Also in this letter:

■ The next big charter for India’s CBDC

■ Tax notices: Zomato, Swiggy to reach out to GST authorities

■ ETtech explainer on Artificial General Intelligence

Appario looks for a new way to keep selling on Amazon

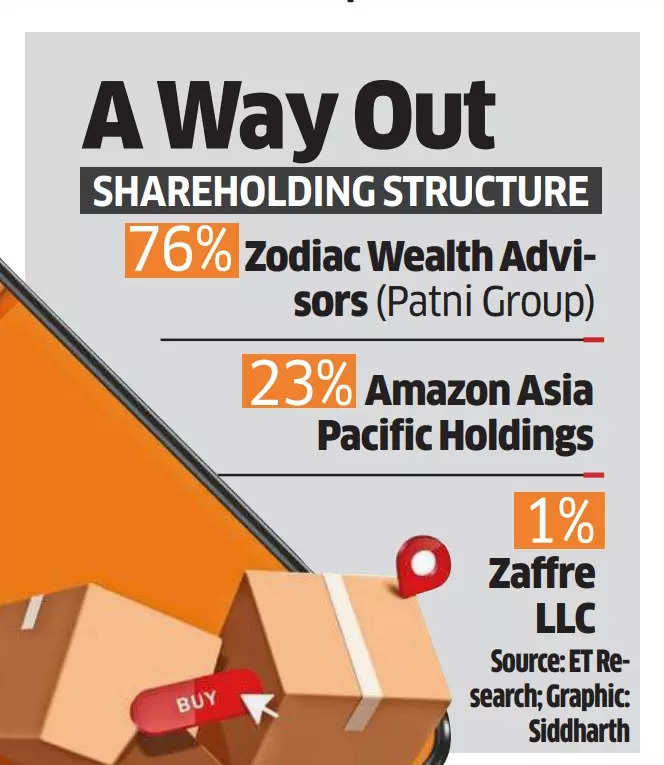

Appario Retail, the largest seller on Amazon India, is scripting a change of plans for its future on the ecommerce platform. This comes after Amazon and Patni group – the joint venture partners of Appario’s parent firm Frontizo Business Services – announced plans last October to delist the entity from the Indian marketplace within a year.

Tell me more: Sources told us that Patni group and Amazon have considered bringing in a new joint venture partner for Appario Retail to be able to continue selling on the Indian marketplace. This underscores the scale of large sellers on Amazon and how they move huge volumes of orders on the marketplace.

Initial plans: The company was initially expected to continue with its business model of being a seller on Amazon’s India marketplace till this month and subsequently transition to an alternate business model.

In April, ET had reported that Appario Retail was transferring its existing inventory to a new set of sellers on the online marketplace. At the time, this was aimed at delisting Appario from the Amazon India site amid increasing regulatory scrutiny of online sellers with investment from the marketplace.

But, why: A key reason for the potential change of plans for Appario is that several new seller firms that have emerged on Amazon have been finding it difficult to operate smoothly on the marketplace.

The rulebook: Indian regulations do not permit a foreign-owned entity running an online marketplace and its group companies to own stakes in any seller on the platform, or to have control over their inventory.

The government had red-flagged proximity between sellers and ecommerce marketplaces after small traders alleged that ecommerce companies were promoting their preferred sellers on the platforms.

Dealshare cofounders Vineet Rao, Sankar Bora exit post rejig

Sankar Bora (left) and Vineet Rao, cofounders, Dealshare

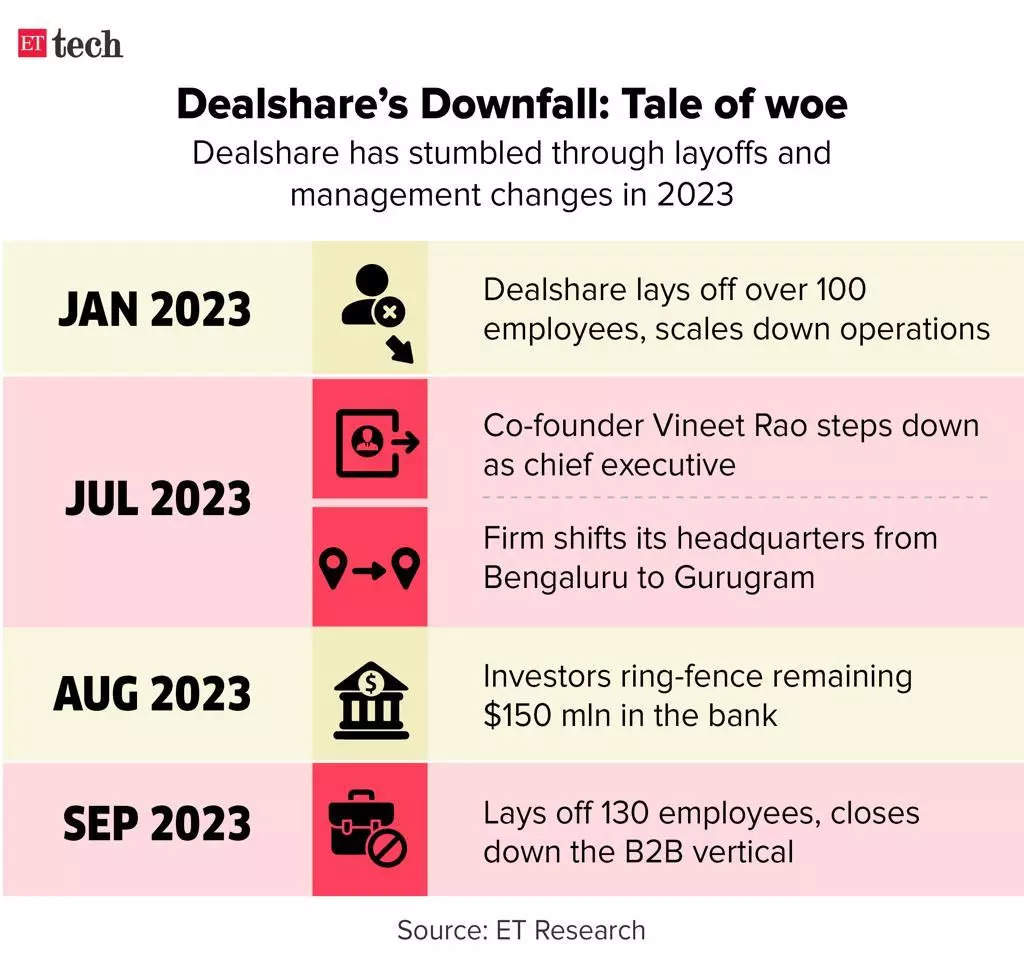

Vineet Rao and Sankar Bora, two of the founders of ecommerce platform Dealshare, have left the firm and no longer have any roles in the company, sources told us.

Leadership changes: While Rao ‘stepped down’ as chief executive in July and was supposed to work with the board to hire a new CEO, he has now left the company, several people aware of the matter said. Bora, who was chief operating officer at the firm, has also moved on.

New CEO soon: Dealshare was started by Rao, Bora, Sourjyendu Medda, and Rajat Shikhar in 2018 and counts Tiger Global, and Alpha Wave among its investors. Medda and Rajat continue to operate inside the firm.

Also on board are senior executives like former Big Bazaar chief executive Kamaldeep Singh, who was hired as president of its retail business, and Rajesh Purohit, formerly at SPAR Hypermarkets India, who is a senior vice president of retail. The new CEO is expected to be finalised before the end of next month.

Investors in control: Dealshare in September had to shut its B2B business following a review by its investors and fired another 130 employees. Just about 500 employees are now left in the firm.

Because of the restructuring, it is expected to clock only half of last year’s total sales, as per current estimates. The company is on an annualised gross sales run rate of about $150-$200 million, sources have said.

RBI seeks ways to make digital currency payments as easy as cash

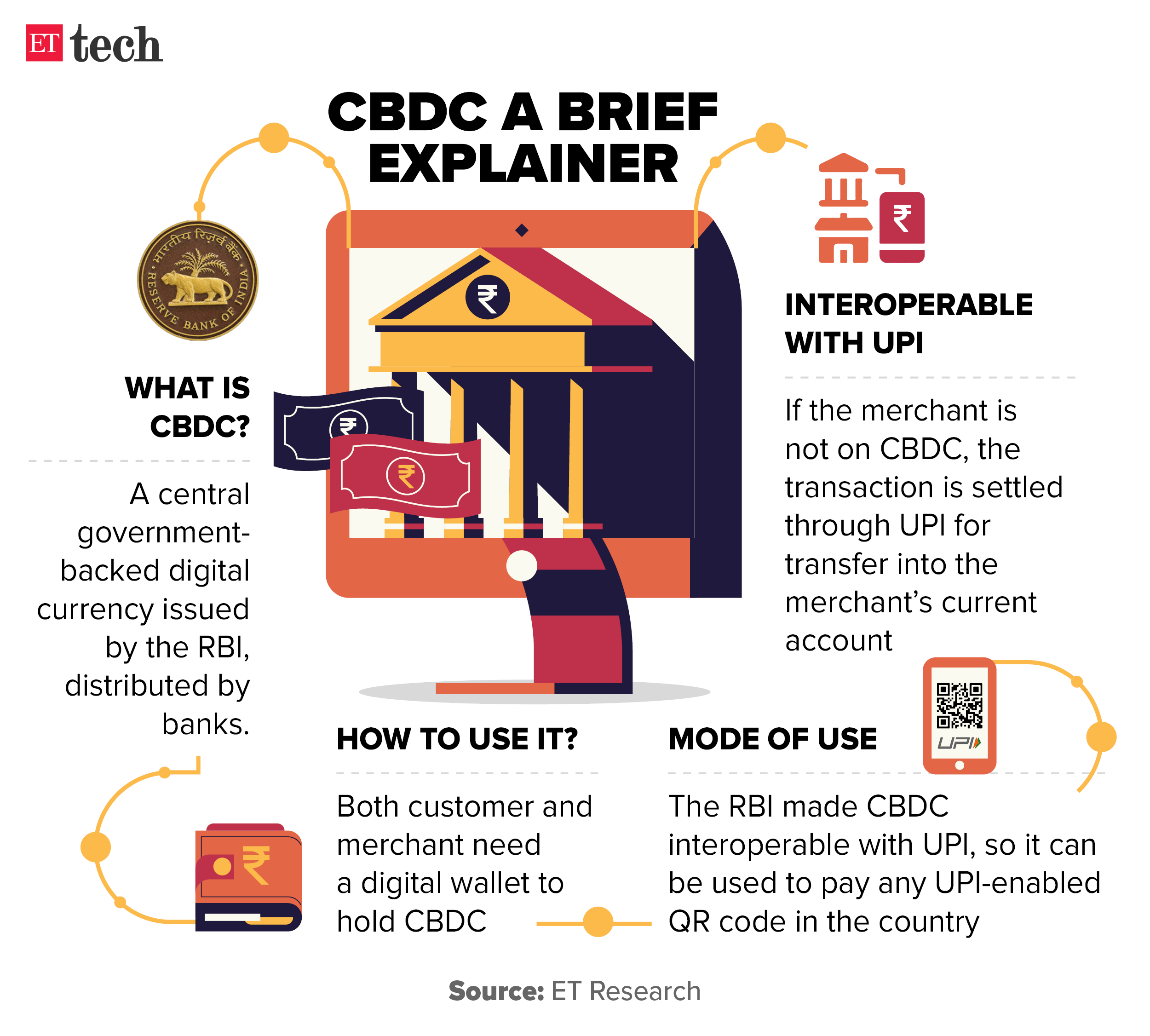

Offline and feature phone-based payments and purpose-defined payments are the next big charters for the Reserve Bank of India and the National Payments Corporation of India (NPCI) for pushing the adoption of the central bank digital currency (CBDC).

What is CBDC? To counter the popularity of private cryptocurrency, the Indian government endorsed a new form of digital currency termed CBDC. While the RBI developed the currency, which is backed by the sovereign, banks were entrusted with distribution.

Status of CBDC? The RBI is now running a pilot with around 14 banks in the country where consumers are being invited to create a separate digital wallet for CBDC transactions.

While the target was to achieve a million transactions per day, it is currently in the tens of thousands, industry insiders said.

Building new use cases: The RBI is looking to build fresh use cases around purpose-based payments that can be used for benefit transfer schemes. It can also be used for something as simple as giving pocket money to children to be used only for canteen food.

Feature phone payments and offline payments which still require cellular networks currently can go truly offline with CBDC. That will help drive financial inclusion, said people in the know.

Zomato, Swiggy want to clarify stance to DGGI on tax notice

Food delivery platforms Zomato and Swiggy are planning to approach goods and services tax authorities to explain their position after they received notices seeking tax on delivery fees collected from consumers.

Broader ramifications: The issue could have wider implications, a senior government official said, as other companies collecting such fees could also be asked to pay tax on the amount, which the platforms claim they pass on to their delivery partners.

Catch up quick: The Directorate General of GST Intelligence issued notices to the two food delivery companies, seeking Rs 400 crore from Zomato and Rs 350 crore from Swiggy as GST. These are pre-demand notices, which give the companies a chance to explain their position to the government before a final demand notice is issued, the people said.

Double-clicking: Typically, in the case of delivery platforms gig workers operate as delivery partners, and are paid based on the orders serviced. Customers are charged a fee for this delivery.

“Aggregators account for the delivery fees in their revenues…and then show the pay-outs (to delivery partners) as part of their expenses. This is perhaps where the confusion with GST authorities has arisen,” a person briefed on the matter said.

Artificial General Intelligence: An enabler or a destroyer?

The unravelling of the OpenAI saga over the past week has brought attention to artificial general intelligence (AGI), especially with the revelations in a Reuters report that several researchers at the company had warned its board of a “powerful artificial intelligence discovery that they said could threaten humanity.”

Some questions answered:

What is AGI? Artificial general intelligence is understood as software that has the general cognitive abilities of human beings and can perform any task that a human can.

How’s it different from genAI? While genAI learns from a large amount of data fed into its model and can generate new data, AGI is comparable to human intelligence broadly and is a larger and more ambitious goal for developers to create.

Does AGI pose risks? The apprehension around AGI systems is they could go beyond human control or may not align with human values. Further, AGI could pose an existential risk, according to industry leaders such as Sam Altman, Google DeepMind’s Demis Hassabis, and Anthropic’s Dario Amodei, the New York Times reported.

Other Top Stories By Our Reporters

Deepfakes are a threat, new regulation coming to tackle it says IT Minister: The government will come out with new rules and regulations to control the spread of deep-fake content, information technology minister Ashwini Vaishnaw said.

ET Exclusive: Taj Hotels’ data breach may have exposed 1.5 million customers | The personal information of about 1.5 million people may have been exposed in a data breach at the Tata-owned Taj Hotels group earlier this month, ET has learnt.

RBI’s hardening cautionary stand on unsecured lending and its impact on the larger market: As the Reserve Bank of India wants banks to go slow on unsecured lending, a major impact could be felt in the securitisation of such loans.

Global Picks We Are Reading

■ How a Fervent Belief Split Silicon Valley—and Fueled the Blowup at OpenAI (WSJ)

■ Hard Drives, YouTube, and Murder: India’s Dark History of Digital Hate (Wired)

■ The end of anonymity on Chinese social media (Rest of World)