Deliveroo: Fly in the IPO soup

The market debut of UK food delivery firm Deliveroo earlier this year was one of the worst in recent history, and shares many similarities with Paytm’s.

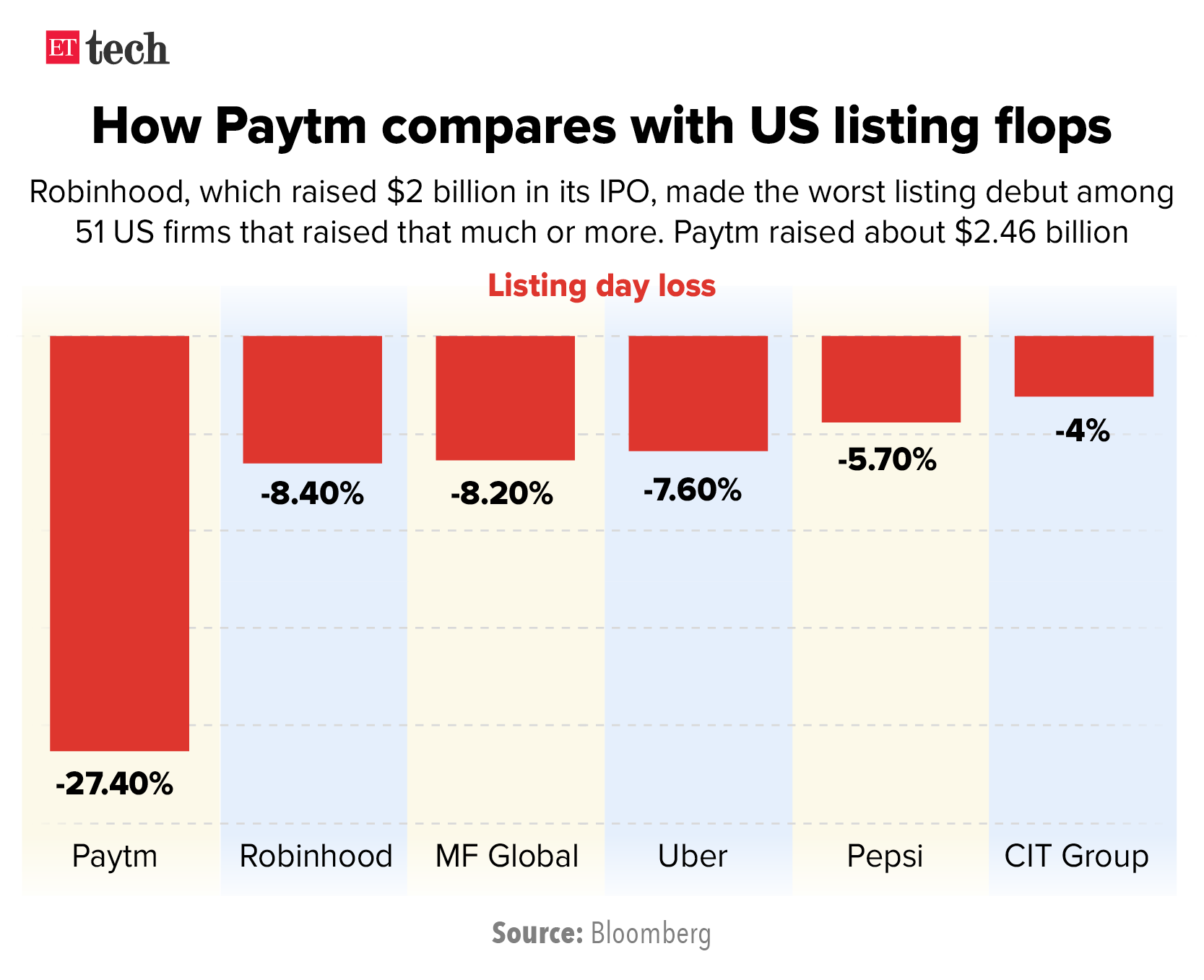

Deliveroo, which is backed by Amazon, had a nightmare on its first day of trading on the London Stock Exchange on March 31. Soon after the markets opened, its shares fell from the issue price of £3.90 to around £2.73—a 30% drop—before recovering to £2.87 by the end of the day—a 26% drop. Paytm’s first-day fall ws 27.4%. Deliveroo’s poor debut wiped nearly £2 billion off its market cap and was the worst ever first-day performance for a London IPO worth more than £1 billion, according to data from Dealogic.

As with the Indian fintech firm, investors questioned both Deliveroo’s valuation and its ability to generate profits. Another reason for the flop debut was that many top institutional investors including Legal & General, Aviva, and BMO Global said they would avoid the IPO over the company’s poor treatment of workers.

Deliveroo’s debut was in stark contrast to that of US rival DoorDash, which saw its shares jump more than 85% on its first day of trading last December, giving it a market cap of more than $60 billion. The company had priced its shares at $102 each, above its range of $90-95, and they began trading at $182.

How’s it going? After hitting an all-time high of £3.86 in August, Deliveroo’s share price is now £3.08, well below its offer price of £3.90.

Robinhood: Off the mark

In January, US brokerage app Robinhood was all over the news after a group of Reddit posters used it to drive up the share price of US electronics chain Gamestop by more than 1,600% by buying and holding the poorly performing stock, in the process bankrupting two hedge funds that had short positions against it.

Within days, Robinhood took the controversial decision to limit trading in GameStop and many other heavily shorted stocks to closing positions only—meaning traders couldn’t buy shares as the prices fell.

Robinhood quickly incurred the wrath of many, not least the Redditors who had caused GameStop’s share price to skyrocket. A lawsuit was filed in New York, accusing the company of “purposefully, willfully, and knowingly” removing the GameStop stock, and several members of Congress called for a hearing on Robinhood’s actions.

Six months later, on July 28, Robinhood sold shares in its IPO at $38 each, raising close to $2 billion ahead of its public debut on the Nasdaq the next day. It sold 52.4 million shares, valuing it at $32 billion, slightly lower than forecast. Co-founders Vlad Tenev and Baiju Bhatt each sold shares worth about $50 million. The company was last valued in the private markets at $11.7 billion in September 2020.

On its stock market debut, Robinhood shares started trading at $38—the low end of its range — but crashed as much as 10% at one point and ended the day at $34.82, an 8.4% decline, causing Robinhood’s market cap to drop by about $3 billion on debut.

How’s it going? Robinhood’s shares were trading just below $30 on Friday, meaning those who invested in its IPO still haven’t recovered their losses.

Uber and Lyft: Crash and burn

On May 9, 2019, Uber sold 180 million shares at $45 each in its IPO, raising $8.1 billion at a valuation of $82 billion, ahead of the most anticipated listing since Facebook (now Meta). The $82 billion valuation was still well below the $120 billion it had originally sought. Its last private valuation was about $76 billion.

On its first day of trading, Uber’s shares opened at $42. The stock briefly jumped up to $45 briefly in the first five minutes before dropping to an intra-day low of $41.06 in the next five. After swinging back and forth throughout the trading day, the share price closed at $41.57, a 7.6% drop from the IPO price.

Uber was the second ride-hailing company to go public in the US, after rival Lyft did so in March that year. Lyft’s stock, which it offered at $72 a peice, popped as much as 23% to $87.24 in its debut before ending the first day 8.7% up at $78.29. The next day, however, the stock crashed 12% and Lyft’s share price has never crossed $70 since. Its IPO performance led to reduced expectations from Uber’s listing.

How’s it going? Uber’s stock swung wildly during the pandemic, falling to an all-time low of $21.33 in March 2020 before surging to an all-time-high of $60.63 the following February. It is currently at $44.15, just below the $45 IPO price. Lyft’s stock saw a similar swing during the pandemic and is now at $47.61 a share, well below the $72 offer price.

BIG STORIES BY OUR REPORTERS

Paytm’s business model less understood than others’: Vijay Shekhar Sharma

Paytm founder Vijay Shekhar Sharma

Paytm’s listing should be seen as a first-day reaction and not a reflection of the company’s long-term performance, founder Vijay Shekhar Sharma said after the company’s stock fell more than 27% below its IPO price on market debut.

According to him, business models of fintech platforms such as Paytm were not as well understood as those of other startups that have gone public.

- “These are easy to understand models… If I sell a wallet or a phone, or I can pick up food from a restaurant…then you know the business model…compared to how do you acquire customers? How do you make money and what’s cross-selling like? These are questions asked by public market investors,” Sharma told us in an interview after the day’s close.

Stock markets are “opinion-polls” in the short term and “weighing machines” in the long term. “Stock market cannot impact the purpose of the company,” he said.

Click here to read the full interview.

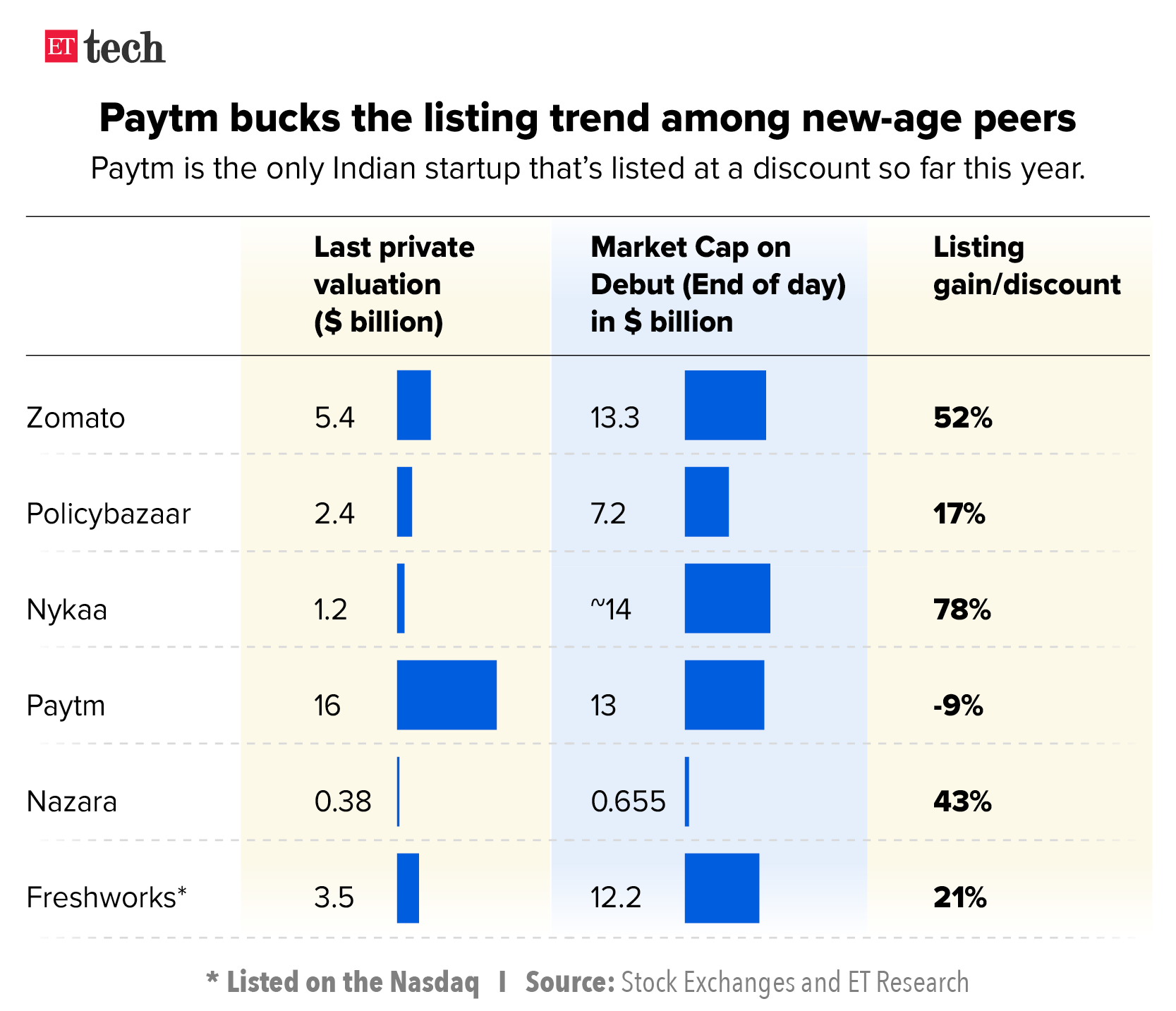

Paytm’s wobbly debut may hit upcoming tech IPOs in India: Paytm’s disappointing stock market debut, where its market capitalisation fell below its last private valuation, may impact upcoming tech IPOs in India and overall financing rounds at startups, investors and analysts told ET. Paytm’s IPO may, in fact, soften the private markets and tech valuations overall in what has been a record year for dealmaking in the digital economy, they said.

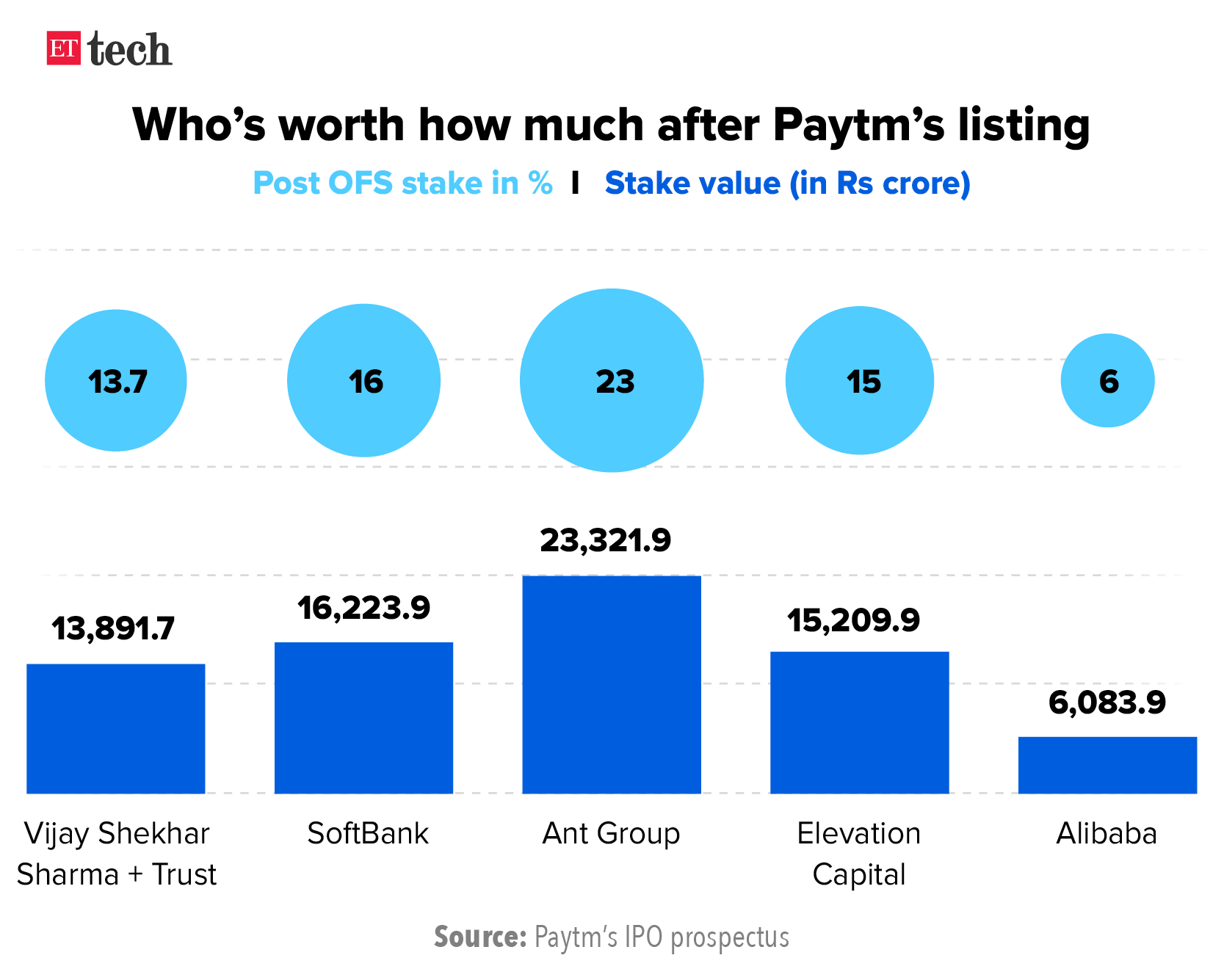

Paytm’s early investors clock returns despite lacklustre listing: While Paytm’s market cap settled at $13.6 billion, lower than the $16 billion valuation it commanded at its last private fundraising in November 2019, its early backers—including SoftBank, Ant Group, Alibaba and Elevation Capital—still made money from the listing.

Paytm’s nightmare listing eclipses worst US flop debuts: One97 Communications’ day one nightmare eclipsed the worst trading debuts ever by US firms that raised at least $2 billion in their IPOs. Paytm had raised about $2.42 billion.

Also Read: SoftBank open to investing in Indian fintech after Paytm lists

Open to investing in fintech post Paytm’s listing: SoftBank

SoftBank’s Munish Varma (left) and Samir Juneja

Having missed out on taking a wager on fintech, payments and the wider financial services sector due to its $1.6-billion exposure to Paytm, SoftBank is now actively scouting opportunities in the space.

“Lending is a big opportunity along with payments and allied businesses and all these collect large amounts of data. The winner in this category will be the one who can take all this data that’s been collected and transform it into some monetisable product—for example, insurance manufacturing,” Munish Varma, managing partner at SoftBank Investment Advisors, told ET in an interview before Paytm’s listing.

Sumer Juneja, partner and head of India at SoftBank Vision Fund, said financial services is not a winner-take-all market or a duopoly as there will be more than just one or two winners.

“In financial services, if you look at HDFC Bank, it has a $120 billion market cap but their market cap is around 9%. So given the depth, I don’t think it matters if you are number one or number two..,” Juneja said.

It’s value creation over profits for Policybazaar founders

%20and%20Yashish%20Dahiya.jpg)

Policybazaar founders Alok Bansal (left) and Yashish Dahiya

Short-term focus on profit can be destructive for long-term value creation for new-age firms like Policybazaar, cofounder Yashish Dahiya told us after the insurtech platform’s parent firm—PB Fintech Ltd.—listed on the bourses at 17.53% premium to its IPO price.

The stock ended nearly 23% higher, at Rs 1,202.90.

- “You are valuing them (new-age companies) for what they can become in 5-10 years’ time. Let’s not be stupid and force these companies to try and declare profits early. That will be value-destroying for shareholders in the long term…without a shadow of doubt,” Dahiya said.

The company was not taking any “pressure on profitability” after the IPO, he said.

Click here to read the full interview.

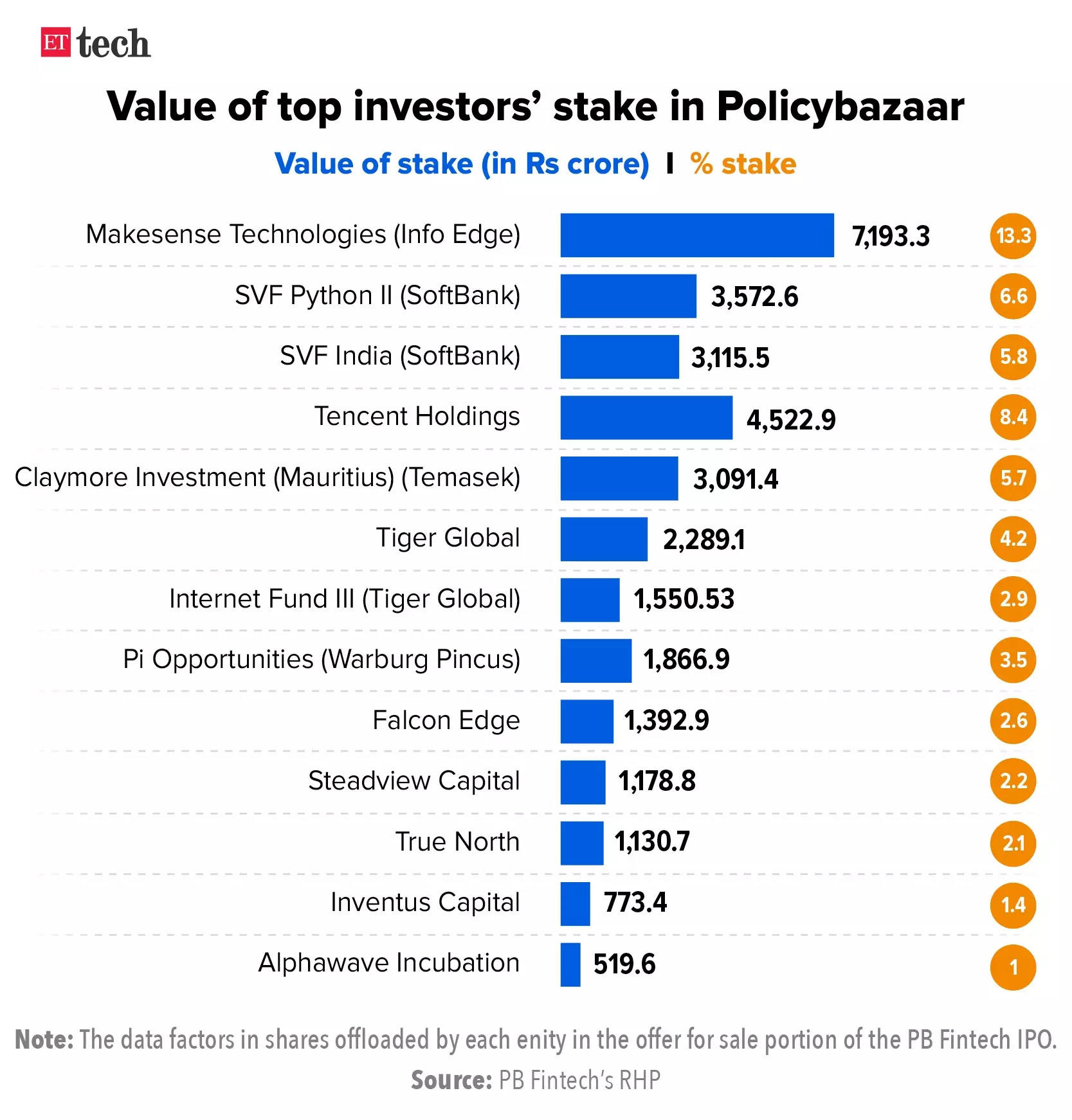

Meanwhile, the fortunes of more than a dozen institutional investors—SoftBank, Tencent, Tiger Global, Temasek, Warburg Pincus, Falcon Edge, etc.—soared due to the listing gains posted by Policybazaar on day one.

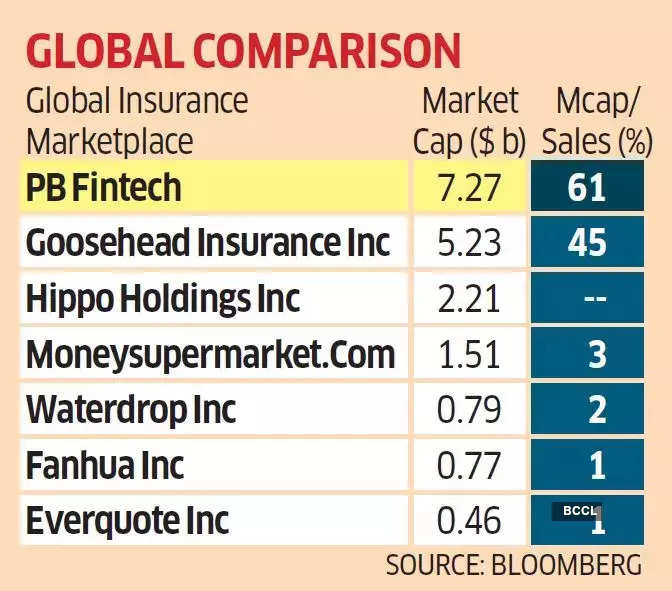

Policybazaar, the most valuable insurance bazaar in the world: PB Fintech, the parent firm of Policybazaar and Paisabazaar, has emerged as the most valuable insurance marketplace in the world upon listing.

The insurance broker currently trades at 61 times market cap to sales compared to 45 times of US-based Goosehead Insurance or three times the UK-based Moneysupermarket.com.

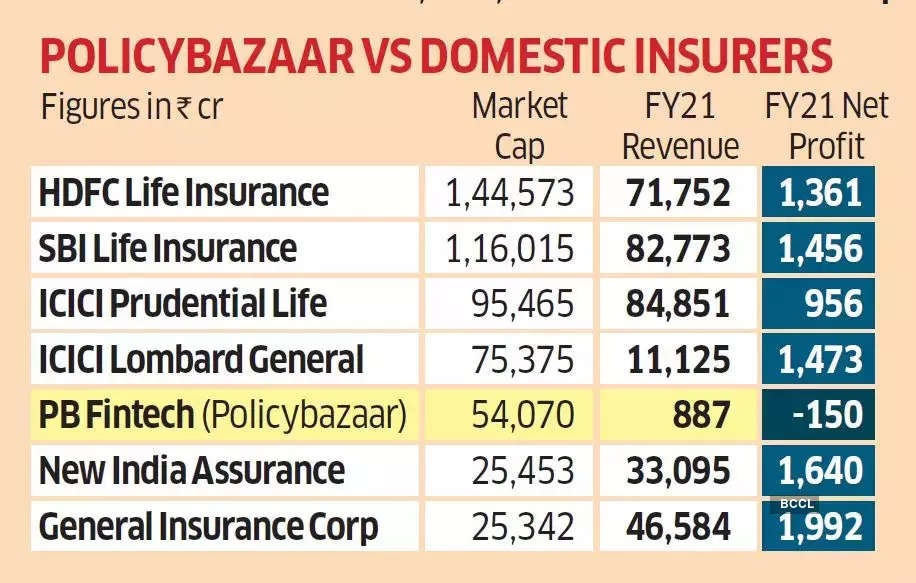

Its market cap of about Rs 60,000 crore, however, is still small compared to listed private insurers like SBI Life Insurance, HDFC Life Insurance and ICICI Prudential Life Insurance.

Zomato in talks to invest $500 million in Grofers

Zomato is in talks to invest as much as $500 million in Grofers, making it the food-delivery and restaurant-discovery platform’s largest investment so far in a company. The proposed deal marks an extension of its food delivery battle with Swiggy into the so-called ultrafast commerce segment, which is attracting a slug of investor capital globally.“Talks are on between the two companies and Zomato is most likely to invest the full $500 million by itself,” said one of the people cited above. “There were some discussions with SoftBank and others, but those have not fructified into anything yet.”

ETtech DEALS DIGEST

■ Mensa Brands, the Thrasio-style ecommerce venture founded by former Myntra CEO and Medlife cofounder Ananth Narayanan in May 2021, has turned unicorn after raising $135 million in a new funding round led by Alpha Wave Ventures.

■ Flipkart has agreed to acquire a majority stake in online pharmacy SastaSundar as the ecommerce major forays into the digital healthcare business amid a pandemic-triggered consolidation in the sector.

■ Kunal Shah, serial entrepreneur and founder of fintech startup Cred, has acquired NBFC Parfait Finance & Investment through Newtap Technologies, a new entity floated by him personally. The Reserve Bank of India has approved the acquisition.

■ Cosmetics etailer Purplle has raised $60 million from Premji Invest, the family office of Wipro founder chairman Azim Premji, at a valuation of $630 million.

FROM THE CRYPTO WORLD

The meeting chaired by PM Narendra Modi on cryptocurrencies on Saturday underscored the divergent views of the government and the RBI on cryptocurrencies such as bitcoin and the exchanges on which they are traded.

- Most stakeholder departments at the meeting favoured some form of regulation but RBI is believed to have reiterated its advocacy of a ban, citing macroeconomic and financial stability concerns. The central bank met stakeholders of the domestic crypto industry separately to discuss grey zones in the functioning of the new asset class.

In a related development, industry experts and associations informed the parliamentary committee on finance that cryptocurrency is here to stay, and the challenge is to find ways of regulating it, a view endorsed by some members of the panel who expressed concern over its misuse.

Those concerns are justified. Cyber criminals are impersonating or spoofing social media identities in order to deceive consumers into giving them access to their crypto wallets.

Meanwhile, several crypto exchanges in India have decided to refrain from launching fresh advertisements on print, television and radio. This comes days after crypto exchange WazirX decided to abstain from putting out print and TV ads, amid discussions on regulations for the cryptocurrency sector.

MORE TOP STORIES

Bonanza for founders of IPO-bound startups

Nearly half-a-dozen startup founders. whose companies are debuting on the stock markets in 2021, are being wooed by their boards with additional stake and milestone linked rewards to ensure they retain “skin in the game”.

- The growing trend is aimed at “rewarding” founders at firms where typically, investors own significantly higher stakes than entrepreneurs.

Meanwhile, India’s markets regulator has proposed a limit on the money raised from IPOs that startups can use for M&As, unless takeover targets are explicitly identified beforehand.

Sebi has also taken note of the huge profits private equity investors have made by selling shares in several recent IPOs. To improve transparency in disclosures, it now wants bankers to clearly state the cost of acquisition for large investors in IPO advertisements.

Nykaa’s plans after listing, as per founder Falguni Nayar

Nykaa founder Falguni Nayar

Nykaa will continue to focus on growth and profitability while investing heavily in marketing and acquiring customers, founder Falguni Nayar said.

That, after profit of India’s biggest cosmetics etailer was nearly wiped out in the September quarter compared to a year ago. Nykaa’s net profit fell 96% year-on-year to Rs 1.2 crore in the three months ended Sept. 30 on the back of revenue that rose 47% to Rs 885 crore.

“We will push the pedal on acquiring more customers,” Nayar said.

“Last year, the marketing costs were unusually low and there was revenge buying seen in the market post the first wave of the pandemic,” India’s richest self-made woman said. “This year, July, August and September were muted but we expect the festive buying to continue well into next year till February-March when the wedding season kicks in.”

Google seeking ‘different solutions’ on Play Store fees, India head says

Google India head Sanjay Gupta

Google is looking for “different solutions” to address the concerns of the country’s internet startups over the commission charged by the search giant on in-app digital subscriptions bought on its Play Store, country head Sanjay Gupta said.

The American company is “working globally and locally to figure out those right solutions in the next few months,” as India is too diverse a country to have “one big mega solution” for the developer ecosystem, he said in an interview during the ‘Google for India’ event.

“I am very confident that in the next few months, we should find a better solution.”

Also Read: ‘Google prepared for more regulatory scrutiny in India’

For India’s midsized IT firms, freshers are key to winning the talent war

India’s mid-sized IT firms are pulling out all the stops to attract talent to their fold amid record-high attrition that’s afflicting even their larger peers.

L&T Infotech and Persistent Systems as well as Mindtree and Coforge are working on their branding to attract freshers and win lateral hires from the likes of Tata Consultancy Services, Infosys and Wipro. In the three months ended Sept. 30, the wider software services industry clocked an attrition rate of 20%—significantly higher compared to even the previous quarter.

The mid-sized firms see freshers as the way out of this talent crunch.

Also Read: IT firms, startups resort to ‘stealing’ to hire the best from rivals

That’s all from us this week. Stay safe and get that jab.