This in an 80% expansion in value for the company, which was last valued at $ 2.5 billion following the close of a $315 million round in July 2021 that was led by Singapore’s Temasek, which has also invested in the latest funding.

Other existing investors like Epiq Capital, Avendus Future Leaders Fund II too have participated in this round with funds being released in tranches, sources said.

ET had reported on April 13 that

Lenskart was in the final stages of closing a new round and that it could be valued at between $ 4.5 -5 billion.

“The round has closed at $200 million and money has been coming in tranches from investors. They (Lenskart) are not looking at more capital in this round,” said the person cited above.

With this, the eyewear platform, which was started in 2010, has raised a total of around $1 billion, including secondary share sales. In a secondary financing, existing investors sell their shares to new investors and the money does not go to company coffers.

Discover the stories of your interest

While the SoftBank-backed company did not comment on closing its latest financing, its founder Peyush Bansal told ET that Lenskart is planning to open 400 more stores in India adding to its existing network of over 1,000 stores.

“We are looking to grow by 60-70% in the current financial year. While most of the 1,100 stores of Lenskart are in India, we will continue to expand with 400 new stores as we look to scale our revenue,” he said.

ETtech

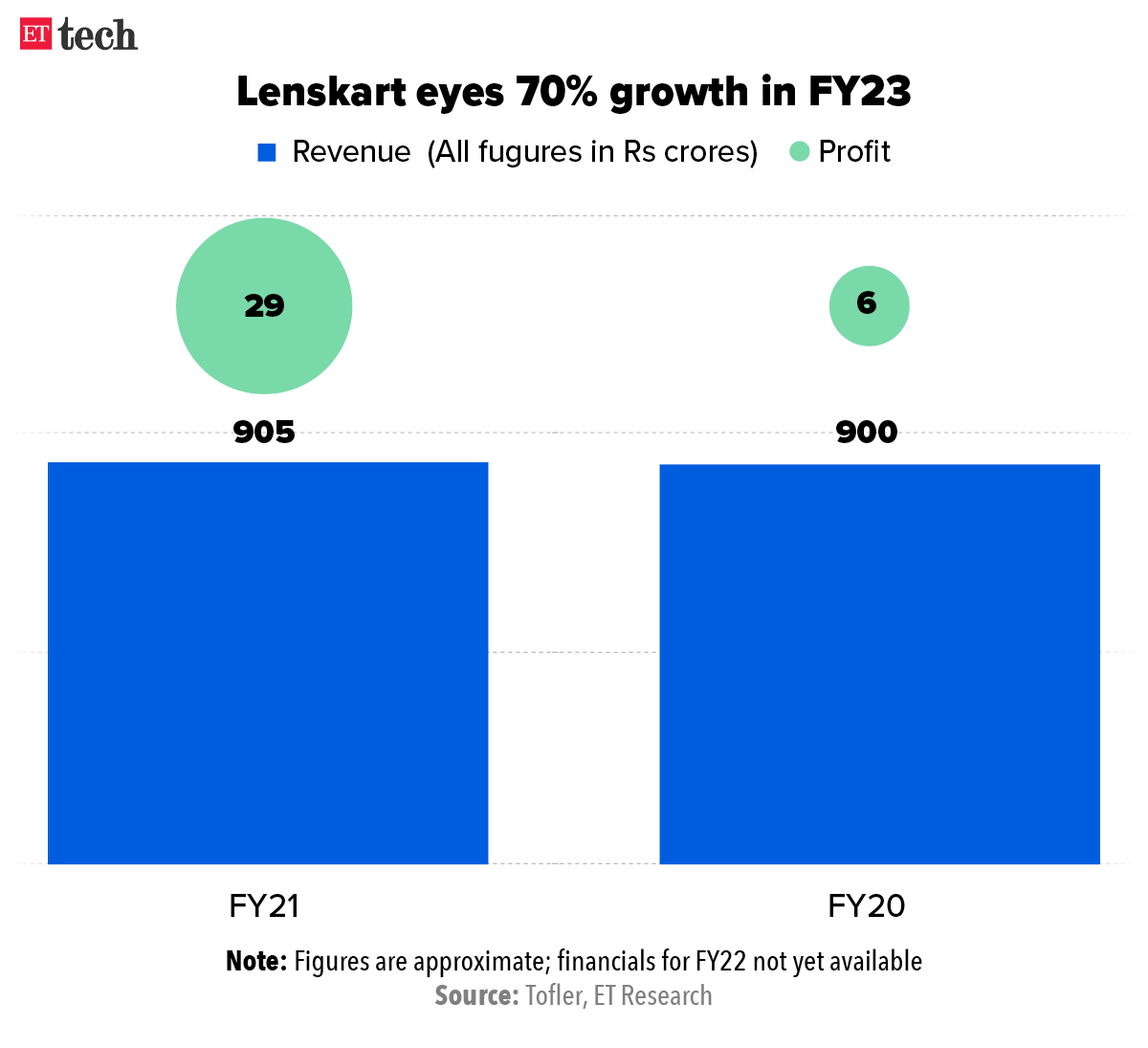

ETtechLenskart reported an operating revenue of over Rs 905 crore in financial year 2021 along with profits of nearly Rs 29 crore, as per regulatory filings.

Latest audited financials for fiscal 2022 are yet to be available with the Registrar of Companies (RoC).

In a statement last week, Lenskart said it grew by 65% year-on-year in 2021 and is on track to grow by over 50% in 2022, without providing specific numbers.

On June 30, Lenskart had closed a

$400 million acquisition of Japan’s Owndays to create one of the largest eyewear businesses in Asia. Bansal told ET at the time that the two firms combined have a revenue run rate of $650 million in the ongoing financial year with $400 million from Lenskart and the rest from Owndays.

According to Bansal the Owndays deal is a significant step in the company’s plan to build an Amazon or

like business group. Lenskart is also in the final stages of getting its manufacturing plant ready and is expected to play a major role in the supply chain to service orders from this unit. Bansal had said in 2020 that he was planning to invest around $50 million in this facility.

ETtech

ETtech

Global expansion

Going forward, Lenskart also plans to list other eyewear brands on its platform through Neso–the recently formed subsidiary– that will invest and acquire eyewear brands globally. The roll-up ecommerce arm of

Lenskart saw financing of $100 million in capital recently and appointed a new CEO Bjorn Bergstrom.

According to a person aware of the plans, Lenskart is looking to acquire a majority in eyewear brands with a revenue in the range of anywhere between $10-$50 million and then scale it with the founding team of those brands.

“Bjorn, the new CEO is meeting several brands and the team is evaluating the options. Most investments are expected to be a majority stake purchase but not a 100% buyout,” this person aware of Neso’s plans said. “It is still early days but the idea is to invest in solid brands and offer them the distribution of Lenskart, across channels.”