She said Mamaearth will focus on offline sales to fuel its next phase of growth, while other brands will retain their focus on online sales.

Elevate Your Tech Prowess with High-Value Skill Courses

| Offering College | Course | Website |

|---|---|---|

| Indian School of Business | ISB Professional Certificate in Product Management | Visit |

| IIM Lucknow | IIML Executive Programme in FinTech, Banking & Applied Risk Management | Visit |

| IIT Delhi | IITD Certificate Programme in Data Science & Machine Learning | Visit |

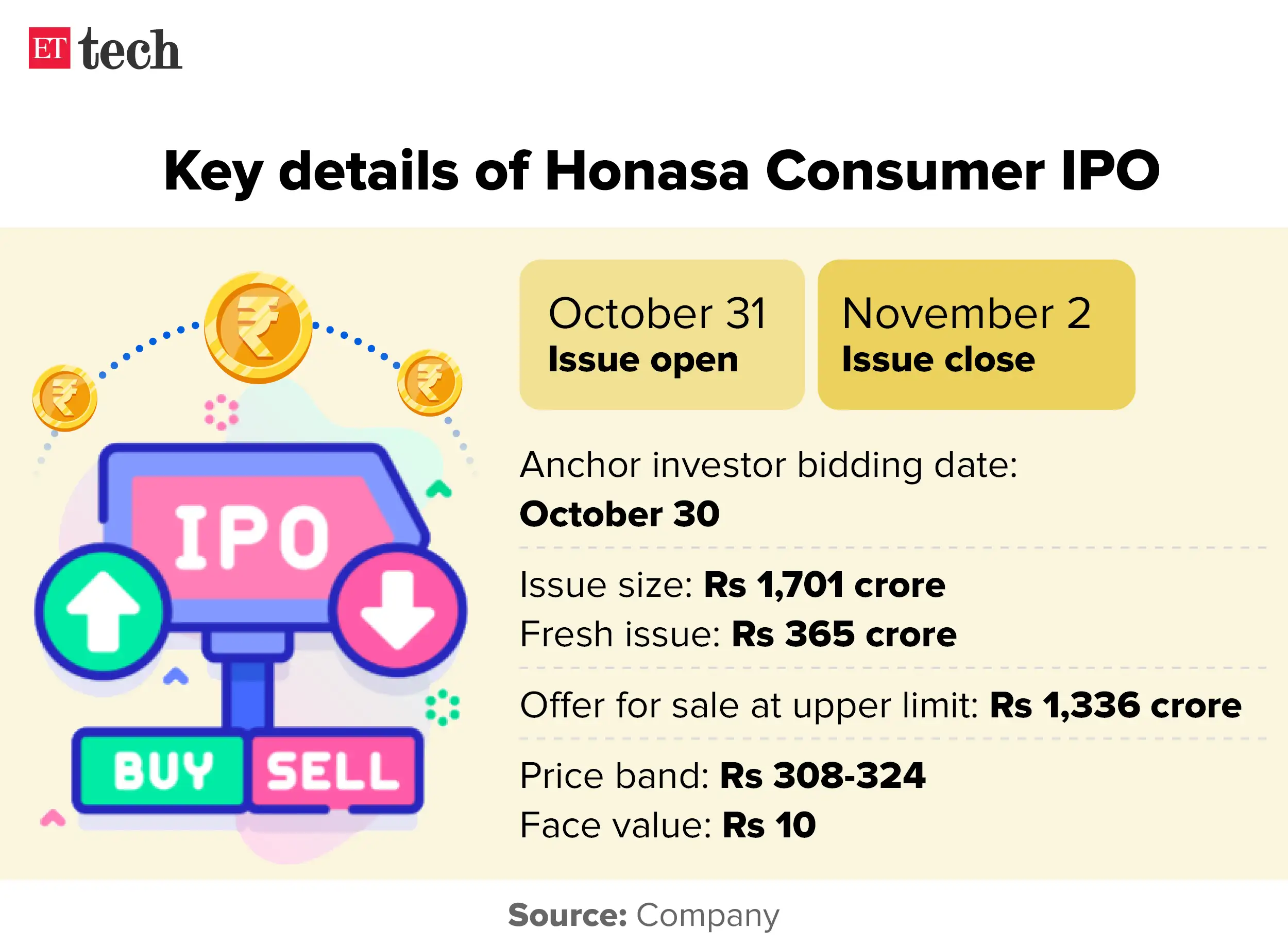

Alagh was speaking to ET on the sidelines of the company’s press conference to announce the Rs 308-324 per share price band for its upcoming public issue.

At the upper end of the range, the issue size will be Rs 1,701 crore, valuing the company at Rs 10,425 crore ($1.25 billion).

“Every brand goes through a journey. For Mamaearth, which is now present online as well as offline, the focus there is to find the next set of consumers…reality is that 80% of the transactions within the beauty and personal care segment are still happening offline and hence, that’s going to be the largest driver of growth for us,” she said.

Also read | Mamaearth parent says contribution of top 10 products to operating revenue decreasing

Discover the stories of your interest

Honasa owns six brands–Mamaearth, The Derma Co, Bblunt, Ayuga, Aqualogica and Dr Sheth’s. Mamaearth is the flagship brand, garnering the highest revenue for the Gurugram-based company. For the June quarter, Mamaearth reported operating revenue of Rs 303.63 crore or 67.1% of the company’s total operating revenue.“For our newer brands like Aqualogica or Dr Sheth’s, we still feel that there are a lot of consumers online who are looking because they are early adopters,” Alagh said.

Going ahead, Honasa is also betting on the premiumisation of the beauty and personal care segment.

“We are currently positioned at a slightly mass premium play across all of our brands. In the short term, that’s the focus that we are going to drive in the future as well, but we are betting on premiumisation as a trend,” Alagh said.

Financial overview

Alagh said the company’s management was focussed on growing revenue as well as profits going forward.

For the June quarter, Honasa reported revenue from operations of Rs 464.49 crore, a 49% rise from a year earlier. Net profit stood at Rs 9.24 crore, against a loss of Rs 2.51 crore a year ago.

ETtech

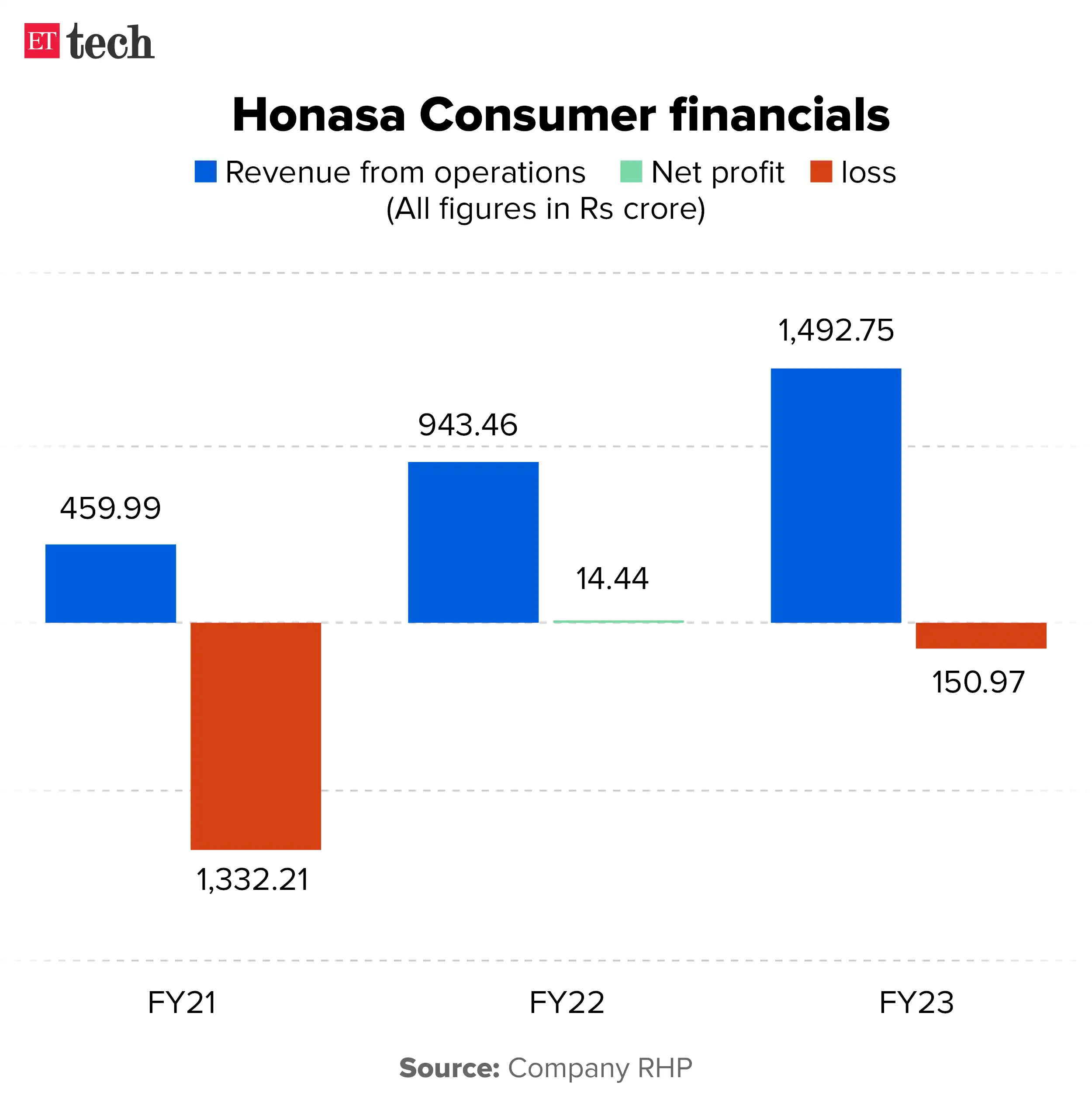

ETtechFor FY23, the omnichannel retail company plunged to a net loss of Rs 150.97 crore, from a net profit of Rs 14.44 crore in FY22. Operating revenue, however, grew 58% to Rs 1,492.75 crore.

Alagh said the annual loss in FY23 was on account of an exceptional item, and that the company was operationally in profit during the period.

“We’ve done three acquisitions till date. Two are brand acquisitions – Bblunt, and Dr Sheth’s, and one was a content platform called Momspresso. Momspresso was not scaling efficiently the way we wanted it to; for that matter, it was becoming a drag on our P&L, because of which last year, we decided to shut that business down,” she said, adding that the exceptional item was on account of the company taking a full impairment of Momspresso.

“If you just remove that, the business was actually profitable last year. The company is still profitable as it continues to evolve, and that’s what we see in the future as well,” she added.

Also read | Mamaearth IPO: Meet Ghazal and Varun Alagh, cofounders of Honasa Consumer

Offering details

The Honasa Consumer IPO consists of a fresh issue of shares worth Rs 365 crore, and an offer-for-sale (OFS) of Rs 1,336 crore. Bidding for anchor investors will open on October 30.

ETtech

ETtechIn December last year, when Honasa Consumer had issued its draft red herring prospectus, the company had planned for a Rs 400 crore fresh issue. The OFS component of 41.25 million shares has also been reduced from an initially planned 46.82 million.

Commenting on the reduced IPO size, Arvind Vashistha, managing director, head of India equity capital markets, Citigroup Global Markets India said, “Investors thought that at this value, it is not as attractive to sell and hence they reduced the size of the IPO; that is the key driver for it. It’s a business that has net invested capital at the moment and the management team’s thought was that at this point of time, Rs 365 crore worth of primary is enough to fuel the growth of the business for the next few years”. Citigroup is one of the book running lead managers for the Honasa Consumer IPO.

ETtech

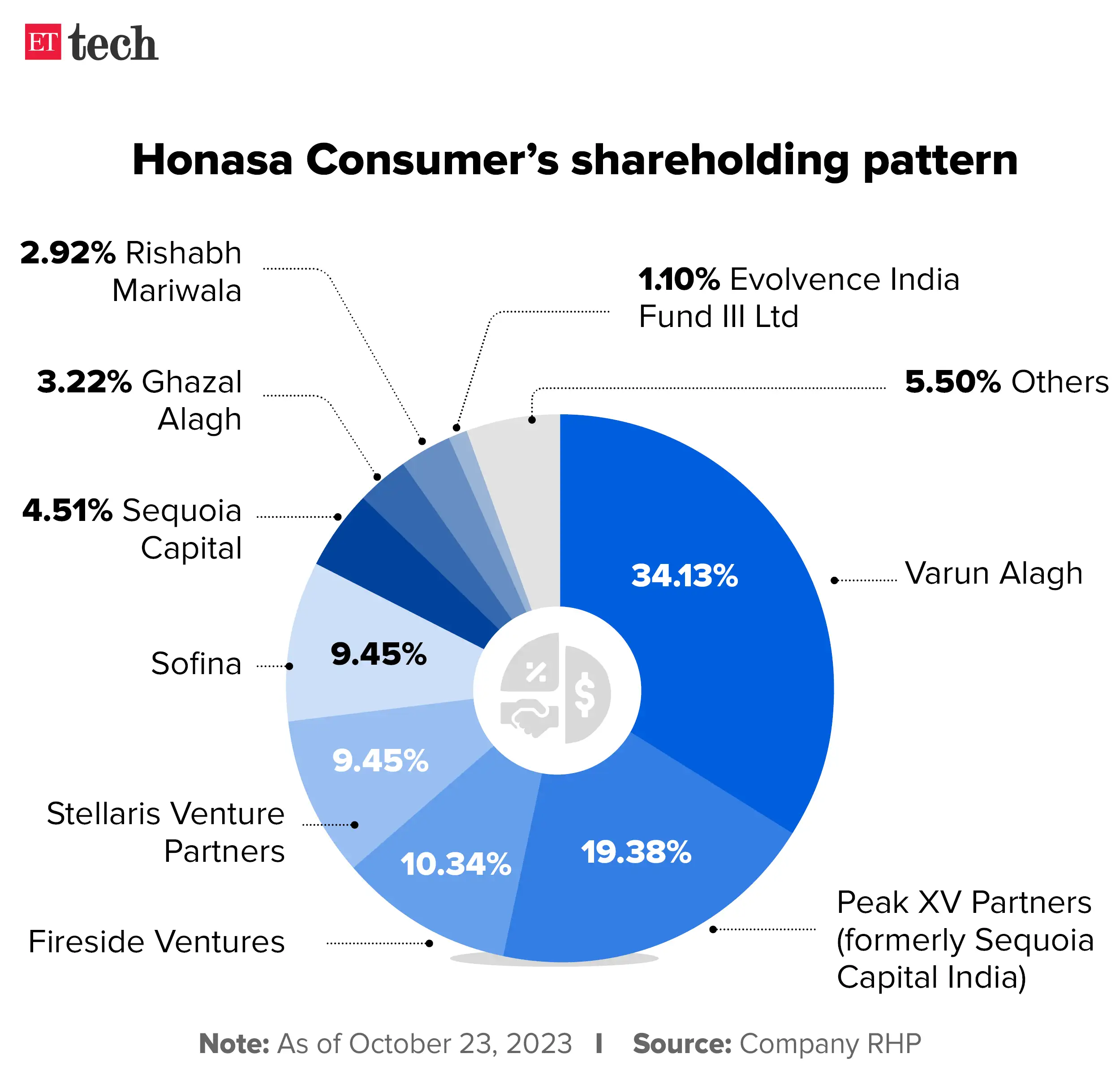

ETtechAmong the selling shareholders, Honasa cofounders Varun and Ghazal Alagh will sell stakes worth up to Rs 103 crore and Rs 3 crore, respectively.

The company’s investors Stellaris Venture Partners and Sofina will sell stakes worth up to Rs 355 crore and Rs 310 crore, respectively. Fireside Ventures will sell shares worth up to Rs 258 crore, while Marico’s Rishabh Mariwala will sell his stake worth up to Rs 185 crore. Other selling shareholders include Snapdeal cofounders Kunal Bahl and Rohit Bansal, and actor Shilpa Shetty Kundra.

ETtech

ETtech