Also in this letter:

- SBI invests $20 million in Pine Labs

- UPI transactions scale new peak in December

- Key moments from the Elizabeth Holmes trial

Flipkart’s businesses register strong revenue growth in FY21

Flipkart India, the group’s wholesale unit, reported revenue growth of 25% in FY21, while Flipkart Internet, the marketplace arm, grew 32%.

- Flipkart Internet clocked an operational revenue of Rs 7,840 crore for the period under review but its losses increased by 49% to Rs 2,881 crore.

- Flipkart India meanwhile saw a 25% increase in revenue to Rs 42,941 crore in FY21, while its losses fell by 22% to Rs 2,445 crore.

Flipkart Internet generated 36% of its revenue from marketplace fees while 31% came from offering logistics services. Payment gateway services contributed 11% to revenue in FY21 while advertising and other services had a share of around 18%, the filings showed.

Structure: Ecommerce major Flipkart’s parent company is registered in Singapore and it operates in India through a number of units. Its core online retail business is under Flipkart Internet, and Flipkart India is the wholesale unit, which largely sells and buys goods in bulk to and from suppliers and sellers.

Flipkart Internet generates revenue through marketplace fees, which is a combination of fees it charges from sellers for providing its platform, payment gateway services, shipping, and other services. Flipkart also has other units for payments and logistics.

Focus areas: CEO Kaylan Krishnamurthy told ET in an interview on Monday that Flipkart plans to scale verticals like grocery and hyperlocal deliveries along with its value-focused platform Shopsy.

He said the Bengaluru-based company, majority owned by US-based Walmart, will double down on these bets, and push healthcare and travel, in which it made strategic investments last year, instead of diversifying further this year. The last two years have been primarily about launching new products, but in 2022 “we will scale all of these businesses”, he said. “Shopsy, grocery, travel and healthcare, these are big and we made massive investments … We want to really get these to the next level of growth and pull in customer adoption over the next 12-18 months.”

State Bank of India invests $20 million in Pine Labs

Pine Labs CEO Amrish Rau

Online payments and merchant solutions firm Pine Labs said State Bank of India (SBI) has invested $20 million in the company, but did not share any further details of the investment.

In a statement, Pine Labs said it would invest in scaling its new product Plural, a payment gateway.

Raking it in: IPO-bound Pine Labs raised around $700 million across multiple tranches last year and was last valued at $3.5 billion.

We reported in December that it was in advanced stages of talks to raise at least $100 million from Falcon Edge and that the total funding round could increase to $200 million.

US IPO plan: Pine Labs, best known for its offline merchant payments tool, is also looking to list in the US in the first half of 2022, we reported last month.

“In the past year, several marquee investors have placed their trust in our business model and growth momentum and that is a gratifying feeling. This association with SBI is a personally satisfying experience as I had started my career selling financial services technology to SBI,” said Amrish Rau, chief executive of Pine Labs.

Curefoods picks up five more brands: Meanwhile Curefoods, a cloud kitchen startup, has acquired five more brands to strengthen its direct-to-consumer play and create a house of brands. The company now has more than 20 brands in its portfolio and will look to increase this to 25 by the middle of the year.

Ninjacart’s Rs 100-crore stock option buyback: Ninjacart, a fresh produce supply chain startup, said that it has executed an ESOP buyback of Rs 100 crore.

Both current and former employees with vested ESOPs as of December 2021 are eligible to participate in the buyback, with the option to sell all of their vested ESOPs. This is the company’s second stock option buyback—the first one was conducted in 2019.

Also Read: Flipkart tops Indian tech Esops list with Rs 17,000 crore pool

Tweet of the day

ETtech Done Deals

■ NewQuest Capital Partners and existing investor PremjiInvest have infused Rs 507 crore in iD Fresh Food. Early investor Helion Ventures made an exit with a 10X return.

■ Geniemode, a business-to-business cross-border e-commerce startup, has picked up $7 million in a Series A funding round led by Info Edge Ventures, the investment arm of Info Edge.

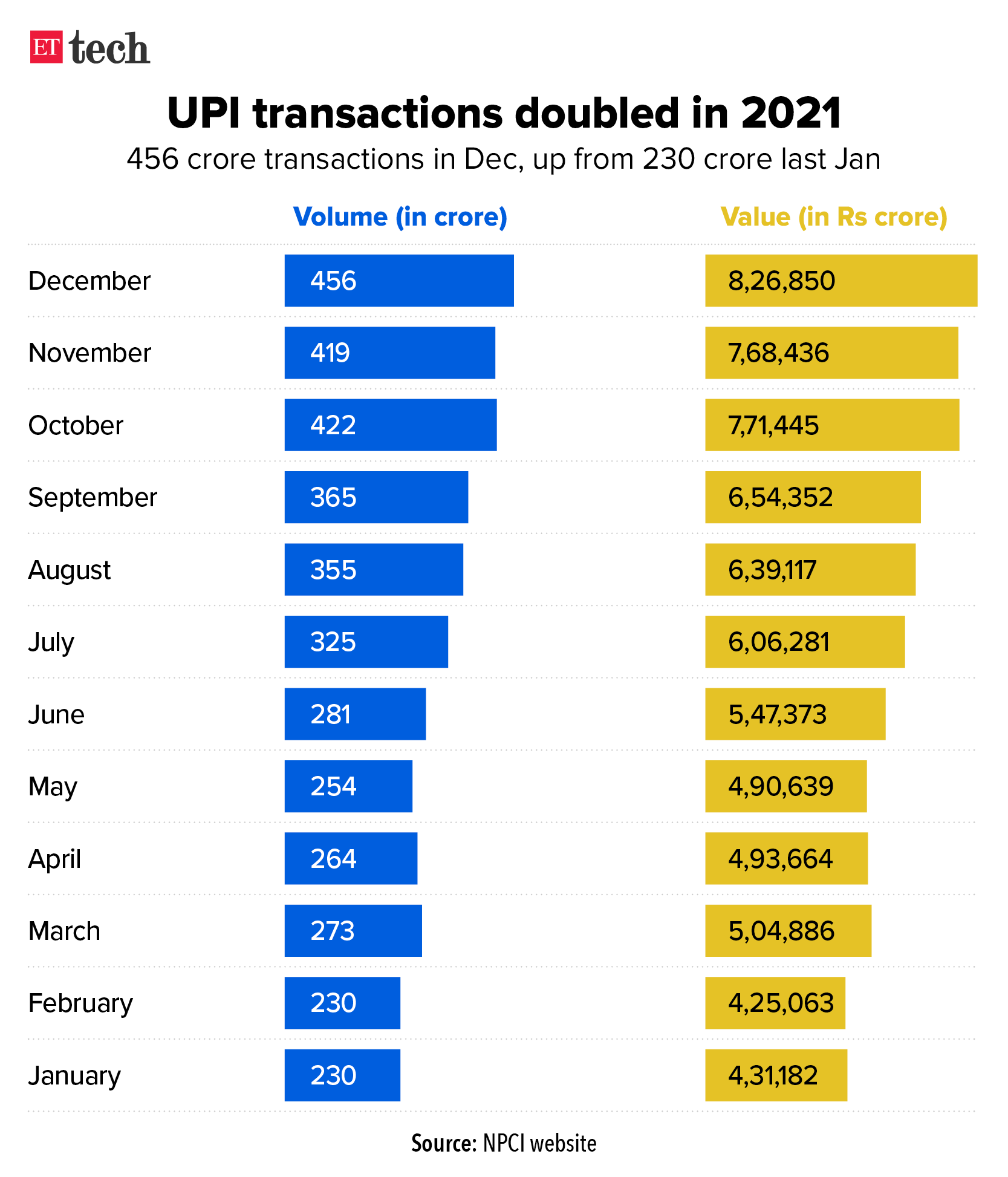

UPI transactions scale new peak in December 2021

Transactions made using the Unified Payments Interface (UPI) scaled a new peak in December 2021, surpassing the previous record set in October, when the value of UPI transactions crossed $100 billion for the first time.

- In fact, the volume and value of monthly UPI transactions have nearly doubled since the start of 2021.

According to data put out by the National Payments Corporation of India, 456 crore UPI transactions amounting to about Rs 8.27 crore were conducted last month. That compares with 422 crore transactions worth about Rs 7.71 lakh crore in October, and 230 crore transactions worth Rs 4.31 lakh crore last January.

UPI transactions hit a peak in October on the back of the festive season sales. There was a marginal dip in November before a surge in December. In all of 2021, more than 3,800 crore UPI transactions amounting to Rs 73 lakh crore were conducted.

NPCI now expects the UPI platform to hit a billion transactions per day after the Reserve Bank of India enables the use of UPI wallets for low-value offline transactions. A framework for this was released by the central bank on Monday. This will allow payments to be made without putting pressure on the core banking systems at lenders.

Theranos verdict: Key moments from the Elizabeth Holmes trial

Theranos founder Elizabeth Holmes

A jury in the US has found Theranos founder Elizabeth Holmes guilty of defrauding investors in the blood testing startup, convicting her on four of 11 counts.

Prosecutors said Holmes, 37, swindled private investors between 2010 and 2015 by convincing them that Theranos’ small machines could run a range of tests on just a single drop of blood from a finger prick.

She was convicted of investor fraud and conspiracy, but acquitted on three counts of defrauding patients who paid for tests from Theranos, and a related conspiracy charge. Holmes rose to fame after founding Theranos in 2003 at the age of 19. She attracted both high-profile wealthy investors and board members including media mogul Rupert Murdoch.

Here are the key moments from her trial.

Former Secretary of Defense testifies: Arguably the most high-profile person to take the stand, other than Holmes, was James Mattis, a retired four-star general who served as Secretary of Defense under Donald Trump and sat on Theranos’ board from 2013 to 2016. The prosecution said bringing highly credible people such as Mattis on board was one of the ways in which Holmes used “borrowed credibility” to perpetuate the fraud.

Mattis said he was interested in the device’s possible military applications because he thought it could perform the range of blood tests the company claimed it could. “I would not have been interested in it were it not,” he said.

Holmes takes the stand: One of the biggest questions around the trial was whether Holmes would take the stand in her own defence. In the end, she testified for nearly 24 hours over seven court days.

While Holmes was largely calm, even smiling at times, she became emotional at several points while talking about her ex-boyfriend Ramesh ‘Sunny’ Balwani, Theranos’ former president and COO. Balwani, who faces the same charges as Holmes and has pleaded not guilty, is set to be tried soon.

Click here for the full report.

Also Read: Elizabeth Holmes and the story of Theranos

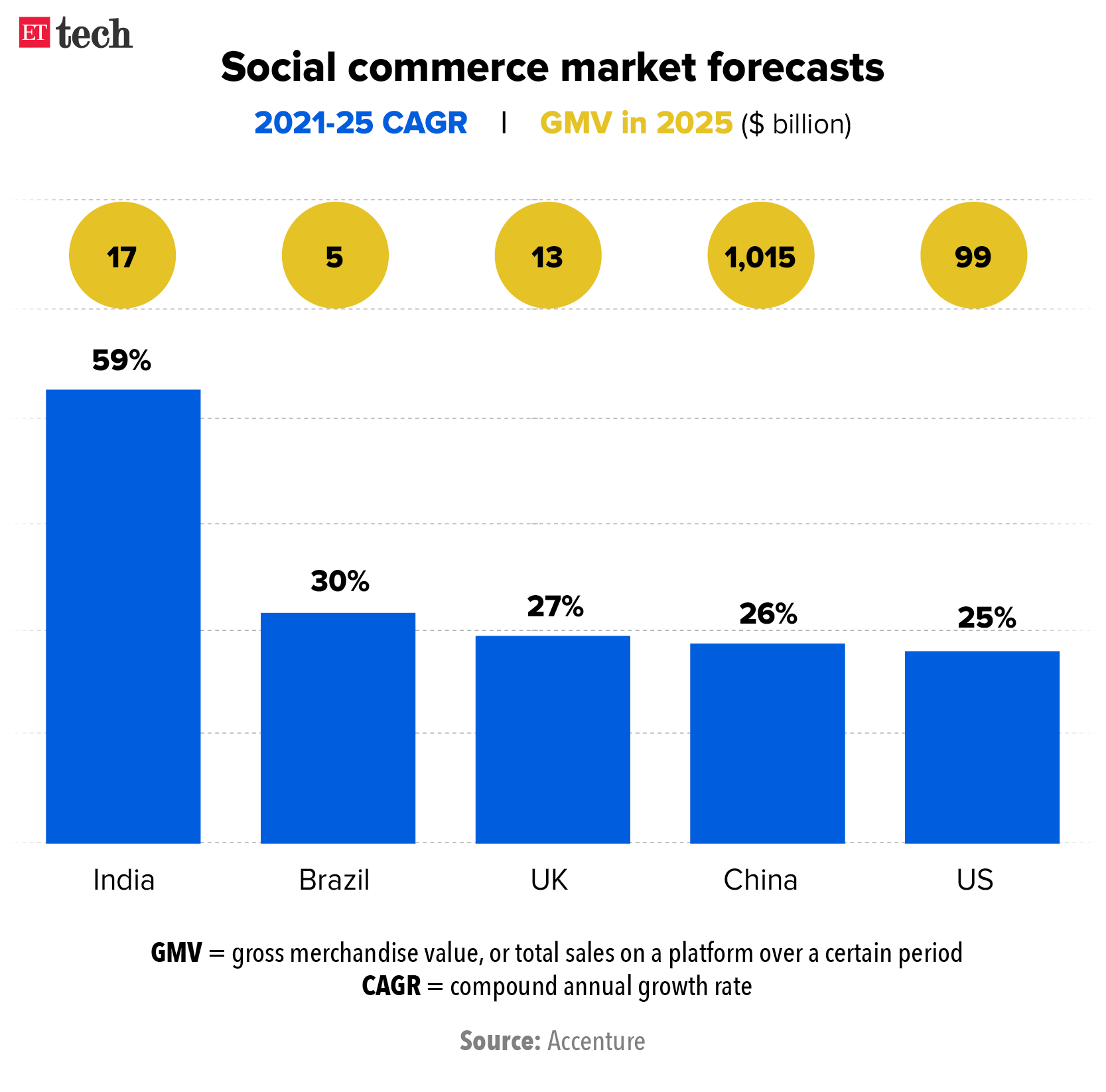

Social commerce market will hit $1.2 trillion by by 2025: Accenture

The global social commerce market will grow two-and-a-half times from $492 billion in 2021 to $1.2 trillion by 2025, with India’s market growing the fastest over this period, according to a report by consulting firm Accenture. That’s three times faster than traditional ecommerce is expected to grow, the report said. By 2025, social commerce is expected to account for 17% of all ecommerce spending, up to 10% currently, it added.

Social commerce refers to transactions that take place entirely within the context of a social media platform, meaning that click-through ads on social media platforms that take users to a brand’s own website don’t qualify.

Titled ‘Why shopping’s set for a social revolution’, the report was based on an online survey of 10,053 social media users in China, India, Brazil, the US and the UK from August 12 to September 3, 2021. It also involved in-depth interviews with shoppers and sellers from those five markets in May and June.

Fastest growth in India: The report said that though China would remain the most advanced market both in size and maturity, the highest growth would be seen in developing markets such as India and Brazil. “In these markets, social commerce has the potential to leapfrog ecommerce as new business models allow for greater participation in digital commerce across all spectrums of society,” it said.

Accenture said that India’s social commerce market is expected to grow at a 59% compound annual growth rate (CAGR) to $17 billion in gross merchandise value (GMV) by 2025. Brazil’s market will grow at 30% CAGR to $5 billion over the same period. China’s social commerce market will grow at 26% to more than $1 trillion, while the US market will grow at 25% to just under $100 billion, less than a 10th of China’s.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.