Credit: Giphy

Also in this letter:

■ Rebel Foods announces $10 million Esop liquidation programme

■ Future of edtech is online-plus-offline, says Sequoia India MD

■ OfBusiness seeks CCI nod to acquire steel maker SMW Ispat

Crypto tax becomes law; FM says 1% TDS ‘not an additional tax’

Around 5 pm on Friday, the Lok Sabha approved the Finance Bill 2022, which includes the new tax framework for crypto assets that finance minister Nirmala Sitharaman had proposed in her budget speech in February.

Sitharaman, who moved the bill for consideration and passage in the Lok Sabha, said the government was yet to decide whether to regulate or ban crypto, and that the 1% TDS on all crypto transactions was “not an additional tax”.

FM speaks: On the issue of the 1% tax deductible at source (TDS), which has been heavily criticised as debilitating to the industry, Sitharaman said, “TDS is more for tracking, it is not an additional tax. The person paying TDS can always reconcile it with their other taxable income. TDS is a legitimate way to track transactions and widen the [tax] base.”

Responding to accusations that the government was giving mixed signals on virtual digital currencies (VDA), Sitharaman said, “We are very clear. Whether we want to regulate or ban it, [we will decide] when consultations are concluded. But till then, we are taxing it as a lot of transactions are happening.”

What came before: Earlier, Pinaki Misra, the BJD MP from Odisha said the government had created the impression that dealing in cryptocurrency was a sin, and accused it of creating confusion on the subject. “The RBI governor has said crypto is just hot air, and this government wants to tax hot air,” he said.

BJP MP Nishikant Dubey, a staunch opponent of crypto, said that the assets were used for paying bribes and laundering money.

Dubey, the BJP MP from Godda, Jharkhand, said, “The situation that crypto has created worldwide is this…If you want to indulge in corruption, if you want to pay a bribe, you will do so in crypto. If you want to buy drugs, you will do it with crypto.”

Supriya Sule, the NCP MP from Baramati, Maharashtra also accused the government of sending mixed signals on crypto. “Everyone believes that crypto is not good for this country. Then why aren’t you banning it? Why are you taxing it 30%?”

Cloud kitchen unicorn Rebel Foods announces $10 million Esop liquidation

(From left) Rebel Food founders Kallol Banerjee and Jaydeep Barman

Rebel Foods, the company behind Faasos, Behrouz Biryani, Ovenstory Pizza and Mandarin Oak, has announced a $10 million employee stock ownership plan (Esop) liquidation programme for eligible current and former employees.

Details: The liquidation was open to everyone who had vested options by October 31, 2021.

Rebels Foods said it would set aside a sum to allow for such liquidation every year. This year, over 150 present and former Rebel Foods employees got to liquidate their vested options through this programme, it said.

“The $10 million Esop programme will offer significant wealth creation opportunities for those who have joined us in our mission of building and scaling a platform for great quality brands across all customer food missions in every neighbourhood in the world,” said Ankur Sharma, cofounder of Rebel Foods.

Flush with money: Rebel Foods secured $175 million in funding led by Qatar Investment Authority (QIA), last October. The firm was valued at $1.4 billion after the round, booking itself a spot in the unicorn club.

Rebel Foods had said in October 2021 that it planned to launch its IPO in the next 18-24 months.

Esops, Psops and Tsops: While several startups have launched Esops to attract and retain employees, we reported on March 2 that Urban Company said it would offer stock options in the company worth Rs 150 crore to its gig workers – who comprise plumbers, electricians, cleaners, groomers and so on – through a ‘partner stock ownership plan’ (Psop).

And last July, we reported that edtech firm Unacademy plans to issue stock options worth $40 million to teachers on its platform over the next few years.

Future of edtech is online-plus-offline, says Sequoia India MD

Sequoia India’s managing director, GV Ravishankar

The future of the edtech industry post-Covid continues to be a combination of online and offline, and the ‘omnichannel’ model represents the sustainable future of the industry, according to Sequoia India’s managing director, GV Ravishankar.

Quote: “Offline learning is not going away anytime soon. In fact online complements offline really well and the omnichannel model is going to be around for a long time and steer the industry,” Ravishankar said at Unstoppable India, a TiEcon Delhi-NCR 2022 event on Friday. We will see the omnichannel model of learning continue to grow, he added.

Offline plays: Many of India’s top edtech platforms are eyeing the omnichannel model. Unacademy earlier this month opened its first ‘experience stores’ in New Delhi. Byju’s also recently announced its offline plans with the launch of Byju’s Tuition Centre.

Industry insight: Ravishankar, who sits on the board of two edtech unicorns, Byju’s and Eruditus, said that while the entry barrier is low for the online education industry, scale continues to be a challenge since a firm’s success depends largely on the trust it creates among its students.

“You can enter easily but scaling is a challenge because again, it’s a competitive market. You have many established players and education is a tough business,” he said.

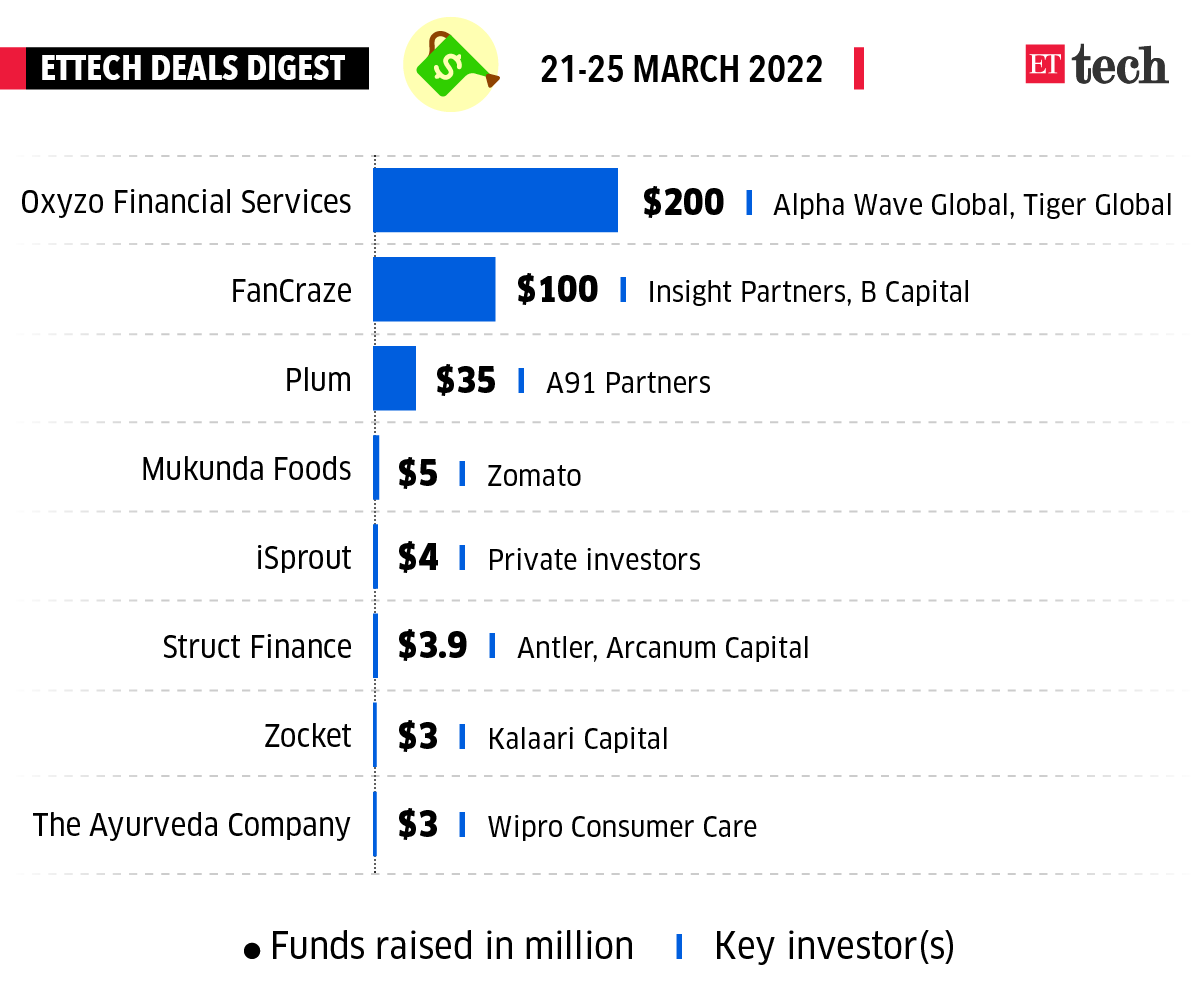

ETtech Deals Digest

Oxyzo Financial Services, the lending arm of SoftBank-backed business-to-business (B2B) commerce startup OfBusiness; digital collectibles company FanCraze; and direct-to-consumer (D2C) beauty brand Plum were among the startups that raised funds this week. Here’s a look at the top funding deals of the week.

OfBusiness seeks CCI nod to acquire steel maker SMW Ispat

Business-to-business (B2B) commerce startup OfBusiness asked the Competition Commission of India (CCI) to clear its acquisition of a majority stake in thermo mechanical treatment (TMT) steel manufacturer SMW Ispat. The deal size was not disclosed in its application.

Sources briefed on the matter said OfBusiness’s parent firm OFB Tech is acquiring a 100% stake in the firm largely to acquire its key brand, Sangam TMT.

OfBusiness said in its application that the deal does not lead to any competition concerns irrespective of the manner in which the markets are defined.

Glance acquires gaming firm Gambit: InMobi’s consumer internet arm Glance said on Friday that it has acquired a gaming company Gambit Sports, which will accelerate its ambition of building the biggest platform for NFT-based live gaming experiences for Gen-Z across different markets.

NFT push: Glance will leverage Gambit’s expertise to launch engaging live gaming experiences including tournaments, game shows, game streaming and multi-player games on lock screen. In the coming quarters, Glance also plans to launch NFTs in live gaming. This will potentially enable creators, streamers and developers to monetize through assets and NFT-based game creation, while giving gamers unique experiences.

Also Read: What are NFTs and why do they matter?

Swiggy Instamart named official partner of Tata IPL 2022: India’s cricket board announced on Friday that Swiggy Instamart will be the official partner of Tata Indian Premier League (IPL) 2022.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.