Also in this letter:

■ Lumikai’s Fund II gets $50 million infusion

■ Accenture’s Q3 results

■ Zuckerberg ready to fight Musk in a cage match

More trouble for Byju’s as key board members, auditors resign

Byju’s directors (L to R) GV Ravishankar, MD at Peak XV Partners, Russell Dreisenstock of Prosus and Vivian Wu of Chan Zuckerberg Initiative

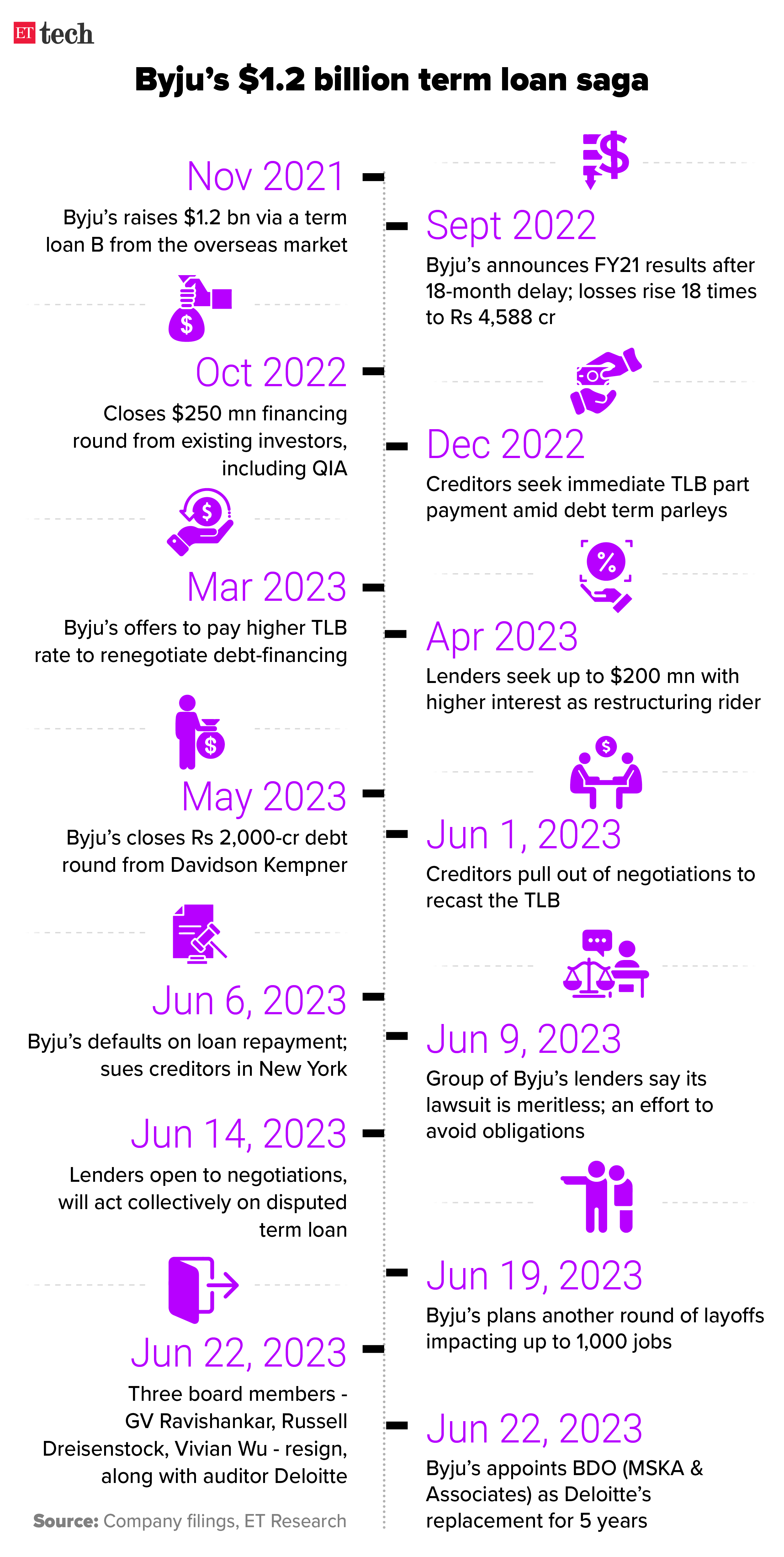

Edtech major Byju’s has been hit by a double whammy as three of its directors and its auditor Deloitte Haskins have resigned. GV Ravishankar, managing director at Peak XV Partners, Russell Dreisenstock of Prosus and Vivian Wu of Chan Zuckerberg have resigned from the company’s board, sources told ETtech. Byju’s however said reports about the directors’ resignations are speculative. The company’s statutory auditor, too, sent in its resignation today, citing delays by the company in submitting its financial statements for audit.

Also read | Byju’s and the debt trap haunting Indian tech startups

Timing: The exits couldn’t have come at a worse time for the Bengaluru-based edtech, which has been struggling with court cases, loan defaults, and a much-delayed filing of its financial results for the year ended March 31, 2022.

Also read | Byju’s begins another round of layoffs; to impact 500-1,000 employees

Quote, unquote: “All the three investors have collectively decided to resign…There are ongoing discussions between the company and the shareholders,” said a person in the know of the matter.

Lost ‘significant influence’: Last year, Prosus said it had lost ‘significant influence’ over Byju’s as its stake was diluted to just below 10% in the firm. As of November 2022, it held about 9.67% in the edtech firm, which is facing multiple challenges currently, including trying to finalise new terms for its $1.2 billion term loan B.

Auditor Deloitte Haskins resigns: Deloitte Haskins, the statutory auditors of Byju’s, tendered its resignation on Thursday with immediate effect citing a long delay by the latter in furnishing audited financial statements for the year ended March 31, 2022.

New statutory auditor: Byju’s said it had appointed BDO (MSKA & Associates) as its statutory auditors for a period of five years commencing from FY22. Further, BDO will cover the holding company Think and Learn Pvt Ltd, its material subsidiaries such as Aakash Education Services Limited, and the overall group consolidated results.

Timeline: Byju’s $1.2 billion loan case

Also read | Byju’s lenders scrap talks to restructure $1.2 billion loan

Byju’s versus lenders: Byju’s is currently renegotiating the terms of its $1.2 billion term loan B with lenders. Both sides have filed suits against each other. While lenders such as Glas Trust Company are pursuing legal action against the edtech firm in Delaware, Byju’s has filed a suit against hedge fund Redwood and its entities in New York, against their demand for “accelerated repayment”.

PM Modi exhorts Micron to boost chipmaking in India

.jpg)

Prime Minister Narendra Modi with Micron CEO Sanjay Mehrotra during a meeting, in Washington, USA

Prime Minister Narendra Modi has invited American chipmaker Micron Tech, exhorting it to be a force multiplier in India’s efforts to become a semiconductor hub. “The prime minister invited Micron Technology to boost semiconductor manufacturing in India,” the external affairs ministry said in a statement. Partnership in the semiconductor sector is among the main goals of the initiative on Critical and Emerging Technology (iCET) framework agreed upon by the US and India.

Make in India push: This comes a day after the cabinet sanctioned production-linked incentives (PLIs) worth Rs 11,000 crore ($1.34 billion) for the Micron plant, which is slated to be constructed in Gujarat.

Modi, who is visiting the US at the invitation of President Joe Biden and First Lady Jill Biden, also invited semiconductor equipment maker Applied Materials Inc. to India for the development of process technology and advanced packaging capabilities.

Quote unquote: After meeting Modi, Micron Technology CEO Sanjay Mehrotra said, “We look forward to greater opportunities in India. Micron is a global leader in memory and storage, and we are a supplier for memory and storage in all end markets, from data centres, to smartphones to PCs, and today really fuelling the AI engine as well.”

Tell me more: Micron’s India venture aligns with the White House’s efforts to encourage US chip companies to invest in the country. Global companies are exploring India as a viable investment destination for semiconductors.

The Indian semiconductor market was valued at $27.2 billion in 2021 and is expected to grow at a healthy CAGR of nearly 19% to reach $64 billion in 2026.

Gaming focused VC Lumikai unveils Fund II, eyes $50 million corpus

From left: Lumikai’s founding general partners Justin Shriram Keeling and Salone Sehgal

Indian gaming-focused venture capital fund Lumikai has launched its second fund targeting $50 million, for investments in pre-seed to Series A firms in the gaming and media sectors.

Details: The New Delhi-based venture firm, which has so far tied up commitments worth roughly half of the fund corpus, expects to close the fund over the next 6 to 12 months, it said on Thursday. The so-called Fund II follows Lumikai’s first fund that raised $40 million in 2020, a year after its inception. It has backed startups like Loco, Eloelo, and Bombay Play previously.

Fund II includes limited partners (LPs) – who invest in venture funds—like South Korean gaming behemoth Krafton, listed Indian gaming firm Nazara, and Napster CEO Jon Vlassopulos.

Quote, unquote: “We have already deployed 75% of the funds from Fund I, and both the funds will have a maturity horizon of ten years,” said Salone Sehgal, founding general partner at Lumikai. The firm is already in term-sheet stage conversations with three investee firms from the second fund, she added.

Portfolio: Lumikai has mostly stuck to investments in the casual and other non-real money gaming (RMG) sectors, besides one investment in a firm called Buystars. “I think the regulatory environment in RMG has only started clearing up now… we are a diversified player so we won’t discount investments in RMG entirely,” said Justin Shriram Keeling, founding general partner at Lumikai.

Challenge Accepted: Mark Zuckerberg ready to fight Elon Musk in a cage match

Slightly-built he may be, but the Meta chief is game for a fight. Mark Zuckerberg says he is ready to take on beefy Tesla-SpaceX-Twitter boss Elon Musk in a cage match, accepting a challenge by the latter.

Musk’s challenge: Recently, 51-year-old Musk had tweeted that he would be “up for a cage fight” with Zuckerberg. The 39-year-old Meta CEO, who is an aspiring mixed martial arts (MMA) fighter, shot back by posting a screenshot of Musk’s tweet on Instagram, with the caption: “send me location.”

Also read | ChatGPT creator OpenAI lobbied EU for less stringent rules: report

The catalyst? The challenge from Musk came in the wake of reports that Meta is planning a new ‘text sharing’ social media network. According to a report by The Verge, Musk has been “taunting” Zuckerberg on Twitter, which led to Meta chief product officer Chris Cox telling employees the company thinks creators want a version of Twitter that is “sanely run”. Cox reportedly said coding was underway for the platform.

Advantage, Zuckerberg? Zuckerberg recently won a jiu-jitsu tournament. He also claims to have completed the “Murph Challenge” workout in 39 minutes and 58 seconds, running a mile, completing 100 pull-ups, 200 press-ups and 300 squats, before running another mile, all while wearing a 9 kg weighted vest. Last month, Zuckerberg competed in his first Brazilian jiu-jitsu event, where he defeated an Uber engineer and won two medals.

Accenture’s revenue forecast disappoints as IT spending weakness persists

IT consulting firm on Thursday Accenture forecast fourth-quarter revenue below Wall Street estimates on worries that rising economic uncertainty will keep IT budgets tight and prevent businesses from signing fresh contracts. Accenture forecast current-quarter revenue in the range of $15.75 billion to $16.35 billion.

Weak demand: Demand for IT services in the United States remains weak and might be impacted further after US Federal Reserve Chairman Jerome Powell’s congressional testimony on Wednesday hinted at the likelihood of further interest rate hikes.

Details: Cognizant Technology Solutions last month said it faced pressure in signing smaller contracts due to softer discretionary spending. Tata Consultancy Services said in April that US recovery hadn’t materialised as expected and had, in fact, worsened.

Q3 performance: Revenue for the quarter ended May 31 was $16.56 billion, in line with estimates. Excluding items, Accenture earned $3.19 per share compared to estimates of $3.04.

Layoffs: Accenture said in March it would lay off 19,000 employees. Its workforce jumped about 16% and 23% in fiscals 2022 and 2021 respectively and it said it aims to have cost savings of $1.5 billion through fiscal 2024.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra in Mumbai and Erick Massey in New Delhi. Graphics and illustrations by Rahul Awasthi.