Also in this letter:

■ What’s the biggest hurdle to India’s digital growth?

■ Razorpay marks international foray

■ SoftBank profit plummets 97%, Arm deal collapses

Investor’s lawyer on BharatPe board as battle with Grover heats up

Hi, Tarush here. It’s been more than a month since the expletive-laden audio clip allegedly featuring BharatPe cofounder Ashneer Grover was leaked on the internet. Nonetheless, there hasn’t yet been a dull moment in the saga, which has blown up into a full-fledged corporate battle between Grover and the company board.

Chances of an amicable solution, which already looked bleak at best, suffered another blow on Tuesday when news emerged that BharatPe’s early investor Insight Partners, which holds around 10% in the company, appointed its principal and deputy general counsel John Weinstein to the company board on February 1.

Timing is key: What’s interesting is that BharatPe’s board is being changed even as the audits it ordered – by Alvarez & Marsal (A&M) and PricewaterhouseCoopers (PwC) – are still ongoing. This begs the questions: Why are BharatPe’s investors increasing their representation on the board? What are they really scared of?

Grover has already called current chief executive Suhail Sameer “spineless” and accused him of dancing to the board’s tunes. Now with another investor-led board member, the differences between Grover and the board will only grow.

Ashneer against his own: Last week, ET reported that Grover had written to the company board asking it to oust Sameer from the board of directors. This morning, we broke the news on Grover looking for suitors for his 9.5% stake in BharatPe, potentially before the final probe findings are tabled before the board. This suggests that Grover is preparing his options to exit BharatPe if push comes to shove. Both sides have also lawyered up.

Many battles, one Ashneer: Grover has already picked several fights with BharatPe, including his altercation with CEO Sameer and a demand for a Rs 4,000 crore payout for his stake. But he, his wife Madhuri Jain, and members of her family face serious allegations of financial impropriety.

There’s also the Directorate General of GST Intelligence (DGGI) investigation from last year, which was launched after the agency searched BharatPe’s head office and found that around Rs 51 crore was paid to 30 non-existent vendors. The company’s reply was signed by Jain’s brother-in-law Deepak Jagdishram Gupta, who was responsible for procurements at the company.

With all this unfolding, the big question is: will Grover even make a comeback when his voluntary leave ends on April 1?

Livspace turns unicorn after raising $180 million

Home renovation platform Livspace said on Tuesday it crossed a valuation of $1 billion after raising $180 million in a late-stage funding round led by KKR & Co.

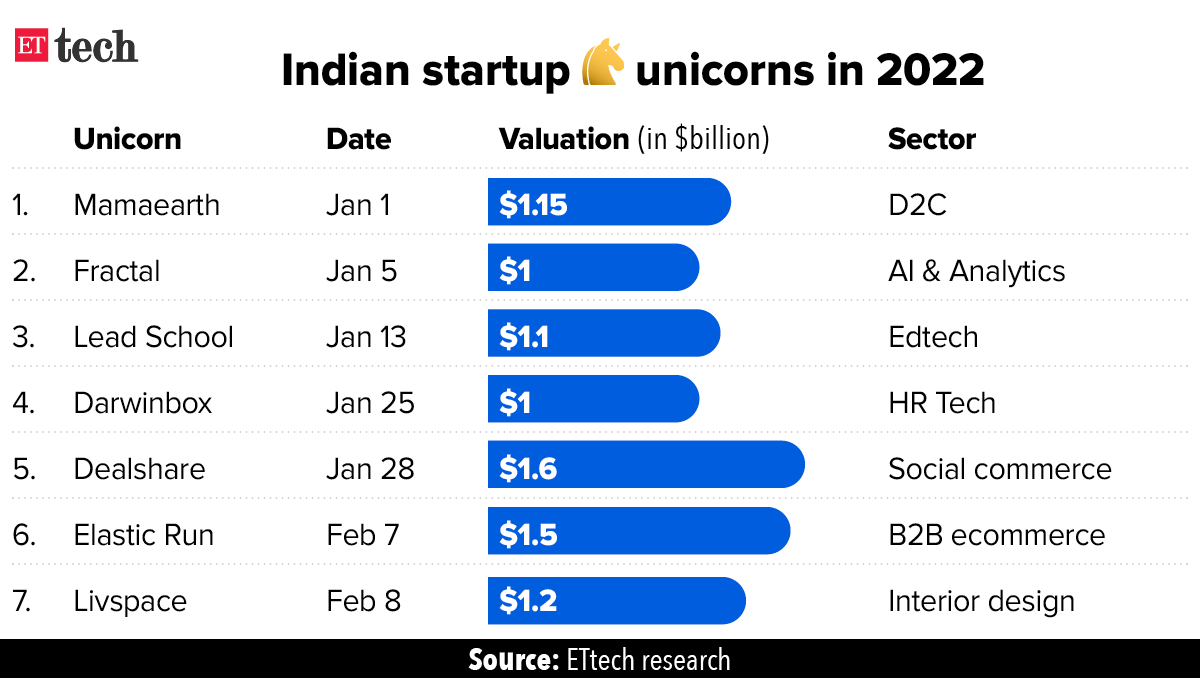

Seventh heaven: The home renovation platform is the 86th Indian startup unicorn, according to Venture Intelligence Unicorn Tracker.

It is also the seventh startup of 2022, and the second in two days. We reported yesterday that ElasticRun, a kirana-focused business-to-business ecommerce firm, had joined the club after raising $300 million in a round led by SoftBank Vision Fund II.

A record-breaking 2021 saw 43 new firms join the club.

Swedish retailer Ikea, and other early backers Jungle Ventures, Venturi Partners and Peugeot Investments, also invested in the round. Livspace, a Singapore-registered firm with significant operations in India, has raised about $450 million to date.

The deal is the latest in a series of investments in the consumer internet space for private equity firm KKR, which has previously bet on Indian eyewear retailer Lenskart, China’s digitised dairy startup Adopt A Cow, and small enterprises-focused platforms GrowSari and KiotViet in South East Asia.

Other done deals

- Pine Labs on Tuesday announced the acquisition of Mumbai-based online payments startup Qfix Infocomm for an undisclosed sum. The acquisition is in line with Pine Labs bolstering its play in the online payment gateway segment as it now looks to offer business software tools to direct-to-consumer (D2C) brands.

- Mintifi, a digital lending platform for distributors and retailers, has raised $40 million (roughly Rs 298.6 crore) as a part of a fresh funding round led by Norwest Venture Partners and Elevation Capital, the company said on Tuesday.

- Virtual events platform Airmeet has raised $35 million in its Series B round led by Prosus Ventures and Sistema Asia Fund. RingCentral Ventures, KDDI Open Innovation Fund, DG Daiwa Ventures and Nexxus Global also participated in the funding round, alongside existing investors Sequoia Capital India and Accel India.

- Influencer marketing platform Kofluence on Tuesday said it has raised $4 million (Rs 30 crore) in a funding round led by Nikhil Kamath, cofounder of Zerodha and True Beacon.

Tweet of the day

ETtech Opinion: Online threats are the biggest hurdle to India’s digital growth

India’s Union budget has set forth a vision to accelerate the country’s economic recovery and sustainable, long-term growth with a focus on infrastructure and digitalisation. The emphasis placed on innovation and technology in the areas of finance, healthcare, education, and agriculture make it clear that India’s march forward as a leading economy will continue to be fueled by its embrace of digital technologies.

But as we build for the future, we also need to emphasise our responsibility to ensure that people are protected from an evolving range of online risks — from phishing to financial fraud and misinformation. We know that new users, children, and older generations in particular are vulnerable to threats from bad actors. As we look to scale access to services and connectivity to everyone, this threat of online harm and safety will become the biggest hurdle to our progress.

This is our seatbelt moment – the seatbelt of online safety, and we need to act with urgency on this front. Last year, we at Google announced a significant ramp-up of our efforts in India and our commitment to protecting users against this multidimensional challenge.

Click here to read the full column by Sanjay Gupta, VP & country head, Google India

Razorpay marks international foray with Curlec acquisition

Razorpay, which provides digital payments and financial services to businesses, has picked up a majority stake in Malaysian fintech firm Curlec to expand into Southeast Asian markets.

It joins Indian fintech companies such as Pine Labs that have expanded to the region.

Details: The entire Curlec team will join Razorpay as a part of the deal. The Indian fintech firm declined to comment on the details of the acquisition but said it valued Curlec at roughly $20 million. Razorpay will also look to invest more in the firm and acquire a 100% stake in it over time.

What’s the plan? Razorpay is looking to expand its core payments services to Southeast Asian customers and launch recurring payments in new geographies. It is also expected to enable cross-border payments for Southeast Asian businesses with the acquisition.

Razorpay will take its payments stack to the Malaysian market first. Over time, it is expected to expand to other key Southeast Asian markets including Indonesia, Thailand and the Philippines.

Fintech IPO: Meanwhile, Razorpay’s fintech peer Navi Technologies is gearing up for an IPO later this year. The company, founded by Sachin Bansal has converted itself into a public entity, according to regulatory filings accessed by ET. It has also appointed bankers, including ICICI Securities and Axis Capital, to help float its IPO on the domestic exchanges, a source told us.

SoftBank profit plummets 97%, Arm deal collapses too

SoftBank Group reported a 97% drop in quarterly profit and the collapse of a deal worth up to $80 billion to sell chip designer Arm on Tuesday, turning up the pressure on the Japanese conglomerate to boost its sagging shares.

Details: The company reported a net profit of 29 billion yen ($251 million) in the October-December quarter versus a record 1.2 trillion yen a year earlier, when its tech portfolio rallied.

- SoftBank’s Vision Fund unit reported an investment gain of 111.5 billion yen ($967 million), down from 1.4 trillion yen a year earlier.

- Many SoftBank portfolio companies are trading below their listing price, with office-sharing firm WeWork, ride hailer Grab and used-car platform Auto1 all down last quarter.

- It has also been hurt by exposure to China with shares of Alibaba, in which it has a stake, dropping by a fifth last quarter.

Arm and a leg: SoftBank said it dropped the sale of chip designer Arm to US firm Nvidia because of regulatory hurdles, sources told Reuters. They added that Arm would plan for an IPO instead of the sale, which would have been worth as much as $80 billion.

The poor results and scrapped deal mark major setbacks for SoftBank’s fundraising plans as valuations again come under pressure from growing investor caution and China’s regulatory crackdown on tech firms.

“We were in the middle of a blizzard and the storm has not ended, it has got stronger,” Masayoshi Son, SoftBank’s founder and chief executive, said in a briefing after the results were announced.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.