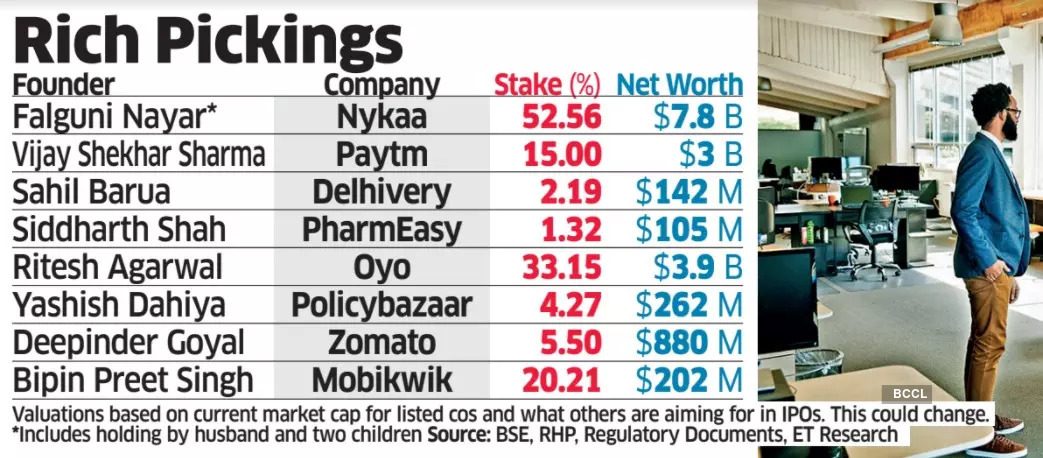

Policybazaar parent PB Fintech, which is listing on bourses on Monday, granted fresh options up to 10,657,500 to founder Yashish Dahiya, while cofounder Alok Bansal received 4,567,500 new options, as per the red herring prospectus. Dahiya and Bansal own 4.27% and 1.45%, respectively, in the firm, compared to SoftBank, which owns more than 15%.

ET reported last month that all five

founders of PharmEasy were given 9,987 stock options under its employee stock ownership plan (Esop) before it filed its draft initial public offering (IPO) papers.

The board of IPO-bound logistics startups Delhivery has approved grant of new stock options to its founders and senior leadership thrice this year, with the latest being in September, according to regulatory documents and its draft IPO paper. These grants are often performance- and time-based, with different vesting schedules, but it boosts their holdings in the company.

“Founders have been given long-term Esops for continuing to lead the company over the next six to seven years. In some cases, founders have also invested their own money, to show their confidence in the firm at pre-IPO round valuation,” said one of the founders going public this year, explaining why the board had granted the new stock options and awarded them a bonus for achieving certain milestones.

ET also reported in September that Paytm founder Vijay Shekhar Sharma is

getting a significant amount of new stock options that would increase his holding by 2-3% in Paytm parent One 97 Communications, which is due to list on the bourses on November 18.

Similarly, Zomato founder Deepinder Goyal was also

allocated nearly 70% of new stock options as part of its 2021 Esop programme before going public.

“This has emerged as an important trend in tech startups to instil confidence in the management of a company after the listing,” people involved in the approvals told ET.

They said most startups with multiple founders end up having low single-digit holdings in their firms by the time of the IPO, in contrast to the situation with US-based startups. Without such options being granted, there is little incentive for an entrepreneur to continue scaling their ventures when early investors are clocking record gains through the IPO, the sources said.

For founders who can’t immediately sell their shares, a lot of their net worth is on paper during the listing process.

Inspiring Confidence

Experts are of the view that this growing trend is a positive one for the startup sector.

Siddarth Pai, founding partner at venture fund 3one4 Capital, pointed out that “compared to major US startups, where founders can have 30-40% in their company, (in India), it is in single digits to early teens, depending on whether it’s a solo founder of multiple cofounders.”

“Besides the new options and bonus being an incentive, it also increases their (founders’) stake in the company after the IPO and inspires confidence in management,” he said. “Skin in the game and shareholder alignment are crucial for investors. It’s a combination of factors that are at play, as founders now also have to be answerable to analysts and public shareholders.”

Several industry executives involved in the IPO plans of a company said many of the startups had plans to go public a couple of years ago, but they couldn’t, and so had to dilute their holdings to raise capital to sustain operations. “Now they (founders) have taken the company to this stage that everyone can get some exit and clock good returns. I think investors are well aligned with these approvals and this is needed,” said a venture capital investor who has seen at least two of his portfolio firms issue such options to founders.

In contrast to

Nykaa’s Falguni Nayar and Paytm’s Sharma, who is a solo founder, most entrepreneurs together hold 10% or so at the time of an IPO. “There is a commitment to make most of the tech companies profitable and create more value. While public shareholder scrutiny will go up on performance every quarter, they (shareholders) must also acknowledge the founding team’s commitment,” this person said.

And it’s not just an IPO-bound company rewarding its top management — Tata-owned BigBasket founders were given ‘MSOPs’ after the acquisition, as

reported by ET in September.

“They (founders) are typically in low single digits and this (new options) helps in topping it up,” said Mohan Kumar, founder and managing partner at Avataar Ventures. “After listing, they have to sustain valuation, get scrutinised quarter-on-quarter and are expected to run the company without any glitch in the next three to four years. That’s a fair deal for founders.”

Executives ET spoke to said there is no room for error, going forward, and two to three quarters of relatively bad performance can trigger rude reactions from investors. “Earlier, it was just your board (being answerable), but not once you go public. The expectation on execution is of being flawless after having raised money at higher valuation than private markets,” another senior industry executive told ET.

Pai said that having the founding team around post-IPO is critical, as in case a founder leaves soon after listing, the price (of the stock) could crash and have untold repercussions on the company. “Founder transitions, especially after listing, place the company on very precarious footing,” he added.

Another senior executive at one of the major startups doing one of the largest IPOs said the board itself had proposed allocating new stock options to the founder, as he had not taken any before. “It was unanimously agreed (upon),” he said.

Global Trends

This is also a global trend, where founders in Silicon Valley and other global markets have got similar rewards in the run-up to going public. In fact, founders in US tech companies often get a hefty jump in their pay packages for having taken the company to the IPO stage, a recent report by Wall Street Journal said. In India, most founders of the top startups earn anywhere between Rs 1-3 crore per annum, including variables.

All said, some of the incentives and changes for founders are also being done by keeping in mind the possibility that some public investors might not agree to granting such rewards to founders. Shareholder activism in tech companies going public is an inevitability and founders will be probed more deeply on a quarterly basis, according to Pai.

“At those points, performance is the only thing that matters, and any further management incentives will be linked to performance and probed deeply,” he said.

One of the investors mentioned above said it’s a matter of time before some shareholders will bring activism to tech companies, like others. “It will happen. The extent to which it plays out is for all of us to see over the next one to two years,” he said.