Credit: Giphy

Also in this letter:

■Vivo asks ED to unfreeze bank accounts, says existence in jeopardy

■Twitter fires back at Musk, says no deal terms breached

■Dodging raids, passing the buck were keys to Uber’s strategy: report

Lightspeed raises $500 million to invest in startups across India, Southeast Asia

Bejul Somaia, partner, Lightspeed

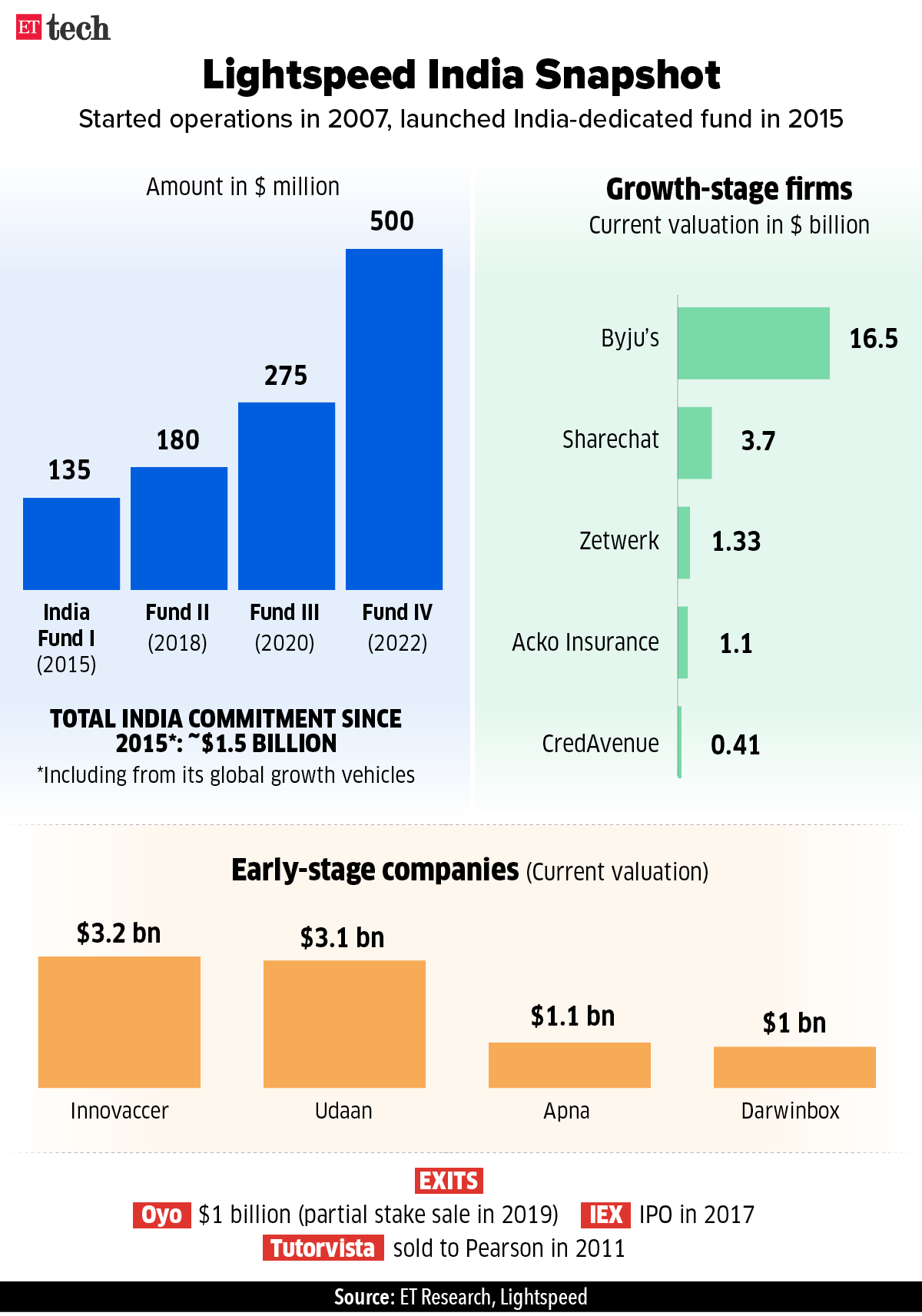

Lightspeed Venture Partners has closed its largest India- and Southeast Asia-dedicated fund at $500 million, joining a growing set of technology investors that have amassed large amounts of dry powder amid a slowdown in funding.

Giant leap: Lightspeed, which has backed startups such as Oyo, Udaan, Sharechat and Byju’s, has increased the size of its fourth India fund substantially from its previous corpus of $275 million, which it racked up in 2020.

The fund will cut cheques of $500,000 to $15 million and focus on seed to Series B investments, with growth capital coming from its global vehicles.

The India fund is a part of the $7 billion that Lightspeed announced it had raised overall to deploy in early- and growth-stage companies.

Bejul Somaia, partner, Lightspeed, who set up the fund’s India franchise in 2007, has been promoted to the global leadership team and will serve on various investment committees in addition to his existing role.

“As companies build for bigger opportunities, they need more capital and so to execute the same strategy, you would need a larger capital base in any case,” he said in an exclusive interaction with ET.

Go big or go home: Lightspeed’s $500 million raise comes as an increasing number of early-stage investors have been shoring up far bigger funds over the past year or so as digital businesses gained immensely on the back of the pandemic.

Vivo asks ED to unfreeze bank accounts, says existence in jeopardy

Chinese mobile phone maker Vivo’s Indian arm has urged the Enforcement Directorate (ED) to unfreeze its bank accounts so it can continue its business. It said the freezing of its 10 bank accounts has “jeopardised its very existence” in the country.

Representation: Vivo India sent a representation to the ED on July 7, two days after the agency raided the phone maker and 23 associated companies. Before doing so, the ED had ordered nine banks to freeze all 10 of Vivo India’s bank accounts.

ED’s orders were served to Vivo India on July 6, according to the company’s representation.

Existential threat: Vivo India told the agency that being unable to access Rs 251.91 crore in its accounts would “lead to a situation of commercial and civil death”.

“While we are committed to cooperating with the investigation, such an irreversible action, even if temporary, jeopardises the very existence of Vivo,” it added.

Court directions: Last week, acting on a petition filed by Vivo India, the Delhi High Court had directed the ED to decide on the company’s representation.

Vivo’s lawyers contended that the company had to make monthly payments of around Rs 2,826 crore towards statutory dues, salaries, rent and daily business operations.

ED’s allegation: In a press statement on July 7, the ED said Vivo India remitted Rs 62,476 crore — almost half of its turnover of Rs 1,25,185 crore — out of India, mainly to China. “These remittances were made in order to disclose huge losses in Indian incorporated companies to avoid payment of taxes in India,” said the agency.

In all, the ED seized 119 bank accounts of various entities with a total balance of Rs 465 crore.

Twitter fires back at Musk, says no deal terms breached

Twitter has fired off a letter to Elon Musk, accusing him of “knowingly” ending his $44 billion takeover of the firm. Twitter denied Musk’s claims that the company breached the terms of the deal — days after the Tesla CEO walked away from it.

Quote: “Twitter demands that Mr. Musk and the other Musk Parties comply with their obligations under the Agreement, including their obligations to use their respective reasonable best efforts to consummate and make effective the transactions contemplated by the Agreement,” said Twitter in the letter.

Also read: Test-fired booster rocket bursts into flames at SpaceX plant

What’s next? Twitter, adamant about completing the deal, has already vowed to sue Musk, which could see both parties locked in a lengthy court battle in the next few months.

It’s almost impossible to predict the outcome of any protracted legal battle, but law and business experts believe Twitter likely has the stronger case.

The case could also end in a settlement, with the two sides negotiating a lower price. If Musk wins, there’s also the question of the $1 billion breakup fee. He can certainly afford it, but will he want to pay?

Also read: How Elon Musk damaged Twitter and left it worse off

Dodging raids, passing the buck were key to Uber’s strategy: report

Uber used illegal tactics, political lobbying, and ethically questionable practices to expand its footprint across the globe, according to reports from a four-month-long probe by the International Consortium of Investigative Journalists, led by the Guardian.

A trove of about 124,000 conversations, including emails, messages, and WhatsApp texts between 2013-2017 – called the Uber Files – were leaked to the UK-based publication, putting the spotlight on the alleged ‘corrupt practices’ of Uber when it was headed by cofounder Travis Kalnick.

India angle: India was jolted in December 2014, when an Uber driver sexually assaulted and raped a woman in New Delhi and threatened to kill her if she reported the incident.

Even as the police nabbed the perpetrator, Uber’s top executives in San Francisco were quick to pass the buck on to the Indian authorities, citing the lack of background checks of drivers in the country, according to the report.

It also said Uber used a “kill switch” – which cuts off access to its servers – to prevent government officials, particularly taxmen, in India and other countries from accessing its records in case of a raid or probe.

Whistleblower: Mark MacGann, Uber’s former chief lobbyist for Europe, the Middle East and Africa, was the source of the leaked data. “It is my duty to speak up and help governments and parliamentarians right some fundamental wrongs,” MacGann told the Guardian. “Morally, I had no choice in the matter.”

Tweet of the day

Vauld reveals $70 million shortage in letter to creditors

Troubled crypto lender Vauld has revealed a shortfall of $70 million to its creditors in a letter that we have reviewed. In it, Vauld said it has assets worth $330 million while its liabilities stand at $400 million.

Statement: “We also have a mismatch of tenure where we have committed a significant proportion of our assets under management towards loans with a tenure of another 3-11 months that can’t be recalled early,” Darshan Bathija, cofounder of Vauld, wrote in the letter.

Vauld, which froze all transactions last week, is set to be acquired by Nexo amid the ongoing crypto winter.

Meanwhile, the founders of bankrupt crypto hedge fund Three Arrows Capital’s founders have disappeared from the public sphere, according to The Verge. The company, which filed for bankruptcy last week, managed assets worth $10 billion at its peak.

Also Read: Shrimps and whales keep bitcoin afloat

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.