When you bought something from an e-commerce site like Flipkart or Amazon, you must have noticed that there was a free EMI option. The majority of these deals are on expensive items, smartphones, and electronic goods.

You can purchase the item you want and pay for it over three, six, or nine months with a free EMI. Because you are not required to pay any additional interest on the EMI, this is distinct from standard EMIs. However, given that the Reserve Bank of India does not permit loans with zero interest rates, how does this free EMI function?

Deepesh Raghaw, a SEBI Registered Investment Adviser (RIA), stated on his Twitter account that the solution lies in the seller offering an upfront discount. Raghaw stated that when a customer selects a no-cost EMI and uses a credit card to pay, two things take place to facilitate the transaction.

According to Raghaw, the credit card facilitates a loan for the discounted amount at specific interest rates that exactly equal the total price of the good. First, the merchant offers an invisible discount based on the duration of the loan.

Say, on the off chance that a thing was evaluated at Rs 30,000 and the client decides on half year EMIs, he will be expected to pay Rs 5000 every month. The customer purchases the item and repays it in six installments. He doesn’t care about price fluctuations. Yet, what occurs behind the scenes isn’t known to him.

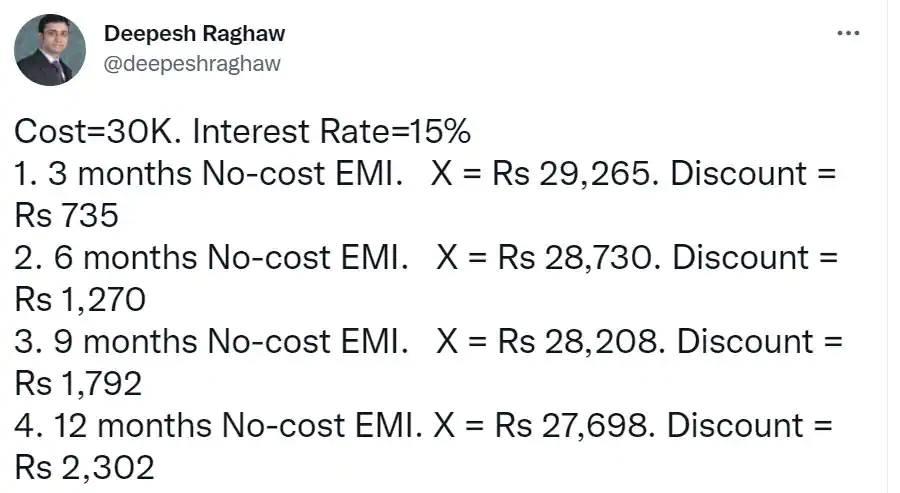

Let’s say the credit card or bank lends the money at 15% per year. First, they find the discounted price, which, when charged at 15% per year, equals Rs 30,000 at the end of six months (Rs 5000 per month, including the principal and interest rate).The amount in this instance is Rs 28,730.Thus, the loan amount would be Rs 28,730, but the merchant will receive a discount of Rs 1270 (Rs 30,000-Rs 28,730) because the item was priced at Rs 30,000.The seller and the bank are involved in this.

Thus, the product was actually sold for Rs 28,730, and the bank received Rs 1,270 in interest. The seller and the merchant each receive a portion of the customer’s payment of Rs 30,000.Concerning the tenure, why only three, six, or nine months?

According to Deepesh Raghaw, the seller will be required to pay a greater discount if the tenure is extended because the interest on the amount will be higher. In this way, the vender first saves the most extreme markdown he/she can endure on a specific item and afterward banks conclude their financing cost to get the last estimation sync with the cost at which a purchaser gets the item.

no cost emi “The discount that allows us to provide you with the experience of no-cost EMI grows as the loan term grows. The discount that the retailer can offer is limited. The loan term is automatically restricted as a result. You now understand why free EMI terms typically range from three to nine months. “Usually three to six months,” Raghaw stated.

He stated that despite the scheme’s name, it is not actually a zero-cost offer. Every month, interest is charged with GST. To close the loan in this example, you paid Rs 30,229.GST of 229 rupees raises costs annually by 2.6% from 0%.As a result, you pay a little bit more than the purchase price. As a result, it’s not really a free EMI,” he stated.