In her budget speech on Feb. 1, Finance Minister Nirmala Sitharaman announced that India will tax all “virtual digital assets” at 30% – with no deductions or exemptions – from April 1.

But the real killer blow, especially for traders, is the 1% TDS (tax deductible at source) that will apply to every single transaction involving crypto.

Until now, standard income tax rules have been applied, under which gains on crypto transactions fall either under ‘business income’ or ‘capital gains’, depending on the nature of the transactions and the length of time across which they took place. But from April 1, India will treat income from crypto as it does lottery winnings, which are taxed at 31.2%.

How do India’s punitive new tax rules for crypto compare with those of other countries? Let’s find out.

United States

In the US, cryptocurrency falls under the same tax regime as stocks – capital gains tax. A capital gain is any money made on an investment. Say you invested $100 in a stock and cashed out once it grew to $110, the capital gain would be $10.

There is no capital gain until an asset is sold, which is a loophole the super-rich use to pay off loans without having to pay income tax.

The US Federal tax rate on cryptocurrency capital gains ranges from 0% to 37%.

Taxpayers are required to determine the fair market value of virtual currency in US dollars as of the date of payment or receipt.

Any gains or losses made from a crypto asset held less than 12 months (short term capital gains) are taxed at the upper marginal tax bracket in which the person’s taxable income falls. Any losses can be used to offset income tax by a maximum of $3,000, and any further losses can be carried forward.

If the crypto was held in excess of 12 months (long term capital gain), the applicable tax rate is much lower – 0%, 15% or 20% – depending on individual or combined marital income.

United Kingdom

The UK, like the US, treats cryptocurrencies the same as stocks for individual investors. If you buy and ‘dispose’ of cryptocurrency as a personal investment, you must pay capital gains tax on the profits. The tax-free allowance for capital gains tax is £12,300.

‘Disposal’ is a broad term that includes selling tokens for money, exchanging one type of token for another, using tokens to pay for goods or services, and giving away tokens to another person (unless it’s a gift to a spouse or civil partner).

The capital gains tax rates for disposing cryptocurrencies are 20% for higher rate (40%) and additional rate (45%) taxpayers, and 10% for basic rate (20%) taxpayers, with some caveats.

Also, capital losses from cryptocurrency can be considered for the tax liability, meaning if you sell your crypto for a loss, the loss can be deducted to reduce the overall capital gain.

In cases where the individual is running a business in crypto assets, income tax takes precedence over capital gains tax.

Germany

Germany is considered a crypto tax haven as it does not recognise crypto as monetary currency, commodities, or stocks. Rather, crypto is considered private money.

For crypto that you have owned for more than a year, the sale is tax-free regardless of the profit.You don’t even need to declare them in your tax return.

If you sell crypto assets within 12 months of buying them, profits up to 600 euros are tax-free. Profits over 600 euros from selling bitcoins are subject to tax. But even if your profit is only 1 euro more than the non-taxable value, you’ll have to pay taxes on the entire profit.

It’s a different matter for businesses, though. A startup incorporated in Germany must pay corporate income taxes on crypto gains, just as it would with any other asset.

Bermuda

There’s another type of country that doesn’t tax cryptocurrency gains – good old tax havens, where all assets, not just digital ones, attract little or no tax.

The island nation of Bermuda is one such territory. It doesn’t impose income, capital gains, withholding, or other taxes on digital assets, or on transactions involving them.

Not only does Bermuda not tax digital assets, it even accepts tax payments in crypto. In October 2019, it became the first country to accept payments for taxes, fees, and other government services in USD Coin, a so-called stablecoin whose value is pegged to the US dollar.

Written by Zaheer Merchant in Mumbai.

TOP STORIES BY OUR REPORTERS

Ashneer Grover vs BharatPe: The story so far

BharatPe CEO Suhail Sameer and cofounder Ashneer Grover.

Ashneer Grover wants CEO Suhail Sameer removed from the BharatPe board, even as the legal battle between the embattled cofounder and the fintech unicorn unravels.

In a letter dated Feb. 2, Grover told the BharatPe board that he has decided to “withdraw my nomination of Suhail Sameer as a director nominated by me to the board of directors of the company”. Sameer, who was hired by Grover in 2020, was made CEO in August 2021. Grover had assumed the role of MD around the same time.

- Grover has also alleged that the board pursued tactics of “corporate intimidation” by appointing law firm Shardul Amarchand and including it in board discussions.

Internal findings: The news of the letter came amid reports that Alvarez & Marsal had found evidence of financial irregularities around recruitments and payments to non-existent vendors. at BharatPe during a preliminary probe. Grover’s wife Madhuri Jain, who is head of controls at the fintech startup, is under the scanner as well.

Friday’s developments came a fortnight after Grover took voluntary leave until the end of March after allegations that he abused and threatened a bank employee last October. Click here for a timeline of the events that have conspired since the beginning of the year.

Earlier this week, Grover hired New Delhi-based law firm Karanjawala & Co. amid mounting pressure to leave the company, even as he expected to arrive at an amicable resolution with the board.

Also Read: Without freedom, I’m happy being a shareholder, founder: Ashneer Grover

Headed for court? On Friday evening, several sources told us the BharatPe board was unlikely to accept Grover’s demand for a payout to leave the company. They said the saga is expected to culminate in a complex legal battle since Grover is unlikely to leave BharatPe without being paid.

Also Read: Ashneer Grover, Aman Gupta fuel Shark Tank meme explosion

Budget 2022: A cryptic ‘crypto’ tax, and other highlights

Indian crypto had its breakthrough moment when Finance Minister Nirmala Sitharaman, in her budget speech, said that income from trading these digital assets would be taxed at 30%.

While that doesn’t make cryptocurrency legal, it gives some sort of recognition to the industry. My colleague Apoorva Mittal captures the conundrum in our budget special newsletter published earlier this week.

Here’s the TL;DR on crypto:

- A 30% tax on income from crypto assets.

- Losses can not be set off against any other income.

- 1% TDS on all crypto transactions above a certain threshold.

- Gift taxes, if any, will be the liability of the recipient.

- RBI-backed ‘digital rupee’ to be launched in FY23.

The budget was also the first time the government explicitly defined “virtual digital assets”.

- Any information, code, number or token, generated through cryptographic means or otherwise, that provides a digital representation of value, or functions as a store of value or a unit of account, and can be transferred, stored or traded electronically.

It wasn’t all good news, though. Several crypto platform executives said the 30% tax would hurt active traders and could force them to take their business abroad. Nischal Shetty, cofounder of WazirX, said the 30% tax rate would be a “damper for those who are at a lower bracket tax bracket because of their yearly income”.

Related Coverage

In other budget news,

Govt’s digital push to drive big business for startups: Technology startups focused on areas such as drones, space imagery and artificial intelligence will likely be among the biggest beneficiaries of Budget 2022. (read more)

15% cap on tax surcharge: The surcharge on long-term capital gains tax has been capped at 15% for all listed and unlisted companies, Sitharaman said in her budget speech. This addresses a long-standing demand of new-age companies, which wanted share sales of unlisted firms to be taxed at par with those of listed ones. (read more)

EV firms cheer battery swapping policy: To increase the adoption of electric vehicles, the government will release a policy for battery swapping this year, the finance minister said, one that brings in standardisation and interoperability. (read more)

Ather Energy plans new scooters to take on Ola in EV war

Ather Energy has started working on new variants of its electric scooters with a longer range and better value for money. The company is building a bigger battery pack for this, several people aware of the matter told us.

- The move comes amid increasing competition in the EV space, especially from Ola Electric that recently launched its own electric scooters – S1 and S1 Pro. Range is one of the most important factors customers look at when buying such a vehicle. On this, Ather lags Ola.

Ather Energy plans to launch a new variant with better battery life in six months, one of the sources said. It is expected to provide a real-life range of 110-115 km on a full charge, up from the 85 km the current Ather 450x offers.

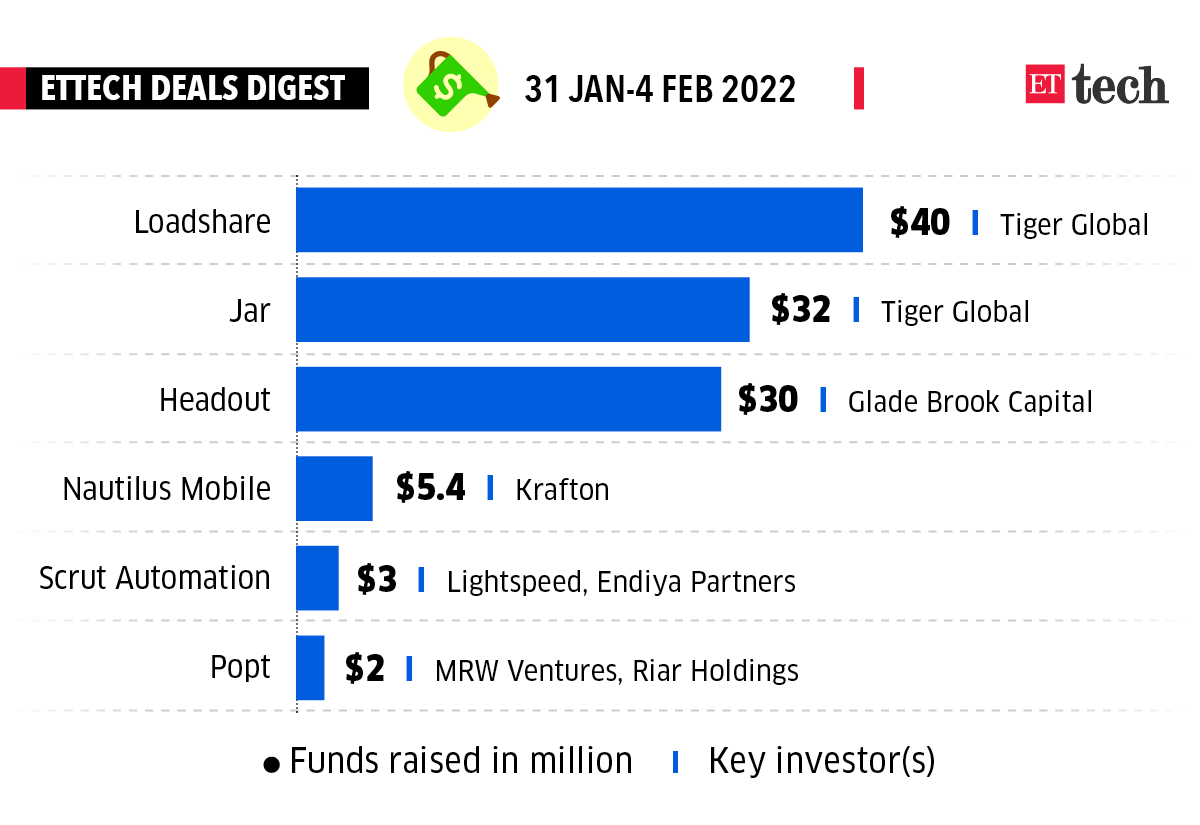

ETtech Deals Digest

- Zomato’s co-founder and CEO Deepinder Goyal has transferred all his shares in Blinkit’s parent firm Grofers International Pte. Ltd. to New York-based investment firm Tiger Global, according to regulatory documents accessed by ET.

- Jar, a startup for daily savings, has raised $32 million in a Series A funding round led by New York-based investment firm Tiger Global.

- South Korea’s Krafton Inc. has invested $5.4 million in JetSynthesys’ Nautilus Mobile, marking its first investment in a game development studio in India.

- India’s sovereign wealth fund, the National Investment and Infrastructure Fund (NIIF), has led a $240-million secondary funding round in FirstCry, thus making its first bet in the country’s internet economy.

- Chargebee, an enterprise-focused subscription management platform, has raised $250 million in a new funding round co-led by Tiger Global and Sequoia Capital.

Meta says Facebook growth slowing in India as well

Meta Platforms Inc., which reported the first ever sequential drop in Facebook’s daily active users in the December quarter, is seeing the platform’s growth slow in India as well.

- “User growth in India was limited by an increase in data package pricing. We believe competitive services are [also] negatively impacting growth, particularly with younger audiences,” Meta Platforms CFO Dave Wehner said.

But Neil Shah, vice president (research) at Counterpoint Research, said in India, Facebook faced stiffer competition from streaming apps than short-video platforms, as many Indians binge watch shows on their smartphones.

Also Read: The Meta meltdown burnishes appeal of TCS, Infosys

Cognizant sees digital emerging as dominant revenue stream

Cognizant India Chairman Rajesh Nambiar

Cognizant Technology Solutions Corp. expects its digital business to account for 55-60% of its overall revenue from 44% at present, even as the New Jersey-based IT services firm bets big on working with Big Tech companies.

Financial performance: In constant currency terms, Cognizant’s revenue rose 10% to $18.5 billion in 2021. In the fourth quarter ended Dec. 31, its revenue stood at $4.8 billion–up 14.2% on a year-on-year basis. This is the first time since 2015 that Cognizant has reported a double-digit revenue growth in a quarter.

- Digital accounted for 44% of total revenue in FY21, up from 42% in the previous year.

“When you look at the future, it (digital revenue) has the potential to go up to 55-60% of our revenue,” Cognizant India Chairman Rajesh Nambiar said. “We’re going to be a $20-20.5 billion company with growth of 8.5%-11.5% year-on-year.”

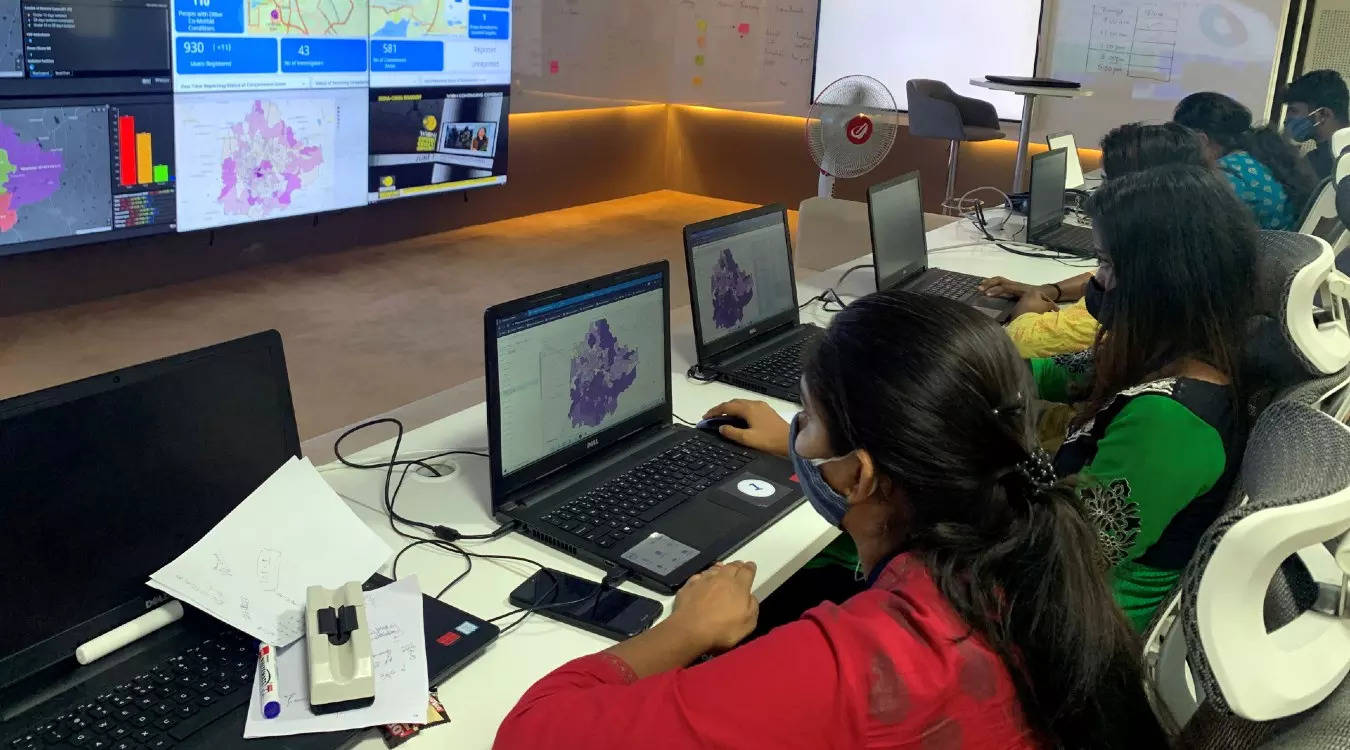

BPO industry looks to double its presence in small towns in four years

India’s $38 billion business process outsourcing industry is looking to double its presence in the country’s smaller towns in the next four years, piggybacking on the success of the work-from-home phenomenon.

- Nasscom and the Ministry of Electronics and IT are chalking out four operating models under the “work from home town” (WFHT) model and identifying 100 locations, of which 20 of them have already been finalised, executives told ET.

The industry’s plan is to drive 10% of employees and 10% of revenues (for the industry) from 100 towns, officials said. At the top of the list are places such as Warangal, Siliguri, Salem, Lucknow, Indore, Bhopal and Visakhapatnam.

Curated by Tushar Deep Singh in Mumbai. Graphics and illustrations by Rahul Awasthi.

That’s all from us this week. Stay safe.