Also in this letter:

■ MeitY to discuss new cybersecurity rules with VPN firms

■ Dedicated metaverses for banking, ecommerce come to life

■ Online discounts on electronics are back as sales slow

Credit card payments on UPI present many challenges to fintech firms

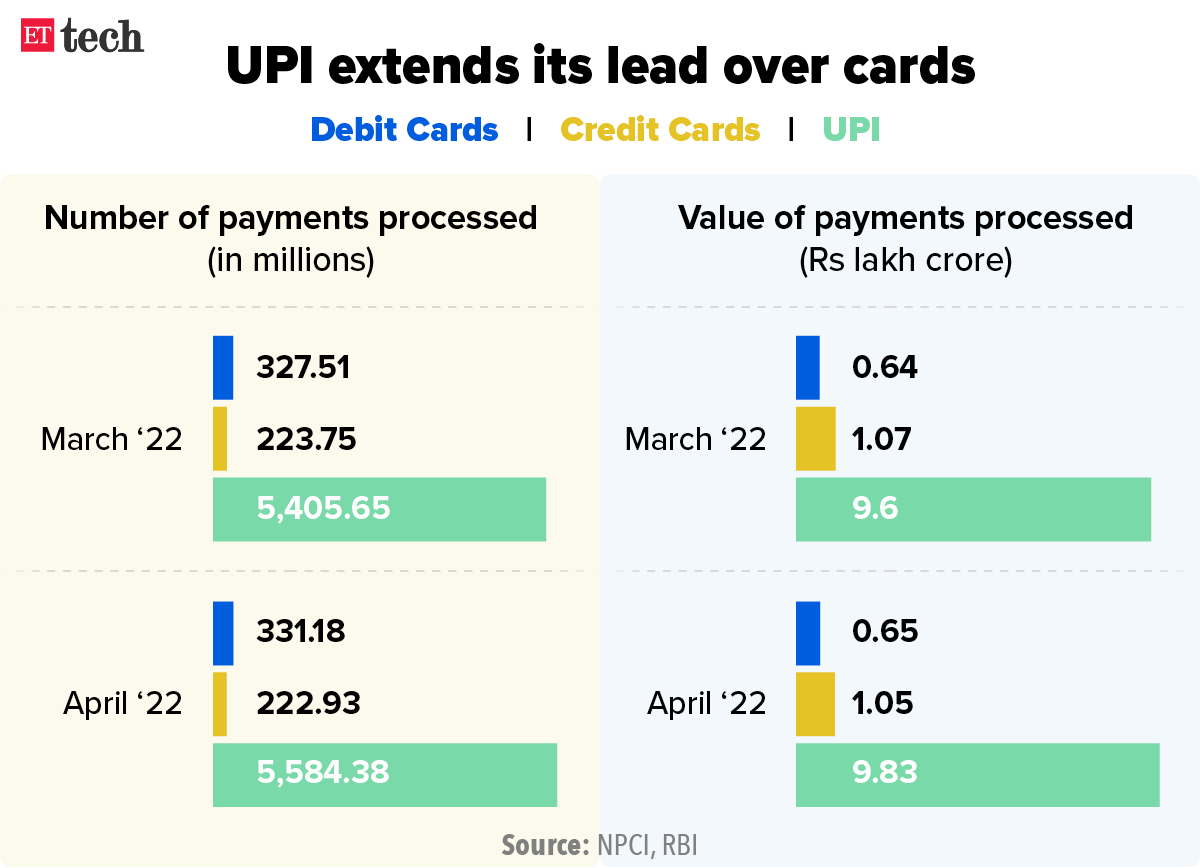

Even as the fintech industry cheers the RBI’s decision to allow credit cards to be linked with the Unified Payments Interface (UPI), it faces challenges on consent architecture, merchant know-your-customer (KYC) guidelines and the zero merchant discount rate (MDR) regime for UPI.

MDR is a fee that merchants are charged by their issuing bank for accepting payments from customers via credit and debit cards. There is currently no MDR for UPI payments.

The RBI’s will undoubtedly boost the credit card industry as well as digital credit-line fintechs that have been dabbling in payments through card-based offerings.

Yes, but: Several fintech executives we spoke to said the full roll out of credit-card-based UPI payments will take at least six months, and that several questions remain unanswered.

While the RBI and the National Payments Corporation of India (NPCI), which runs UPI, are expected to release the operating guidelines shortly, the addition of card-based UPI payments may require significant upgrades to the UPI infrastructure, several fintech executives and entrepreneurs told us.

Consent architecture, KYC upgrades: Executives at point-of-sale fintechs and UPI payment apps we spoke to said merchant guidelines for KYC for credit cards and UPI are very different. Merchants who accept credit cards have to go through a much stringent KYC process from the acquirer, which includes providing a GST number, to streamline chargebacks and counter fraudulent payments.

This means third-party UPI apps such as PhonePe, Paytm and Google Pay may have to redo their KYC for merchants and upgrade their technology for stricter KYC.

The big one: But the biggest challenge for the industry will be to reach a consensus on the MDR for credit card payments on UPI. Who will bear the cost of MDR, which is charged on credit card payments but not UPI?

MeitY to discuss new cybersecurity rules with VPN firms on Friday

The Ministry of Electronics and Information Technology (MeitY) has invited VPN companies, tech policy groups, legal experts and cybersecurity experts for a consultation on Friday to discuss various aspects of the Indian Computer Emergency Response Team’s (Cert-In) latest guidelines on cybersecurity, sources told us.

The consultation is likely to be chaired by Minister of State for Electronics and Information Technology Rajeev Chandrasekhar. It has been planned by the IT ministry in response to a joint letter sent by tech policy groups such as The Dialogue, AccessNow, Internet Freedom Foundation, SFLC.in, BSA India and others.

The meeting comes just days after two VPN companies, Surfshark and ExpressVPN, shut down their servers in India, rejecting the government’s mandate to store details of their customers, including their names, addresses and the purpose for which they were using a VPN service.

Quote: “Policy heads from various companies will also be present. There will be discussions primarily on the Cert-In directives, and whether they have had an adverse impact on the startup ecosystem. We also expect senior officials from other ministries to be present,” a source said.

Pushback: Apart from VPN companies, tech policy groups and various cybersecurity and legal experts have criticised the new directives.

But so far, the government has stuck to its guns. Chandrasekhar said recently that companies which did not wish to adhere to the Cert-In guidelines were free to leave India.

Dedicated metaverses for banking, ecommerce come to life

The metaverse – a collection of futuristic virtual spaces that combine aspects of digital and physical worlds – is increasingly attracting traditional businesses. The trend is partly driven by FOMO (fear of missing out) on the next big way to engage with audiences.

Dedicated metaverses for industries such as ecommerce and banking are coming to life as companies look at virtual environments for engagement and lead generation.

Who’s doing what: While the metaverse, as conceived by tech CEOs and experts – as a fully realised virtual world that is pitted to eventually replace today’s internet – is far from being manifested, many rudimentary versions of it have come up, led by virtual reality (VR) gaming.

In April, ecommerce platform Flipkart launched Flipkart Labs to test Web3 and metaverse use cases.

Kiya.ai, a digital solution provider for financial institutions, last week launched a banking metaverse where it will build secure 3D virtual environments for banks to create life-like experiences for its customers.

FMCG brands like McCain, Tata Tea, ITC and Mondelez’s Cadbury are doubling down on their investments in the metaverse to up their customer acquisition and brand engagement, as we reported on April 2.

Online discounts on electronics are back as sales slow

Discounts for consumer electronics have returned to ecommerce platforms after a gap of two years as the sale of televisions, smartphones and refrigerators has slowed.

While in bigger towns and cities, pent up demand has been exhausted and consumers have diverted their expenditure to travel and eating out, for consumers in smaller towns and rural areas, overall inflationary pressure has eaten away discretionary spends.

“Discounts have made a comeback and will continue till the festive season since brands have to create demand and grow their business,” said Pradeep Jain, managing director of Jaina Group, which retails Karbonn and Sansui brands.

Industry executives said Amazon and Flipkart have lined up a few sales till August with Amazon’s flagship Prime Day sale expected next month-end. The first and biggest online festive season sale is expected in the last week of September.

Smartphone and electronic products will be the focus segment during the sale period, industry executives said. Even in the ongoing monsoon sale, discounts on these categories have made a comeback.

TWEET OF THE DAY

Beauty retailer Purplle is India’s second startup unicorn this week

Online beauty and personal care products retailer Purplle has raised $33 million from Paramark Ventures at a valuation of $1.1 billion.

Two in one: This makes it the 17th Indian tech startup to turn unicorn this year, and the second this week after online education venture Physics Wallah, amid a funding winter in the global startup ecosystem.

Existing investors Premji Invest, Blume Ventures, and Kedaara Capital also participated in the round. The company has raised $215 million to date, including this round. Its earlier investors include Goldman Sachs and Verlinvest.

The company, which competes with larger rival Nykaa, has seven million monthly active users and over 1,000 brands on its platform, including five private labels.

It said its annualised gross merchandise value was $180 million in FY 2022. It has 2,400 employees.

Disrupted: The online beauty market, traditionally dominated by large multinational companies, has seen startups like The Good Glamm Group, Sugar Cosmetics and Mamaearth raise substantial funds in the last two years.

ETtech Done Deals

■ Fintech startup Cred has raised Rs 617 crore (about $80 million) in the first tranche of its latest funding round, according to filings with the Ministry of Corporate Affairs. The company told us it was raising $140 million in a mix of primary and secondary funding, which will value it at around $6.4 billion.

■ SolarSquare, a business-to-consumer (B2C) solar products startup, has raised $4 million, led by early-stage venture investment firm Good Capital. US-based Lowercarbon Capital, Singapore-based Symphony Asia, and Zerodha cofounder Nithin Kamath’s Rainmatter also participated in the round.

Other Top Stories By Our Reporters

■ IT firms brace for growth hit: IT-Business Process Management services are expected to show some level of recessionary impact on growth in the near- to mid-term as concerns over inflation and recession grow across the United States and Europe, the largest markets for TCS, Infosys and Wipro.

■ Equinix to invest $86 million for third data centre: Digital infrastructure company Equinix said it would invest over $86 million to build its third international business exchange (IBX) data centre in Mumbai. To be named MB3, the first phase is scheduled to open in the second quarter of 2024.

■ TCS well-placed for growth, says N Chandrasekaran: Tata Sons chairperson N Chandrasekaran has cautioned against a “stagflationary impulse” in the backdrop of the Russia-Ukraine conflict. Addressing the 27th annual general meeting of TCS, he said the company was well positioned to leverage the demand for digital solutions in this environment.

Global Picks We Are Reading

■ What does ‘tech company’ even mean anymore? (Rest Of World)

■ NASA joins the hunt for UFOs (The Washington Post)

■ Supply crunch looms for world’s most cutting-edge chips (WSJ)