Less than a month later, Celsius, a major crypto lender, froze all withdrawals and left countless depositors in the lurch.

Over the past seven months, the total market cap of all crypto assets has plummeted from about $3 trillion to about $880 billion – a 70% drop.

Crypto is having a nightmare in 2022, it’s safe to say, but things could get even worse. That’s because a tether, a lynchpin of crypto trading, has come under increasing scrutiny and shown signs of weakness in recent months.

What is tether?

Tether, like terraUSD, belongs to the breed of cryptocurrencies called stablecoins. Unlike regular cryptocurrencies such as bitcoin, a stablecoin is designed to have a fixed value, which is most commonly done by pegging its price to a traditional currency.

Tether was launched in 2014 by iFinex, which is also the parent company of cryptocurrency exchange Bitfinex.

It is pegged to the US dollar, and iFinex claims it holds actual dollars, bonds, treasury bills and other assets in reserve to serve as collateral. This means in theory, anyone who wants to exchange tethers for US dollars can do so quickly and easily.

Indeed, tether can only hold its value so long as it continues to redeem its tokens for $1 each, and investors have faith that the tokens are fully backed by liquid assets. If that faith were to vanish, it would take down not just tether but arguably all of crypto.

Tether, after all, is not just any stablecoin – it’s THE stablecoin, and the third most-traded cryptocurrency in the world after bitcoin and ether.

And because stablecoins are used mainly to buy other cryptocurrencies, tether’s tentacles touch most – if not all – other digital coins. Tether in fact doesn’t have its own blockchain. Instead, users can transact with it on some of the bigger blockchain platforms, such as Ethereum, Tron, Algorand, Solana, Avalanche and Polygon.

There are currently 70 billion tethers in circulation, making it three times the size of terraUSD before it collapsed.

“Tether is really the lifeblood of the crypto ecosystem,” Hilary Allen, a finance expert at American University, told The New York Times. “If it imploded, then the entire facade falls down.”

Controversies

You might think such a vital cog of the crypto machine would be trusted and widely respected, but you’d be wrong. iFiniex, rightly one of the most scrutinised companies in all of crypto, hasn’t always inspired trust, to put it mildly.

In January 2018, the company dismissed an accounting firm it had hired for an audit, citing “the excruciatingly detailed procedures [the auditor] was undertaking for the relatively simple balance sheet of Tether.”

In 2019, the New York Attorney General’s office initiated a probe into whether Bitfinex sought to cover up the loss of $850 million funds held by Tether.

Almost two years later, Tether and Bitfinex reached a settlement with the attorney general’s office in February 2021, under which it would pay $18.5 million in fines and release a quarterly report detailing the reserve’s composition for the next two years.

The company started to publish reports on its assets in 2021, but still does not specify exactly where its reserves are held.

Tether may also have been used from time to time to artificially inflate the price of bitcoin and other cryptocurrencies.

In 2018, an academic study looking at the 2017 crypto bull run found that a particular player on the Bitfinex exchange would use newly minted tether to buy bitcoin and support the price of the world’s largest cryptocurrency when it fell.

Since the start of the crypto crash, investors have pulled more than $10 billion out of tether, in what has been described as a slow bank run. This was accelerated by the crash of the terraUSD stablecoin in May and the freezing of withdrawals on the Celsius Network – another crypto ‘bank’ – in June.

Is this the crumbling edifice of crypto, as tether’s critics claim, or much ado about nothing?

Only time will time.

Written by Zaheer Merchant

Top Stories By Our Reporters

Zomato board approves Blinkit buy for Rs 4,447 crore

Blinkit acquisition to add significant addressable market for Zomato, says CEO Goyal: Zomato’s acquisition of quick commerce company Blinkit for Rs 4,447 crore in an all-stock deal on Friday will add a significant addressable market for the firm, wrote the company’s cofounder and CEO Deepinder Goyal in a letter to his shareholders.

Also read: Why nobody is talking about 10-minute deliveries anymore

RBI and Fintechs

Fintechs seek six months to comply with RBI credit rule

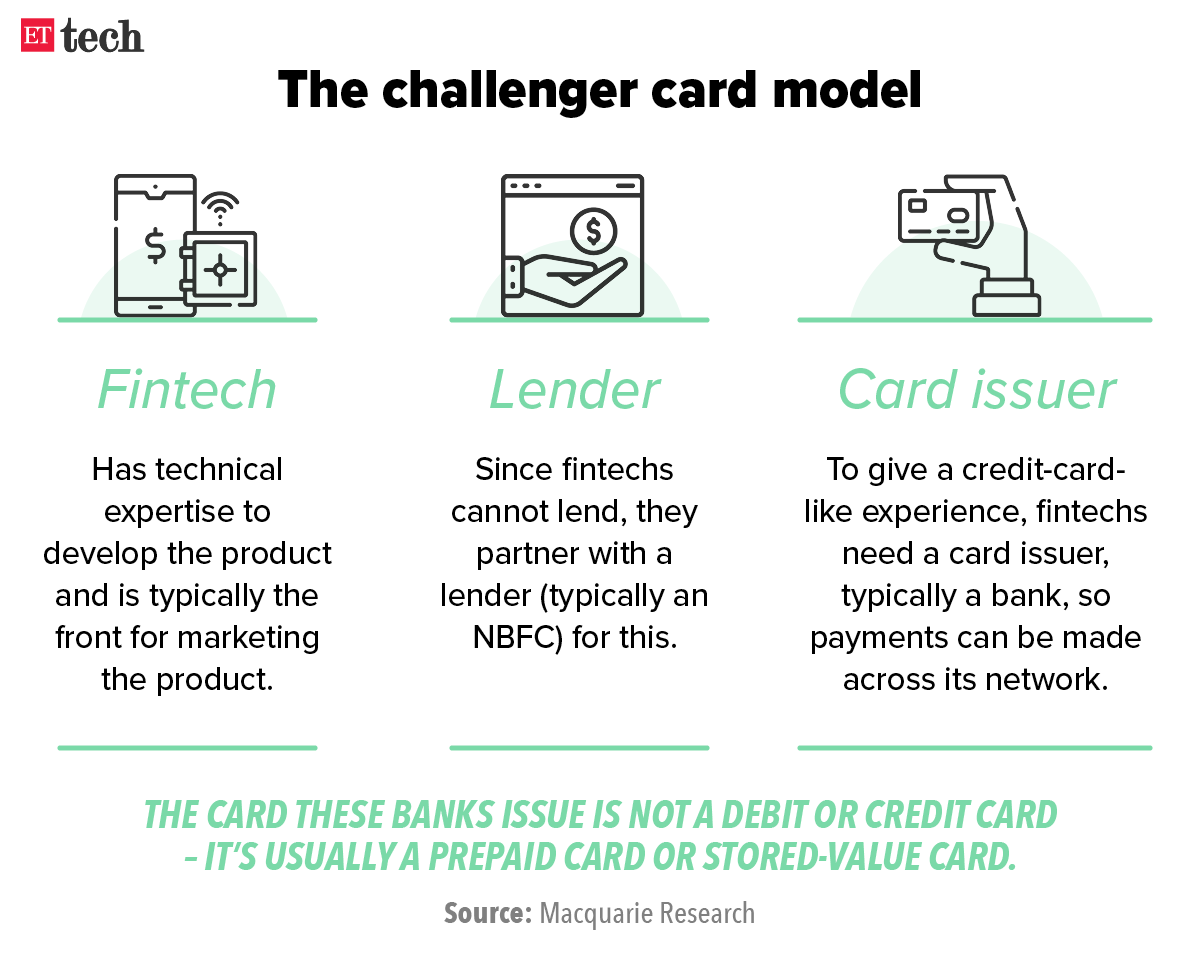

At a meeting on Thursday evening, fintech companies decided to seek an extension of at least six months for Reserve Bank of India’s latest mandate, which has sent credit card challengers and other card-based fintechs into a tizzy. Two people who attended the meeting, arranged by Digital Lenders Association of India (DLAI), told us they see the extension request as the “most critical” part of the ongoing issue.

Fintechs to ping govt, RBI governor on central bank note: Top fintech companies are uniting to petition the union government and the Reserve Bank of India for clarity on the central bank’s recent directive, sources told us. In a one-page circular, issued on Monday, RBI had directed all non-bank pre-paid payment instruments (PPIs) to stop loading credit lines onto their products.

RBI’s stance on fintech has government’s backing: The Reserve Bank of India’s latest move barring non-bank prepaid payment issuers from loading credit lines onto their products has the support of the government, which also wants a comprehensive regulatory framework soon for the fintech sector.

Some fintech firms freeze prepaid cards after RBI order: Fintech firms such as Jupiter, EarlySalary and KreditBee have temporarily stopped customers from using their prepaid cards, multiple sources told us, after RBI banned the non-banks from loading credit lines on prepaid payment instruments (PPIs).

RBI circular leaves fintech firms dazed and confused: The central bank’s latest communication to fintechs, which bars non-bank wallets and prepaid cards from loading their credit lines into these products, has caused widespread confusion in this segment of the payments industry, although the order came after many new-age companies reportedly assumed the lender’s role without building sufficient safeguards.

Non-banks can’t load credit lines on prepaid payment instruments, says RBI: The Reserve Bank of India on Monday disallowed non-bank wallets and pre-paid cards from loading their credit lines onto these platforms. The regulator, in a one-page circular addressed to non-bank pre-paid payment instruments (PPIs), directed them to stop the practice immediately.

RBI extends June 30 deadline for card tokenisation by 3 months

Sale of Ola Electric scooters slumps to 130-200 a day

Cashback drives surge in WhatsApp Pay UPI transactions

Sequoia’s Surge to raise ceiling for seed-stage investments

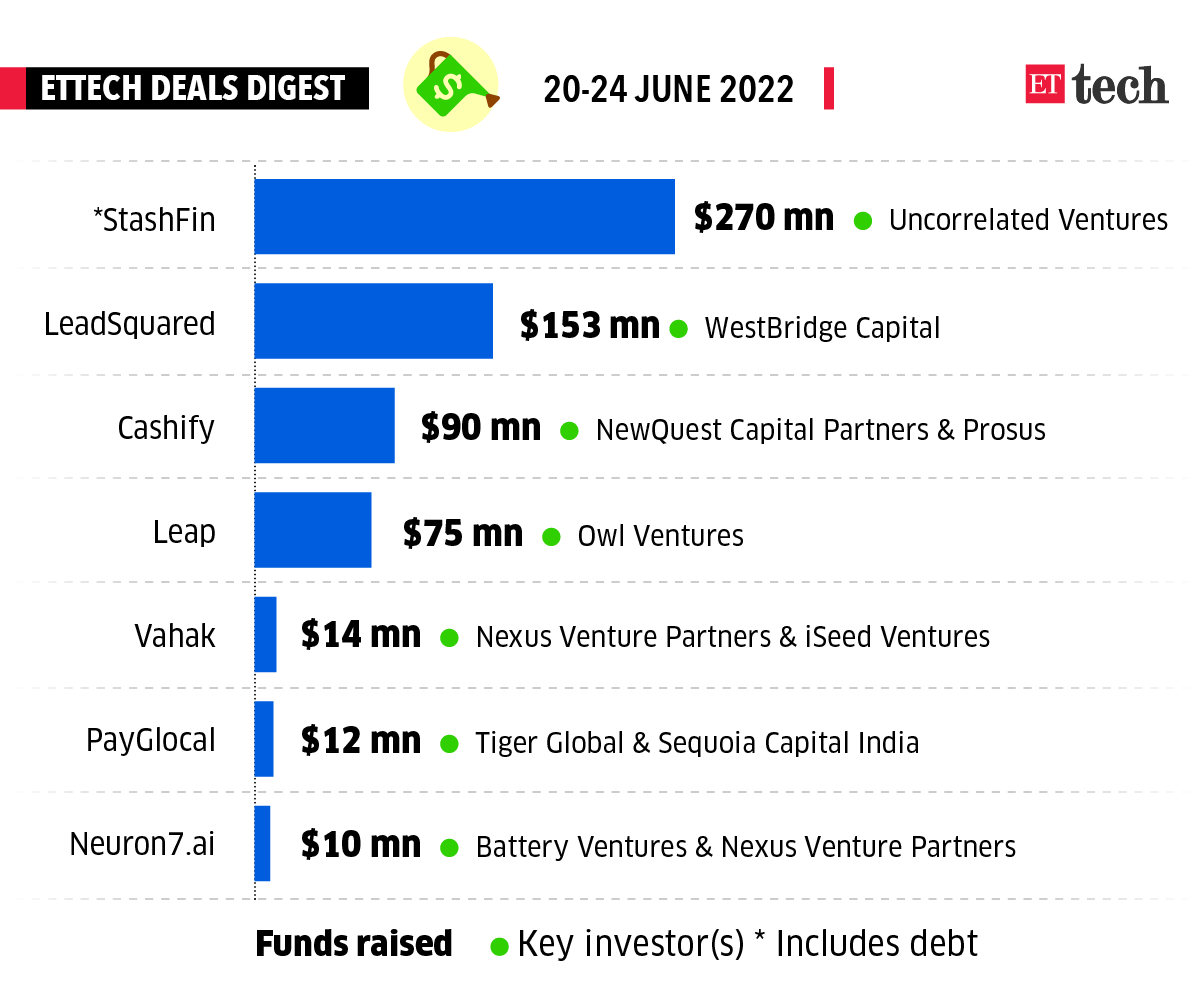

ETtech Done Deals

■ Xpressbees, a leading logistics service provider, has decided to extend its services to direct-to-consumer (D2C) brands just days after rival Shiprocket acquired Pickrr to bolster its direct commerce business.

■ Matrix Partners India, an early investor in companies such as Ola, Razorpay and Dailyhunt, among others, will raise a $450 million India fund, according to a regulatory filing with the US Securities and Exchange Commission.

■ Early-stage venture capital firm Fundamental VC has launched its maiden fund with a target corpus of $130 million. The sector-agnostic fund will invest in pre-seed and seed rounds across consumer internet, healthcare, insurance, financial services, Software-as-a-Service (SaaS), gaming, and artificial intelligence, a senior executive told ET.

■ Milky Mist, a direct-to-consumer dairy and fresh foods brand, is in talks with private equity funds such as Kedaara, True North, TA, Temasek and others to raise $100-120 million in a funding round. This will be the bootstrapped company’s first institutional funding round, four people with direct knowledge of the development told us.

■ Edtech startup BrightChamps is planning to close mergers and acquisitions worth $100 million through stock and cash deals in the ongoing fiscal year (FY23), cofounder and chief executive Ravi Bhushan told us.

■ Digital payments service provider Pine Labs has acquired application programming interface (API)-based infrastructure company Setu in a cash-and-equity deal for about $70-75 million. Pine Labs chief executive Amrish Rau said the deal was significant but refused to disclose its exact size.

Cryptoverse

DeFi bubble bursts, spooking VCs and retail investors in India

Shashank Bhardwaj from Delhi is writing off his entire investment in US-based crypto lending platform Celsius Network. The 28-year-old Bhardwaj had pumped in 30-40% of his entire crypto portfolio into the platform to earn interest on “crypto that was lying around in his wallet.”

Celsius drops: Celsius, which had almost $12 billion under management as of May, lent out the deposits of customers – who were treated as unsecured creditors – to other users and invested in decentralised finance (DeFi) protocols. Bhardwaj, like other retail investors, was attracted to the platform because of the returns it promised. However, Celsius told customers on June 12 that it was pausing all withdrawals, swaps and transfers between accounts because of extreme market volatility.

Indian crypto investors who succumbed to FOMO are being tested: Indian crypto investors remain under stress, anticipating that the worst may be yet to come. The crypto market has recorded one of the worst crashes in its short history over the past fortnight, wiping off a few hundred crores of Indian investors’ money.

CoinDCX halts crypto withdrawals, sparks anger on social media: Crypto exchange CoinDCX had paused all crypto withdrawals without informing its users in advance, causing a furore on social media. The recent liquidity crises at several institutions, including Celsius Network, which paused crypto withdrawals and transfers, has stirred fear among Indian retail, we reported on June 21.

The IT corner

TCS case puts spotlight on job terminations in IT industry

The spotlight is on unlawful terminations in the country, experts said, after a Chennai labour court recently asked Tata Consultancy Services (TCS) to reinstate with back wages an employee who was asked to leave over seven years ago.

TCS may roll out chip-based e-passports this year: Tata Consultancy Services (TCS) could roll out chip-based e-passports by the end of the year, a senior executive told us.

TCS is also setting up a new command and control centre with the Ministry of External Affairs (MEA), and a new data centre to support the project’s backend requirements, said Tej Bhatla, head of its public sector business unit.

Curated by Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.

That’s all from us this week. Stay safe.