Also in this letter:

■ TikTok owner Bytedance in talks to relaunch in India

■ NBFCs, venture debt firms eye supply chain finance

■ Delhivery can grow without compromising on profits: CEO

Big Four emerge as top poachers of IT talent

Top Indian IT service providers have become the biggest poaching ground for the Big Four accounting and consultancy firms, KPMG, Deloitte, PwC, and EY, which are fuelling record attrition rates at these firms, data exclusively sourced by ET showed.

Over 15% of the net addition by the Big Four in FY22 are from the top five IT companies.

Experts said better pay and the addition of global companies to their CVs cause employees to choose the Big Four firms, which are expanding their presence in the country to strengthen their tech offerings and platforms related to tax and accounting.

Deloitte and EY hired more employees on a net basis in the previous fiscal year, and the two companies are among the top recruiters of IT talent laterally, according to data shared by specialist staffing firm Xpheno.

A study of talent movement at the Big Four showed a majority of the top five places they hired from last year were IT companies.

But why? With the infusion of technology in auditing, data analytics, consulting and forensic services that these companies provide, their demand for technology professionals has grown manifold.

Better pay, too: The Big Four and consulting companies are ranked better in terms of compensation, offering salaries and annual increases in line with global standards, according to human resource experts.

Back-to-office strategies: For employees that haven’t been poached by the Big Four, India’s top IT firms face a different challenge – getting them back to offices. A large portion of their employees have become used to working from home and are now reluctant to return.

Some firms have rolled out interesting strategies to encourage more people to do so, such as inviting employees for weekly meetings at a pub or a restaurant, or creating workplaces where new parents can bring their children.

TikTok owner Bytedance in talks to relaunch in India

Bytedance, parent company of TikTok, is looking to strike a new partnership in India and hire former and new employees as it seeks to re-enter one of the world’s largest internet markets, several sources told us.

Hiranandani talks: The Chinese internet giant, which shut down Indian operations in 2021 following the ban on TikTok, is in initial talks with realty major Hiranandani Group for a partnership, the sources said.

The Mumbai-based group, which runs data centre operations under Yotta Infrastructure Solutions, recently launched a technology-led consumer services arm – Tez Platforms — and expects to invest up to Rs 3,500 crore in the new business over the next two to three years.

Talks between the two groups are at an exploratory stage, sources said, adding that union government officials have been informally sounded out about the plans.

A senior government official told us, “There have been no formal talks with us yet. But we have been informed of the plans. As and when they come to us for approvals, we will examine their request.”

Data storage: A second government official aware of the developments noted that when Chinese apps were banned in June 2020, one of the major issues was the uncertainty of where the user data was being stored and processed by these companies.

“Critical user data should not be stored outside India. All apps and websites have either made provisions to store data locally or are making necessary changes to their data storage and processing policies. If they (Tiktok) come back, they will have to follow these norms,” the official said.

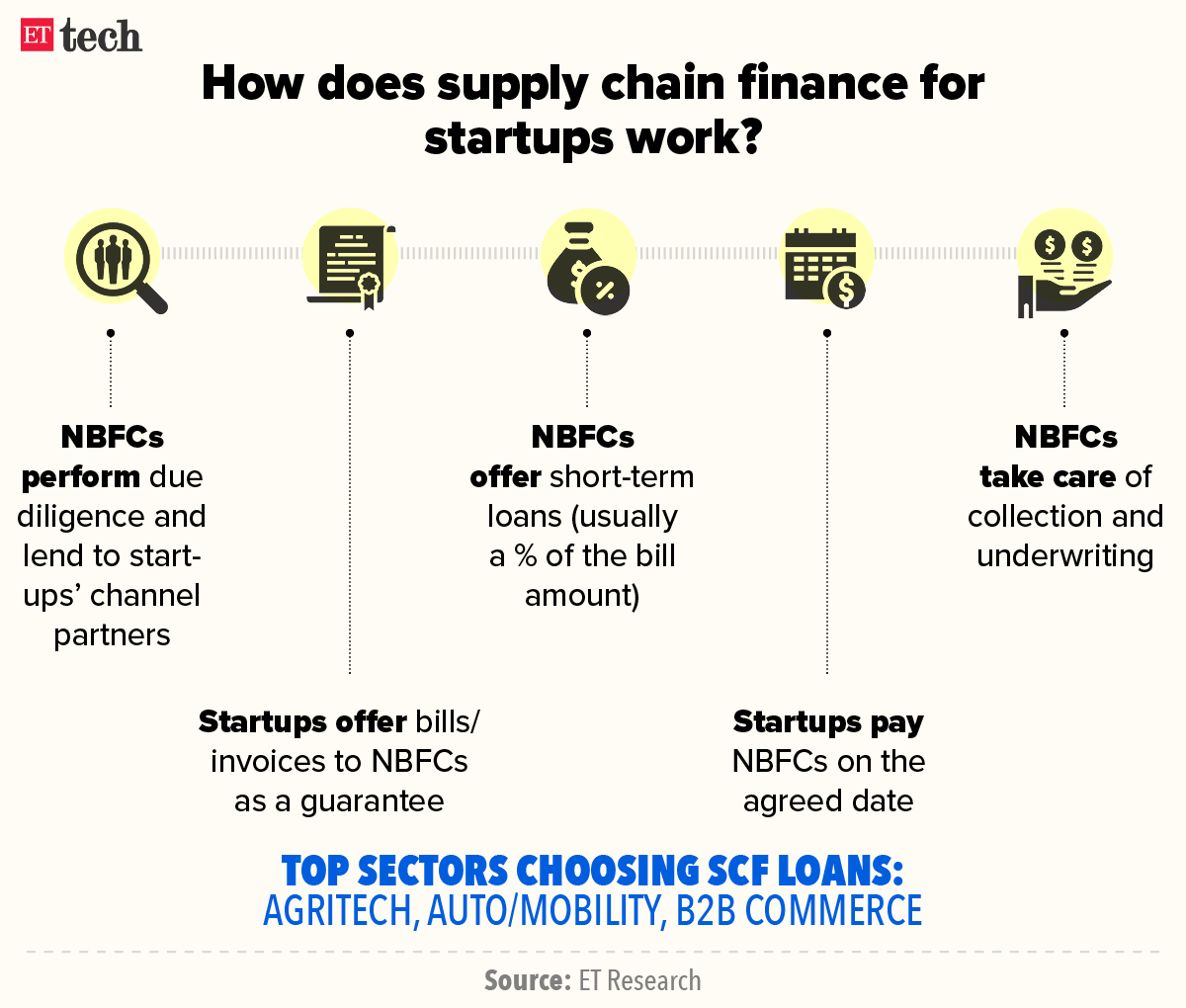

Liquidity crunch prompts NBFCs, venture debt firms to eye supply chain finance

Non-banking financial companies (NBFCs) and venture debt firms are getting into the business of supply chain finance (SCF).

Why? The move comes amid a liquidity squeeze following the Reserve Bank of India’s (RBI) decision to hike interest rates, even as startups are seeing increased customer stickiness.

On May 4, the RBI hiked its key repo rate by 40 basis points (bps) to curb record-high inflation. The step, analysts said, would suck out around $5 billion from the system. In its June review of the monetary policy, RBI is expected to further increase rates.

What is SCF? Supply chain finance is a lending solution provided to suppliers and other channel partners of a startup to optimise cash flows.

“We are building a solution that will address the supply chain finance issues for startups,” said Ishpreet Singh Gandhi, founder and managing partner of venture debt firm Stride Ventures. Stride said it has seen startups from the ecommerce and automotive segments in its portfolio evince interest in supply chain finance.

On Tuesday, Gandhi announced the launch of a new NBFC – StrideOne – which offers customised credit to startups and their suppliers. The NBFC has raised Rs 250 crore to develop the product.

TWEET OF THE DAY

Delhivery can grow without compromising on profits, says CEO

Delhivery does not see its planned growth coming at the cost of profits, the company’s senior management told us on Tuesday, a day after it reported its maiden earnings.

Catch up quick: The Gurugram-based startup, which listed on the bourses last week, more than doubled its revenue from operations to Rs 2,071 crore in the quarter ended March 2022, from Rs 1,031 crore in the same quarter a year ago.

It reported a net loss of Rs 119.8 crore, nearly the same as in the same quarter a year ago.

Public-market investors have been wary of new-age firms’ ability to show profits or a path to profitability.

Yes, but: Delhivery cofounder and chief executive officer Sahil Barua and Sandeep Barasia, the chief business officer, told ET in a post-earnings call that its operating leverage would kick in even as it continues to chase growth.

“Growth and profits are not conflicting objectives for us at an operating level. The challenges that investors rightly have is if you are losing money at the unit level,” Barua said.

He added that the company is better placed to face inflationary pressure on both fronts – fuel and labour. It has passed on the fuel price hike to its business to business (B2B) clients while it is able to absorb the cost better in its B2C business, he said.

Info Edge bets on Housing.com founder Rahul Yadav’s latest startup

Sanjeev Bikhchandani-led Info Edge has been investing in Housing.com founder Rahul Yadav’s latest startup, Broker Network. Operated by parent 4B Networks, it provides a technology platform to help brokers connect with properties, buyers and other brokers.

According to recent filings with Indian exchanges, Info Edge invested Rs 137.12 crore in 4B Networks in March, through its subsidiary Allcheckdeals India (ACD), and has been investing in the company over multiple tranches. It invested Rs 9 crore in February and Rs 18 crore in December 2021.

Info Edge, through ACD, now holds 57.16% in 4B Networks.

Founded in November 2020, 4B helps real estate developers and brokers communicate and conduct business via the Broker Network Platform. It helps brokers conduct site visits and provide home-loan-related services to their clients.

The company has over 500 employees, and Yadav is its chief executive, according to Linkedin.

Other Top Stories By Our Reporters

Infosys to sharpen focus on cloud, digital biz: Infosys sees a huge opportunity in the cloud and digital business and will continue to focus on expanding its capabilities in these areas, chief executive Salil Parekh said on Tuesday.

ETtech Explainer: What are Esops? Gone are the days of conventional salary packages. Employees, especially those at tech companies and startups, are increasingly demanding stock options (Esops), through which they can own stakes in the companies they work at and benefit from their growth. But what are Esops and how do they work?

Global Picks We Are Reading

■ Tension inside Google over a fired AI researcher’s conduct (Wired)

■ I tried to read all my app privacy policies. It was 1 million words. (The Washington Post)

■ Forget LinkedIn — Your Next Job Offer Could Come via Slack (WSJ)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.