The India Post Office isn’t simply an assistance that can link you to any region of the planet, yet additionally has a differed rundown of speculation schemes that can assist you with expanding your investment funds in a proper measure of time, with extraordinary financing costs in every arrangement.

If you are an enthusiastic investor and need to pick a plan that offers okay, then the post office is the best spot to put away your cash. The plans presented by Post Office are not dependent on market rates and have a guarantee with regards to returns.

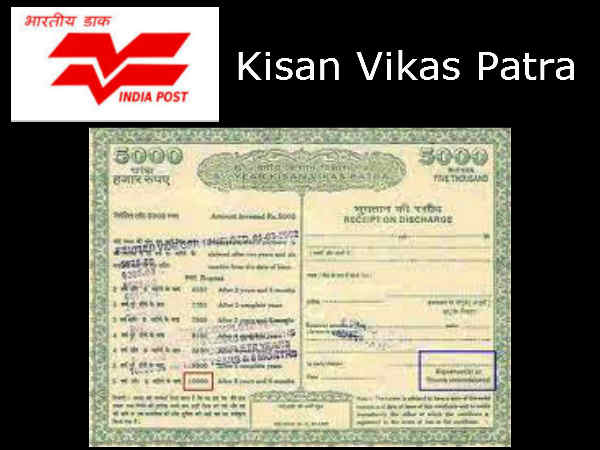

One of the famous plans of the post office is the Kisan Vikas Patra scheme, which can assist you with basically multiplying your investment funds in quite a long while. The Post Office’s Kisan Vikas Patra Small Savings plan can be begun by you with a base speculation measure of Rs 1000.

One can open an account in this post office plan for themselves or for a minor. A joint account can likewise be opened in the Kisan Vikas Patra plot. The base investment sum in this plan is Rs 1000 while there is no most extreme sum for this.

The subtleties referenced on the post office site express that assuming an investor decides to be a piece of the KVP scheme for a long time, which is more than 10 years, their underlying venture will stand multiplied. This plan at present offers a 6.9% interest rates on ventures.

The account of the Kisan Vikas Patra conspire is likewise transferrable starting with one post office then onto the next. There is a candidate choice likewise accessible for this investment funds plot, and the account can likewise be moved starting with one individual then onto the next.

The maturity (secure) of the Kisan Vikas Patra can be encashed following more than two years (30 months) from the date of issue of the KVP endorsement. It should be noticed that investors will likewise have the advantage of assessment exclusion in this plan, under 80C of the Income Tax Act.

To open a KVP little investment funds scheme account, one should require the accompanying documents – Aadhar Card, Residential Proof, KVP Application Form, Age Proof, Passport Size Photograph, and Mobile Number.