Also in this letter:

■ With IPO delayed, PharmEasy targets Ebitda breakeven by next year

■ Paytm shareholders vote to reappoint Vijay Shekhar Sharma as MD

■ No consideration to levy any charges for UPI services: Finance Ministry

Institutional investors oppose Esops of top startups

Institutional investors, including foreign funds, are opposing listed startups’ plans to dole out stock options and pay packages to some of their top employees.

Why? People with direct knowledge of the matter said investors are red-flagging the stock option issuances on the grounds that they are happening at deep discounts to current market prices.

The opposition also stems from concerns that continually issuing such shares would dilute the share capital base and hurt existing shareholders.

What’s going on: Late last month, 82% of investors voted against an employee stock option pool (Esop) scheme proposed by Zomato, while 72% of institutions voted against one by Delhivery.

In the case of digital Paytm’s parent One97 Communications, institutional investors voted against the remuneration proposals for founder Vijay Shekar Sharma and chief financial officer Madhur Deora.

In the shareholder meeting on August 19, while most investors approved the reappointment of two directors including Sharma, about 76% of institutional investors voted against the remuneration proposed for Sharma.

Similarly, 75% of these institutions also voted against the remuneration proposed for Deora. However, both the resolutions passed due to strong support from retail investors, who hold the biggest chunk of Paytm.

In the pipeline: Market participants said at least two more listed startups will have to get their Esops ratified by investors in the coming weeks and these, too, could face opposition from institutions.

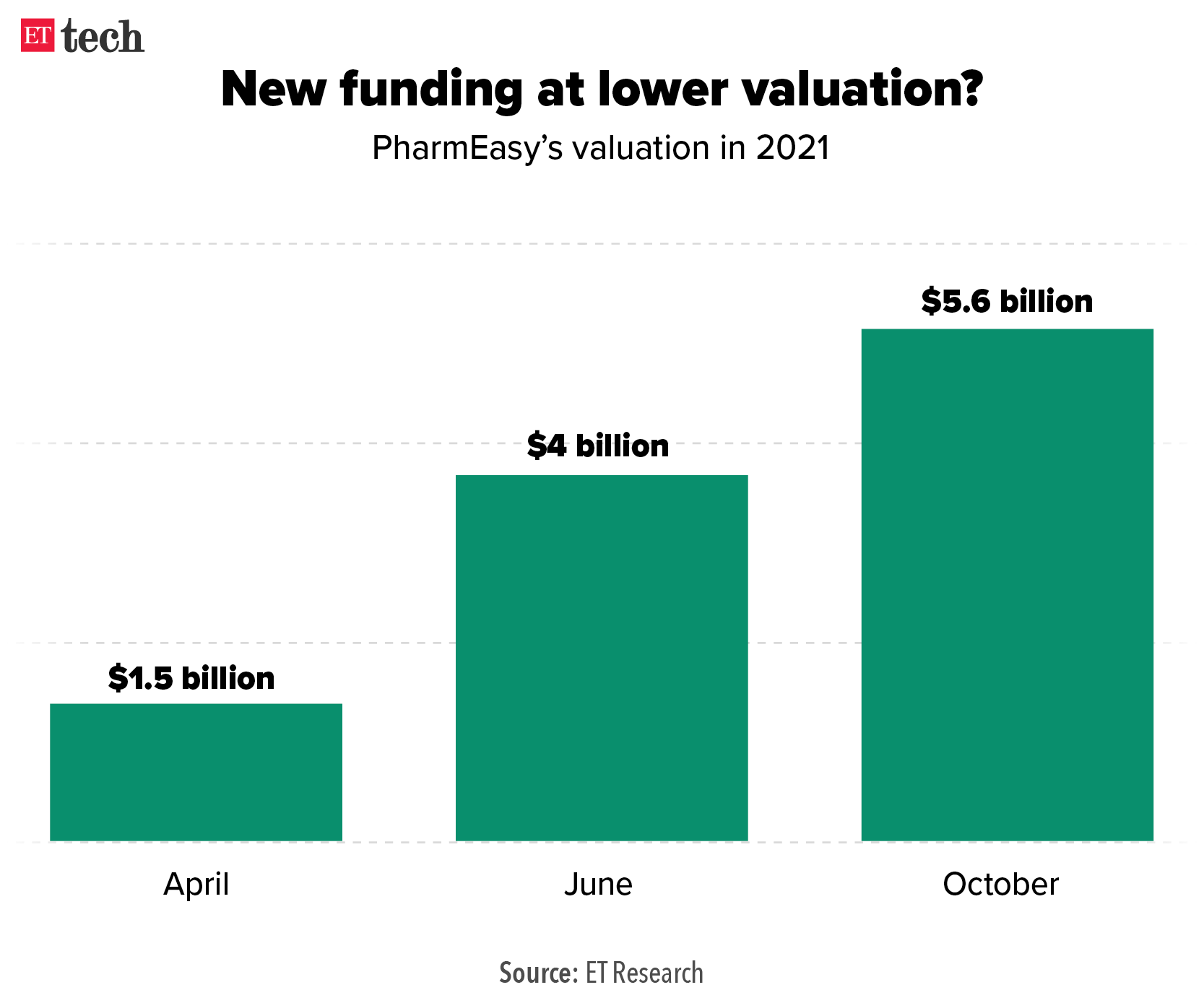

With IPO delayed, PharmEasy targets Ebitda breakeven by next year

PharmEasy, which has decided to postpone its IPO plan to next year, is cutting its burn and is aiming for Ebitda breakeven in a year, people in the know said. Ebitda, or earnings before interest, taxes, depreciation, and amortisation, is a measure of a company’s overall financial performance.

Catch up quick: In a letter dated August 19, PharmEasy parent API Holdings told shareholders it has withdrawn its draft IPO papers from Securities and Exchange Board of India (Sebi), citing “market conditions” and “strategic considerations”. Sebi had cleared its IPO proposal in February.

Cut the burn: PharmEasy’s monthly cash burn is now down by around 50% to around $5 million, one of the sources said.

API Holdings is estimated to have closed the financial year 2022 with 50% growth in revenue to around Rs 6,400 crore.

“In the ongoing financial year, PharmEasy is expected to grow its topline 30% and has halved its Ebitda losses by about 50%,” a person aware of the matter said.

Fundraising: The company has also finalised a $100 million convertible equity investment from Goldman Sachs, people in the know said. This will be converted into equity when PharmEasy closes its next funding round next month, a source said.

The Mumbai-based firm is also stitching up a private financing round through a rights issue, in which company founders are expected to invest personal capital, people in the know of the matter said.

The valuation is yet to be finalised but it is likely to be at a discount compared to PharmEasy’s previous post-money valuation of $5.6 billion, our sources said.

Paytm shareholders vote to reappoint Vijay Shekhar Sharma as MD

Paytm parent firm One 97 Communications Ltd said 99.67% of its shareholders who voted approved the resolution to reappoint founder Vijay Shekhar Sharma as managing director of the company for five years – from December 19, 2022 to December 18, 2027.

Paytm said that all seven resolutions were duly passed, with over 94% of votes cast in their favour. These included:

- Sharma’s remuneration for the next three financial years

- Reappointment of Madhur Deora as executive director, president and chief financial officer of the company

- Reappointment of Elevation Capital’s co-managing partner and early backer Ravi Adusumalli as director of the company

The development comes as three proxy advisory firms including – Institutional Investor Advisory Services India (IIAS), InGovern and Stakeholders Empowerment Services – had advised shareholders to vote against reappointing Sharma as CEO and managing director.

No consideration to levy any charges for UPI services: Finance Ministry

The Finance Ministry on Sunday said United Payments Interface (UPI) is a digital public good and there is no consideration in the government to levy any charges on this. This statement allays fear emanating from the RBI’s discussion paper on charges in the payment system suggesting that UPI payments might be subject to a tiered charge based on various amount brackets.

Currently, there are no charges levied on transactions done through UPI.

“UPI is a digital public good with immense convenience for the public & productivity gains for the economy. There is no consideration in Govt to levy any charges for UPI services. The concerns of the service providers for cost recovery have to be met through other means,” the Finance Ministry said in a tweet.

Context: The RBI discussion paper issued earlier this month said, UPI as a fund transfer system is like IMPS and therefore, it could be argued that the charges in UPI need to be similar to charges in IMPS for fund transfer transactions.

TWEET OF THE DAY

IT attrition may spike again as firms delay performance-linked payouts

A decision to hold back variable pay by top IT companies such as Wipro could imply softening revenue growth for the $200-billion software services export industry. It could also mean attrition — which has already touched unprecedented levels — could further spike up due to the cut in the performance-linked incentive, analysts told us.

Driving the news: This comes as Wipro last week communicated to employees that mid- to senior-level staff will not receive their variable pay for the June-ended quarter while junior associates will get only 70% of the targeted pay. TCS, too, had delayed a performance bonus by a month for a certain band of employees due to “administrative” reasons.

Analysts say the companies will be taking to undertake bold moves to cut costs as attrition may have peaked. Wipro has managed to keep its attrition rates relatively flat as compared to its peers, with the April-June level down to 23.3% from 23.8% in the sequential period. Other IT majors — TCS, Infosys and HCL Tech reported an uptick in the metric during the same period.

Other Top Stories By Our Reporters

IT firms pause fat pay hikes for new hires: The days of crazy IT salary increases are slowing down as companies tighten their negotiation bandwidth and set fixed budgets for specific roles amid rising margin pressures. They are choosing to go past candidates seeking counteroffers that take them higher than their budgeted costs, half a dozen executive search firms told ET.

ONDC charts new strategy as it races to meet deadline: Open Network for Digital Commerce (ONDC), the government-backed ecommerce platform, had set an ambitious target to go live in 100 cities by August. Yet, by August 17 it was live in only 45 cities, after starting pilots in five from April 29. ONDC chief executive Thampi Koshy is unfazed though.

HBO Max India launch on indefinite hold: Warner Bros Discovery has put the plans to launch popular American subscription video-on-demand (SVOD) service HBO Max in India on hold, even as the company is looking at cost-cutting measures globally and working on merging Discovery+ with HBO Max in the existing markets. The move has prompted the India content head of HBO Max, Saugata Mukherjee, to quit within a year of joining.

Founders adopt hands-on approach for better customer connect: Startup founders, such as those of Zepto, Mr. Milkman, Classplus, Blackbuck, Wakefit.co, and Fi, are ramping up efforts to connect with customers through in-person interactions, phone conversations, and social media, in many cases anonymously.

Global Picks We Are Reading

■ In new election, Big Tech uses old strategies to fight ‘big lie’ (The Washington Post)

■ The low threshold for face recognition in New Delhi (Wired)

■ Google will modify search algorithms to tackle clickbait (The Guardian)