With an end goal to check expansion, the Reserve Bank of India (RBI) raised the repo rate by 90 premise focuses throughout recent months. Thus, banks have begun expanding their lending rates, influencing both new and existing credit borrowers, who should now pay higher EMIs.

In July, top banks in India, for example, State Bank of India, HDFC Bank, and ICICI Bank, expanded their MCLR across different tenors.

Here is a correlation of the MCLR on credits of SBI, HDFC Bank, and ICICI Bank after the July hike.

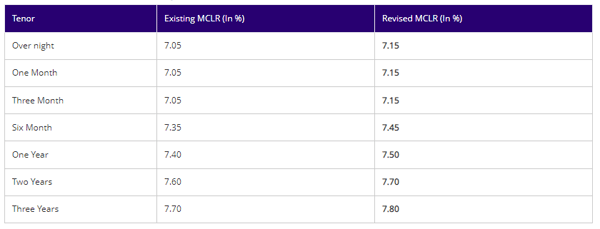

State Bank of India MCLR

The State Bank of India has raised its minor expense of marginal cost of funds-based lending rate(MCLR) by 10 premise focuses across all residencies. The new rates are material from July 15, 2022.

As indicated by the State Bank of India site, the bank has chosen to raise the MCLR for credits with a one-year development from the current 7.40% to 7.50%. The half year MCLR rate has been raised from 7.35 percent to 7.45 percent, while the two-year and three-year MCLR rates have been raised to 7.7 percent and 7.8 percent, individually.

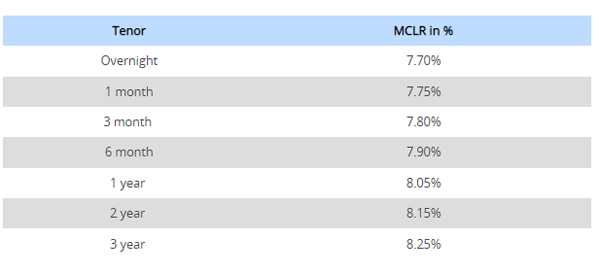

HDFC Bank MCLR

HDFC Bank has expanded its minor expense of assets based loaning rate (MCLR) on credits of all developments by 20 premise focuses (100 premise focuses = 1%), starting July 7, 2022.

As indicated by the HDFC Bank site,, the short-term MCLR is currently 7.70 percent, up from 7.50 percent beforehand. The MCLR for one month is 7.75 percent. The three-month and half year MCLRs are 7.80 percent and 7.90 percent, separately. The one-year MCLR, which is associated with numerous shopper credits, will presently be 8.05 percent, the two-year MCLR will be 8.15 percent, and the three-year MCLR will be 8.25 percent.

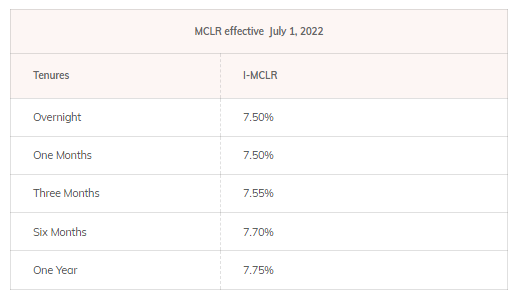

ICICI Bank MCLR

ICICI Bank has raised its marginal cost of funds-based lending rate(MCLR) across all residencies by 20 premise focuses. One premise point rises to 0.01 percent. The higher loan costs will produce results on July 1, 2022.

As indicated by the ICICI Bank site, the short-term MCLR rate has been expanded to 7.50 percent from 7.30 percent. The one-month, and three-month MCLRs have been expanded to 7.50 percent, and 7.55 percent, separately.

What is MCLR?

The MCLR is the minimum interest rate a bank can charge for a loan. Banks are allowed to give any class of credit on a fixed or drifting lending rate under the MCLR system. In this way, for all credits connected to that benchmark, the bank won’t lend at a rate that is lower than MCLR of that specific development.

As per the PNB site, “The philosophy utilizes the minor expense or most recent expense conditions reflected in the loan cost given by the banks for acquiring assets (from deposits and getting) while at the same time setting their lending rate. This implies that the interest rate given by a bank for deposits and getting are the unequivocal variables in the estimation of MCLR.”