to new markets.

- Flipkart recently announced it was partnering with video platform Moj to launch a live commerce product.

- Myntra also announced its foray into live commerce in November through influencer partnerships.

- Video sharing platform Roposo, too, is experimenting with live commerce.

A fresh start? Live commerce has had little success in India until now, but the entry of well-funded players may signal a new chapter. Small video platforms have either discontinued their live commerce products or pivoted to other models.

Industry experts attributed the limited success of live commerce in India to challenges such as poor back-end technology to host concurrent live streams, insufficient supply of live streamers, and inability to bring organic traffic during live streaming.

Razorpay valued at $7.5 billion after raising $375 million

Razorpay founders Harshil Mathur (left) and Shashank Kumar

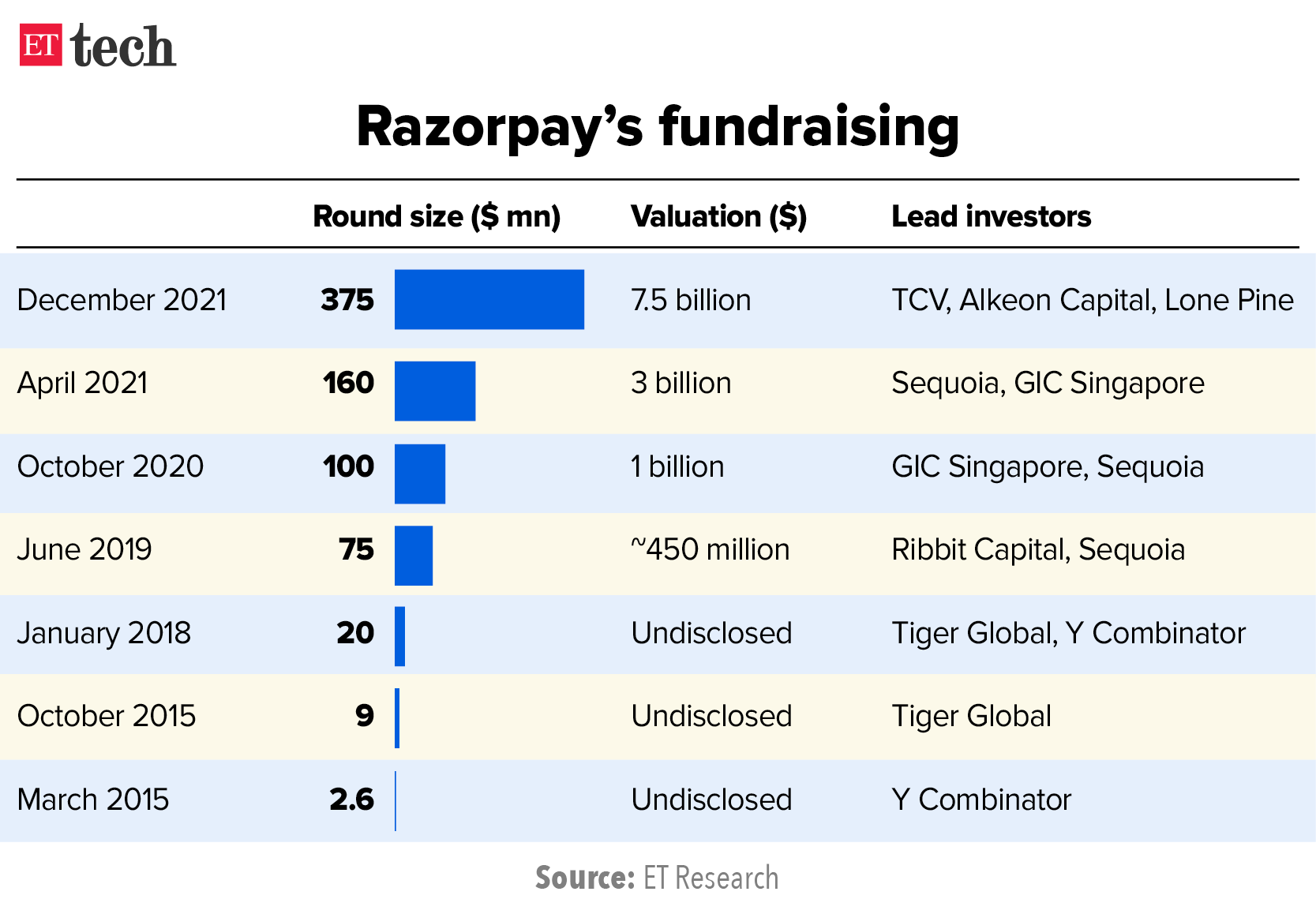

Payments firm Razorpay has seen its valuation grow seven times in just over a year.

Driving the news: The company has raised $375 million (Rs 2,850 crore) in a new funding round led by TCV, Lone Pine Capital and Alkeon Capital, taking its valuation to $7.5 billion. That’s seven times what it was valued at around this time last year, when the startup joined the unicorn club. We had reported on November 10 that TCV, an investor in Netflix and Airbnb, was in talks with Razorpay to participate in a new funding round.

This makes Razorpay one of India’s highest-valued startups. The company has raised $741.5 million in total. In April, it had raised $160 million at a post-money valuation of $3 billion.

Investors splash the cash: The new round was initially being finalised at around $250 million at a valuation of $6-6.5 billion but increased to $375 million thanks to increased investor interest. This was due to the growth in Razorpay’s core business and neobanking platform, a person briefed on the matter said. The company has been one of the major beneficiaries of the pandemic-induced acceleration in digital payments.

IPO boost: Harshil Mathur, the company’s cofounder and chief executive officer, said the participation of these investors was a significant validation and would prove an advantage when Razorpay approaches a potential initial public offering in the next two to three years. Existing investors such as Tiger Global, Sequoia Capital India, GIC and Y Combinator also participated in this round, the company said.

Razorpay recently said it is targeting a total payment volume (TPV) of $90 billion by the end of next year. This came after the company clocked a TPV of $60 billion this year, after targeting $50 billion. That represents 300% year-on-year growth for the second consecutive year, the company said.

Tweet of the day

Oh-micron! IT services firms cautious on return to office

Thanks to Omicron, India’s top software exporters are taking a cautious approach to their previously announced back-to-office plans, slated for January, senior executives told us.

Who’s saying what: TCS said less than 10% of its associates are working from its offices currently, while any plans for a full-fledged return to office would be a “calibrated move.”

- Infosys said it has “taken a cautious approach” keeping in mind the “changing health situation”.

- HCL Technologies said it “will continue to monitor the emergence and impact of Covid variants which could limit the movement of employees.” The company said a tenth of its employees are currently working from the office, and it expects to continue with the current hybrid model.

This contrasts sharply with their announcements during second quarter results in October. At that time, most IT companies said that they would initiate back-to-work plans by the end of December or in January. In November, industry body Nasscom estimated that half of India’s 4.5-million technology workforce would return to office thrice a week from the new year.

How the data protection bill will affect the average Indian

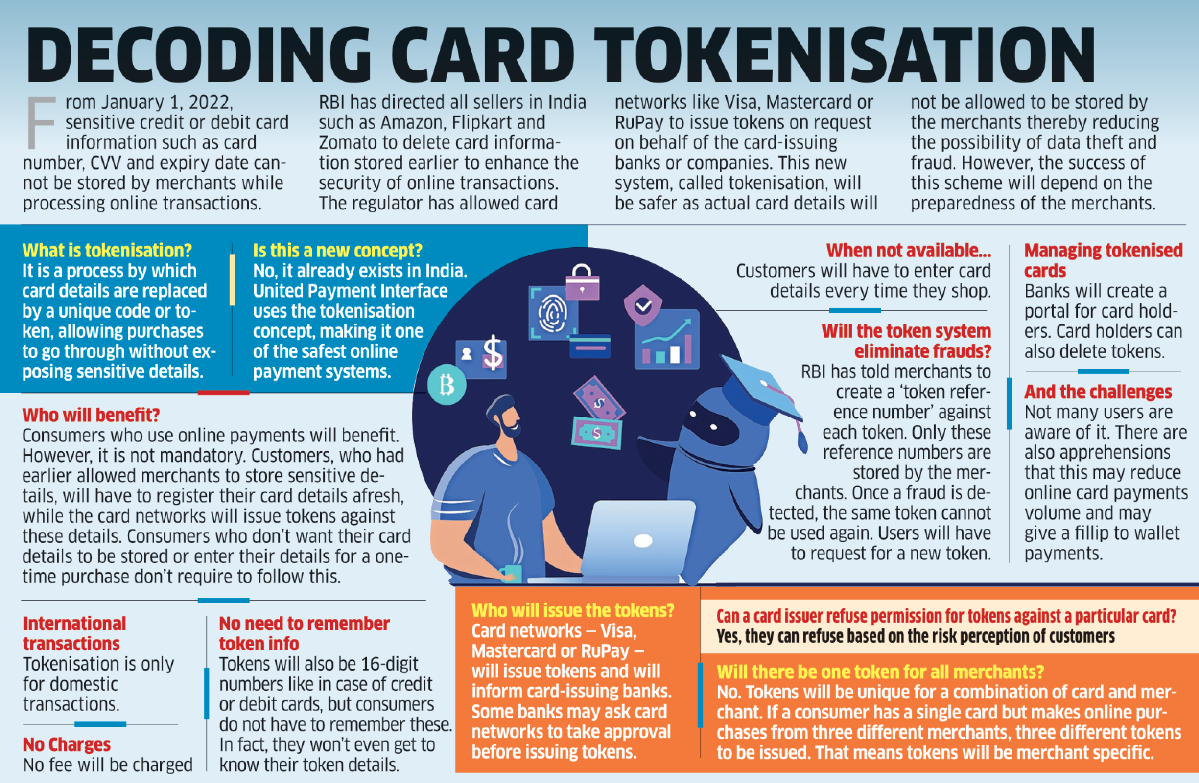

India is in the final stages of enacting a privacy legislation that will protect the data of its citizens.

A parliamentary panel that studied the Personal Data Protection Bill, 2019, submitted final suggestions on Thursday, widening its scope to regulate other key aspects of the digital economy. The government is likely to present the bill in the budget session of Parliament.

Once passed, what will the legislation mean for an average Internet user, an emerging business, children below 18 years of age and the government itself?

Here are some excerpts from an ET analysis.

Average internet user: The bill aims to protect internet users and keep their data private. It compels companies and the government to seek consent while collecting data. It also recommends that the collected data be limited to a specific purpose, minimise the quantum of data sought from users and store most of it within the country.

Government official: The government will be able to exempt its own agencies from legal oversight without sufficient checks and balances. This means various government agencies will have the power to collect and process personal data without consent or by applying other legal safeguards. The exemption gives wide-ranging powers to a government official and increases the risk of state surveillance.

Emerging data business: The panel recommends the promotion of a digital economy. This will not only increase compliance costs to meet regulatory requirements but also hinder startups from collecting data beyond a specific objective.

Child browsing the internet: No child under the age of 18 may be tracked, profiled, monitored or subjected to targeted advertising online, according to the proposal. It also broadens the scope of these restrictions to include all data fiduciaries, even discarding the concept of a guardian data fiduciary.

Click here to read the full version.

Infographic Insight

Exchanges offer top dollar for crypto talent in India

Cryptocurrency exchanges are struggling to hire experienced professionals due to a shortage of people with the relevant knowledge and skills in India. Meanwhile, demand for talent is soaring, with several well-funded crypto firms scaling and diversifying their businesses.

- For instance, crypto exchange CoinSwitch Kuber has grown from 25 to more than 380 employees in the past year and a half.

Headhunters and industry executives say that the 25-30 exchanges that operate in India are looking for talent across functions such as technology, compliance, legal, risk management, marketing and sales.

Salaries jump: Because of this shortage, “we have to offer steep salary packages for techies ranging from Rs 1.5-7 lakh per month,” said Praveenkumar Vijayakumar, chairman at Malaysia-based crypto trading platform Belfrics Global. The average salary offered to tech employees across exchanges is around Rs 2 lakh a month for those with two to four years of experience, industry trackers said.

Crypto wants you: “Currently, there are at least 40-50 CXO-level openings between the top ten exchanges. Most of the big exchanges that are well-funded are scaling or pivoting, so demand for talent across levels is robust,” said Ashish Sanganeria, senior partner and national technology lead at global head-hunting firm Transearch.

Global market: The global nature of the top crypto talent has also contributed to rising salaries in India. “There is competition from across the globe for crypto talent, hence salaries are shooting up. We have given mid-year raises three times to some of our brightest and some of our earliest hires,” said Edul Patel, cofounder and chief executive at crypto trading platform at Mudrex.

Other Top Stories By Our Reporters

Krafton leads $6.5-million funding round in FRND app: FRND—an audio-focused dating app—will use the funding to expand its services beyond 10 Indian languages. For Krafton, FRND is its fourth Indian investment after Nodwin Gaming, Loco and Pratilipi.

WeWork India looks to add 1 million sq ft coworking space in 2022: More than 50% of the planned expansion for next year is already pre-committed, WeWork India CEO Karan Virwani said, adding that the company has turned profitable due to “solid demand over the last year”.

A look into the future of hybrid malls: As metaverse for work and leisure become a virtual reality, a hybrid mix of connectivity-enabled technology is expected to be a common element of everyday life in 2030.

Global Picks We Are Reading

- Apple seeks dismissal of India apps market antitrust case (Reuters)

- Theranos and the logic of startup bets (NYT)

- Apple should make a giant iPad as its smart home portal (Bloomberg)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.