Credits: Giphy

Also in this letter:

■ ShareChat may pick up $300 million amid funding winter

■ SoftBank slashes executives’ pay after historic Vision Fund loss

■ China leading the world on EVs, renewable energy: Elon Musk

FrontRow lays off 145 employees, MPL to sack 100

Two startups announced layoffs on Monday.

Driving the news: Edtech firm FrontRow has laid off close to 145 full-time and contractual employees, almost 30% of its workforce, as funding dries up amid the market downturn.

Meanwhile, esports app Mobile Premier League (MPL) is laying off 100 people, or about 10% of its workforce, and is exiting Indonesia, the company wrote in an email to employees, which we have reviewed.

FrontRow: The company confirmed the layoffs to us, and said they were undertaken to increase efficiencies and lengthen the company’s runway. It said most of the layoffs were from the sales and business development teams.

“Given the market conditions, we’ve prioritised increasing efficiencies across the business both through higher automation and focussing on profitable channels,” the company said in a statement. ”To ensure that we achieve that goal… we had to take a few difficult prioritisation decisions over the past few weeks,” it added.

MPL: “The last few months have been insane. The philosophy of growth at all costs is now reversed. The market is now rewarding profitable growth over growth at all costs,” MPL cofounders Sai Srinivas and Shubh Malhotra said in an email to employees.

“It’s imperative that we as a company respond to this change and respond fast,” they added.

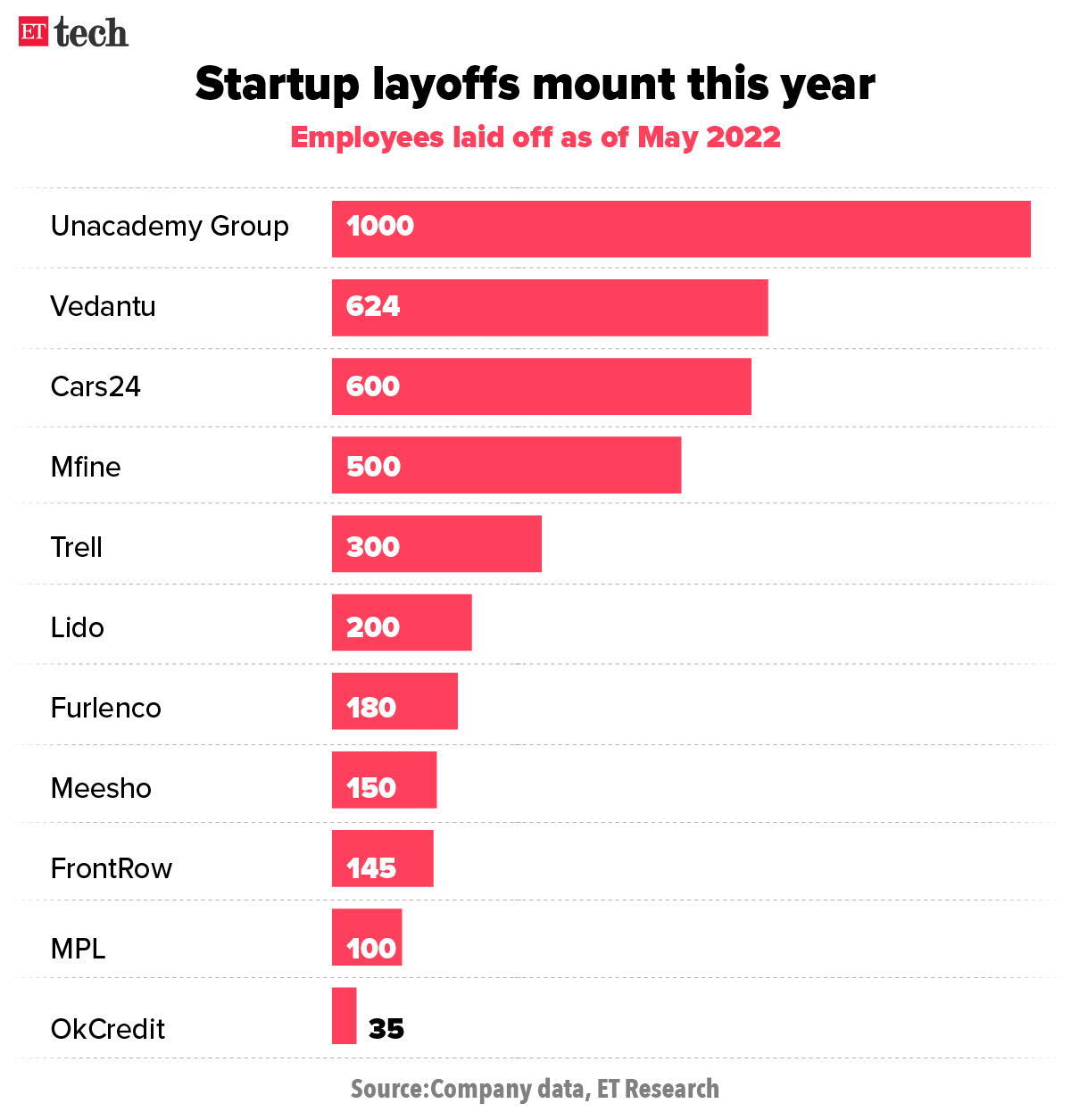

Edtech firms lead startup layoffs: After years of hypergrowth, edtech firms are bracing for a slowdown in funding and a few, including Unacademy and Vedantu, have laid off employees in recent months to cut costs and increase efficiencies. But edtech firms aren’t the only ones in a tight spot.

Other startups that have laid off employees in the past few months include social commerce platforms Trell and Meesho, used cars platform Cars24, and digital health platform Mfine.

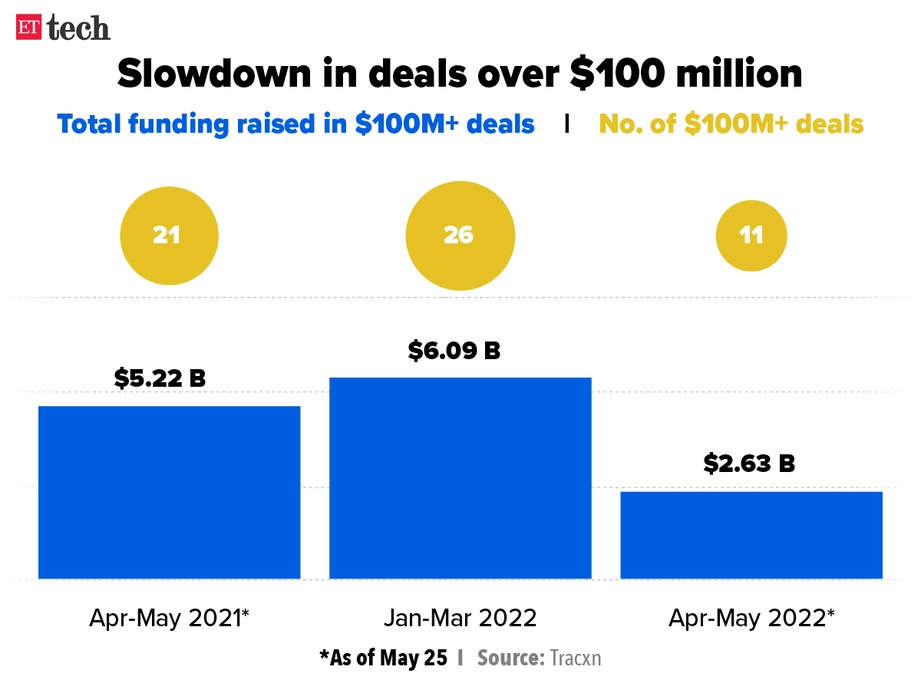

Funding freeze: We reported on Monday morning that big-ticket funding rounds have suffered a huge blow in the past two months. From April to May 16, there were only nine funding rounds of more than $100 million, totalling a little over $2 billion. There were 27 such deals in January-March, according to data sourced from New York-based analytics platform CB Insights.

ShareChat may pick up $300 million amid funding winter

Mohalla Tech, ShareChat’s parent company, has raised nearly $300 million in fresh funding from Google, Times Group and Singapore’s Temasek Holdings, valuing the social media firm at nearly $5 billion, Reuters reported, citing two sources involved in the deal discussions.

A deal is set to be announced as early as next week, the sources added.

This is Google’s second key investment in India’s short video space, having previously backed Josh, which competes with ShareChat’s sister firm Moj.

Musk stake? The firm also counts Twitter and Snap among its investors. If Tesla CEO Elon Musk’s bid to buy Twitter goes through, he will potentially have a stake of between 6% and 8% in ShareChat, the source added.

ShareChat was last valued at $3.7 billion in a $266 million funding round from investors including Alkeon Capital and Temasek.

Cheer amid gloom: Google’s investment, which comes in a bearish market for Indian startups, shows the appetite for the short video sector and the startup’s investment thesis, one of the sources said.

SoftBank slashes executives’ pay after historic Vision Fund loss

First it cut investments, and now SoftBank is cutting paycheques. After marking a stunning $26-billion loss in its Vision Fund unit, SoftBank Group has handed out steep pay cuts to its top executives.

Son still shines: The company’s founder and chief executive officer Masayoshi Son has kept his pay unchanged at 100 million yen (roughly $785,000), but four of the top six executives have seen their salaries drop, according to a company filing on Monday.

- Simon Segars, who stepped down as the head of the company’s chip unit Arm Ltd, earned 1.15 billion yen, and saw a pay cut of 40% from the previous year.

- Ronald Fisher, who also stepped down from his role leading the Vision Fund’s US arm in April, earned 126 million yen, marking an 86% cut.

- Ken Miyauchi, chief of SoftBank’s domestic telecom operation, made 539 million yen; chief financial officer Yoshimitsu Goto made 293 million yen – both had double-digit pay cuts.

- SoftBank did not disclose the compensations of former chief operating officer Marcelo Claure and Rajeev Misra, who heads Vision Fund.

Earlier this month, Son said that this year the group was likely to slash investments to half or even a quarter of its total in 2021.

Tech CEOs lose big: Meanwhile, the rout on Wall Street this year has led to a sharp drop in the net worth of tech magnates. Musk’s net worth has fallen $46 billion in the past five months, while Jeff Bezos and Mark Zuckerberg have ‘lost’ more than $53 billion each. Bill Gates has shed $15 billion in net worth while Larry Page has shed more than $26 billion.

Tweet of the day

China leading the world on EVs, renewable energy: Elon Musk

Though Tesla’s Gigafactory in Shanghai is currently facing logistics issues due to Covid-19 lockdowns, CEO Elon Musk seems to have complete faith in the potential of the country’s electric vehicle (EV) and renewable energy sectors.

Self-driving the news: Musk said on Monday that whatever the world thinks of China, the country is leading the race on EVs and renewable energy.

Earlier this month, the Tesla boss praised Chinese factory workers for putting in extreme hours while taking a shot at US workers. “[Chinese workers] won’t just be burning the midnight oil, they will be burning the 3am oil, they won’t even leave the factory type of thing, whereas in America people are trying to avoid going to work at all.”

Tesla India in limbo: Meanwhile, Tesla has been having a hard time with the Indian government over high import duties, with Musk asserting on Twitter that Tesla will not manufacture in India until it is allowed to first import, sell and service its cars in the country.

We reported on May 5 that Tesla’s team in India had been reassigned to work for the larger Asia-Pacific region after a two-year stalemate with the government.

FRL’s independent directors accuse Amazon of trying to destroy the firm

Amazon caused the downfall of Future Retail Limited (FRL) when it could not buy its assets on the cheap, placing FRL on the brink of bankruptcy, the independent directors of FRL have said.

Replying to a letter from Amazon, the directors said, “Your feigned concern over the state of affairs in FRL is a falsehood and an attempt to gloss over this inconvenient truth.”

They added, “Your letters are not motivated by the concern or interest of FRL stakeholders, but only as a self-serving act to destroy FRL at any cost”.

Last week, Amazon had accused the independent directors of Future Retail of facilitating a “fraudulent stratagem” to transfer its 835 stores to Mukesh Ambani’s Reliance Group.

In their reply, the directors wrote, “Your allegations that independent directors facilitated the stratagem and aided and abetted the so-called fraud to handover the stores to Reliance is false to your knowledge, and a narrative now being created by you to carry on your battle with Reliance using FRL as a pawn.”

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant and Aishwarya Dabhade in Mumbai. Graphics and illustrations by Rahul Awasthi.